Largest Luxury Watch Retailer Ethos IPOs

Good Morning Toasters!

Hi friends!! Finally some respite eh? Investors showed their true colours, with the closure of the mammoth LIC IPO eventually freeing up capital for most retail traders & investors (I think). Let’s hope these days continue!

In today’s issue, we cover the IPO of India’s largest luxury watch retailer, Ethos Limited, which has a strong competitive edge through an omnichannel, Pan-India presence, while most competitors are focused/limited to maintaining a regional business. At the time of writing, the retail portion was subscribed to ~53% of the allocation.

Aditya Birla Fashion and Retail dropped their numbers, recording their best-ever Q4 performance. The company is now spread across, with brand offerings no longer just limited to Lifestyle and Pantaloons. ABFRL delivered an EBITDA beat, recording a positive contribution vs loss expectations (from the analyst community)

And finally, we’ve started a rollout of our newest product, Trade:able, that aims to democratise trading, via a unique and fun learning experience. There are a bunch of amazing rewards and prizes to win. Click here to know more.

Market Watch

Nifty 50: 16,240.30 | -19.00 (-0.12%)

FII Net Sold: INR 1,254.64 crore

Sensex: 54,208.53 | -109.94 (-0.20%)

DII Net Bought: INR 375.61 crore

IPO News

Luxury Watch Retailer Ethos Limited accesses the markets; what’s up and what do you need to know?

