Motherson Sumi Acquisitions in Line with Vision 2025 Targets

Yesterday’s Market Performance(11th October)

Nifty: 17946.00 I 50.80 (0.28%)

FII Sell Net: INR -1,303.22 Cr

DAX: 15,199.14 I 6.99 (-0.05%)

Sensex: 60135.78 I 76.72 (0.13%)

DII Sell Net: INR -373.28 Cr

FTSE: 7,146.85 I 51.30 (0.72%)

Howdy Toasters!

In today’s issue of the Morning Toast, we discuss:

- Motherson Sumi (MSS) acquires CIM Tools, India (CIM), and Nanchang JMCG.

- Bata gave a breakout above its main resistance level (1900).

- Bloomberg Consolidated Q2 results.

- As always, an education concept to keep you chugging along.

Motherson Sumi acquires with a view to achieving Vision 2025 targets: What’s up and what do you need to know? 🧐

-

Motherson Sumi (MSS) acquires CIM Tools, India (CIM) and Nanchang JMCG, China with a view towards penetrating the aerospace segment and improving its presence in the Chinese Auto markets

-

Acquired for a cash consideration of INR 2.4 Bn & INR 0.4 Bn, the two companies have a cumulative topline of INR 3.5 Bn for FY & CY20

Interesting! Company Profiles? Product Portfolios? Financial Implications? (Yesss!) 🤔

CIM Tools, India

- The company is engaged in machining, surface treatment, sub-assembly and testing of detailed aircraft parts (doors, wings, tail, fuselage etc.); primary customers include Boeing / Airbus (termed as Primes in the aerospace world)

- MSS has acquired a 55% stake at a valuation of INR 4 Bn, with CIM’s FY20 & FY21 revenue at INR 2 & INR 1.3 Bn (with ~20% margins)

- CIM has a robust INR 15Bn+ order book, which is to be executed over a 5 year period (>80% is backed by long term agreements)

- The addressable market for aerospace materials & aero-structures is expected to touch USD 2 TN by 2040 (huge!!) owing to strong demand for new airplanes on the back of growing passenger traffic

Nanchang JMCG, China

- The company is engaged in automotive mirrors for Passenger & Commercial Vehicles (PV, CVs) with a 6-7% market share for CVs in China

- Nanchang posted a EUR 17 Mn turnover in CY20 while recording positive cash flows as well

- Customers of Nanchang include Ford, Isuzu, and Changan (through JV partners of JMCG)

- Through this acquisition, a subsidiary of MSS in China (SMR-NBHX) will strengthen its manufacturing footprint (6 new facilities), while providing extra capacity for the region

Nice! Final word? What are the overall ramifications for MSS? (Great q broo) 👌🤘

- MSS launched Vision 2025, pre-pandemic, and yet continued with the same targets as recently as November 2020, reiterating the company’s vision of touching USD 36 Bn in revenue by 2025 (for context, revenue in FY20 was USD 9 Bn)

- While these acquisitions are small steps towards realizing this vision (present revenue contribution perspective), the overall rationale is not lost, with the company entering markets/product solutions that are bound to be value accretive in the longer term

- The CIM acquisition provides a head-start into the high-entry barrier aerospace business, with the company possessing 60+ qualifications/certifications and is on the path of achieving USD 1 Bn+ in revenue

- Similarly, China is an extremely important geography for MSS, contributing 7% to the topline, with Nanchang strengthening present manufacturing capabilities

Keep a track? 📌

![]()

Over 11% return in the last 11 days, Bata India is on a roll 🚀👀

-

Analyzing Bata India on a weekly time-frame (over 40 weeks) indicates that the stock just gave a breakout above its main resistance level (1900)

-

The share had been trading below its year-long resistance (1900) and has finally closed above this level, trading in a sideways momentum for the best part of last year (and facing resistance around 1705)

-

In 2021, on the back of good volumes and momentum build-up, the stock broke out above these resistance levels

