Persistent Systems Acquisitions Strengthen Payment/Cloud Capabilities

Yesterday’s Market Performance

Nifty: 17,532.05 I -86.10 (0.49%)

FII Buy Net: Rs 139.29 Cr

DAX: 15,156.44 I -104.25 (-0.68%)

Sensex: 58,765.58 I -360.78 (0.61%)

DII Sell Net: Rs 613.08 Cr

FTSE: 7,027.07 I -59.35 (-0.84%)

We’d love to hear your thoughts on our newsletter. Please take this simple survey and give us your feedback. Survey

Howdy Toasters!

Join our Discord community where we discuss all things related to finance (trading, investing, economics, data, MFs & more) + memes (of course). Join Here (promise we won’t spam, have we ever??)

In this edition of Morning Toast, we’ll cover

- The latest acquisitions made by Persistent Systems

- A technical setup (breakout) in a renewable energy company

- And as always, an education concept to keep you going

![]()

GMR Infra: 41.00 | +2.65 (+6.91%)

- The script zoomed over 6% after the airport regulator reportedly allowed GMR Hyderabad International Airport to gradually increase user development fee (UDF) April 2022 onwards

Bharti Airtel: 675.90 | -12.40 (-1.80%)

- The stock market was down almost 2% after The Department of Telecom (DoT) slapped a penalty of Rs 1,050 crore on Bharti Airtel based on sector regulator Trai’s recommendation five years ago, sources said

Persistent Systems (PSYS) recent acquisitions strengthen payment / BSFI & cloud capabilities what’s up and what do you need to know? 💪🚀

The deals:

-

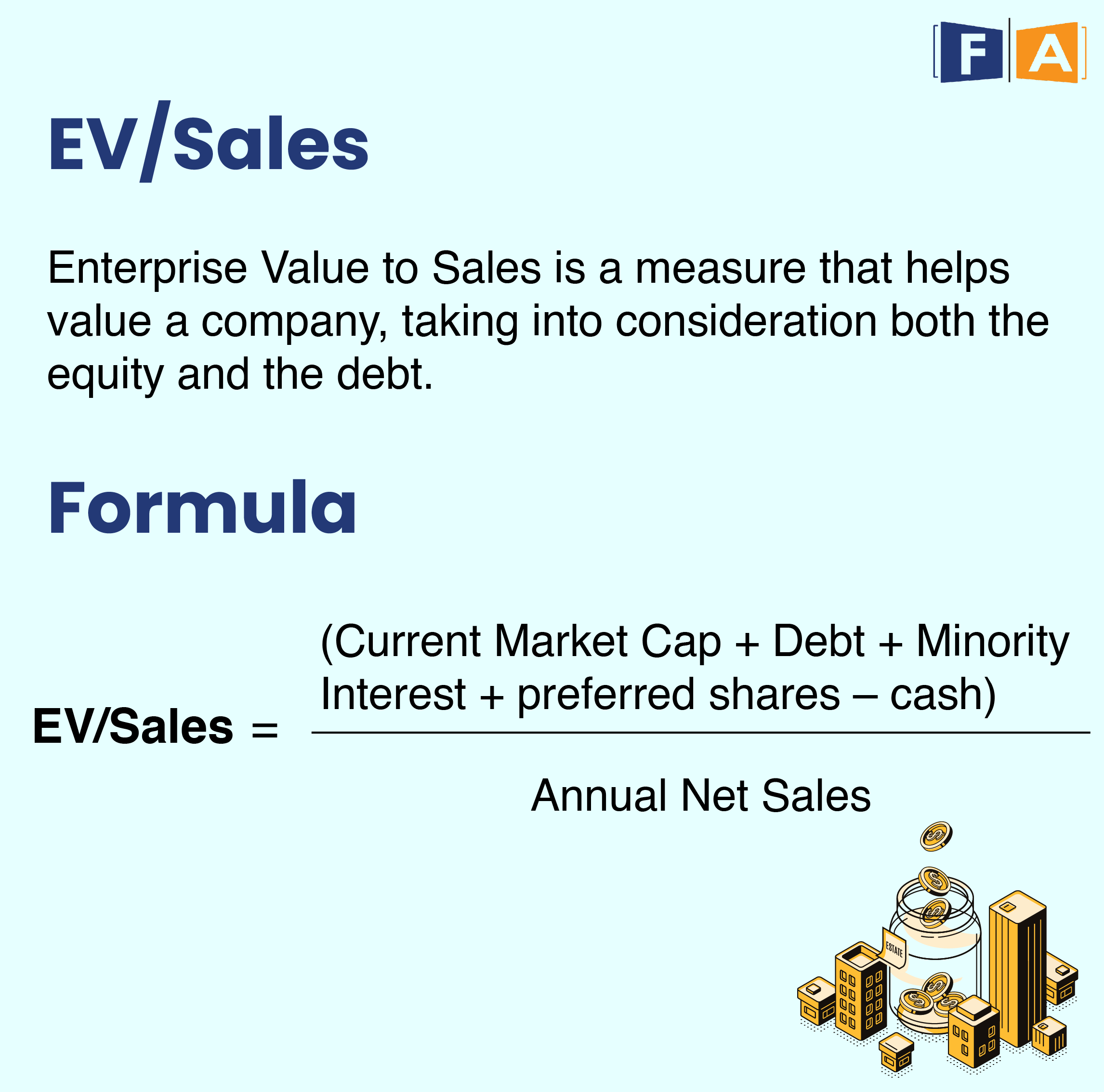

The company has entered into an agreement to acquire Software Corporation International (SCI) and its affiliate Fusion360 LLC for cash consideration of USD 53 Mn (valuing the company at 3.1x EV / Sales CY20)

-

Likewise, PSYS in another transaction, has agreed to acquire certain assets of Shree Partners LLC (USA) and it’s Indian subsidiary Shree Infosoft for a cash consideration of USD 6.9 Mn (0.9x EV / Sales FY21)

Why?

