ICICI Bank Stamps Digital Leadership

Nifty: 16,912.25 | -284.45 (-1.65%)

FII Net Sold: INR 3,361.28 crore

Sensex: 56,747.14 | -949.32 (-1.65%)

DII Net Bought: INR 1,701.56 crore

In today’s issue of the Morning Toast, we discuss:

- ICICI Bank stamps digital leadership

- Trent bent out of shape?

- An education concept to keep you chugging along

ICICI Bank stamps digital leadership, en-route to becoming a ‘Super BankTech’: What’s up and what do you need to know? 🧐

The company hosted an analyst day over the weekend, showcasing their digital offerings & providing a strategic update.

- One of India’s largest banks, and the OG lender to continuously evolve with changing times, ICICI is well & truly on a digital transformation journey, through –

-

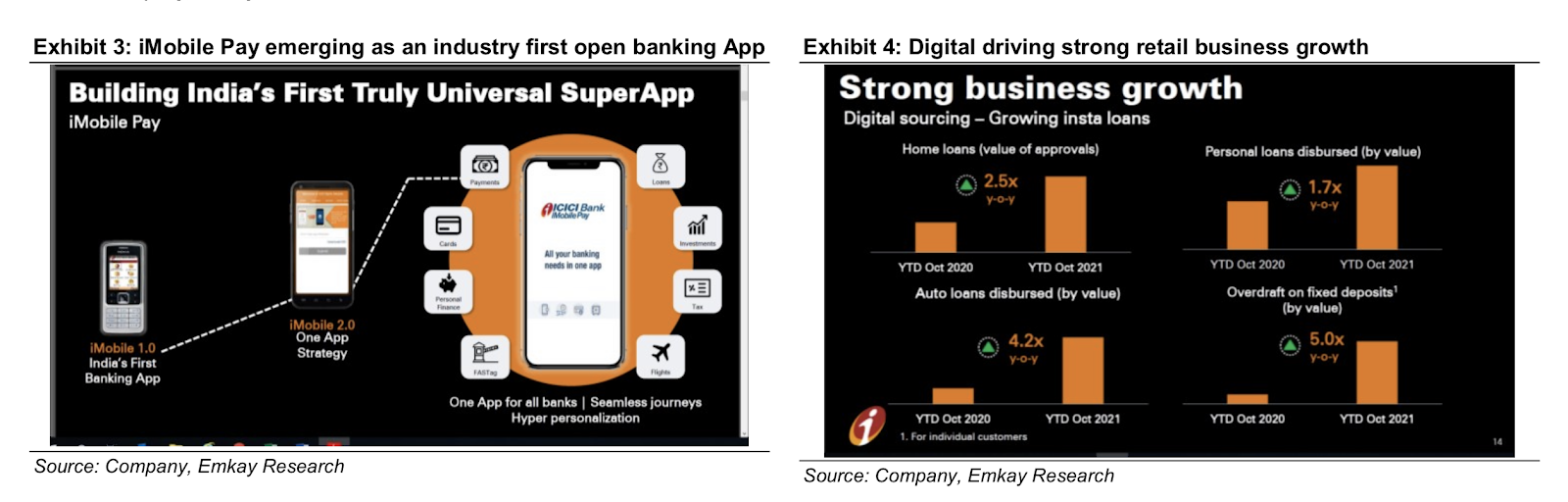

Industry first customer-agnostic Super Banking App (i-Mobile)

-

A digital lending solutions for mortgages / other retail products, i-Lens

-

Credit Cards (CC) partnership with Amazon, that has resulted in >2 Mn cards issued, and significant market share gains (from HDFC Bank)

-

-

On the non-retail front, and to work with new age entrepreneurs (SME, BB & merchant lending), the Bank has launched digi products like Instabiz (1 Mn Clients), Insta Current A/C, Trade Emerge (high take rate based, cross-border transactions) and Epaylater (for merchant lending)

