Reliance Industries Primed to Reverse Trend?

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss:

- Reliance Industries primed to reverse trend?

- Omicron hit India harder than you thought

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty:16,605.95 | -187.95 (-1.21%)

FII Net Sold: INR -4,338.94

Sensex: 55,468.90 | -778.38 (-1.38%)

DII Net Bought: INR 3,061.70

Technical Setup

Reliance Industries primed to reverse trend? 🚀

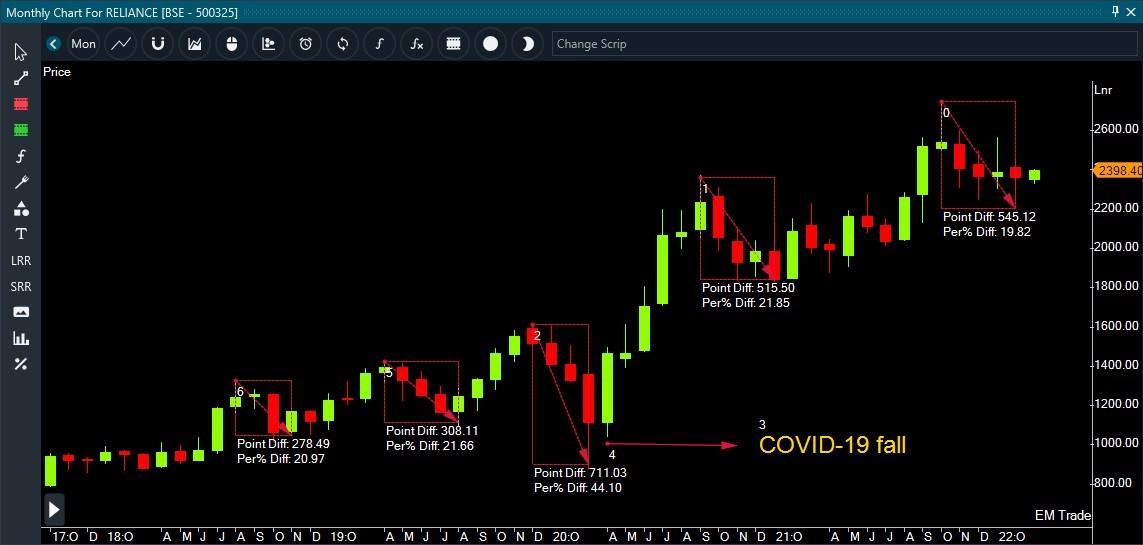

- Reliance Industries has corrected ~18.7% from its last high, in the last couple of months; taking into consideration such past scenarios, RIL invariably reverses its trend post a fall between 20-25% (see image below)

- Measuring the average intensity of fall for a stock, is one of the tools that a trader can use to predict change in trend, well in advance

- Analyzing Reliance Industries on a weekly time frame, indicates that the stock has been consolidating (making a falling wedge – bullish chart pattern) for the past 5-6 months, thus making an accumulation zone (see image below)

- Prices have made a good base around the demand zone (2250) which previously acted as a stiff resistance (role reversal)

- This increases the chances for reversal of trend (to an uptrend) on current levels (let’s check on a daily chart, for more confirmations)

Okay great! Tell me more? Any confirmations?

- On a daily frame (see image below), prices had given a breakdown, below the 200-day SMA (strong support), but recovered and sustained above the moving average, which is indicative of buying pressure (fake breakdown)

- The support band present also helped in the recovery of prices. Prices showed recovery after correcting around 20% from the top (intensity of fall)

That’s Great! How do I enter / exit such a setup? 🤩

- Current levels can be a good time to enter as prices are trading in a range. A trailing stop-loss can be set below the 200-day SMA (swing trade) to limit your losses

Interesting! Final thoughts? 🧐

- On a weekly time frame, prices making a falling wedge and taking support along the demand zone shows a positive bias

- On a daily time frame, prices trading above the 200-day SMA, taking support along the support band (2250-2290) increases the probability of the stock continuing its uptrend

Keep a track?

