RBL Bank Halfway There To Redemption?

Good Morning Toasters!

Yoo friends!! Happy weekend! Hope you get some downtime before the week and markets kick-off and we’re back to asking all kinds of existential questions (if you catch my drift 🤭)

In today’s issue, we cover RBL Bank, which is amidst a kind of (?) turnaround in fortunes. The Bank has pretty much ground growth to a halt, with a strategic redo of its longer-term priorities. A new MD is expected to be appointed soon, which should augur well for the longer-term execution of the strategic roadmap put in place by the board.

TikTok is stepping on some pretty big toes. We looked at consumption data from the US markets, which seems to point to a shift in consumption trend in not just core categories of Gen Z and Millennials, but also traditionally tougher categories of Boomers & more. TikTok is poised to eventually be on the same Revenue parity as YouTube, the OG Video King of the world.

And finally, we’ve started a rollout of our newest product, Trade:able, that aims to democratise trading, via a unique and fun learning experience. There are a bunch of amazing rewards and prizes to win. Click here to know more.

Market Watch

Nifty 50: 15,782.15 | -25.85 (-0.16%)

FII Net Sold: INR 3,780.08 crore

Sensex: 52,793.62 | -136.69 (-0.26%)

DII Net Bought: INR 3,169.62 crore

Global Tech News

TikTok continues to feast on its rivals; what’s up and what do you need to know?

- Launched initially as an application for children to consume videos (think: insane dance skills or science-based videos), TikTok has morphed into the biggest existential threat to the world’s OG social network

- Capitalising on the consumer generational shift towards short-form content (on-set of too much to do in too little time) via a seemingly infinite collection of music-backed videos under 60 seconds, algorithmically tailored to user’s interests

- TikTok is now the third most used application in the US, topping Twitter, Snapchat, Pinterest and LinkedIn; Average Monthly Active Users (MAUs) for the app which were a shade lower than 1 Bn in Q1CY20, have grown to ~1.6 Bn in 9 quarters

- Competitors have taken note, with Reels a big area of focus for Meta (via Facebook & Instagram), while non-traditional players like Pinterest (primarily photo sharing) launching Watch and Netflix including Fast Laughs to hop onto the short-form content bandwagon

So, what’s working for them? Give some more information?

- ~36% of the population above the age of 12 is using TikTok, with this # growing from only 11% two years ago, behind only Facebook & Instagram, while all other competitors have recorded de-growth during the same period (damn!!)

- And amongst the younger age group of 12-34, most gains have come at the expense of Facebook, with more # of people switching over to TikTok; a similar trend is visible in the 34+ age range, with 1/3rd of the addressable market size using the application, up from 2%, 2 years ago

Why is that the case?

- TikTok’s gains illustrate an ability to bridge the age gap, a unique point of differentiation among its social media competitors; Snapchat doesn’t share 34+ years of data (which probably means it’s not good), and Pinterest has struggled to retain beyond its core demographic, and Meta lost users for the first time

- Also to highlight is the extreme ease of the on-boarding process, which doesn’t require the user to go through the traditional Sign-Up process, instead of opening up on the scroll instead, making it extremely easy for the user to start the experience

Interesting! What about revenues? And way forward?

- Operating on an ad-based revenue structure, TikTok is minuscule in comparison to the elephant in the room (Meta), with revenues of ~USD 4 Bn in 2021 (estimates, as the company, is private)

- That # is expected to triple this year, surpassing the combined revenues of Snapchat & Twitter, with estimates of ~USD 24 Bn by 2024, which will essentially mean parity with the OG King of Video, YouTube

- TikTok is expanding from its short-form underpinnings, raising the maximum length of a video to 3 minutes a year ago, with plans to increase this limit to 10 minutes in the future (context: average video duration on YouTube is 15 minutes)

- From a revenue perspective, the app has started forming 50% revenue share agreements with creators, to incentivise and build out an additional revenue item

Finally?

