Video-Based Social E-Com: Redefining India’s E-Com Ecosystem?

Yesterday’s Market Performance

Nifty: 16568.80 I -45.80 (-0.28%)

FII Sell Net: 595.32 CR

DAX: 15,965.97 I 44.02 (0.28%)

Sensex: 55629.49 I 162.78 (-0.29%)

DII Buy Net: 729.49 CR

FTSE: 7,169.32 I 11.79 (0.90%)

We’d love to hear your thoughts on our newsletter. Please take this simple survey and give us your feedback. Survey

Howdy Toasters!

Join our Discord community where we discuss all things related to finance (trading, investing, economics, data, MFs & more) + memes (of-course). Join here (promise we won’t spam, have we ever??)

In today’s issue, we discuss;

- Video-based social e-commerce- poised to be the next big thing in the Indian e-commerce industry? Keep reading.

- July’21 recorded the highest FII inflows in the last year.

- Top movers and shakers of the market, other important financial news, and an educative concept to help you keep learning. Read along!

![]()

HDFC Bank: 1513.00 | -1.65 (-0.11%)

-

The stock ended in the red after gaining over 3% at open on August 18 after the RBI relaxed restriction placed on sourcing of new credit cards

Vodafone Idea Ltd: 6.45 | +0.70 (+12.17%)

-

The stock price surged over 10% on August 18. The company is in discussion with bond holders to refinance over Rs 6,000 crore of debt

Note: Above are not owned by the authors of the newsletter and are neither recommendations to buy the stocks; not our style at FinLearn

![]()

Video-Based Social E-Commerce is taking shape in the country (wait, whaat?) 📲

- A tongue twister right? (we feel you); Video-Based Social E-Commerce is an integration of e-commerce with video content, with the objective of demonstrating a product better (okay?)

-

Designed to address two fundamental issues in the present e-commerce model, Video Commerce platforms are focused on introducing the next billion users to the world of e-commerce (Tier 2 and beyond), and building trust through influencer based content (think: introducing beauty products to a first time user)

-

There are similarities, yet the approach varies; E-Commerce players in the past have included video content as a means to educate, with a view towards building engagement and leading towards payment

-

Video-Based E-Commerce Players are approaching the problem differently; they aim to integrate the core tenets of social media (& everything that comes with it), with the technology stack of an e-commerce platform (think: suppliers, platform, payments, logistics, delivery, return & cancellations)

-

Instagram is doing this, especially with reels, allowing users to peruse video content and finish the journey by purchasing the product on their e-commerce platform / or directly through the brand landing page (think: D2C)

Okay. Players, global comparisons et al. (you know it) 😏

- The creator space exploded post-TikTok’s ban (check this issue to know more), with brands allocating more marketing $$ towards non-traditional means of reaching their target audience (going beyond regular Facebook Ads)

-

Youtube acquired video-commerce platform SimSim (in July this year), Trell (another video e-commerce player) raised USD 45 Mn from a Mirae and H&M Group, and InfoEdge owns a fair bit of BulBul, which is in the same space (damn!!)

-

The potential for monetization remains huge – to give you context, Chinese player Kuaishou, has periodically increased its engagement (through shopping) and now has a monthly GMV of USD 50 Billion; TikTok (and parent ByteDance) have recently set up their E-Commerce unit, with plans to include this step in the user’s journey

Woahh! Tell me more? 😎

- Video E-Commerce has its benefits, especially for products that require demonstration (think: apparel & makeup); with content that shows the user how to use the product, while providing a glimpse on how the product would look on them (a massive upgrade from looking at static pictures) and thus building trust in the process

-

Platforms like SimSim, Trell & BulBul aren’t necessarily English first, allowing brands to target users through vernacular languages, touching Tier 2 cities & beyond

-

E-Commerce is all about trust – the first cycle (starting 2013) established the medium in Metro & Tier 1 Cities, with average ticket sizes rising through deep discounting; the second phase aims to capture the next billion users (Tier 2 and beyond), by building trust to increase the average purchased value beyond the INR 300-700 range (that is the norm presently)

