MFs Maintain Their MoJo Despite Red Candles Everywhere

Good Morning Toasters!

Ssup bros!! Hope the week started on a positive note for you. In today’s issue, we cover in detail LTIs merger with Mindtree, which creates India’s 6th largest technology company.

Mutual funds have gone from strength to strength, maintaining a sense of balance in the markets (if you catch our drift 😛), and deploying growing AUMs.

And finally, we’ve started a rollout of our newest product, Trade:able, that aims to democratise trading, via a unique and fun learning experience. There are a bunch of amazing rewards and prizes to win. Click here to know more.

Market Watch

Nifty 50: 16,301.85 | -109.40 ( -0.67%)

FII Net Sold: INR 3361.8 crore

Sensex: 54,470.67 | -364.91 (-0.67%)

DII Net Bought: INR 3077.24 crore

Corporate Development

L&T Infotech and Mindtree agree on a merger scheme; what’s up and what do you need to know?

The Deal

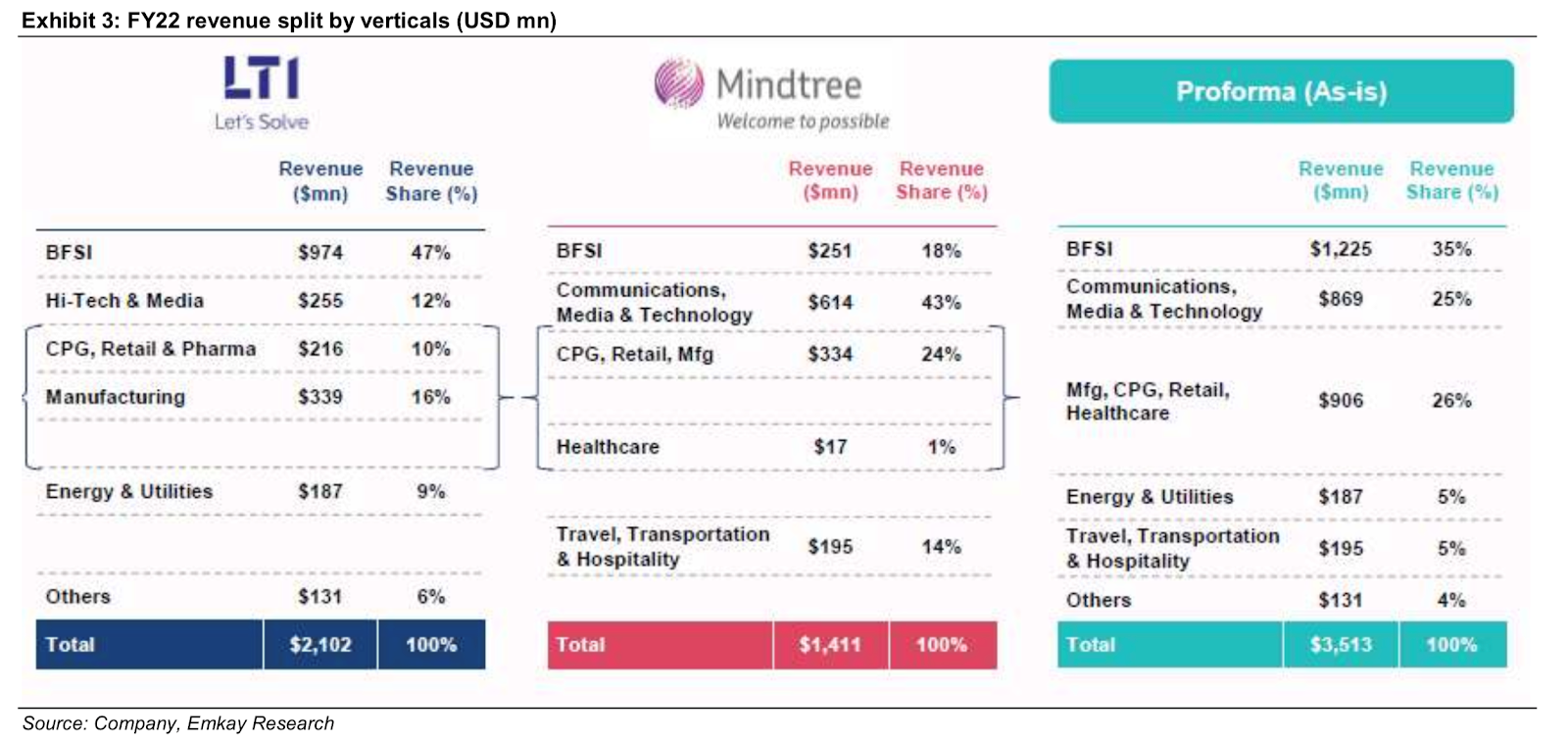

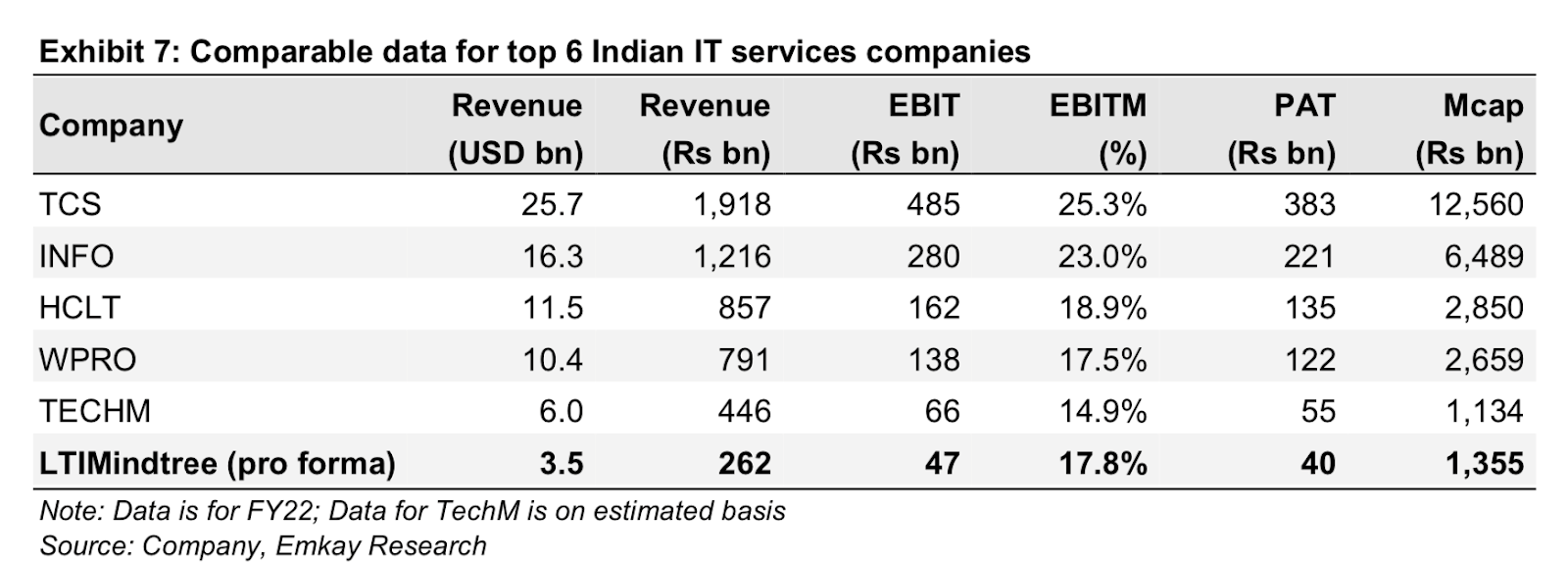

- The boards of L&T Infotech and MindTree have approved a merger scheme of the two companies, with the combined entity called LTI Mindtree Limited, with combined revenues >USD 3.5 Bn

- Shareholders of MindTree will receive 73 shares of LTI for every 100 shares they own, with L&T Group (designated as Promoter) owning ~69% in the newly formed entity

- MindTree’s current CEO and MD will lead the newly formed entity, with the incumbent CEO of LTI resigning recently; both companies are expected to operate independently till the closure of the transaction (regulatory & shareholder approvals)

Background

- This isn’t the first sojourn between the companies; in 2019, LTI attempted India’s first hostile takeover (in the IT Industry), performing a creeping acquisition move on MindTree

- Resisting at first, MindTree eventually acceded, with parent Larsen & Toubro (L&T) owning ~61% of MindTree through a series of share purchases (via public market operations)

- Since then, the two Technology companies within the L&T Group have performed independently, growing individual business lines

The Rationale

- The amalgamation of two companies with a mutual parent (L&T) is likely designed to enhance LTI MindTree’s ability to –

- Leverage scale and bid for large scale transformation technology deals

- Exploit complementary capabilities of both companies

- Enable cross-selling / up-selling opportunities across 750+ clients in both entities

- Larger cash pool, enabling war-chest to address gaps via M&A

- From a bottom line perspective, the combined entity will likely be able to streamline operations, cut repeating roles (think: Sales, Delivery, Operations) and positively affect unit economics

Thoughts?

