Radico Khaitan, UNSP to Benefit from Strong Volume Recovery

Yesterday’s Market Performance

Nifty: 17895.20 I 104.90 (0.59%)

FII Sell Net: INR -64.01 Cr

DAX: 15,206.13 I 44.73 (-0.29%)

Sensex: 60059.06 I 381.23 (0.64%)

DII Sell Net: INR -168.19 Cr

FTSE: 7,095.55 I 17.51 (0.25%)

We’d love to hear your thoughts on our newsletter. Please take this simple survey and give us your feedback. Survey

Howdy Toasters!

Join our Discord community where we discuss all things related to finance (trading, investing, economics, data, MFs & more) + memes (of course). Join Here (promise we won’t spam, have we ever??) 😏😉

In today’s issue of the Morning Toast, we discuss:

- Strong volume recovery for alcobev industry to further boost growth rates

- Titan Company released a Q2 business update, indicating robust recovery and strong performance

- As always, an education concept to keep you chugging along.

![]()

Prevest Denpro: 240.50 | +11.45 (+5.00%)

-

The script zoomed 5% after Equity Intelligence India, owned by ace investor Porinju Veliyath, picked up 92,800 shares in the company at Rs 228.91 a share

Piramal Enterprises: 2,736.45 | -151.95 (-5.26%)

-

The script tumbled over 5% on October 8. The company on October 7, had announced the demerger of its pharmaceuticals business.

Strong volume recovery for alcobev industry to further boost growth rates; What’s up, which players are most likely to benefit and what else do you need to know? 🥂🧐

-

Interactions with companies & management personnel (Source: Emkay Global) indicates strong recovery trends for alcohol beverage players in most states

-

Barring Andhra Pradesh, IMFL (Indian Made Foreign Liquor, categorised as all types of hard liquor manufactured in the country) has witnessed growth over pre-Covid levels, including in Maharashtra which has traditionally been a heavy consumer

-

In case of beer, overall recovery is robust, with strong growth in Karnataka (major consumer amongst states), up 6% / 30% in Q2 vs FY20 / 21, and double digit growth in Eastern States, UP & Rajasthan (through price reductions)

-

AP, Telangana & Kerala continue to deliver sub-par volume growth for a variety of reasons, including high taxation, limited supply due to localised lockdowns & lack of OTC sale

Nice! What can be expected in the near term? Margins, Regulations? (You know the drill :PP) 🤔

- To safeguard the industry (during Covid-19) states pan-India initiated a COVID tax reversal to help alcohol manufactures during lockdowns (when liquor shops, restaurants were shut)

-

In continuation to such a favorable policy, states have improved distribution models and worked on increasing liquor outlets –

-

Delhi has changed policy, from government-owned stores to private vendors, with 60% of 850 retail shops presently operated by the government

-

Rajasthan has allowed converting all outlets to composite shops, which allows country liquor shops to sell IMFL & Beer as well (6000+ shops)

-

AP has opened 300 new liquor shops in tourist locations, indicative of an of more moderate policy stance in comparison to previous regimes

-

Telangana, UP & Rajasthan have all initiated price cuts of INR 10, 20, 35 per bottle

-

- Key near-term catalysts for the sector can include a similar reduction in taxes in West Bengal and the closure of a Free Trade Agreement (FTA) with the UK, which could potentially reduce the duty on scotch-imports

Margins

-

Glass, which makes up 40-50% of Raw Material costs is likely to see an inflationary trend, on account of higher fuel prices and sharp uptick in Soda Ash, which can bear down on overall margins

- Ethanol prices (ENA), the other major contributor is likely to remain soft given the low inflation in key crops (sugarcane & maize)

-

Better than expected recovery, and a strong regulatory push are likely to drive performance (company & stock) going forward, with key catalysts like price cuts, enhanced distribution capabilities and global free trade agreements to provide timely impetus

