RBI MPC at Key Juncture

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss

- Rising inflation will dominate the MPC’s upcoming meeting

- Reliance ready to climb?

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty: 17,463.80 | +197.05 (+1.14%)

FII Net Sold: INR 892.64 crore

Sensex: 58,465.97 | +657.30 (+1.14%)

DII Net Bought: INR 1,793.35 crore

Economy News

Rising inflation will dominate the MPC’s upcoming meeting; what’s up and what do you need to know?

- RBI’s MPC will be announcing some major moves on Feb 10, including and most importantly, a review of the bank’s key interest rate in light of rising inflation

- It is expected to hike the reverse repo rate (interest banks earn by parking their surplus funds with the RBI) by 15-25bps from its current 3.35% (damn, no ways😒)

- Repo rate (the rate at which the RBI lends to commercial banks) is expected to remain unchanged at 4% and stance to change to ‘neutral’ from ‘accommodative’

- Liquidity reduction is foremost (from Rs. 6.5 tn to pre-covid Rs. 2 tn+ ) and maintaining an inflation target between 2-6% seems to be the ask

- Foreign Exchange market has been resilient so far while the rates market has borne the brunt – a reversal of trend is expected

How bad is the situation?

- India’s CPI stood at 5.6% in Dec’21 (5-month high) with WPI at 13.6% – a situation only getting worse once elections conclude and fuel prices rise

- Globally too it is a struggle (crude oil prices > $90/barrel) made worse by the trillions of dollars pumped via relief packages – Fed has signaled a rate hike soon (we’ve covered this extensively)

- The gov. has heavy borrowing plans next fiscal and the RBI has to continue to support the bond market and the pressure building up there

What exactly is the bond situation?

- Bond yields have been rallying since December (10-year G-Secs has risen from 6.47% to as high as 6.9%)

- Following the news of high market borrowing for the next fiscal (Rs 14.3 lakh crore, budget linked) domestic bond yields touched 6.9% (last seen in July 2019)

- RBI may save the day by announcing an Operation Twist (OT) to anchor long term bond yields

Other Implications? And of course, market considerations?

- The currency market will have to share some of the macro adjustments – likely to stabilize organically to growth and policy reaction functions

- A BoP deficit may warrant domestic liquidity creation leading to full forward deliveries of OMO sales; OMO purchases are very much a possibility

- To counter this a staggered CRR hike of 1-1.5% is expected; both moves combined could limit the hit to bank’s bottom line albeit there will be communication challenges

- While a 15-25 bps hike in fixed reverse repo may not be too disruptive at this stage (a stark contrast to Fed actions), the market will look out for commentary on managing prevalent financial conditions going forward (think: bond surplus, and liquidity tightening plan)

Around the World 🌎

- Walt Disney Co. is expected to show a modest increase in subscriptions (+ 7 million totaling to 125 million) in the Dec quarter – also a major increase from the 2 million added the previous quarter. Theme parks are also expected to show a strong recovery in sales despite the Omicron spread. Investors however continue to punish with a 30% drop from its high in Mar’21 owing to slow subscriber growth.

- Visa is now facing a tough and rather an unusual competitor – the eCNY which is China’s new digital currency. With a pilot in the Beijing 2022 Olympics, it is taking share away from title sponsor Visa (Visa & Cash were the only acceptable forms of payments so far). Visa seems to have decided not to speak out against this decision as it may anger the Chinese government and hamper any chances it had of entering their lucrative payments market.

- Investing in SPACs just got more lucrative with a new ETF coming into the picture – their value proposition being small returns for no risk. Investors may demand their money back before a merger, or in case the sponsors run out of time to find a target. Meanwhile, the cash is placed in a trust that earns interest from riskless securities. The only downside? It requires a lot of active trading and fees can sometimes skyrocket. Interesting stuff for sure, watch this space for more!

Technical Setup

Reliance ready to climb? 🚀

- Analysing Reliance Industries on a daily time frame, indicates that the stock has been taking support (2290-2315) multiple times, thus making these levels high demand zones (see image below)

- Prices have made a double bottom pattern (bullish), and might lead to a good up move post-breakout above its upcoming resistance (2420)

Okay great! Tell me more? Any new tools?

- On a 15-minute time frame, prices broke the resistance and retested breakout levels which is an indication of a positive chart structure.