What have our friends, the institutions, been upto in the last month? 🧐

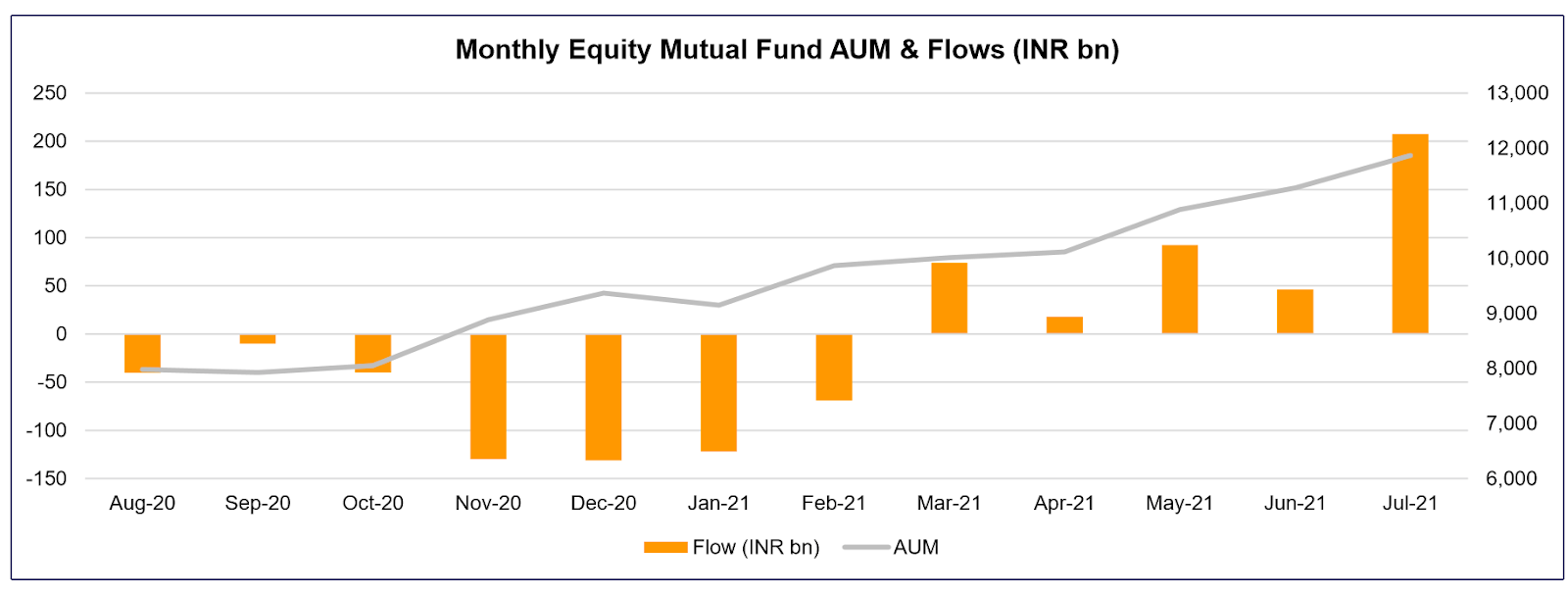

- Domestic Equity Mutual Funds continue to see inflows for the fifth month running, with July’21 recording the highest inflows in the last year (see image below)

Names?

-

Among large-caps, Zomato (ooh), HDFC Bank and ICICI Bank were top buys; other financial players that saw healthy flows included Axis Bank, SBI & Bajaj Finance (interesting to see HDFC here, since it has suffered in the recent past)

-

There was a fair bit of churn in the Large Cap technology space, with HCL Tech & Tech Mahindra seeing inflows and Infosys & TCS seeing outflows (possibly due to a valuation mismatch?)

-

Other large cap names that saw outflows included SAIL (steel cycle coming to a close?), TATA Motors, Maruti Suzuki and Hindalco Industries

Interesting! Mid & Small Caps? And, what about FIIs? (elephant in the room)

- Among Mid & Small Caps, some interesting buys included Aditya Birla Fashion & Retail (check out our previous note here), Clean Science & Technology, TVS Motor (EV Space is getting on), KIMS Hospital (recent IPO of South India based player) & Bajaj Electricals

- At the other end of the spectrum, MFs decreased their holdings in broking players like Motilal Oswal, Angel Broking (possibly indicating an end of a bull market cycle), Metropolis Healthcare, PI Industries (been a favorite for MFs in the past, so a bit surprising)

- FIIs were net sellers in the month of July, clocking outflows to the tune of INR 1.5 Bn (it’s also the largest outflow in the last 12 months)

