Netflix Explores A Major Strategic Shift

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss:

- Netflix explores a major strategic shift

- Life Insurance closes the year strongly

- Results Preview

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty: 17,136.55 | +177.90 (+1.05%)

FII Net Sold: INR 3,009.26 crore

Sensex: 57,037.50 | +574.35 (+1.02%)

DII Net Bought: INR 2,645.82 crore

Global Company News

Netflix explores a major strategic shift; what’s up and what do you need to know?

- The world’s goto streaming platform reported a drop of ~200,000 subscribers for the first quarter (most US companies follow calendar year cycles), missing out on its own projection of adding 2.5 Mn subscribers for the current period

- The company added that it expects to lose 2 Mn global subscribers in the current quarter; the declining growth brought Netflix’s paid global subscriber base to 221.6 Mn, down from 221.8 Mn in the previous quarter

- Netflix commented on slowing revenue growth, after years of 20%+ gains, is likely going to be the norm going forward, with headway made dying the Covid-19 pandemic hiding fault lines that have emerged in the business over the last few years (more on the below)

- The platform lost ~700,000 subscribers after it shut its service in Russia, with business in Central & Eastern Europe also suffering due to the conflict; US & Canada lost 600,000 subscribers, which was attributed to the price increases undertaken during the last quarter

Damn! So what’s the shift? And why the loss in subscribers? (Great q brooo)

- The company blamed password-sharing among its members and increased streaming competition for pressuring revenue growth; the platform estimates that besides the 222 Mn paying households using the platform, ~100 Mn additional homes have access to the services (damn!!)

- To tackle inefficient utilisation of services, the company is testing password-sharing subscription models that it believes will allow it to monetise sharing and accordingly build revenue