Around the World 🌎

US Cos are reporting results this week; Which ones caught our attention –

- Target Corp reported a phenomenal year with a revenue of $106 billion (vs $77.1 billion for the year ended Feb. 1, 2020) helped by stronger traffic in its stores through the holiday season as well as growth across its merchandise categories including food, apparel and home goods. It also offset higher supply-chain costs and wages with overall earnings rising 12% to $1.54 billion. Target shares rose 9.8% in Tuesday’s trading

- Salesforce.com Inc (one of the major business software providers) also logged higher revenue for the quarter at $7.33 billion (vs $5.82 billion a year earlier) as it leveraged the need for digital transformation post the pandemic. Remote work caused entire industries and governments to purchase digital tools. It however logged a loss of $28 million for the fourth quarter down from a gain of $267 million in the year-ago period

- A major disappointment came from Domino’s Pizza with quarterly revenue of $1.34 billion (vs. $1.38 billion expected) though its net income rose to $155.7 million (vs $151.9 million a year earlier). Most of it has to do with a labour crunch resulting in shorter opening hours and unfulfilled deliveries. It also announced CEO Ritch Allison will be retiring and the COO will be taking his place. After falling about 8% in trading earlier Tuesday morning, Domino’s shares closed flat

Economy News

Omicron hit India harder than you thought; what’s up and what do you need to know? 🦠

- India has revised its GDP growth estimate to 8.9% (from 9.2% earlier) for FY22 implying a slower Q4FY22 owing mostly to the albeit mild Omicron wave

- In better news, though all sub-sectors (apart from trade, transport, and communication) seems to will have crossed pre-Covid levels by end-March’22

- Geopolitical tensions and especially the energy supply disruptions may have an effect on growth in the near term although a lasting effect is not expected

Can we get some numbers, please?!

- Q3FY22 was slower than expected at 5.4% due to an unfavorable base effect with a GVA (Gross Value Added) growth rate of 4.7%

- An industrial sector slowdown (especially in the manufacturing and auto sector) as well as supply-chain disruptions did not aid the situation

- Agricultural growth slowed to 2.6% due to unfavorable weather conditions and weak rural demand

- A moderation in the output of contact intensive services, trade, etc. could be seen in Q4 due to both a third covid wave as well as geopolitical escalations

Tell us more!

- The demand side doesn’t look that good with consumption slowest to recover since the pandemic and concentration of purchasing power at the top

- The broader consumer space has lower incomes and savings which are not enough for the private sector is already weighed by global uncertainty on sentiments, demand, and cost

- Government consumption and investment is the need of the hour to fulfill the growth and jobs needs until its private counterparts recover

Any good news?

- FY22 should see steady growth in agriculture (at 3.3%) and a full reversal of the contraction in the industry (10.3% vs. -3.3% in FY21) and services (8.6% vs. -7.8% in FY21)

- Manufacturing is likely to record a robust 10.5% in FY22 with services growth at 12.% led by public admin and other services

- Private consumption and GFCF grew robust in FY22 on a low base, while government consumption remained healthy

- Quick control of infections and healthy vaccination rates may mitigate the effect of the virus while the energy supply shock (thank you Russia 😒) is also likely to be resolved soon

What else caught our eye?👀

Geopolitics may delay our biggest IPO

- The GoI may be reconsidering the timing and initial deadline of March-end of LIC’s IPO following Russia’s invasion of Ukraine

- The IPO would have played a huge role in meeting the country’s divestment target of $10.4 billion through asset sale for the year

- The Finance Minister said that she would ideally like to go ahead based purely on Indian considerations but will consider global events if the situation warrants

Good news for Indian workers

- The average pay hike is expected to increase from 8% in 2021 to 9.1% in 2022 according to the 2022 Workforce and Increments Trends Survey by Deloitte Touche Tohmatsu India

- 34% of organizations are planning to give double-digit average increments (vs 20% in 2021 and 12% in 2020)

- Life sciences and IT sectors are likely to give the highest increments in 2022 as well as FinTech, IT-product companies, and digital/e-commerce organizations

Educational Topic of the day

Average True Range (ATR)

Average true range (ATR) is a volatility indicator that shows how much an asset moves, on average, during a given time frame. The indicator can help day traders confirm when they might want to initiate a trade, and it can be used to determine the placement of a stop-loss order.