Nifty50 Corrected 2.3% In The Last 5 Days, What’s Up

Yesterday’s Market Performance

Nifty: 17671.70 I 185.60 (1.04%)

FII Sell Net: INR 5,142.63 Cr

DAX: 15,688.77 I 7.56 (0.05%)

Sensex: 59306.93 I 677.77 (1.13%)

DII Buy Net: INR 4,342.51 Cr

FTSE: 7,237.57 I 11.90 (0.16%)

Howdy Toasters!

In today’s issue of the Morning Toast, we discuss:

- Nifty50 corrected ~2.3% in the last 5 days, so what now?? Read-Along

- United Spirits (UNSP) kicks off strategic review of popular brands

- Results Preview

- An education concept to keep you chugging along

![]()

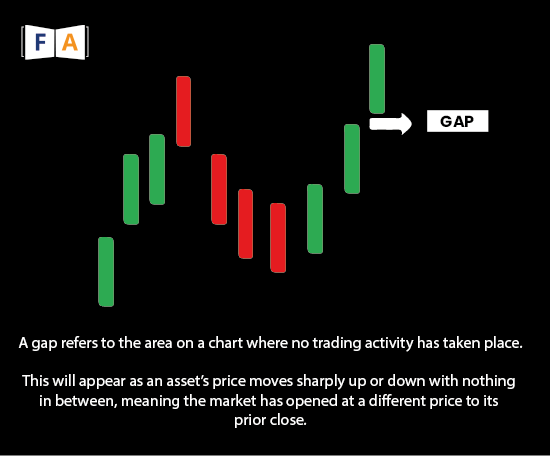

Nifty50 corrected ~2.3% in the last 5 days; What’s up and what do you need to know? 🧐

- Analyzing Nifty 50 on a weekly time-frame (over 60 weeks), indicates that our benchmark index has been taking support at a rising trendline (view image below)

-

Nifty 50 has been in a constant uptrend for the better part of 2020 and 2021 (duhh!) breaking earlier highs and making news ones (HH); taking support at a rising trendline, and making higher lows (HL) in the process

Interesting! Tell me more? 😮

-

Nifty 50 has been in a strong trend since the Covid fall (think March 2020), with the index rallying from 7500 to 18000+, however the past couple of weeks have finally shown a different picture, with some weakness through healthy (?) corrections

-

Currently, prices are trading close to the support band (17610-17740) which also happens to be the 50-day Simple Moving Average; a good support level for swing traders

-

This makes chances for a reversal at these levels more probable, although if prices breach the support band and the 50-day SMA, index might continue to plunge

Interesting! Final thoughts? 🤔

- The consistent higher high lower low patterns have made sure Nifty stays in a strong uptrend and the support band and 50-day SMA on daily time-frame makes the chances of reversals (prices moving higher) more probable

-

From a macro perspective, with the onset of 4 large IPOs (cumulative value >20,000 crores), rising inflationary trends, changing monetary policy scenarios (decreased government bond purchase program) and greater FPI selling, the Nifty50 is at a precarious point (?), with traders & investors keen to see direction before deciding their next move

-

Breaching of the current support, coupled with changing macro scenarios, could define the near term?

Keep a track?

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

![]()

United Spirits (UNSP) sets new strategy targets, with double-digit topline growth insight; What’s up and what do you need to know? 🧐

- UNSP delivered a strong second-quarter performance, led by Sales / EBITDA growth of 14% / 30%, led by improved trade environment, and strong mix gains

- P&A growth (Premium range, highly margin accretive) was robust at 20%, led by 6% volume growth and 14% increase in realizations (high double-digit volume growth in Premium Scotch Whiskey & favorable brand mix)

- Underlying gross margins improved by 3% (huge!), led by improving sales mix (towards premium branded portfolio)

- The company indicated a continuation of the current margin profile in the medium term, with inflationary pressures (in glass) likely to be offset by improving product mix & COVID-19 induced cost efficiencies

Interesting! New Strategy? Give some information? 🤔

- The company delivered a new growth strategy to achieve double-digit sales growth, led by much higher P&A growth vs history 9-10% rates (nice!)

- Led by a greater focus on their scotch portfolio, a step-up in the introduction of global brands to Indian markets and dialing up innovations in luxury segments the company is poised to take advantage of the changing demand dynamic –

- Enter the craft segment through the launch of epitome whiskey,

- Target new & emerging categories through the launch of Guinness Beer

- Of key importance for the company is to accelerate digital transformation & drive speed and simplicity through –

- Use Artificial Intelligence (AI) to advance inventory optimization, intelligence-driven purchase information, & support supply chain transformation

Nice! Final thoughts? Valuations etc? 😁

- The growth outlook for the company & the industry, in general, is improving, with increased aggression (new initiatives) and strong volume recovery trends cumulatively positive for the company

- In addition, strong regulatory alignment is key for sustained growth, with recent initiatives (think: price cuts, increased distribution dynamics) designed to benefit alcohol cos

- UNSP has outlined an ambitious plan, that aims to be value accretive at both sides of the coin, yet execution remains key, with regulatory push a key monitorable

- The company trades at 52x FY23E earnings, trading at a discount to peers UBBL, Nestle, HUL (other consumer discretionary peers), with a comparative return profile

We covered UNSP, UBBL & Radico Khaitan in detail. Click here to know more.

What else caught our eye? 👀

Winter vacations look tough

- Indian airlines will operate 4.38% fewer flights in the upcoming winter schedule, and focus mostly on the more profitable flights

- They have been allowed to operate at a full capacity since the middle of the month, however, customer traffic is still slow

- SpiceJet, Indigo, AirIndia, and GoAir have cut their schedules by 30%, 0.65%, 8%, and 0.78%. Only Vistara has increased its schedule by 22%.

Paytm employees to enjoy the IPO season

- Employees of One97 Communications holding shares and options can earn up to $900 million at the top end of the price band for the IPO

- Founder Vijay Shekhar Sharma owns ⅔ rd of this pool of ESOPs and will plow back a lot of it into the company’s insurance arm Paytm InsurTech

- One97 Communications is seeking a valuation close to $20 billion in its IPO

Nykaa IPO on a roll

- FSN E-Commerce Ventures (parent to Nykaa) saw its IPO subscribed 1.56 times excluding the anchor allotment on Day 1 itself

- Day 2 of the process saw an oversubscription by 4.8 times owing to huge retail interest

- Most brokerage firms are positive on the IPO and have given it a subscribe rating.

Saturday 30th October: Aarti Industries, AIA Engineering, Amber Enterprises, DCB Bank, Dhanuka Agritech, IDFC First Bank, Indian Oil, Kalpataru Power

Monday, 1st November: Aditya Birla Cap, Bayer Crop Sci, HDFC Ltd, IRCTC, Relaxo Footwear, Tata Motors

Check out our website “FinLearn Academy” to know more details on various

trading & investing topics.