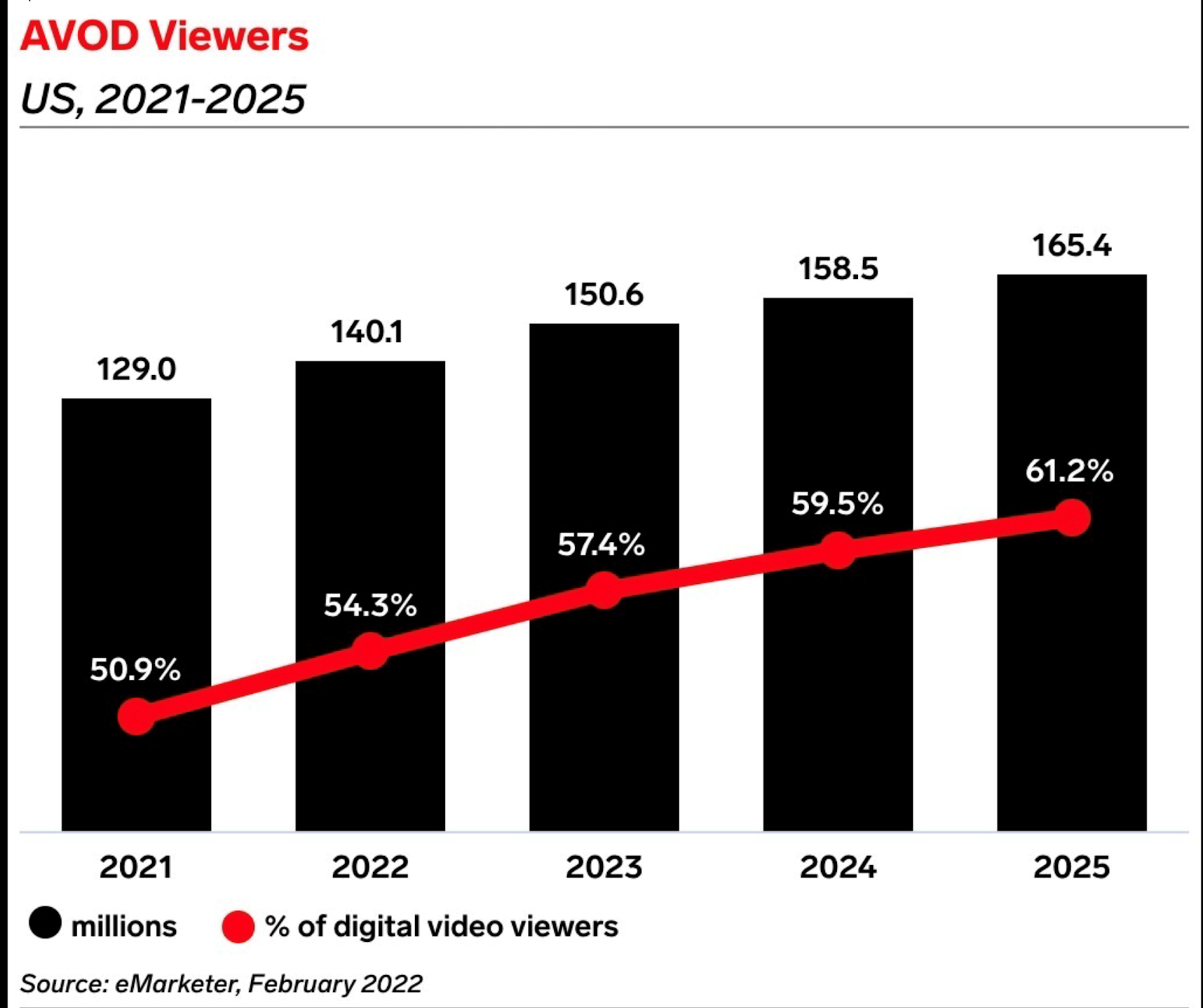

- Likewise, with a growing number of streaming options, consumers have become more price-sensitive, with competitors offering cheaper services, that are ad-supported

- Likes of Hulu, HBO Max, Disney+ have also pushed into the ad-supported streaming offering, which allows acquiring users at lower price points, albeit with the inclusion of advertisements to offset the loss in revenue

- Advertising-based Video on Demand (AVOD), is a model which includes viewers paying for with their eye-balls, i.e., content that is either free or subsidised via advertising (see image below)

Interesting! Anything else? Final thoughts?

- Netflix is the gold standard / North Star Metric when it comes to understanding / gauging the streaming industry, and with their growth faltering, there is a growing feeling amongst the analyst community of a general slowdown

- The company’s CEO has always shied away from complicating product offerings, instead of sticking to services that are easy to understand, and yet with the latest announcement that approach seems to be changing

- The stock is down ~40% this year, and was down ~25% post announcement of results, with slowing revenue & subscriber loss weighing heavily; whatever the changes, there will likely be a significant impact across the industry, both in US & Canada, and globally

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- Goldman and their golden men – Goldman CEO David Soloman is taking a piece of the profit from the firm’s private investment funds that could be worth hundreds of millions of dollars over the next few years. The move is extremely controversial as it could anger both shareholders and fund managers (the piece will come out of their pockets). But the top executives can only avail these benefits if they also invest their own money in the funds. Bank CEOs are increasingly seeing their pay being dimmed after immense money is being made in crypto, NFTs, and even private equity.

- Asset >> Company – Though the crypto market has in general been down lately (BTC ~ 11%, Ether ~16%) stocks of crypto-focused companies are performing worse falling as much as 60% this year. The largest U.S. exchange, Coinbase Global Inc., is down 40% year to date, and the combined market capitalization of these crypto companies has fallen to roughly $60 billion from $100 billion in November. The assets are driven by consumer interest but companies derive value from how well they sell their products, but trading volume does play a huge role in their success.

- Another big housing bet – Blackstone Inc. has acquired student-housing owner American Campus Communities Inc. for $12.8 billion majorly betting on the rise in rent as more college students return to campus. The pandemic did not deter rent collection in the US college market as students continued to pay inspite of online classes. Adding to the advantage is a national housing shortage pushing rents up further and an increased influx of international students. The purchase price of $65.47 a share is about 14% above Monday’s closing price.

Industry News

Life Insurance closes the year strongly; what’s up and what do you need to know?

We performed a deep dive on the Life Insurance Industry, with the objective of demystifying the sector, including analysing LIC’s IPO. Click here to know more.