-

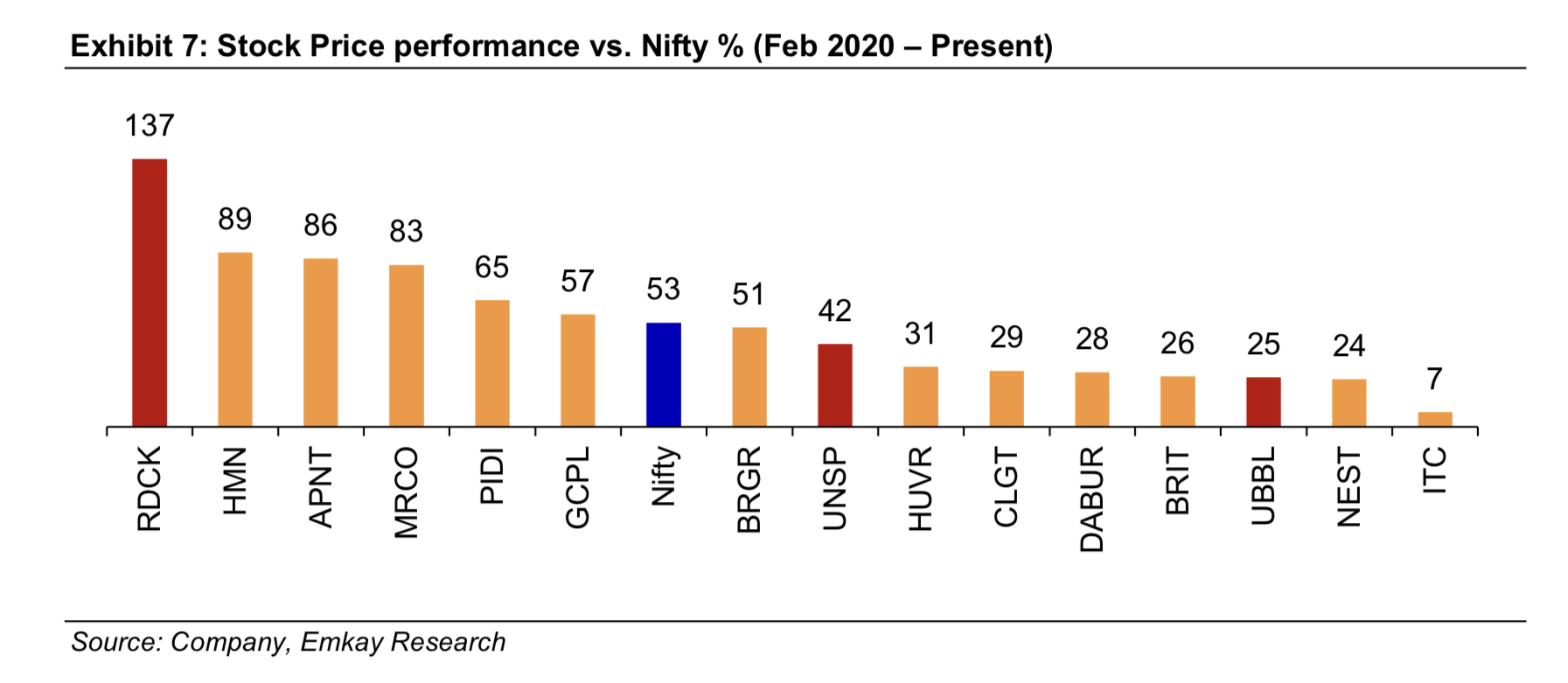

UNSP & UBBL have under-performed the Nifty50 since the beginning of the pandemic (Feb 2020), with Radico Khaitan the clear outlier amongst consumer peers (see image below, highlighted in red)

-

UBBL is benefitting from reduction in beer prices in UP / Rajasthan / Telangana in Q1 and WB last year, driving growth and recover in these markets; full unlocking and continued price reductions will drive stock performance going forward

-

Radico Khaitan was impacted lesser (in comparison to peers) in FY20-21, and will likely benefit from regulatory changes in WB & New Delhi

-

New leadership, with renewed aggression and a sharpened focus towards a more premium segment (P&A) are likely to positively impact top & bottom line for UNSP

We covered Radico Khaitan in detail at the time of Q1 results. Check it out here.

![]()

Titan Company business update pre Q2 results indicates robust recovery and strong performance across divisions 🚀👀

-

Titan Company (TTAN IN) released a Q2 business update, indicating robust recovery and strong performance, with the Jewelry division reporting a 2 Year CAGR of 32% (huge!!)

-

Excluding bullion sales, the jewelry segment grew 78% in Q2FY22, strongly aided by pent-up demand, and helped by a 10% store addition CAGR (414 stores vs 345 in Q2FY20)

-

The company indicated that pent-up demand was observed in gift purchases, occasions, milestone buying, weddings & investments in gold (all things you’d associate in a pre-pandemic world)

-

In a push to garner market share from the unorganized space, the company’s entire distribution network is now Hallmarking compliant (certifications, which help significantly during the re-selling process)

Damn!! What about other business segments? 😕

- Watches & Eye-wear also posted strong recovery, returning to Pre-Covid levels with a 2 Yr revenue CAGR of -2% and 3%; recovery was aided by strong store addition (8 new stores for eyewear & 24 for watches), improvement in mall walk-ins and consistent growth in e-commerce sales

-

Caratlane (diamonds) also reported 95% growth, through the launch of new merchandise

-

Fragrances, Accessories & Taneira grew 121% (small base included), heavily aided by higher operational stories, health recovery in spends, e-commerce & department stores

Interesting! So quarter expectations? Longer-term view? (All great questions) 🤨

-

As per Bloomberg & street estimates, the company is expected to report a solid 64% revenue growth to INR 71bn (for the second quarter), with operating margins expected to touch 11.5% (levels last seen pre-Covid)

-

PAT is expected to double on a quarter on quarter basis (estimates)

-

The stock was up ~9% post the announcement, with the market extremely enthused with the performance, recovery & and longer term likelihood

Interesting! Give me some names? Which stocks are most likely to benefit? 👀📌

-

Among large Private Banks, ICICI Bank is likely to be the greatest beneficiary, with strong growth / asset quality and profitability (healthy cards performance, CASA Ratio continuing to inch-up, strong collection efficiency and minimal NPA formation)

-

Similarly, HDFCB through a comeback within the Cards space is likely deliver better than expected credit growth, which can lead to better profitability

-

Among smaller private bank, we recently covered Federal’s Q2 preview, throwing shade on the growling CASA profile, coupled with a shift towards more margin accretive products and a concerted effort to work with fintechs to enhance distribution capabilities (bringing down Cost of Acquisition)

Share your views by replying to this mail 🤓

What else caught our eye? 👀

MPC matches all expectations

- MPC’s accommodative stance on both rates and liquidity was maintained.

- However, growth is still sub-par they said, and policy action is needed to aid in a double-digit growth revival.

- Inflation has been on the down-low off late and is likely to edge down in Q3FY22 (due to easing food inflation risks and base effects.)

- Longer tenor VRRRs are believed to be the tool of choice towards normalization (with the quantum for 3QFY22 increased substantially)

- Further liquidity infusion stopped with no GSAP planned after the last sale of bonds, with no other premature tightening measures planned

For more context, check out our detailed preview here:

Petrol & Diesel at all-time highs

- Rates for petrol and diesel was hiked to all-time high levels in line with international oil prices.

- Petrol increased by 30 paise/liter and diesel by 35 paise/liter.

Check out our blog to read more on analyzing an IPO