Introduction

In today’s fast-paced financial landscape, where stock markets fluctuate rapidly, staying updated with the latest news and understanding market sentiment has become essential for successful stock trading. This article delves into the role of news and market sentiment in stock trading, highlighting the significance of daily market news sentiment, its impact on stock prices, and how it can be used to make informed trading decisions. Furthermore, we explore how stock market news and sentiment contribute to enhancing trading education. So let’s dive into the intricacies of this fascinating subject.

Understanding the Significance of Daily Market News Sentiment

Daily market news sentiment refers to the collective feelings, attitudes, and opinions of investors and traders toward the financial markets. It reflects the overall mood and perception of market participants, which can greatly influence the buying and selling decisions made by traders. The significance of daily market news sentiment lies in its ability to shape market trends, impact stock prices, and create opportunities for traders.

The Impact of News on Stock Prices

News plays a crucial role in shaping stock prices. Positive news, such as strong earnings reports, new product launches, or favorable economic indicators, tends to drive stock prices higher. Conversely, negative news, such as poor financial results, regulatory changes, or geopolitical uncertainties, often leads to a decline in stock prices. Traders closely monitor news sources to gauge the potential impact on stock prices and make informed trading decisions accordingly.

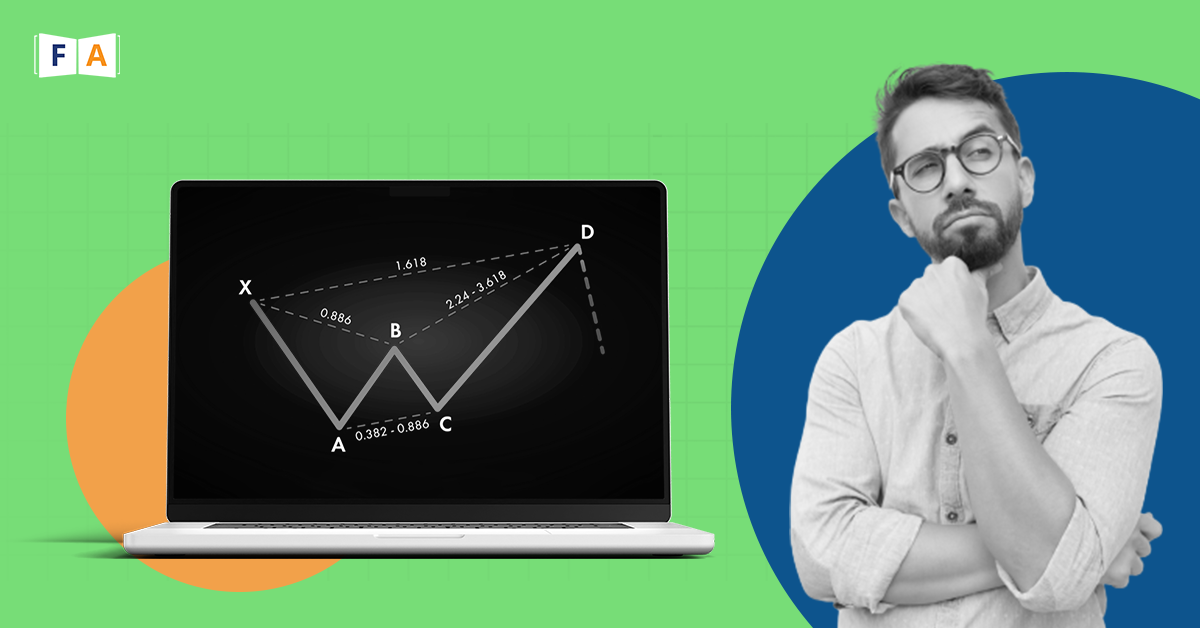

Using Market Sentiment in Stock Trading

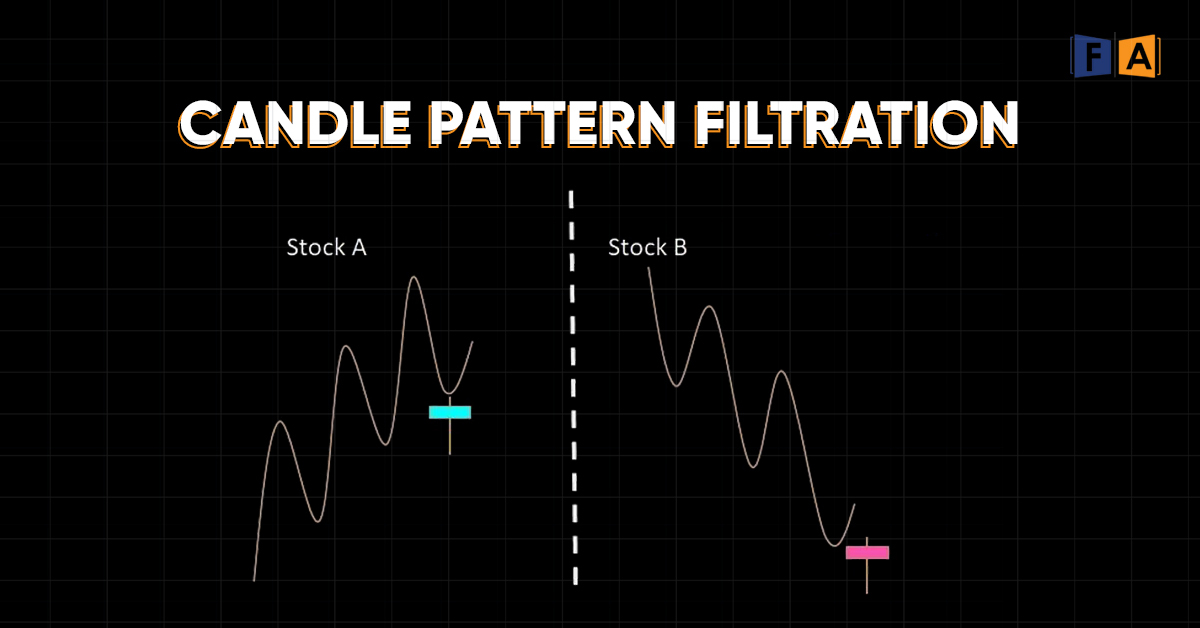

Market sentiment, derived from the collective behavior of investors and traders, can serve as a valuable indicator in stock trading. By analyzing market sentiment, traders can gauge the prevailing market mood, identify potential trends, and anticipate market movements. For example, if market sentiment is overwhelmingly positive, it may indicate an uptrend and provide opportunities for bullish trades. Conversely, if sentiment turns negative, it may suggest a bearish trend and prompt traders to adopt a more cautious approach.

To utilize market sentiment effectively, traders employ various tools and techniques, including sentiment analysis algorithms, social media sentiment tracking, and surveys. These methods help quantify and interpret market sentiment, providing valuable insights for making trading decisions.

The Role of Stock Market News in Making Informed Decisions

Stock market news serves as a vital source of information for traders and investors. It encompasses a wide range of topics, including company-specific news, industry updates, economic reports, and geopolitical developments. By staying informed about these events, traders can gain a deeper understanding of the factors influencing stock prices and make well-informed trading decisions.

Market news platforms and financial websites provide real-time updates on market-moving events, earnings releases, mergers and acquisitions, and regulatory changes. Traders can leverage these resources to identify potential trading opportunities, evaluate risks, and adjust their strategies accordingly. Moreover, news analysis from reputable sources can offer valuable insights into market trends, helping traders stay ahead of the curve.

Enhancing Trading Education with Market News and Sentiment

