McDonald’s Gains As Domino’s Sheds Its Pandemic Gains

Good Morning Toasters!

Ssup friends!! The fun lasted a short time (??), as headline indices fell sharply. US Fed’s annual Jackson symposium, a strengthening US Dollar, equally prioritising growth & inflation, and a monthly expiry make this week an action-packed one.

WLDL, master operator for McDonald’s in West and South India had a memorable Q1, recording best-in-class growth, post-pandemic, even as their new store addition lagged. Domino’s seems to be prioritising elsewhere, focusing on SSSG via loyalty programs, improved delivery time and new product launches, as it continues to lose revenue market share.

Market Watch

Nifty 50: 17,490.70 | -267.75 (-1.51%)

FII Net Sold: INR 453.77 crore

Sensex: 58,773.87 | -872.28 (-1.46%)

DII Net Sold: INR 85.06 crore

Industry News

KFC gains as Domino’s sheds more than its pandemic gains; what’s up and what do you need to know?

- According to a Technopak report, Quick Service Restaurants (QSR chains, McDonald’s, KFC, Pizza Hut, Burger King) have seen strong growth in the recent past, recording a 3 Yr CAGR of 13.5% until Q1FY23

- Going forward, incremental growth is expected from new store addition / SSG improvement in the next 9 months, likely taking 3 Yr CAGR in FY23 to 17%, an ode to the rising wallet share of QSR chains pan-India

- Going deeper, Domino’s has lost market share to KFC, which has gained ~5% revenue share through a 4% rise in store count share, and coupled with improved revenue/store performance, with a similar revenue share loss to Pizza Hut recorded during Q1FY23

- After being the darling of the pandemic, and recording ~11% market share gains, Domino’s has given up all & more of the gains it made, as competitors (including KFC & PH) have caught up through a higher store opening share (in comparison)

- Further, in contrast to competitors increasing store count, Domino’s has also altered priorities, instead focusing on improving its SSSG (Same-Store-Sales-growth) via a mix of loyalty programmes, reduced delivery time (<20 mins) and new product launches

Interesting! Tell me more about Burger King, Pizza Hut and Mcdonald’s?

- Mcdonald’s (WLDL) and Burger King have completely recouped the revenue share lost during the pandemic, even as store count additions have lagged initial estimates/company targets (for WLDL), with return in dine-in sales playing a huge role

- McDonald’s has recorded industry-leading growth of 31% in annualised rev/store, followed by 14% for KFC, and 11% for Burger King, as WLDL has doubled down on new product launches (fried chicken rollout / gourmet burgers have moved the needle)

- At an industry level, 175 new stores were opened during the last quarter, which is huge when compared to the ~300 stores opened in a year (pre-Covid), as annualised new store additions are ~2.5x the past, with near-term store additions across QSR chains robust

- That being said, a buoyant outlook can fall prey to a shortage in quality real estate and/or high employee attrition, as both rent & employee costs form ~20-25% of costs for QSR chains, with increased competitiveness a likely damper, as QSRs compete for wallet share

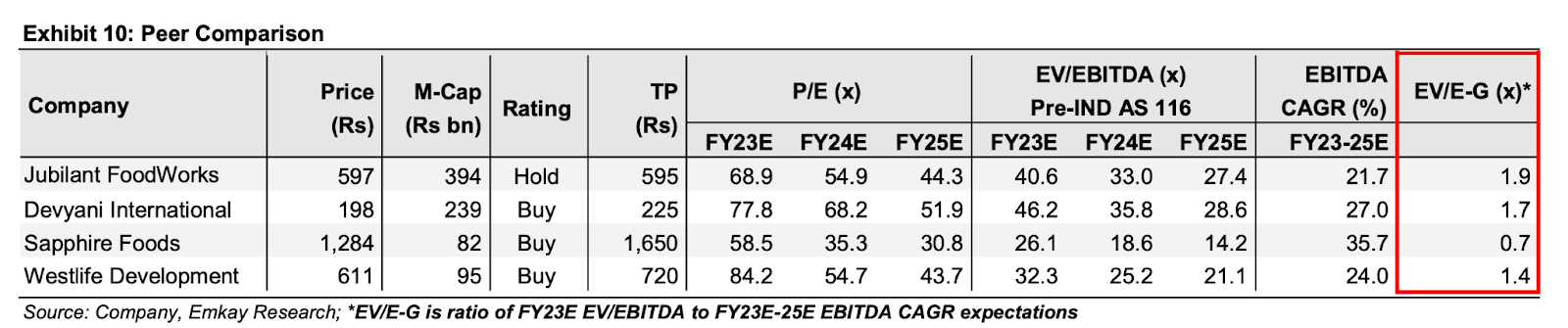

Got it! Final thoughts? Stock & Valuation perspective?

