Star Health Insurance Struggles Continue

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss

- Star Health Insurance struggles continue

- TCNS Q3 Numbers improve FY23 visibility

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty: 16,842.80 | -531.95 (-3.06%)

FII Net Sold: INR 4,253.70 crore

Sensex: 56,405.84 | -1,747.08 (-3.00%)

DII Net Bought: INR 2,170.29 crore

Company News

Star Health Insurance struggles continue; What’s up and What do you need to know?

Financial Performance

- Star Health Insurance reported a weak set of numbers in Q3FY22 (again!), with a claim ratio of ~105%, a combined ratio (money flowing out of the company, including dividends, expenses, claims) of ~135% and a net loss of INR 5.7 Bn

- India’s OG Health only Insurer saw ~27% GWP (gross written premium) growth in 9MFY22 vs 9MFY21, to INR 77.7 Bn; agency led channel contributed ~78%, and now has 534,000 agents, an addition of 77,000 in 9MFY22

- Led by elevated loss levels (more on this below), the required solvency margins (RSM) for Star has moved to the net claims factor in the last 4 quarters;

- In addition, the losses in Q3 reduced the available solvency margin, reflecting material decrease in the solvency margins (only 180% in Dec’21, despite a INR 20 Bn capital fund-raise)

- Solvency margins are key (obviously), in case claims continue to rise; however, the company is in a healthy position, with the expectation of claims normalising in FY23, the RSM will likely move back up to net-premium based factor

Business Performance

- Poor Q3 numbers were primarily on account of –

- Overall higher frequency of claims, with Covid-19 wave adding to more normalised non-Covid claims

- Higher severity of claims on account of covid-19 eave led precautionary measures in hospitals inflating the procedure cost, in addition to medical inflation

- The company entered into tie ups with several banks & NBFCs including Federal, South Indian Bank and LIC Housing Finance; management said several digital initiatives led to >1.2 Mn app downloads, with 61% digital policy insurances in 9MFY22 vs 56% in 9MFY21

- Star Health reported a consistent decrease in the number of Covid claims reported per day, decreasing to <5000 a month from 6500 reported during the peak of Covid

- On the distribution front (company strong points), the management indicated that agency led channel continues to remain the largest avenue (~25% growth), with Bianca, digital & online aggregators growing at a faster pace (albeit on a small base)

Interesting! Tell me more? Going forward?

- On a 9MFY22 basis, Star Health’s claim ratio of 94% in Health was marginally better when compared to larger general insurance peers; the company expects claims to normalise in FY23, with RSM expected to touch 183% from 175% in FY22 (will assist in profitability)

- Likewise, the company has the option to utilise reinsurance and issue subordinated debt to shore up RSM, which gives enough levers before the company needs to look for an equity fund-raise

- Star Health has the advantage of being present in the health insurance industry, which is likely to throw >20% in the next decade (led by volumes & prices);

- Especially taking into consideration the industry large private/public sector growth is much slower, and Star’s commanding leadership position (3x greater than closest competitor), the company’s created a strong network position for itself (list at the juxtaposition of agents, hospitals, & customers)

- From a profitability perspective, returning to Pre-Covid claim ratio of ~66%, leading to a ~95% combined ratio are real possibilities, especially given the outlook post the most recent wave

Okay! Final thoughts? Valuations, stock price?

- Star Health has built out a strong MOAT (Warren term :P) in a highlighly attractive retail health market, and is well poised to grow profitably over the medium to long term (we believe)

- With Omicron turning out to be less impactful as initially expected, and with the management indicating increased momentum in economic activities amid better vaccination coverage & re opening, the company recorded ~17% growth in 9MFY22

- The stocks down ~19% since listing, with the market clearly not valuing the current growth/business dynamics; the proof in the pudding will be performance post Covid-19 business normalisation

Keep a track for FY23 business play out?

Around the World 🌎

Crypto is most definitely the talk of the town, and how! Here’s everything that’s been happening-

- Super Bowl LVI recently concluded and crypto seemed to be omnipresent to say the least with even companies like Budweiser hopping on the crypto ad bandwagon. CoinBase stood out here with a 60 second ad of a floating QR code that changed colours and redirecting scanners to a promotional offer for $15 in free $BTC. It infact went too popular as the website app crashed soon after – not to worry though as all publicity is good publicity!

- Meanwhile, crypto is being leveraged even in the field of politics with all of South Korea’s presidential candidates announcing pro-crypto stances in a bid to win over young voters (10% of total voters are crypto investors). The power of these investors is so strong that a 20% tax bill on crypto gains had to be recalled after some major backlash from the community. The issue of insufficient protection for crypto investors is also increasing.

- There is no doubt that the crypto industry has become extremely lucrative and FOMO seems to be real for Intel who recently announced that they will be entering the crypto-mining space with ‘energy efficient’ chips that will be ready by the end of the year. Their research wing Intel Labs will be working on mitigating the alleged environmental impact due to the enormous power consumption in the process.

Company News

TCNS Q3 Numbers improve FY23 visibility; What’s up and What do you need to know?