Trading education plays a crucial role in equipping traders with the knowledge and skills necessary to navigate the stock market effectively. Integrating market news and sentiment analysis into trading education can significantly enhance the learning experience and provide practical insights for aspiring traders.

By incorporating real-life case studies, analyzing historical market events, and exploring the impact of news and sentiment on stock prices, trading education programs can offer a comprehensive understanding of the dynamic relationship between information flow and market behavior. Additionally, providing access to reliable news sources, sentiment analysis tools, and expert commentaries can empower traders with the resources needed to make informed decisions and improve their trading performance.

Conclusion

In the ever-evolving world of stock trading, keeping a close eye on daily market news sentiment is paramount. News and market sentiment significantly influence stock prices and play a vital role in shaping market trends. By leveraging market sentiment and staying informed about the latest news developments, traders can make well-informed decisions, identify trading opportunities, and enhance their overall trading performance. Integrating market news and sentiment analysis into trading education further equips aspiring traders with the necessary tools to navigate the complexities of the stock market. Stay tuned to the latest market news, analyze sentiment diligently, and embark on your trading journey with confidence.

FAQs about Daily Market News Sentiment and Stock Prices

1. How can I stay updated with daily market news sentiment?

To stay updated with daily market news sentiment, you can subscribe to financial news websites, follow reputable financial journalists and analysts on social media, and utilize news aggregator platforms that curate relevant market news.

2. Can market sentiment alone be used as a trading strategy?

While market sentiment can provide valuable insights, it is not advisable to rely solely on sentiment for trading decisions. It is essential to combine sentiment analysis with other fundamental and technical indicators to make well-rounded trading strategies.

3. How does news sentiment affect different sectors?

News sentiment can have varying effects on different sectors. Positive news about a particular sector can boost investor confidence and lead to increased investment in related companies. Conversely, negative news can trigger sell-offs and downturns in the sector.

4. Are there any sentiment analysis tools available for individual traders?

Yes, there are sentiment analysis tools available for individual traders. Some popular sentiment analysis platforms include social media monitoring tools, news sentiment trackers, and sentiment analysis APIs.

5. Can trading education help me understand market sentiment better?

Yes, trading education can provide you with the necessary knowledge and skills to understand market sentiment better. It equips you with analytical tools, strategies, and insights that can help you interpret market sentiment and make informed trading decisions.

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions in which you consider variables such as…

By: FinLearn Academy

July 6, 2023

In the Indian stock market, scalping and swing trading are two popular approaches used by traders to make profits. Scalping…

By: FinLearn Academy

June 29, 2023