Adani Aims To Be Naturally Atmanirbhar

Good Morning Toasters!

Sssup bros!! Hope it was a happy Monday. FIIs have stayed true to their nature, with not a single day in the last I don’t know how many days that they’ve not ended the day in the red. Unlikely that this trend changes anytime soon, so let’s dig in and keep the momentum strong.

In today’s issue, we cover the Adani family acquisition of Holcim India’s cement assets, which is not only the largest ever transaction in the Infra & Materials space but also propels Adani to the #2 Cement player in the country. Ultratech shareholders weren’t best pleased with this news, with the stock down ~2.3% during the day. The entry of Adani is likely going to make it difficult for Ultratech to expand & grow the way it has until now.

We looked at some Labor market numbers, both globally and locally and it’s not looking good. With a Fed-induced rate hike pushing most Developing Economies to play rate-hike catch-up, a lack of easily available capital is hurting Tech companies and start-ups, that really grew (?) during the Covid-19 months.

And finally, we’ve started a rollout of our newest product, Trade:able, that aims to democratise trading, via a unique and fun learning experience. There are a bunch of amazing rewards and prizes to win. Click here to know more.

Market Watch

Nifty 50: 15,842.30 | +60.15 (+0.38%)

FII Net Sold: INR 1,788.93 crore

Sensex: 52,973.84 | +180.22 (+0.34%)

DII Net Bought: INR 1,428.39 crore

Company News

Adani aims to be naturally Atmanirbhar

- The other half of the A&A band of brothers, the Adani Family, through an offshore special purpose vehicle (SPVs are made for efficient taxation), announced the acquisition of Holcim Limited’s entire stake in two of India’s leading cement companies – ACC & Ambuja

- Holcim Limited is a Swiss-based cement manufacturing company, whose presence in India was via ownership in ACC (~54.4%) and Ambuja Cements (63.2%)

- Termed as a ‘validation of our belief in the nation’s growth story by the Chairman of Adani Group, the total cumulative value of the acquisition was pegged at USD 10.5 Bn (more on this below), making it the largest-ever deal in the Infra & Materials space

- Adani Cement, which was setup only last year and had plans of launching via brown / greenfield investments across North India, is now the #2 player in the country, after Ultratech Cement (who long with JSW, had also bid for the assets)

Damn! Give some details? Why the acquisition? Why Holcim? And potential industry impact?

- India’s cement consumption is pegged at 240 Kg per capita, which when compared to the global average of 525 Kg per capita and China’s consumption of 1600 Kg per capita, positions India at a unique inflexion point (assuming a natural expansion of the country’s middle-class)

- Aiming to build a uniquely integrated and differentiated business model, the cement business has a natural play with the other interests of Adani Group, including Ports, Logistics (think: Airports), Energy and Real Estate

- Holcim’s India assets of ACC & Ambuja provide a combined capacity of 68 Mt spread across the country, and with ~80% capacity utilisation across assets, propels Adani to the #2 position in the industry (for a company that didn’t even have a presence until last year)

- The deal provides a relatively easy exit from India for Holcim Limited while leading to further consolidation in the industry, therefore allowing for better pricing (ideally) as ACC & Ambuja are operating at high utilisations

Interesting! Going forward? And valuations contours?

- Adani Cement plans to increase capacity from ~68 Mt to >100 Mt in the next few years, with rumours of plans to merge the two companies, but keep brands separate

- The corresponding offer share price for Ambuja is INR 385 / share (~7% premium to last week’s CMP) and INR 2300 for ACC (~9% premium), which translates to an offer of INR 502 Bn

- Given the acquisition then crosses a particular % of shareholding (89% for Ambuja and 81% for ACC), Adani is required to make an open offer (when one shareholder ownership >75%) to the remaining shareholders (at the same valuation), taking the total deal size to INR 814 Bn (or USD 10.5 Bn)

- The combined entity has a valuation of EV / EBITDA of 14.6x (on current market nos), which is within proximity (somewhat) of industry leaders Ultratech (15.9x) and Shree Cements (19.0x)

Nice! Final thoughts? Yay or Nay?