- Users of TikTok’s android app spent 1 hour and 22 minutes daily on average on the application, far more than other social media cos

- Being early to the game, and centre-stage of a generational change in habit means TikTok is acquiring from the competition, at a pace

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- Robinhood gets a much-needed investor boost: One of the biggest names in Cryptocurrencies is betting on individual investors. Sam Bankman-Fried, a 30-year-old billionaire founder of the Crypto exchange FTX, has purchased a 7.6% stake in Robinhood Markets, paying USD 648 Mn and making him the third-largest shareholder of the application/company. The purchase comes at a tough time for the company, with Monthly Active Users (MAUs) falling for the company after a high growth period, brought upon by Covid-19

- Twitter gets a dose of Elon 😞: The world’s most talked-about human, released a statement stating that his deal to buy the social network is currently on hold pending details supporting the calculation that spam / fake accounts make up less than 5% of the total active user base. Twitter shares fell ~20% in pre-market trading, with the uncertainty and a possible redaction by Elon hurting the stock. 2 hours after posting his initial tweet, Elon tweeted his intention to “remain committed to the transaction’. Spam / Bots accounts are a major point of contention for Musk, who wants to rid the platform of unauthentic/pointless bots to improve the level of conversation

- Instacart secretly prepares for an IPO: Up against this year’s volatile market, the grocery company Instacart plans to launch an Initial Public Offering, filing its paper confidentially (that’s possible), less than two months after cutting its valuation by 40%. The pandemic provided a major boost to Instacart, with sales growing 330% b/w 2019 and 2020, with the company recording a 15% increase in topline in 2021, as supermarkets indicated a return to pre-pandemic habits as footfalls rose. The company appointed the incumbent CEO in 2021, who arrived from Meta with a specific mandate to grow sales and take the company public

Company News

RBL Bank halfway there to turning around?

Growth

- Heeding a conscious call to slow down growth in its unsecured portfolio, including Microfinance and Cards, RBL Bank loan growth improved to 2% QoQ, from ~0% growth in the last 3 quarters

- That being said, the Bank plans to re-accelerate growth in cards, with reduced focus on the Microfinance business while building out a secured retail portfolio, including mortgages, tractor, gold, and Two Wheeler

- Deposits for the Bank have crossed a sizeable threshold (see image below), and the Current Account: Savings Account Ratio has also normalised to 35%, indicating strong franchise & trust

Asset Quality

- Fresh slippages were lower for the Bank at 4.2% of the loan book, which coupled with higher provisions (money set aside in case of delinquencies) meant the Gross NPA ratio for the Bank declined by 0.44% to 4.4%

- The Provision Coverage Ratio improved to 70%, with the Bank setting aside higher capital to manage future delinquencies, amidst confidence of not having to utilise the full capital

Interesting! Tell me more? Going forward?

- The Bank has gone through substantial change, with the RBI stepping in and replacing the management

- That being said, the incumbent Board’s long term strategy of building out a strong retail liability franchise, coupled with a diversified book, towards a more secured product portfolio augurs well

- RBL has a long term cards partnership with Bajaj Finance, and is expected to double down on that, while also buildout a non-Bajaj based cards franchise in the future

- The Board has submitted recommendations to the RBI for the post of MD & CEO, with a decision likely soon, which bodes well taking into consideration the longer-term plan set in motion

Nice! Final thoughts? Stock & Valuation Perspective?