- A merger between the entities was always on the cards (L&T being the majority shareholder), with the management ascertaining that the time seems opportune now (steady operations, scale & strong leadership, avoiding a potential conflict of interests in clients/partners)

- The proposed amalgamation is going to be problematic in the interim, with any large scale merger requiring a bedding-in period, and more so with a leadership change also taking place (LTi CEO has resigned)

- That being said, the proposed entity has all the makings of being a strong player within the IT & ITeS space, via scale, size, streamlined operations, strong product portfolio and able management team (this is not a recommendation, not our style of FinLearn)

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- Crypto bulls watch out – $BTC fell 3.9% to $34,656 on Sunday afternoon reaching almost half of its Nov all time high of $67,802. $ETH too lost out with a 5.1% decline to $2,565. A key takeaway is that the crypto market is increasingly moving in tandem with the traditional markets as more institutional investors dominate the earlier individual majority. Equity has taken a major hit after a rate hike announcement by the Fed with the tech-heavy Nasdaq Composite hitting its 52-week low

- Mental health is the new kid on the block – VCs and PE firms are pouring billions into the mental health segment including psychology offices, psychiatric facilities, telehealth platforms for online therapy, new drugs, meditation apps and other digital tools, as can be seen by the 9 startups that turned unicorn last year. The pandemic has increased instances of grief, anxiety and loneliness consequently leading to health plans and insurers paying higher rates than in the past for mental health care. The inflow of this capital, however, could push prices for treatments up reducing potential profits, and compromising treatment quality

- China insulated from inflation- Consumer prices in China increased just 1.5% in March (vs 8.5% in the US) and 0.9% overall in 2021 (vs 7.5% in the US). Low consumer demand in China is said to be the biggest reason along with price controls, protectionist trade actions and other aggressive measures undertaken by the government. It will still however need to combat imported inflation as prices of gas, grains and oil from abroad skyrocket

Industry News

Mutual Funds maintain their MoJo despite numerous red candles

- Technically having entered a correction, which is classified as a >10% drop from peak levels, the Nifty50 and other headline indices are in the bear zone, reason enough for MFs and other large institutional investors to stay away and hatch eggs till the tide turns (🌊)

- And yet, investments from domestic mutual funds have remained undeterred in April, deploying INR 22,371 crores and taking the tally of cumulative three-month inflows to INR 73,550 crores, which believe it or not, is a record high

- Local funds have continued to remain bullish on ‘India’ investing >INR 20,000 crore in 5 of the last 6 months, with an average investment of MFs rising in the last one year to INR 16,062 crore, which is ~8x the long term average

- This is also visible in the Gross Buy: Sell Ratio (Number of stocks bought vs sold during a particular period), with local funds skewed towards buying, at 1.25 in April 2022, vs a long term average of 1.07

Damn! Tell me more?

- This unwavering investment and patriotism (😝) by MFs have been able to neutralise record selling by Foreign Portfolio Investors (FPIs), who have cumulatively sold INR 95,674 crore worth of Indian equities in the last 3 months

- And this has been possible due to an unwavering flow of SIPs/investments from retail investors, with MFs now managing INR 20 Lakh crores (AUMs in March)

- This means local funds now have the second largest equity AUMs, following FPIs who account for INR 47 Lakh crores of assets

- A growing Indian domestic MF industry augurs well for the longer term health of the stock market; in times of redemption (selling to divert funds to other asset classes / maintain cash) such as now, with FPIs selling relentlessly, maintaining a balance via a domestic industry limits the pain considerably, as MFs continue to buy

What else caught our eye? 👀

EV sector seems some movement

- In accordance with their carbon neutrality goal, the Toyota Group will be investing Rs. 48 billion ($624 million) to make electric vehicle components in India

- The MoU has been signed with the state of Karnataka and the endeavour may provide direct employment of 3500 new jobs

- The Indian EV space has a forecasted revenue of $20 billion between now and 2026 with 53% of new automobiles being electric by 2040

Inflation hitting the core now

- Prices for the most essential commodities (like bread and biscuits) could see a price increase next month as the open market sale scheme (OMSS) for wheat for the current year has not been announced yet by the GoI

- Wheat flour’s all-India average retail price stood at Rs 32.78 per kg on Saturday (higher by 9.15% YoY) with the highest price in Mumbai at Rs. 49 per kg

- Other products (soaps, shampoo, biscuits and noodles) are also under threat as Indonesia has banned palm oil exports – 45% of our palm oil consumption is met through this channel)

Educational Topic of the day

What is algorithmic trading?

Algorithmic trading is when you use computer codes and software to open and close trades according to set rules such as points of price movement in an underlying market.

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com