That’s awesome, what other price action/trend can give us confirmations? (Yesss, great question) 😕

- On a smaller time frame (daily), the script has been in a constant uptrend (over 7-8 months), with prices breaking earlier highs and making new ones, with small corrections only managing to make higher lows (see image below)

-

The higher highs and higher lows have resulted in the formation of a rising channel (view image below), with the constant momentum and volume leading to the breakout over the rising channel and the main resistance level 1900 (seen on the weekly chart)

- Moving between time-frames is key, with initial trend identification on a weekly chart and final confirmation on daily, each time-frame being key to avoid potential traps

So should we keep track?🤨

-

The constant and steady uptrend (last 7-8 months) which led to a breakout above the rising channel (daily time-frame) and year-long resistance (weekly time-frame), gives us a clear picture on the stock while safeguarding us against possible traps

-

We started on a weekly time-frame with overall price action and trend analysis and took second confirmation on a daily time-frame

What else caught our eye? 👀

TCS makes some bids following parent

- Tata Consultancy Services (TCS) will bid for digitization projects of Air India (recently acquired by parent Tata Sons) and leverage its expertise from working with other airlines (Singapore Airlines, British Airways, etc.)

- It is also bidding for a $50 billion federal IT project in the US – where they believe they are an ‘underdog’

- TCS posted its best quarter in several years (acc to management) for the second quarter of the year – ‘all the verticals and geographies grew very well’ said the CEO.

T + 1 Settlement implementation to be pushed?

- Many clearing corporations have asked for a postponement of the implementation of the T+1 settlement cycle (current launch date is Jan 1) saying that the system is not ready to handle it yet

- A delay of four months is being sought since most global financial institutions go through an IT freeze in December where no changes to internal systems can be made

Demand and Production not looking very bright

- High cost of inputs, skyrocketing global commodity prices, shortage of containers and raw materials like semi- conductors may act as a hindrance to the economy reviving

- For context, raw materials’ costs has increased by more than 50% in the last year itself

Q2 results season has kick-started — below are Bloomberg Consolidated Estimates for you to benchmark company performance.(Source: Bloomberg)