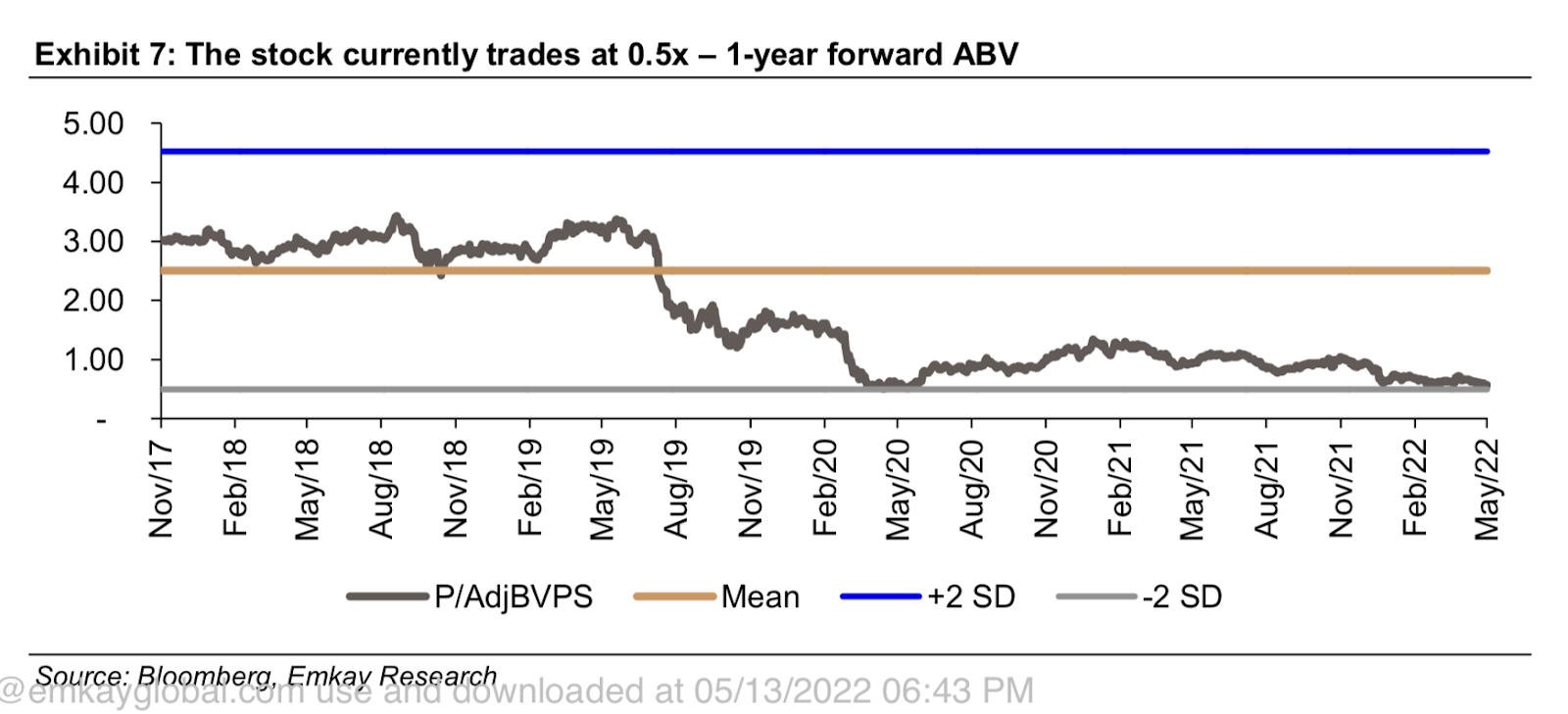

- The stocks are cheap, trading close to the -2 Standard Deviation from Mean P / Adjusted Book Value valuations (see image below), with the stock knowing only one direction since the management issues came to light

- A new MD, with eyes to build on the mid to long term strategic roadmap enacted by the Board should hold the bank in good stead going forward

- A steady improvement in the liability franchise, healthy capital buffers and a re-jig towards a secured retail product portfolio should bode well for the future

We covered the stock at the time of RBI stepping in, with a detailed piece on the ramifications and future prospects. Click here to know more.

Keep a track?

What else caught our eye? 👀

Swiggy makes a major acquisition

- Swiggy will be acquiring Dineout (owned by the Times Internet group) for an all-equity deal valued at $200 million with the platform continuing to operate as an independent app

- The move will allow Swiggy to enter the dining-out market (where rival Zomato had already made a mark) owing to Dineout’s network of 50000+ restaurant partners in the country

- The four founders will be joining Swiggy – the platform was acquired by the Times Internet Group after two years of inception and they have since deployed $50 million into the startup

FMCG companies using cheap tricks

- In a bid to save on costs because of rising prices of edible oils, grains and fuel, FMCG companies are using ‘shrinkflation’ or package downsizing on fixed price items popular among lower-income levels

- Britannia had passed on 65% of its incremental input cost by reducing weights on their existing price points, while Dabur has reduced the volume of key products as well

- Prices in the last four months have run above the RBI’s upper limit of 6% with more expected in the next three quarters

Results Preview (Nifty 200)

Saturday, 14th May: Avenue Supermarts

Monday, 16th May: Bharat Forge

Educational Topic of the day

Capitalization Rate (Cap Rate)

Capitalization rate (or Cap Rate for short) is commonly used in real estate and refers to the rate of return on a property based on the net operating income (NOI) that the property generates.

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com