Financial Performance

- Q3 operating performance was 5-6% higher than Bloomberg estimates, led by higher topline; revenues recovered strongly to 100% of pre-Covid levels vs 72% YoY, led by a healthy 95% / 130% recovery in physical/online channels

- Gross margins rose sharply to pre-Covid levels of ~68% vs 61% YoY, led by the shift in the channel mix toward higher offline sales, and lower dormancy provisions

- Investments in new channels of growth, however kept EBITDA margins at 19% vs pre-Covid levels of 21%;

- Unlike peers, TCNS has sailed through Covid peak efficiently, with higher cash reserves of INR 1.8 Bn vs INR 1.7 Bn (pre-Covid) and health inventory (only 6% is 3+ seasons old)

Business Performance

- Exclusive Branded Outlets (EBOs) additions picked up pace during the quarter, with the company adding 18 new outlets (Pan-India), with expectations to add another 25-30 over the next few quarters (🤷🏼)

- Among new launches, footwear has been gaining traction and contributed in high single digits to sales in ~150 stores (where launched); the company expects a faster ramp-up of bottom wear brand ‘Elleven’, post achieving desired store-level metrics in 15 pilot stores by FY22-end

- TCNS highlighted strong initial signs in their cosmetics business, with the company seeing a potential revenue run-rate of INR 0.8 – 1.0 Bn in the next 19-24 months (vague!)

Interesting! Tell me more? Valuations, Stock Performance et al.

- TCNS acted very differently, when compared to other listen apparel players, focusing on shoring up operations, consolidating cash-flows rather than splurging on brands and platforms (think: ABFRL)

- Taking that into consideration, and achieving a near 100% recovery in operations, while exceeding their cash reserves from pre-Covid levels is commendable, pointing to a sustainable ship

- TCNS is a leader in the salwar-kameez category, right from having a design/source edge to maintaining strong distribution capabilities, with 2x – 3x penetration potential and excellent online / omni presence

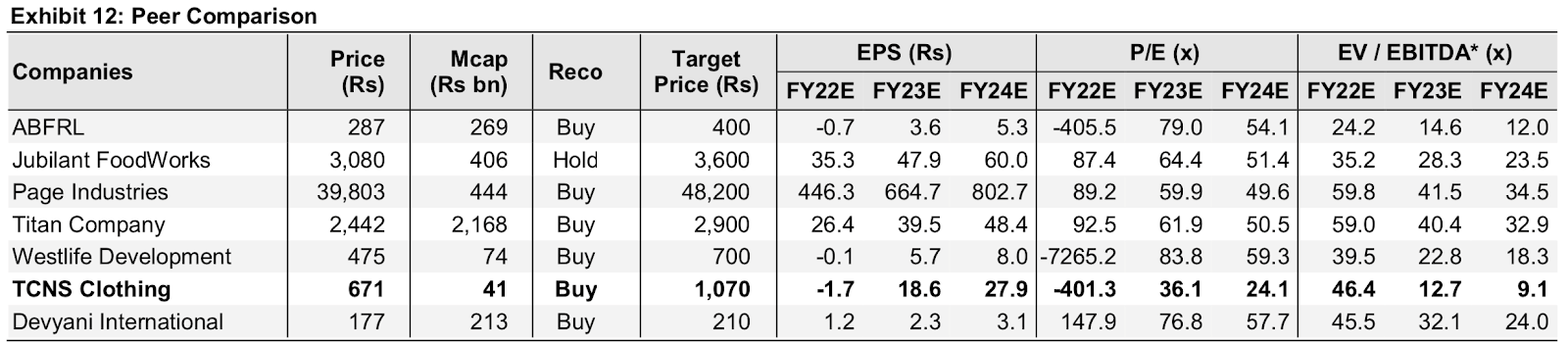

- The company trades at a massive discount to other apparel players, primarily due to a stark difference in size; however, looking at business profile, growth prospects and category expertise, TCNS leaves plenty of scope for an upward re-rating (we believe)

- The stocks been battered in the recent past, is down ~17% YTD, with the street not particularly valuing the current numbers either (stock dipped probably because of broader market performance)

Keep a track?

What else caught our eye?👀

Axis Bank takes over CitiGroup’s retail division

- Axis Bank Ltd. might take over Citigroup Inc’s India retail banking business in a $2.5 billion deal contingent on approval from the RBI

- Citigroup wants to focus on high-growth segments like wealth management and is undergoing a major restructuring process to simplify operations across the globe

- Axis Bank (India’s 3rd largest private sector lender) is focusing on retail loans and is tapping into the pent up demand after the pandemic

Some news about the IPO of our times

- The GoI will most likely be selling a 5% stake in LIC’s IPO and raise Rs. 75000 Cr in the process by selling 316.25 million shares

- With an embedded value of Rs. 5.39 trillion and a valuation of at least Rs. 15 trillion, the GoI might seek a 3-5x multiple while industry avg is 2.5 to 3.5x

- The entire stake will be an Offer for Sale (OFS) with no fresh shares issued and will be the largest amount raised by an Indian Company

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Upcoming company events:

|

Date |

Company Name |

Corporate Action |

Remarks |

|

15th Feb, TUE |

Aarti Industries |

Dividend |

Interim Rs 1 |

|

15th Feb, TUE |

REC |

Dividend |

Interim Rs 6 |

|

16th Feb, WED |

Power Grid |

Dividend |

Interim Rs 5.50 |

Educational Topic of the day

Pledging of Shares

Pledging of shares means taking loans against the shares that one holds.

Pledging of shares is a way for the promoters of a company to get loans to meet their business or personal requirements by keeping their shares as collateral to lenders.

Pledging of shares is generally seen in the companies where the shareholding of the promoters is high. As a thumb rule, pledging of shares above 50% can be risky for the promoters.