Maruti Suzuki Maintains Retail Market Share at 49.1%

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss:

- Maruti Suzuki revenue dips 1% YoY

- Federal Bank doubles down on fintech partnerships to drive growth

- News around the world

- And educational concept to keep you learning every day 🙂

Market Watch

Nifty: 17,277.95 | +128.85 (+0.75%)

FII Net Sold: INR 7,094.48 crore

Sensex: 57,858.15 | +366.64 (+0.64%)

DII Net Bought: INR 4,534.53 crore

Company News

Maruti Suzuki revenue dips 1% YoY; What’s up and What do you need to know? 🚗

Financial Highlights

- The company recorded a revenue decline of ~1% YoY to INR 232.5 Bn, primarily due to lower expected realisations; volumes declined by 13%, while realisations grew by 14%

- EBITDA % contracted by ~2.8% to 6.7%, which was higher than Bloomberg Consensus Estimates, on account of lower sales promotions expenses (discounts) and cost savings efforts

- Overall, adjusted PAT declined by ~48% to INR 10.1 Bn, above estimates due to higher operating profit and lower depreciation / effective tax rate

Business Highlights

- The company has a pending order book of ~264,000 units (pretty large), of which ~117,000 units were CNG vehicle bookings

- Retail market share for the company stood at ~49.1% (woah!!) in Dec’21, with Management targeting ~50% in the coming years, supported by new product launches (more on this below)

- Exports grew 154% to INR 33.4 Bn; amidst weak local demand, exports have grown superbly for the company (& industry) primarily on account of expansion of product range and network across existing / new geographies

- Blended discounts for the quarter stood at INR 15,2000/unit, vs INR 20,185/unit last year (helped in maintaining EBITDA %); the company took a ~2% price hike to pass on commodity inflation in Jan’22 and expects gross margin improvement in Q4FY22

- On Electric Vehicles, the company believes potential for monetisation remains limited, primarily on account of affordability and lack of consistent charging infrastructure (think: TAMO)

Interesting! And going forward? Tell me more? 🤔

- MSIL is likely to initiate an aggressive model action plan in the next 2 years to fill up the white-spaces in its product range, with upcoming product launches likely to include –

- Above-4m SUV

- Below-4m SUV

- Large SUV

- Off-reader

- In addition, the company will launch new-generation models of Brezza, Baleno, Alto, and S-Cross

- The company will, in coordination with Suzuki / Toyota have technological capabilities / upgrades for xEVs, and is expected to commission a Lithium-Ion assembly plan in Gujarat soon

- Chip supplies (everyone’s OG problem) are improving, with production expected to be better in Q4FY22; the company indicated that ~90,000 units during the quarter could not be produced due to chip shortages

Nice! Valuations? Stock Price et al. (You know the drill :P) 😏

- The stocks have been in a strong trend in the last month, up ~19%, despite cyclical challenges (across demand & supply)

- Despite Revenue & EBITDA misses, the market was enthused with the company’s commentary, with the stock up ~8% on the day after the results