- The deal is pegged to a win-for-all, with all related parties gaining from the exercise, Adani entering the cement business, Holcim gaining an exit, consolidation and improved pricing opportunity within the industry and ACC & Ambuja onboarding new, aggressive promoters

- Executed using a combination of infusion of equity capital by the Adani family, and on-boarding significant debt, the interest burden is a damper on the deal, with more clarity needed on whether the group reduces the stake to 75% or delists the company

- Betting on the India growth story, with the expectation to become the world’s largest demand-driven economy, the Adani group is now virtually integrated across the length & breadth of the infrastructure landscape

- And finally, safe to say all listed stocks of Adani Group reacted positively to the news (did you expect anything different?)

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- Traders forsake options – The stock market’s speculative fever seems to have broken as individual traders are no longer falling back on options to ride the stock market’s momentum and push prices higher. 26% of options activity in March was individual investors (vs 30% a year ago) and stock trading activity in general hit a low of 10.7% in January. The recent volatility (partly due to the rise in interest rates by the Fed) has led to traders abandoning momentum traders like SPACs and NFTs as well

- The rich keep getting richer – Median pay package for CEOs reached $14.7 million in 2021 with total compensation rising by at least 12% for most of the executives and most companies recorded annual shareholder returns of nearly 30% (though much of this pay was equity awards which can lose their value very fast). Nine CEOs got pay packages worth at least $50 million last year, and equity was 78% of total compensation for the top 25 CEOs. Major gainers include Peter Kern (Expedia), Tim Cook (Apple), and David Zaslav (Warner Bros. Discovery) among others

- Oil will always be the real gold – Net income for Saudi Arabia’s national oil company rose > 80% as it benefitted from a price boom accelerated by Russia’s invasion of Ukraine. Quarterly profit increased to $39.5 billion and the company even overtook Apple as the world’s most valuable company with a market cap of $2.4 trillion. Aramco has been rejecting US requests to raise output and tame prices, and has shown support to Russia by marginally raising output for them

Global Industry News

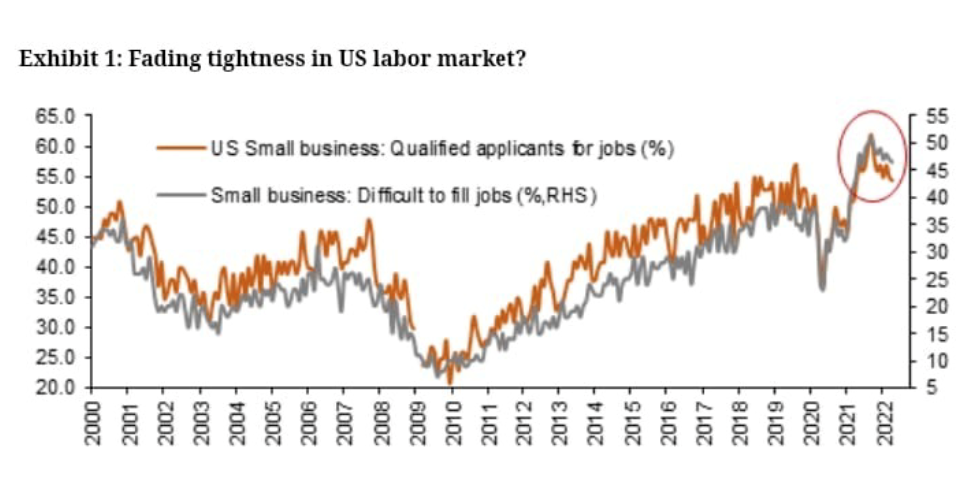

Labour markets take a pause (nooo 😞)

- The Tech-space, which was the lead Covid-19 beneficiary as companies kick-started multi-year transformation journeys, seems to be at the receiving end of a ‘world normalisation’

- There are early signs that labour green shoots may be fading (i.e. slowdown in tech co. hiring), with multiple companies globally now choosing to not hire fresh or worse reduce headcount

- Amazon is probably the prime case in point, with the world’s OG retailer putting a freeze on hiring, after having on-boarded record new members at breakneck speed during the pandemic (to fulfil demand)