|

Infosys |

Wipro |

Mindtree |

|

|

Date of Results |

13th October 21 |

13th October 21 |

13th October 21 |

|

Net Sales |

2,93,806 (Rs in millions) 19.6% (YoY growth) 5.3% (QoQ growth) |

1,93,866 (Rs in millions) 28.3% (YoY growth) 6.2% (QoQ growth) |

24,661 (Rs in millions) 28.0% (YoY growth) 7.6% (QoQ growth) |

|

EBITDA |

75,741 (Rs in millions) 6.0% (YoY growth) 1.3% (QoQ growth) |

41,885 (Rs in millions) 21.8% (YoY growth) (0.2%) (QoQ growth) |

4,796 (Rs in millions) 22.9% (YoY growth) 3.3% (QoQ growth) |

|

PAT |

52,793 (Rs in millions) 8.6% (YoY growth) 1.4% (QoQ growth) |

28,664 (Rs in millions) 17.7% (YoY growth) (10.3%) (QoQ growth) |

3,359 (Rs in millions) 39.7% (YoY growth) (2.2%) (QoQ growth) |

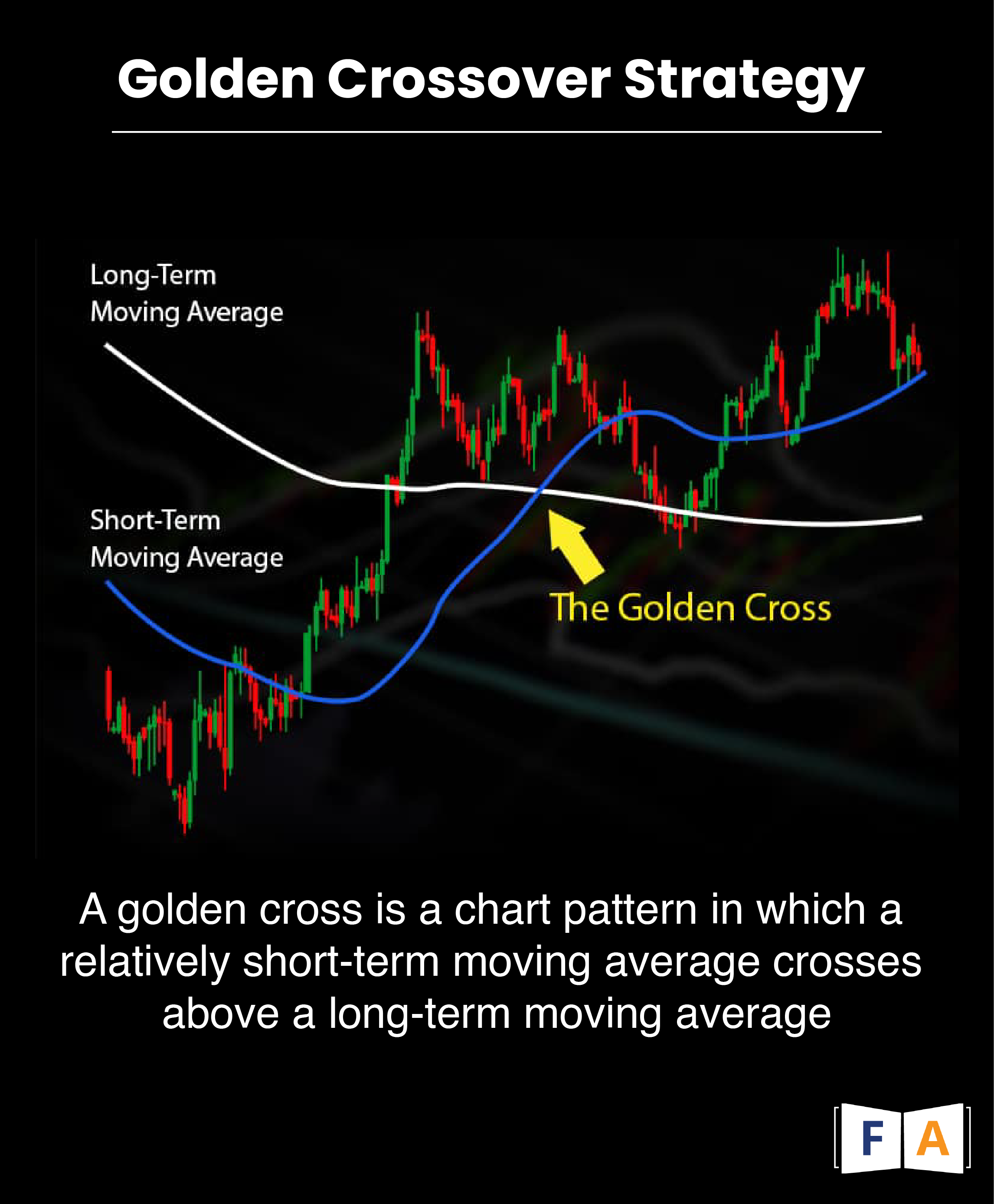

Check out our short video to know about Golden Crossover Strategy.

![]()

Here are the quick takeaways from our RoundTable Discussion on Futures & Options:

- Options are non-linear, it can help you generate revenue even if the market doesn’t go in your direction and keep a check on your losses.

- Getting a sense of timing is the most important thing while trading in Options.

- Formulating a view and a rationale comes by formulating your hypothesis and experience. Don’t focus on 100+ oscillators, practice making clean strategies.

- If you lose money, it can be either because of your view or your strategy. Learn to analyze both.

- Always keep a check on your risk potential before getting into any trade.

Check out the video to watch the full discussion.

We conduct our RoundTable Discussions every Saturday, stay tuned and don’t miss any 🤩

We’d love to hear your thoughts on our newsletter. Please take this simple survey and give us your feedback.