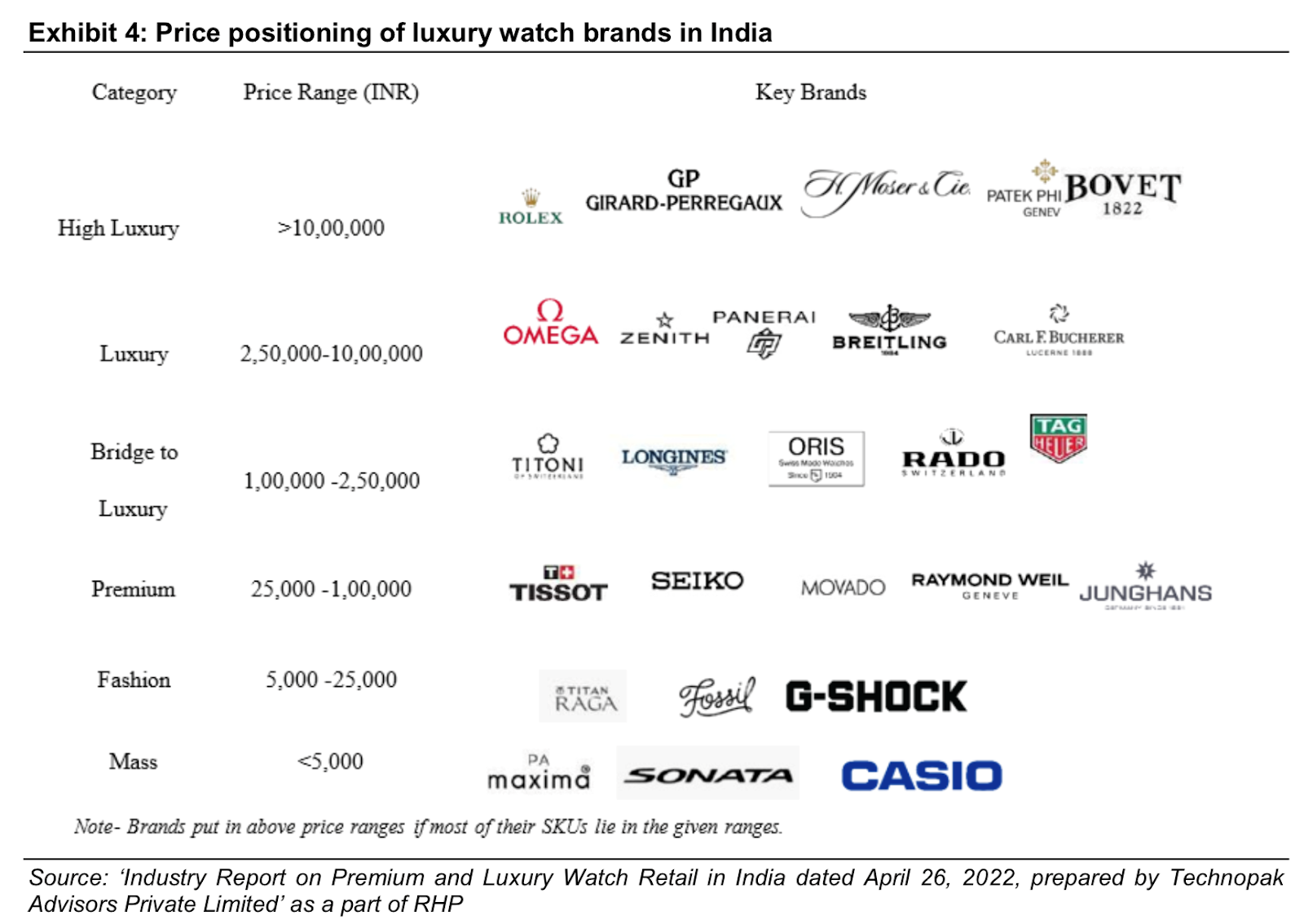

- One of India’s largest watch retailers with 50+ brands, Ethos Limited has a market share of 13% in the INR 6,615 crores premium & luxury watch market

- Built on an omnichannel experience, Ethos has a pan-India presence with 50 stores spread across 17 cities; the company also retails through its website, which is billed as India’s largest in terms of the number of brands & watches offered (in this category)

- Apart from premium & luxury watch retail, Ethos also undertakes retail of pre-owned luxury watches, under the ‘certified pre-owned’ luxury watch lounge in New Delhi

- Ethos Limited is looking to raise INR 472 crores via a fresh issue (company receives capital) of INR 375 Crores and an Offer for Sales (Promoters cashing out) for the remainder value, with a post-money market capitalisation (adding capital raised to initial valuation) of INR 2050 Crores

Okay! Give some information? Company Strengths? Industry Dynamics?

- The Indian watch market is pegged at a sizeable INR 13,500 crores, growing at a CAGR of >10%, and expected to touch INR 22,300 crores by FY25E on the back of increased per-capita income, higher brand consciousness, digitisation and increased urbanisation

- Ethos has access to a High NetWorth Individual database of 283,300 individuals, while traffic to its digital platform has also considerably increased (21.46 Mn sessions in 2021 vs 15.47 Mn in 2019)

- A strong omnichannel presence has allowed the company to create an ecosystem, enabling the customer to discover & purchase watches via one medium or another (see image below)

- With 50 stores, over 7,000 varied premium and luxury watches, and ~30,000 watches in stock at any point, Ethos’s retail store locations are strategically located across malls, airports, and other premium locations (think: Nariman Point, Connaught Place etc), allow the company to acquire all kinds of customers

Interesting! What about going forward? And what about financials?

- The current business set-up is well-geared to grow, with added capital to expand retail presence, watch portfolio and buildout of certified pre-owned (CPO) business –

- Grow in neighbouring countries of Bangladesh, Sri Lanka, Nepal, and the Maldives, while also going deeper into the present cities + expanding into newer demand hotspots

- The company has formed exclusive agreements with brands, that only retail through Ethos outlets, with plans to expand this arrangement with more popular brands

- The global CPO market is pegged at USD 18 Bn and in stark contrast to India, which is currently valued at INR 40-50 crore, with >80% of contribution coming from the unorganised space, leaving plenty of room to grow

- The company plans to develop a mobile application for an improved buying experience, with aims to leverage virtual & augmented reality, at-home viewings and watch recognition (click a picture to get more details on the watch) among other features