- The life insurance industry’s growth momentum picked up in March’22, with the retail weighted received premium (RWRP, definition below) growing by ~12% YoY after two months of slow growth

- The good finish to the year led to the FY22 RWRP growth of 15.7% YoY for the sector, and 21.9% YoY for the private sector

- Interesting, compared with the pre-Covid base, the private sector RWRP 2-yr CAGR in FY22 came in at 14.5% vs a meagre 1.6% for LIC, resulting in the private sector contribution to RWRP increasing by 5.7% to 62.9% in FY22

- A growing private insurer contribution to the overall life insurance industry augurs well for the country, with improved product offerings coupled with a strong brand and ubiquitous distribution strengths a net positive for the industry at large

Retail Weighted Received Premium is the total premium collected through retail policies and only includes single policies, not the group. It is a barometer of the strength of the sector, with strong growth indicating high premiums collected.

Nice! And individual stocks? Can you shed some light on that, please?

SBI Life

- While RWRP was low for the month of March, SBI Life recorded a 25.9% YoY growth for FY22; 2-Yr CAGR was ~15%, which is slightly better than other listed private peers

- In Mar’22, the company sold its highest ever monthly individual policies, touching ~265k; the combination of growing RWRP, and higher policy count indicates a shift in product strategy, moving towards retail protection from savings products previously

- The overall development of FY22 points toward a strong end of the year for SBI Life, which is firing on all cylinders, product, brand and distribution

HDFC Life & ICICI Prudential Life

- HDFC Life 2 Yr CAGR was higher than the private peer average during the similar period, indicating another strong month for the company; the number of policies sold declined for the month of Mar’22, indicating RWRP increased due to an increase in ticket size

- Similar to HDFC Life, ICICI Pru reported a decline in the number of policies sold, while RWRP rebounded from poor months in Jan & Feb to close strongly in Mar’22, indicating an increase in ticket size of the premium received

- On a 2-Yr CAGR, ICICI Pru recorded a 2.6% decline, leading to a material market share loss for the company

Interesting! Anything else? Final thoughts?

- Beyond the top-4 private life insurers (HDFC Life, ICICI Pru, Max Life, SBI Life), Bajaj Allianz Life & the JVs of Public Sector Banks reported impressive growth in RWRP in FY22

- Bajaj Allianz, through its tie-up with Axis Bank, reported a 49% YoY RWRP growth for FY22, including a 2-Yr CAGR of 38%, albeit on a low base (and still)

- Bancassurance (or distribution through banking channels) is key to building out a strong life insurance business, with bank branches providing feet on the street across the length and breadth of the country (also explains SBI Life’s leadership position, as SBI has the highest # of branches)

- The sector’s RWRP growth is expected to broadly track nominal GDP growth, with private leaders growing faster than that and LIC, sustainably gaining market share in the process

- This makes for a strong long term scenario for Life Insurance companies, who have also been significantly stress tested during the last 2 years, and more so during the second wave

What else caught our eye? 👀

India’s growth getting worse

- The International Monetary Fund on Tuesday slashed India’s growth forecast to 8.2% for FY23 (vs 9% estimated in January) majorly due to high oil prices which will affect consumer demand and private investments

- India’s inflation is estimated to average 6.1% in FY23 (RBI’s upper circuit is at 6%) after it climbed to 6.7% in March

- FY24 also saw the forecast being cut from 7.2% estimated earlier to 6.9% now though India is projected to remain the world’s fastest-growing major economy, (China’s GDP growth is estimated to be at 4.4% in 2022)

Adani wants to take over India

- The Adani group has committed to invest Rs.10000 Cr in West Bengal over the next decade that will ‘will span world-class port infrastructure, state of art data centres and undersea cables that will connect them across the oceans, centres of excellence in digital innovation, warehouses and logistics parks’

- In Gautam Adani’s first appearance at the state’s business summit, he said the investment will help generate 25,000 direct and indirect employment

- The group currently has an edible oil plant in the Haldia township and is also the highest bidder for the Tajpur deep sea port (the state is yet to announce Adani Port as the L1 bidder.)

Results Preview (Nifty 200)

Thursday, 21st April: HCL Tech, Nestle (India), Tata Communications, L&T Technology Services, ICICI Lombard General Insurance

Friday, 22nd April: Hindustan Zinc

Educational Topic of the day

Current Ratio

The current ratio measures the ability of an organization to pay its bills in the near term. It is a common measure of the short-term liquidity of a business. The ratio is used by analysts to determine whether they should invest in or lend money to a business.

To calculate the current ratio, divide the total of all current assets by the total of all current liabilities.

Current assets ÷ Current liabilities = Current ratio

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com