Robust operating performance & strong deal wins: What’s up at TCS, Infy, HCL & Wipro?

Yesterday’s Market Performance

Nifty: 18338.50 I 176.70 (0.97%)

FII Buy Net: INR 1,681.60 Cr

DAX: 15,587.36 I 124.64 (0.81%)

Sensex: 61305.95 I 568.90 (0.94%)

DII Sell Net: INR -1,750.59 Cr

FTSE: 7,234.03 I 26.32 (0.37%)

Howdy Toasters!

In today’s issue of the Morning Toast, we discuss:

- Big 4 IT Cos dropped their quarterly numbers, let’s see what’s up!

- Upcoming results for the week

- India’s trade deficit on a spree

- As always, an education concept to keep you chugging along.

Big 4 IT Cos (TCS, Infy, HCL Tech & Wipro) dropped their quarterly numbers in the last week: What’s up and what do you need to know? 🧐

Operating Performance & future growth guidance?

TCS

-

India’s Numero Uno IT company delivered revenue growth of 2.9% QoQ to USD 6.33 Bn in Q2 (missing consensus expectations); growth decelerated (excluding India) on a sequential basis to 2.4% from 3.8% in Q1 in $ terms

-

Supply side challenges, higher subcontracting expenses, and adverse currency movement restricted margin expansion to 0.1% QoQ to 25.6% in Q2

-

Revenue & Operating performance miss for a second consecutive quarter, dampened the overall numbers with guidance un-changed from Q1

Infosys

- The company’s Q2FY22 operating performance was ahead of street expectations (helped by a margin beat); revenues grew 6.3 QoQ in constant current terms to USD 4 Bn

-

Operating efficiencies and SG&A leverage helped in maintaining EBTIM decline to 0.1% QoQ to 23.6%

-

The company raised its FY22 revenue growth guidance to 16.5 – 17.5% CC (from 14-16% at the start of Q2) on the back of broad-based demand, solid deal intake and health detail pipeline, while retaining its EBITM guidance of 22-24%

HCL Technologies

-

Revenue grew 2.6% QoQ to USD 2.8 Bn (3.5% growth in CC terms) for the second quarter, with the company missing expectations in Q2FY22, largely attributed to the decline in Products & Platform business (-8% QoQ CC)

-

The company missed EBITM expectations as well, clocking a 0.6% QoQ decline to 19% margins, as the Products & Platform business weighed heavily on operating performance

-

HCLT reiterated double-digit revenue growth guidance in CC for FY22; similarly, from a bottom line perspective, the company maintained initial EBITM guidance of 19-21% for FY22, on the back of planned investments in certain products, continued salary hikes / negotiations and normalisation in travel costs

Wipro

-

IT services revenue grew 6.9% QoQ (8.1% in CC terms) to USD 2.6 Bn in Q2FY22, ahead of street estimates; from a bottom line perspective, the EBITM declined 0.1% QoQ to 17.7% as revenue momentum and operating efficiencies largely negated wake hikes & investments in sales etc

-

The company maintained previous guidance (from a FY22 perspective), with Q3 revenue in the range of USD 2.63 – USD 2.68 Bn, implying a 2-4% QoQ growth

-

Similarly, the management reiterated EBITM guidance of 17-17.5% for FY22

Deal Wins? Attrition Rate? New Employee additions to prepare for demand? 🤨

TCS

-

The company reported robust deal wins of USD 7.6 Bn for the quarter, with a good mix of small, mid & large sized deals; on a YoY basis, discounting for one mega deal in the base year, intake grew 25% YoY

-

TCS added 19,690 employees, taking the head count to 528,748 employees overall (hugeeee!!), while on-boarding 43,000 fresh graduates in the first half of FY22

-

Attrition inched up to 12% for the second quarter, from 8.6% on a QoQ basis

Infosys

-

Large deal intake was healthy at USD 2.2 Bn in Q2FY22, with 37% new deals and 22 large deals signed, with the company continuing to gain market share as the preferred cloud & digital transformation partner

-

The company reported a massive spike in attrition, up to 20.1% from 13.9% in Q1

HCL Tech

-

The company signed 13 large services and 1 product deal across a variety of sectors, including Life Sciences & Healthcare, Telecom and Manufacturing, taking cumulative new deal size fo USD 2.2 Bn (up 38% YoY)