-

SCI brings domain consulting capabilities & specialises in Payments Solutions, integration & support service for US Banks, setting the foundation for a dedicated Payments Unit within Persistent Systems, and giving PSYS a foothold in the region of Charlotte, USA (hub for US BFSI industry)

-

In addition, the acquisition expands Persistent Systems’s BFSI client footprint by ~10 BFSI clients in North America, with the incumbent CEO of SCI continuing to lead the newly created Payments Unit at Persistent Systems (providing strong domain expertise continuation)

-

Acquisition of Shree Partners enhances PSYS’s capabilities in the cloud, data and infrastructure domains, and adding ~200 employees within the NCR region, servicing clients across US & Europe, within the BFSI and Travel & Hospitality space

-

Combined revenue run-rate of the two target entities was USD 25 in the last year, with a 2 Yr CAGR of 13%

-

From a bottom line perspective, the company expects revenue synergies to gradually decrease margin impact, although for the first 2 years (looking at deal contours) PSYS expects margin hit of 0.05 – 0.075% (marginal in the grand scheme of things)

Interesting! Tell me more?

-

The Payment IT services market is expected to grow by 12.5% in CY21 and reach a size of USD 16.8 Bn (huge!!)

-

These acquisitions, with a specific focus towards Payments Infrastructure & Consultancy, via companies with multiple years of performance & clientele will help PSYS take advantage of the acceleration in demand for payments modernisation

-

Given the low ticket size (~4% revenue addition / low single digit bottom line impact) augurs well in the grand scheme of things for PSYS

And PSYS recent quarter performance? What’s that been like? 🧐

-

The company’s showed consistent services revenue momentum, backed by a strong deal intake (USD 245 Mn for the 1st Quarter), while maintaining a focus on the bottom line (EBITAM expansion)

-

Accordingly to bloomberg estimates, PSYS is expected to deliver 26% EPS CAGR over the next two years

Keep a track? 📌

In case you wish to analyse companies in a similar way, we run on a course on the Art of Stock Picking & Long Term Investing. Check it out here.

![]()

TATA Power breaks out of falling channel, with 15% returns in the past week, what’s happening? 🤔

-

Analysing Tata Power on a monthly time-frame (over 50 months), indicates that the stock just gave a breakout above its main (10+ year) resistance level (142)

-

In a downtrend (for a fair bit), the stock has been consistently trading below its multi year resistance of 142, finally breaking out; as a rule of thumb, and having noticed previous instances, multi year consolidations usually lead to big rallies (having observed in IHCL last week)

-

For a good part of the last decade the stock was trading within a falling channel (between the 2 falling trendlines), making lower highs and lower lows.

-

The stock broke out of the falling channel (view image below), with the accumulation of shares (for almost 10 years) leading to strong momentum (in a multi year resistance breakout)

What other price action / trend can give us confirmations, to avoid any potential traps? (Of-course!!) 🧐

-

Initially, we looked at Tata Power on a monthly time frame, trying to understand the trend the stock is making, analysing the weekly time-frame is equally important to avoid any traps (positional setup)

-

On a weekly time-frame, the script has been in a constant uptrend for over 7-8 months as prices are breaking earlier highs and making new ones and small corrections only managing to make higher lows (view image below).

- This constant momentum has led to the breakout over the main resistance level 142 (seen on monthly chart)

Keep a track? 🤨

-

The constant and steady uptrend (last 7-8 months) which led to a breakout above the multiyear resistance, gives us a clear picture on the stock while safeguarding us against possible traps

-

We started on a monthly time-frame with overall price action and trend analysis and took second confirmation on a weekly time-frame

What else caught our eye? 👀

Ola Electric moving full steam ahead

- Ola Electric has raised another round of $200 million with a valuation of over $3 billion to strengthen its ‘Mission Electric’

- The funds will be used to accelerate development of the electric motorcycles, mass-market scooters and an electric car.

- Investors are watching its moves closely ahead of its planned IPO in early 2022.

Things getting worse for Zee promoters

- The NCLT has asked the Zee directors to comply with the Companies Act and call an AGM as requested by their shareholders (Invesco) before October 3rd.

- The tussle between the largest shareholder and the promoter group has been heating up with the former demanding the latter step down due to issues of corporate governance.

- If Zee refuses to comply, the regulatory body may step in and call the requested meeting themselves.

M&M interested in the EV sector

- Mahindra and Mahindra Ltd is looking to raise funds for its Automobili Pininfarina unit to being its $2.2 million electric hypercar into production

- They might also consider a foreign listing for the EV supercar business.

- The unit could be valued at ~ $500 million. (damn!)