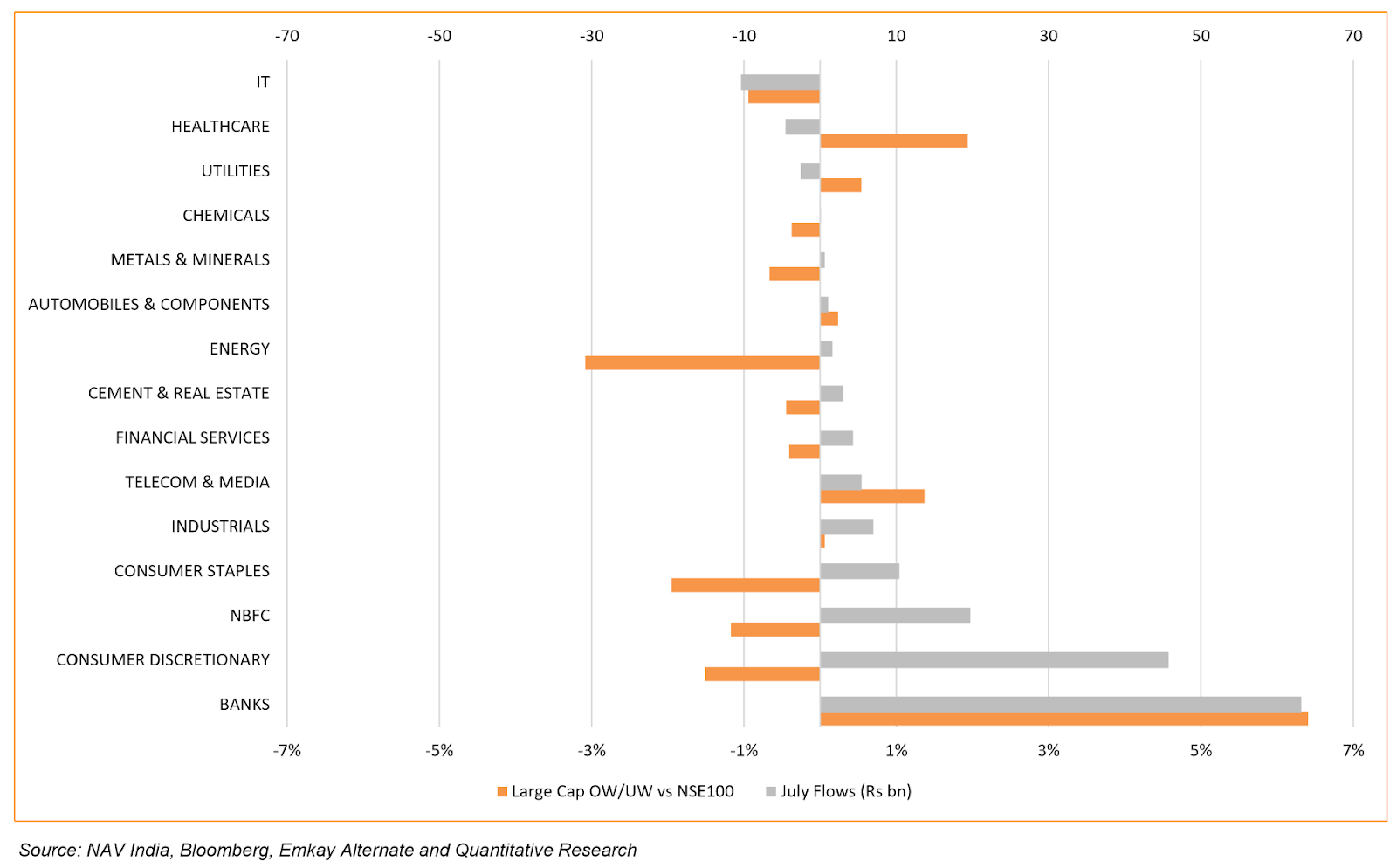

MFs mixed their holdings across Large / Mid Caps, managing flows between sectors

- MFs were overweight (increased their holdings as a % of NSE 100 Index) on Banks, Healthcare and Telecom & Media, and went underweight on Energy, Consumer Staples & Consumer Discretionary (see image below)

-

Large Capitalisation focused (think: Nifty50) MFs bought into Banks & Consumer Discretionary and decreased holdings of Healthcare & IT (possibly due to valuations)

What else caught our eye? 👀

RBI discontinues ban on HDFC Bank, allowing the lender to issue new Credit Cards

- The largest issuer of credit cards in the country received positive news late on Tuesday, when the RBI lifted an eight month ban on issuing new credit cards, and in time to target the festive period

- Easing of the ban opens up a high yielding revenue stream for the bank, that has harnessed increasing loan appetite from individuals to build a low risk and durable retail franchise over the last 2 decades

- While the Bank can reclaim lost market share (ICICI Bank has been the biggest beneficiary), RBI has continued with other restrictions, like introduction of new digital products

China continues tech crackdown

- New draft guidelines released on Tuesday by China’s top market regulator, that aim to prevent internet companies from adopting forced exclusivity and blocking competitor links & apps, sent Chinese Tech stocks tumbling

- Alibaba Group Holdings was down ~5% on Tuesday, with the E-Commerce giant’s American Depository Receipts down ~25% for the year; ADRs for Tencent Holdings were down ~4%, closing at their lowest level for the year

- In addition to regulatory crackdowns, Chinese Tech giants are also facing increased scrutiny from the Securities & Exchange Commission (SEC), with the agency demanding additional disclosures from Chinese companies before allowing them offload shares

Continuous Disclosure

A company’s ongoing obligation to inform the public of significant corporate events, both favorable and unfavorable.

For more click here