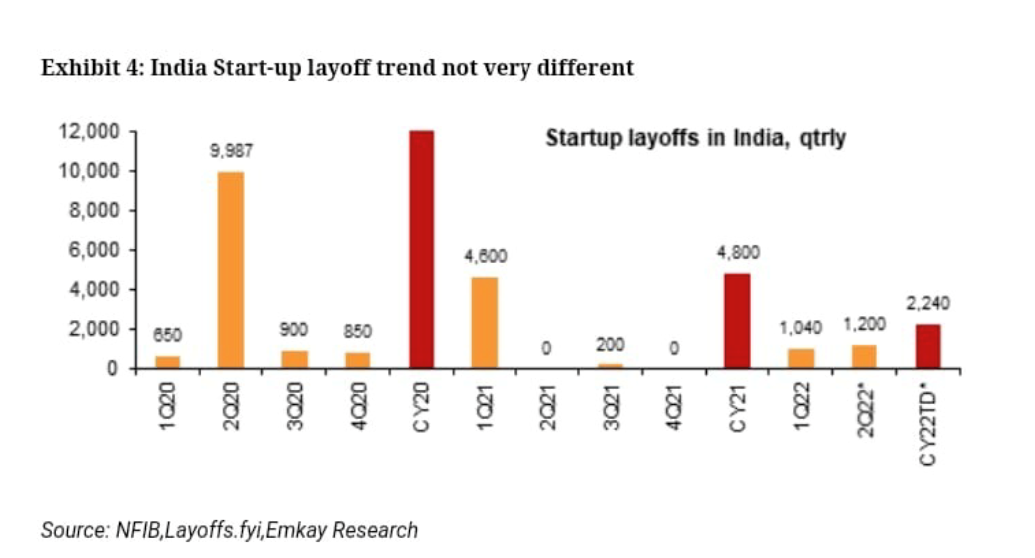

- This scenario is currently applicable in India as well, via startups who raised and hired aggressively during the pandemic, now re-calibrating and decreasing overall headcount (think: Unacademy, Meesho), given the general distrust/confidence in raising capital in the near future

Damn! Why?

- High inflation, has forced the Fed and most Developing Markets (think: India) to super-accelerate their rate hikes (in the name of FOMO) creating a paucity of possible capital available in the future

- This, coupled with a re-assessment of startup business models has forced the once high acquires of labour to re-jig their plans and cut down on budgets, in the face of survival

- These are early days, and yet the writing seems pretty real, with the signs of cooling (reduced hiring, layoffs) expected to intensify as weak and/or unproven businesses are unable to raise capital to continue

- Covid-19 brought a new set of companies to the fore, often at obscene valuations, and with capital now in scarcity, survival is key in this changing market dynamic?

What else caught our eye? 👀

Indian real estate has a new believer

- Apollo Global Management Inc. has planned to bet on the recovery of the Indian real estate market and will be lending about $1 billion to developers in India this year (up from $750 million last year)

- Two-thirds of the sum last year was dedicated to residential properties and this year too 70% will go to home builders and the rest to commercial developers

- Low-interest rates and discounts by developers fueled demand post the pandemic and the market has seen a good growth trajectory

L&T has faith in themselves

- Larsen & Toubro Ltd (L&T) has claimed that its information technology (IT) services business will double to ₹73,980 crores in revenue by the end of Mar’26

- Share of the high-margin business will likely jump from a fifth of total revenue now to 27% and compound annual growth of 23.06% is needed to achieve the management’s target

- The market however believes this target to be ambitious even though L&T has made some key mergers like LTI and Mindtree Ltd, and has allowed its third business L&T Technology Services Ltd to run independently

Results Preview (Nifty 200)

Tuesday, 17th May: Abbott India, Bharti Airtel, DLF, IOC, PI Industries, Dr Lal Path Labs

Wednesday, 18th May: IGL, ITC, LIC Housing Finance, Lupin, Manappuram Finance, ABFRL, Pidilite Industries, Interglobe Aviation

Educational Topic of the day

Book Value Per Share (BVPS)

The book value per share (BVPS) is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding. When compared to the current market value per share, the book value per share can provide information on how a company’s stock is valued.

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com