- Prices are currently trading above 10 SMA (simple moving average), indicative of strength in the counter (short term uptrend)

That’s Great! How do I enter / exit such a setup?🤩

- On a daily time frame, a breakout above 2420 (double bottom pattern) might lead to a bigger up move. A trailing stop-loss can be set at 20-day SMA (swing trade) to limit your losses

- A breakout above the resistance and retest on the 15-minute time frame gives us a good opportunity to enter the stock, with the first target being the upcoming resistance (2420)

Interesting! Final thoughts?🧐

- On a daily time frame, prices taking support at a crucial level and a steady recovery in prices shows positive bias

- On a 15-minute time frame, prices trading above a short-term moving average and breaking upcoming resistance levels confirms signs of the steady uptrend continuing

Keep a track?

What else caught our eye?👀

Bharat Pe’s Grover facing a tough time

- The first red flag was an audio leak of Ashneer Grover (Co-Founder & MD) abusing and threatening a Kotak employee after missing out on Nykaa’s IPO allotment

- Which led to allegations of toxic work culture with an exodus of top talent, and Grover’s ‘God syndrome’ may be the reason for his demotion from CEO to MD

- The last straw was a financial audit which saw money being routed through fake consulting firms and inflated transaction values with non-existent vendors

What’s next?

- With indictments in the past which led to an Rs. 1.54 Cr penalty (Rs. 10.97 Cr loss) and direct connections to wife Madhuri and her family – things are not looking good

- Grover is willing to leave if he is fairly compensated i.e bought out at the correct price but has alleged that the board is trying to ‘arm-twist’ him to take less

- The audit was being done by firm Alvarez and Marsal but PwC will now conduct an independent audit (since the couple can only be ousted if a Big 4 firm indicts them)

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Results Preview

Thursday, 10th February: Amara Raja Batteries, Alembic Pharma, Bharat Forge, Cummins India, Gujarat State Petronet, Hero Motocorp, Hindalco, M&M, MRF, Page Industries, Piramal Enterprises, Sun TV, Tata Chemicals, Trent, Whirlpool, Dr Lalpath Labs, IRFC, HAL

Friday, 11th February: Apollo Hospitals, Ashok Leyland, Divi’s Labs, Fortis Healthcare, Glenmark Pharma, Godrej Industries, Oil India, ONGC, Voltas

Educational Topic of the day

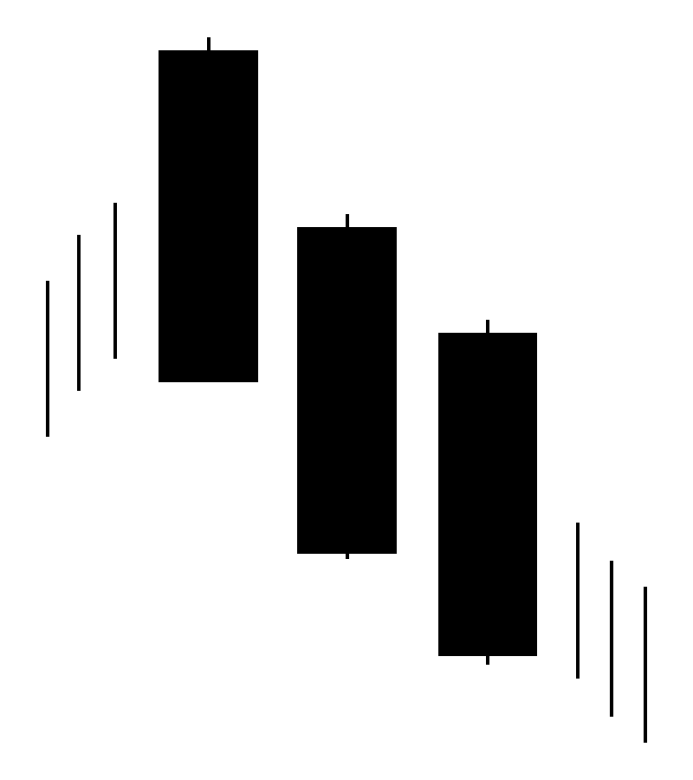

Three Black Crows

The Three Black Crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase.

The candlestick pattern requires that each of the three candlesticks should be relatively long bearish candlesticks with each candlestick opening lower than the previous candle’s open.