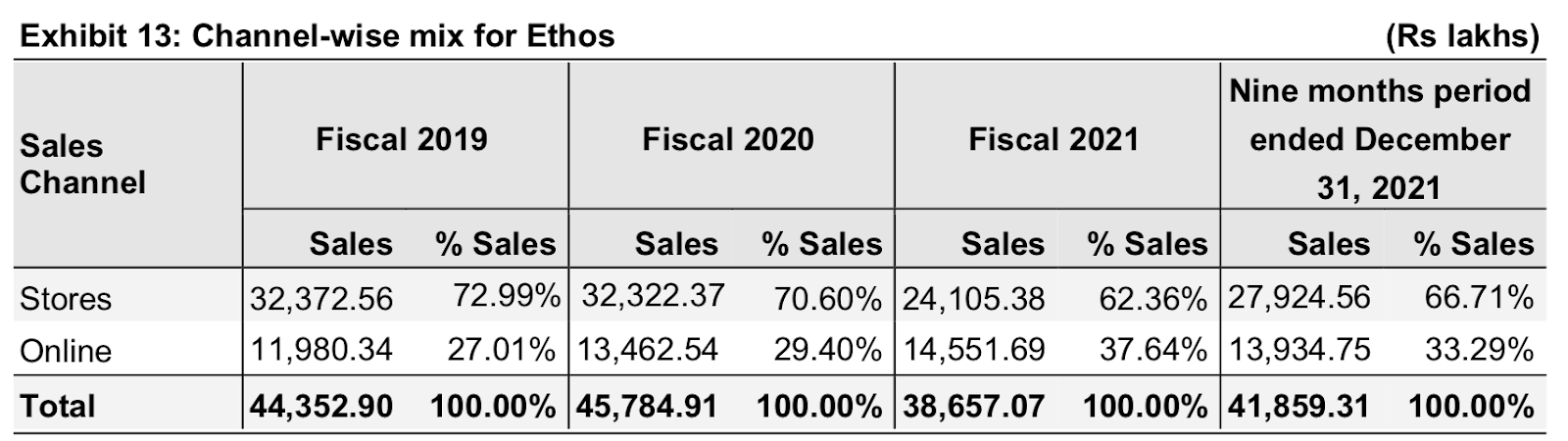

- The company was affected by Covid-19, with stores shut and discretionary spending dropping, resulting in de-growth for FY21; 9MFY22 numbers show the company is on track to touch FY20 / FY19 topline, indicating a return to normal business scenario

- EBITDA % over the last couple of years have ranged b/w 2 -13%, while PAT is in a similar range, affected by the pandemic and growth-oriented nature of the business

- The company spends 1/3rd on average on advertising, and has consistently increased its Average Selling Price (ASP) from INR 73k in 2019 to INR 142k in 2021

Nice! Final thoughts?

- The company commands a leadership position in the Premium & Luxury Segment, with competitors managing only a regional presence, while Ethos maintains a pan-India reach

- Ethos is led by promoters with >3 decades of experience, with their initial venture, KDDL is currently listed and operating the ‘Ethos’ and ‘Summit’ brands, indicating a strong execution track record and industry know-how

- Profitability for the company has gone through a churn, accentuated by Covid-19 and yet, with the industry growing, Ethos is best placed to capture the incremental opportunity via efficient execution (we believe)

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- JPMorgan CEO loses favour – Shareholders of JPMorgan Chase & Co. (the US’s biggest bank) rejected the $50 million retention bonus awarded to CEO Jamie Dimon (vs a compensation + retention bonus totalling $84.4 million last year) and voted against the bank’s compensation plan in general on Tuesday. Only 31% have voted in favour of the proposal though it is unlikely that Dimon will give back the award. The bank is losing favour with investors and gaining criticism over its spending and investments

- Coca Cola doing its way for the planet – The British arm of Coca Cola will be launching packaging that keeps the plastic lids attached to the bottle when opened in a bid to make it easier for consumers to recycle them in their entirety. The company has pledged to use at least 50% recycled material in its packaging by 2030, and this is a step in its strategy to help create a “circular economy” for its plastic products amid regulation

- Boon or bane for Walmart? – Inflation is both hurting and benefitting Walmart – sales have increased as consumers become more price-conscious with comparable sales up 3% (in the quarter ended April 29 vs a year earlier) but the bottom line has not met investor expectations at all clocking in 5% less in profit last quarter than a year earlier on a higher revenue base. Walmart saw its largest % decline since 1987 of 11.4% on Tuesday

Company News

Aditya Birla Fashion & Retail delivers the best-ever Q4 performance; what’s up and what do you need to know?