-

Attrition inched up to 15.7% from 11.8%, with the company adding 11,135 employees in the second quarter (highest in the last 24 quarters)

Wipro

-

The company signed 9 large deals with cumulative value of USD 580 Mn in Q2, with the management indicating an 19% growth in deal wins for the first half of the year

-

Attrition rose to 20.5% vs 15.5% in Q1FY22; the company added 8,150 freshers in Q2, with plans to increase that number to 25,000 by FY23

Company & Industry Outlook:

-

Strong deal wins, robust quarterly revenue performance, healthy / consistent operating guidance are consistent themes amongst the above listed names,

-

Managements across have indicated towards the continuation of a sustained & strong demand environment, one that is broad-based & backed up $$

-

From a people perspective, all companies have reported >16% attrition growth (QoQ), with the lack of available man-power a key trackable metric to judge a company’s ability to take on & successfully execute projects

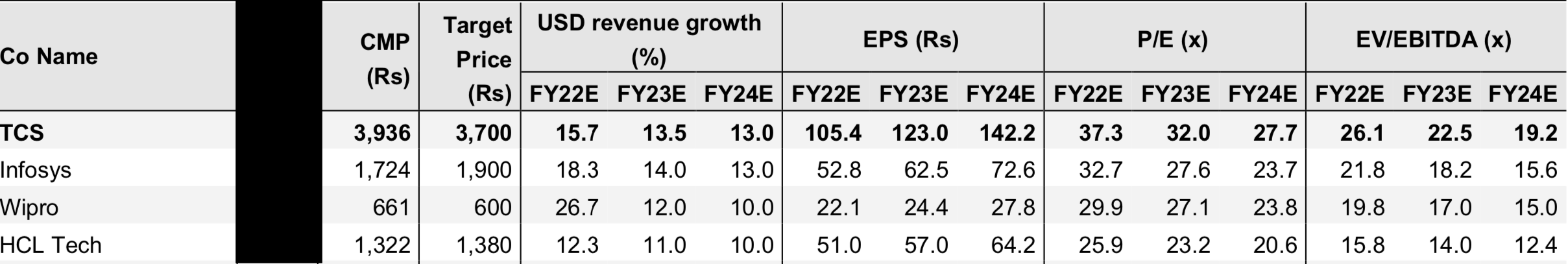

Valuations & Stock Outlook:

-

From a valuations perspective (see image below), all 4 companies trade in a similar range (from a FY24E perspective) with TCS the clear outlier from an Earnings Per Share perspective (and accordingly getting a premium)

-

Taking growth guidance & returns profile and judging against the relative valuation discount on offer, HCL Tech is the cheapest amongst the four names, albeit with some uncertainties pertaining to the Products & Platforms Business which has been a laggard in this environment

- Infosys & Wipro are very similar in their business performance (differing sizes though), yet their valuation gap isn’t much, which indicates a relative under-valuation on the potential of Infosys’s business (taking EPS into consideration)

What else caught our eye? 👀

India’s trade deficit on a spree

- India’s trade deficit widened to $22.6 bn for the month of September – the highest in 14 years.

- Exports in September have risen 22.6% (over last year) to ~ $34 billion buoyed by key sectors like engineering goods and petroleum products.

- Imports won this race however, rising 85% year-on-year to reach the ~ $59billion mark. (mostly to build up inventories before the festive season)

Crypto to take on gold?

- Crypto has become the go to option this festive season at the expense of traditional investment options like gold and jewellery.

- Bitcoin hit a six-month high on October 15, as it rose almost 3% to trade at $59,694.

- The most popular altcoin, Ether, was trading at $3,827 ( > 5% higher.)

Global shortage sprees not going away anytime soon

- There is a surge in demand as economies across the globe open and recover from the pandemic.

- Lockdown has resulted in factory closures that has led to losses in shoes, textiles, automobiles (due to a semiconductor) shortage among others.

- Apart from this there are various issues yet to be resolved on the shipping and transportation fronts

![]()

Saturday, 16th October: HDFC Bank and Avenue Supermarts

Monday, 18th October: Route Mobile, Larsen & Toubro Infotech and Ultratech Cement

Previous