-

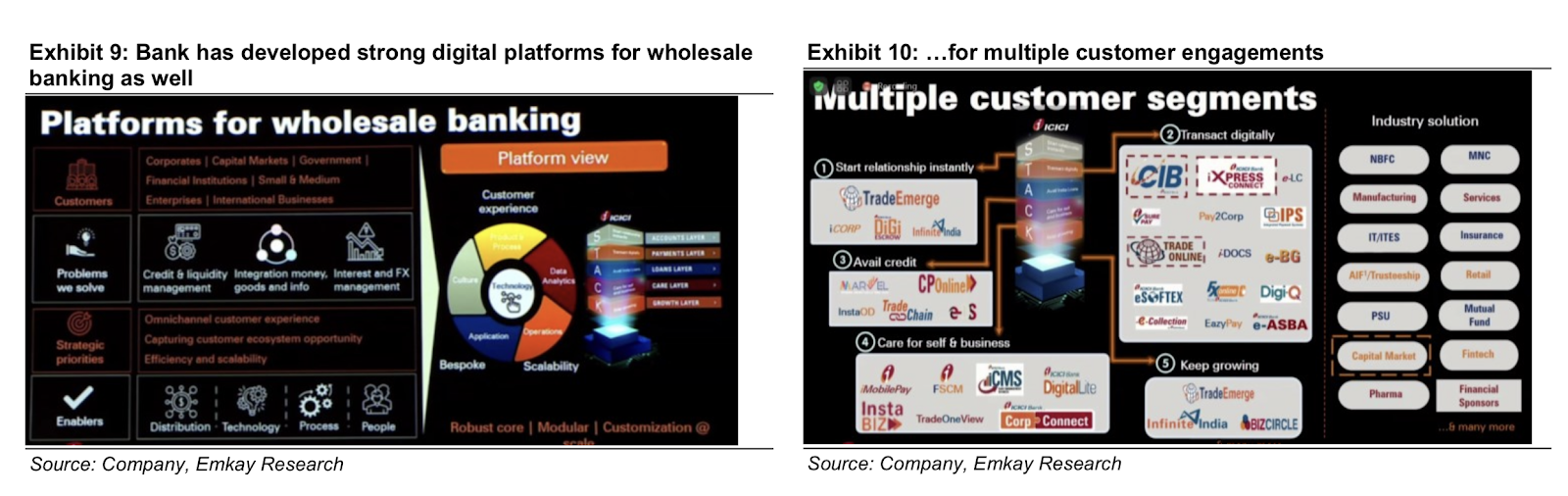

The bank is focusing on hyper personalised digital offerings, be it retail, SME or corporate, to improve customer experience & capture ecosystem / life-cycle returns (see image below)

-

A major, structural change has been the realignment of key responsibilities (at an executive level), with the bank moving away from product linked roles, to a customer-level Return on Equity (RoE) model

Interesting! Tell me more? (Growth is great, but at what cost? Asset quality et al.) 🤔

- As a lender with the experience of n-number of cycles (good & bad), asset quality & underwriting processes have been stress-tested (again & again), ultimately holding the bank in good stead (during high growth phases)

-

For example, the cards partnership with Amazon has not only helped gain market share, but also on-boarded customers with higher spend fees & lower delinquency levels (primarily due to strict underwriting processes)

-

A similar approach is visible in the corporate sector, with the bank clearly focused on return of capital, improving margin profile and developing their corporate banking ecosystem, vs a legacy credit-led approach (with mixed results)

Nice! Final thoughts? (Recent quarter performance, valuations & longer-term view?) 🤩

- ICICI’s performance in the current cycle has been far ahead of its peers in terms of growth, asset quality & margin delivery, with limited delinquencies, lowest provision amongst peer set and strong growth

- While other banking peers are still fixing their back-end related tech troubles (think: HDFC Bank), ICICI has already innovated, via in-house / early stage investments in front-end opportunities to capture NTB (New To Bank) customers

- Strategic & digital endeavours are likely accelerate business growth / profitability, driven by lower customer cycle costs and higher revenue via cross-selling (being a net ++ for bank wide RoEs)

- The stocks been beaten in the recent past, and is down ~9% in the last month, with no material changes to business (since Q2 results)

Keep a track?

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

![]()

- Analysing Trent on a weekly time-frame, indicates that the stock had been in a constant uptrend, before changing direction (see image below)

-

The stock has tested 1200 levels twice and made a swing low around 995, taking support and resulting in the prices making a double top pattern (bearish chart pattern)

- Trent, after making an all-time high (3 weeks ago) started correcting and gave a closing below the rising trendline, which is also a bearish signal.

Great! Second confirmations? Any other tools? 😏

- Looking at the chart on a daily time-frame (see image below), prices have given a closing below the very important support, i.e the 50-day SMA (simple moving average), leading to further correction in the stock

-

Currently prices are making an inside bar, which are defined as short breaks taken by stocks before continuing their ongoing trend (downtrend in this case)

-

Further, prices have managed to breakdown the inside bar (prices broke the law of the parent candle) which can result in the stock continuing its downtrend

Interesting! How do I enter / exit such a setup? 🤩

- Going short would be the ideal trade in this case, after prices give a closing below 995 (breakdown from double top); to avoid traps (bear trap in this case) wait for a retest, defined as prices taking resistance at the breakout level

- Stop-loss should be in place just above the 50-day SMA (trailing stop-loss) and a target as per your RR ratio (2 or more) needs to be set

Interesting! Final thoughts? 🧐

- The breakdown of the rising trendline and the formation of a double top pattern increases the possibility of change in trend (from uptrend to downtrend)

- On a daily time-frame, breakdown below the 50-day SMA and inside bar suggests weakness in the stock

- We started with overall price action and trend analysis and took second confirmation on moving averages and retests, safeguarding us against possible traps

Keep a track?

What else caught our eye? 👀

Countries’ distributors have had enough

- FMCG companies have said that they can only slightly alter terms of trade with organised wholesalers in response to the distributor demands of product price-parity and equal margins

- They are against giving preferential treatment to any particular distribution on the basis of order volume

- This channel accounts for 85% of overall business and a prolonged standoff can heavily harm the same

India’s growth has a new contributor

- A report suggests that $1.1 trillion of India’s growth in the next 11 years will come from ancillary digital asset-related businesses that are yet to be invented

- In fact Web 3.0 and blockchain will be enough to digitise India’s financial ecosystem

- With the right regulatory framework, adoption of digital assets could be twice as fast as the Internet

Govt is really done with crypto

- The union government has made it clear that it does not intend to boost the cryptocurrency sector in the country

- RBI has maintained a strong stance against it citing macroeconomic instability

- The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 has been included for introduction in the current session of the Lok Sabha

Initial coin offering (ICO)

An initial coin offering (ICO) is a type of capital-raising activity in the cryptocurrency and blockchain environment. The ICO can be viewed as an initial public offering (IPO) that uses cryptocurrencies.