- The company delivered its highest-ever revenue and EBITDA, despite a January washout (due to Omicron), growing by 25% and 58% respectively, with traction across business lines Lifestyle, Pantaloons, and Ethnic (more on this below)

- ABFRL continued its strong digital acceleration, with the cumulative e-commerce businesses for the company now contributing ~INR 1000 crore to the top line, up 52% from last year

- The company continued to expand its retail footprint across brands and markets, adding new stores in Lifestyle, Pantaloons and Ethnic categories, while building on its initial strategy of acquiring brands & capabilities (Reebok, House of Masaba et al.)

- In addition to Lifestyle (Allen Solly, Louis Philippe etc.) and Pantaloons, ABFRL has now built-out a strong alternative product suite, covering the growing active athleisure Innerwear, Youth Western fashion (Forever 21, American Eagle), Super Premium Brands (The Collective, Ted Baker, Polo) and Ethnic wear (Sabya, Tarun Tahiliani etc.)

Nice! Give some more information for Q4 and FY22 overall? (Yess my man)

- Lifestyle brand’s margins expanded by 5%, with EBITDA more than doubling in the last year, showing strong results from cost-inflation measures undertaken by the company

- The company expanded its presence by adding 143 during the year, with the e-commerce brand, own recording the highest growth (113%) among all technology initiatives

- Pantaloon’s business continued its comeback (EBITDA grew by 33% over last year), with the company adding 18 new stores during the quarter, while also launching a new app to improve customer experience and acquisition

- E-commerce revenues for Pantaloons grew 81% YoY, showing the positive impact of the application and new/innovative marketing campaigns executed by the company

- The ethnic business (think brands like Sabya, Jaypore, Shantanu & Nikhil) reported a topline of INR 1 Bn, and is on an INR 4.0 Bn run-rate

Damn! That’s a lot of information! Going forward? What about the stock price and valuations? (Yess, wrapping it up bro)

- ABFRL expects to continue on the same trajectory going forward, expanding its omnichannel footprint through a concerted effort to improve its store presence, while building up its e-commerce solutions across brands

- Its recently acquired/accumulated ethnic brand portfolio has a limited store presence (beyond what was there when acquired), with the company indicating plans to aggressively expand its brand footprint

- The company delivered a beat (Bloomberg consensus estimates) on its EBITDA & PAT nos, with the market expecting a loss vs a delivery of INR 401 Crores, with a % expansion of ~3%

- Year To Date the stock has been larger, growing only ~2.6%, while in the lead-up to the results the stock is up ~9.9%; the company currently trades at ~32x FY24E P / E (x) which when compared to the likes of Trent, V Mart, Go Fashion and Page Industries is a stark discount

Keep a track?

What else caught our eye? 👀

Tatas got no chill

- Tata Consumer Products has plans to acquire up to 5 consumer brands to strengthen its position and reap gains from inorganic growth

- It is already facing stiff competition from global names like Unilever, and even domestically from Reliance Industries which has plans to acquire 60 small grocery and household consumer goods brands

- A major advantage for the company right now is that they have managed to weather the inflation storm with prices of their three main commodities – coffee, tea and salt – remaining relatively stable

Saudi Aramco going public

- Saudi Aramco wants to launch an initial public offering of its trading arm (Aramco Trading Co.) and leverage the boom in oil prices with a valuation that is likely to cross $30 billion

- This would likely be one of the world’s biggest IPOs this year with Aramco selling a 30% stake with the only drawback being that they will have to open their books to the public

- Aramco is on a money-making spree and posted its highest profit on Sunday since it got listed (owing to a price jump after the war, and recovery of demand)

Results Preview (Nifty 200)

Thursday, 19th May: Ashok Leyland, Bosch, Container Corporation of India, Dr Reddy’s, Godrej Consumer, HPCL

Friday, 20th May: Gland Pharma, Zydus Lifesciences, NTPC, One97 Communications

Educational Topic of the day

Momentum Investing

Momentum investing is an investment strategy aimed at purchasing securities that have been showing an upward price trend or short-selling securities that have been showing a downward trend. The main rationale behind momentum investing is that once a trend is well-established, it likely to continue.

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com