- QSR chains are poised to grow on the back of new store additions, improved SSSG, and new product launches, as consumers allocate a higher wallet share; dine-ins, especially as post-pandemic reality sets in, are likely expected to have a higher impact than previously envisaged

- WLDL, following its industry-leading Q1 growth, and coupled with an ambitious plan to open 35 new stores this FY, followed by 200 stores over the next 3 years, and coupled with a constantly evolving product range is well-placed to capture the growing share

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- Will AMZN win this one?: Amazon, CVS Health Corp and UnitedHealth Group are among the top bidders for Signify Health, a prominent healthcare company valued at $5 billion. It uses technology and analytics for in-home care of physician groups, health systems and employers. If Amazon secures the deal, it would be the first for its CEO Andy Jassy for whom healthcare has always been a priority and second for the company which recently acquired 1Life Healthcare, parent of One Medical

- Some relief for China or its worst mistake yet?: China’s economy is experiencing one of its worst times as Covid-19 lockdowns force millions to stay at home leading to factory shutdowns, a decrease in industrial production, retail sales and high levels of unemployment. To add to its worries, the real estate sector, a major contributor to the world’s second-largest economy is also suffering due to unfinished projects and heavy debts. To offer some relief in these trying times, the People’s Bank Of China has cut benchmark interest rates on loans given to businesses and households

- Buffett lost his love for Occidental Petroleum: Warren Buffett’s Berkshire Hathaway is already the biggest shareholder of Occidental Petroleum, a resurgent energy company. When it recently received a go-ahead from Federal Energy Regulatory Commission to increase its stake to 50%, there was speculation that Mr. Buffett might be planning to acquire a bigger share of the company but it seems unlikely since share prices are up 146% in the last year, owing to the rally in the prices of oil. The permission was sought because if Mr. Buffett had to exercise his warrants, then his share in the company would become 27%, more than the limit of 25% allowed by FERC

Market News

Profit booking continues (?), as headline indices fall

- In not so bullish fashion (hehe), headline indices fell heavily yesterday (22nd Aug 2022), as traders & investors choose an activity-filled week (more on this below) to book profits

- 30 stock BSE Sensex ended the day ~872 points or 1.46% lower, while the OG Index Nifty50 fell ~268 points, with major indices previously trading in the overbought zone, with the US Fed’s annual Jackson Symposium and monthly F&O expiry not particularly helping matters

- The broader markets also underperformed, as sectoral/strategic indices ended the day lower, with major losers including Nifty Metal (-3%), Nifty Auto, PSU Bank, Realty and Financial Services all down by 2%

- A large part of the recent rally has been attributed to FPIs returning in a big way, especially as the US Dollar weakened post touching all-time highs, a phenomenon that seems to have reversed in the recent past

- The key behind this has been a perceived change in stance at the US Fed, which is meeting this week at its annual symposium (25-27 August), as investors now anticipate the US Fed to find a balance between curbing inflation & prioritising growth, instead of unilaterally only curbing inflation, thereby pushing the dollar higher

Ahh okay! Tell me more? Some charts perhaps? Nifty50, Broader Indices?

- Looking at the Nifty 50 chart on a weekly time frame, prices took resistance around its stiff supply zone (17800-18000) making an inverted hammer candle (Bearish candle)

- The last time Nifty made an Inverted Hammer candle (4 Apr 2022) near its resistance the Benchmark index corrected over 16% (16.26%) over the period of 51 trading sessions (74 days)

- Analysing the daily time frame, we observe that the index gave a breakdown from its short-term simple moving average (10-day SMA) which might lead to a long slump, Although the market is still trading above all other important moving averages (20, 50 & 200-day SMA), a positive sign for investors

- On a daily time-frame, the higher high higher low making Nifty Realty index is currently trading near its support band (430-440)

- Nifty Auto has given a breakdown below a long-rising wedge. The next demand zone for the index is around (12,200-12,350)

- On the other hand, Nifty FMCG after giving a year-long breakout (41,850) is currently trading in a rising channel making higher highs and higher lows

What else caught our eye? 👀

Dubai’s skyline to see a ‘Skypark’:

- As if creating the world’s tallest building wasn’t enough, Dubai now plans to put a giant ring of 3000 metres around it and create sustainable vertical urbanism

- The ‘Downtown Circle’ will encircle Burj Khalifa and float over downtown Dubai. The project will house public, commercial and cultural programs from macroscale offices to terraced houses

- The building will consist of a ‘Skypark’ – a continuous green belt recreating different natural scenarios and climates, vertically connecting the two main rings and will make up a 3D urban ecosystem

Assam Oil Field rekindles its operations:

- Oil India Limited’s Khagorijan oil field in eastern Assam resumed its operations on Saturday after a halt of almost fifteen years. Assam Chief Minister Himanta Biswa Sarma graced the ceremonial function

- The production was initially started in 2004 and is located at a distance of 1.8km from the Brahmaputra. The river underwent severe erosion, caused large-scale devastation and greatly affected the people after which all the operations were suspended in 2007

- The chief minister said that the state government has been taking action and that 80% of work for the embankment has been carried out along with an impending sanction of ₹16.13 crore

Educational Topic of the day

What is a golden crossover?

- A Golden Crossover is a technical chart pattern indicating the potential for a major rally or a decline

- It is seen on the chart when a security’s short-term moving average (50-day SMA) crosses its long-term moving average (200-day SMA)

- If the short-term moving average crosses the long-term moving average (and goes higher), then it is termed a positive golden cross, whereas if the short-term moving average crosses the long-term moving average (and goes lower), then it is termed a negative golden cross

- The golden crossover is also called the death crossover

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com