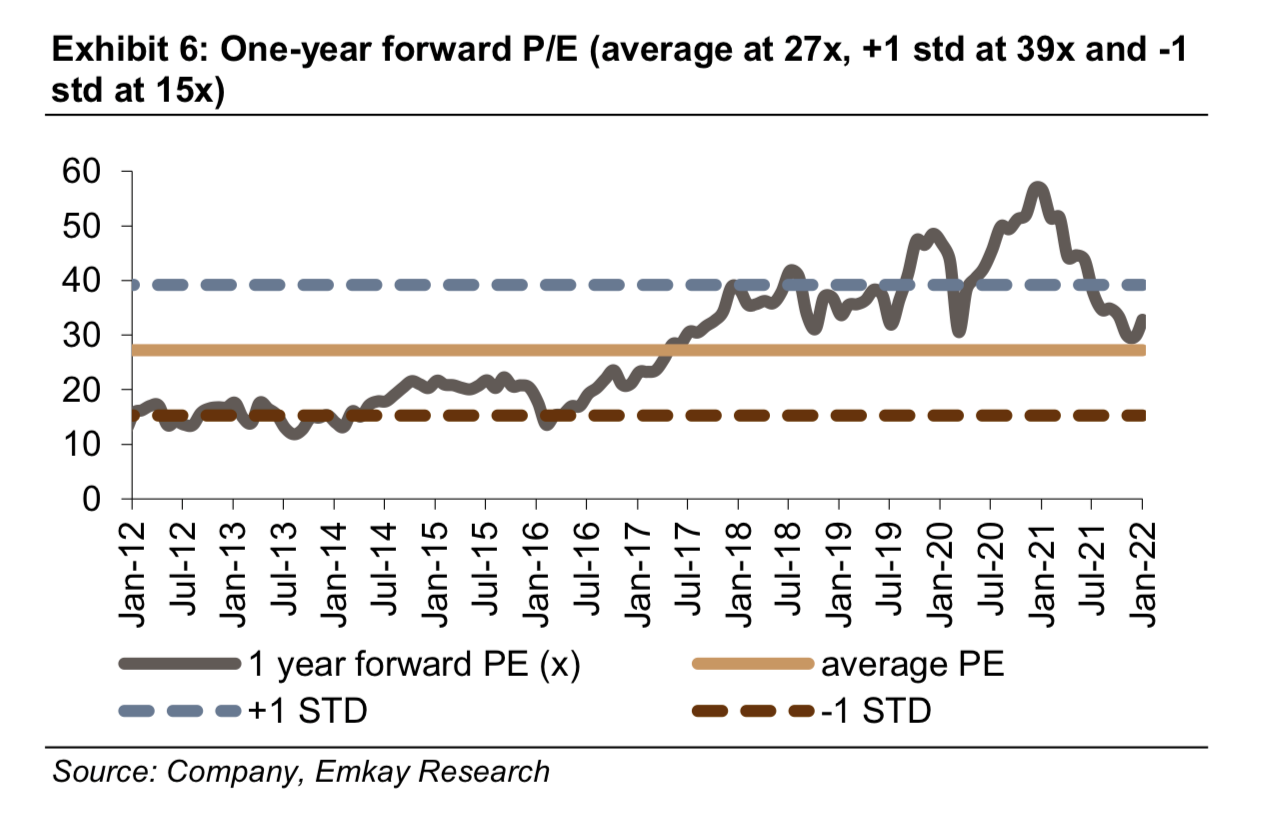

- The company currently trades at ~29x 1 Yr FWD P / E (x) with previous P/E (x) multiple bands placing it in a higher range (see image below)

Keep a track?

Around the World 🌍

With the Fed withdrawing its stimulus, and stock indices plunging into oblivion, things are looking bleak; what happened and what’s next?

- Demand for the haven metal seems to have exploded with over a record net $1.6 billion flowing into the world’s largest physically-backed gold ETF lately. Tensions between Russia-Ukraine and the sell-off seen in other speculative assets like $BTC seem to have escalated the demand

- Meanwhile, the pace of economic growth is likely to decline more sharply than expected (now expanding at 4.4% as opposed to 5.9%) according to the IMF given inflation, Omicron, and supply-chain bottlenecks. The US is seeing the largest downgrade among any country with inflation (last at 7%) playing a major spoilsport

- Federal Reserve officials are expected to keep interest rates near zero, at the conclusion of their two-day policy meeting (Wednesday), while signaling they’re likely to raise rates at their following gathering in mid-March, with the OG Central Bank also likely to approve one find around of asset purchases (rmb those :P)

- But not all things are gloomy – around 77% of companies reporting results so far have surpassed investor expectations. Microsoft showed a lot of promise with stable growth in earnings buoyed by their services cloud business, and big moves in the pipeline to enter the booming gaming industry. Positive results from other tech heavyweights like Apple and Tesla are also expected soon

Company News

Federal Bank doubles down on fintech partnerships to drive growth; What’s up and What do you need to know? 📊

Credit Highlights

- Overall credit growth for the bank improved by 12% YoY / 5% QoQ to INR 1.4 Tn, primarily led by strong traction in the corporate book

- Retail growth was relatively moderate, given the management’s risk-averse news towards unsecured personal loans; growth trends in secured mortgages/car business were better (in comparison)

- The bank’s fintech partnerships are building-out well –

- Partnership with One Card to source cards from new-gen customers

- Has gone live on its micro-lending platform, FedMi to source high margin MFI business

- Launched online lending platform, federalinstaloans dot com to facilitate quick MSME loans

- Closed ~INR 45 Bn in gold / micro-banking loan disbursements via fintech partnerships

- Federal Bank has formed a separate team to strengthen and monitor such partnerships, to drive quality and maintain standards

Asset Quality Highlights

- Fresh slippages were slightly higher than expected at INR 4.5 Bn (~1.4% of loans), due to NPAs from the corporate and business banking segments

- Gross NPAs ratios improved by 18bps QoQ, to 3.1% due to better recoveries, including sales of NPAs to asset reconstruction companies (ARCs)

- The overall restructured pool stood at INR 35 Bn (~2.5% of loans), of which ~98% is secured, with the management indicating a lesser likelihood of relapse from this pool

Interesting! Tell me more? 🤩

- Despite higher Operating Expenditures, the bank reported a Bloomberg Consensus Estimate beat on PAT at INR 5.2 Bn, aided by better Net Interest Margins, higher fees collection and continued reduction in LLPs

- Federal Bank is well & truly on its way to building out a strong fintech side – the bank refrained from significantly adding to its branch network, adding only 27 new branches in the last 5 years

- The CASA (Current Account, Savings Account) ratio for the Bank stands at an all-time high of 36.2%, which should significantly assist in reducing credit costs in the long term (also indicative of trust being shown by customers)

- NIMs are on an upward trajectory, with ~3.3% being a 10 quarter high for the bank, on the back of significant improvement in portfolio mix, higher CASA and lower interest reversal

Nice! Final thoughts? Stock performance et al. 🤔

- The Bank clocked 1% RoA (Return on Assets) in Q3 (as guided), with the expectation that this number, first continues, and secondly improves in the next 2 years (on the back of activities undertaken, listed above)

- Federal expects Net Interest Margins to improve further, on the bank of improved product mix, and lower interest reversals, which should significantly assist in touching mid-teens RoE numbers

- The Banks built out a strong liability/asset profile, maintained management stability (CEO in position >5 years), executed significant digital adoption and kick started improvement in return ratios

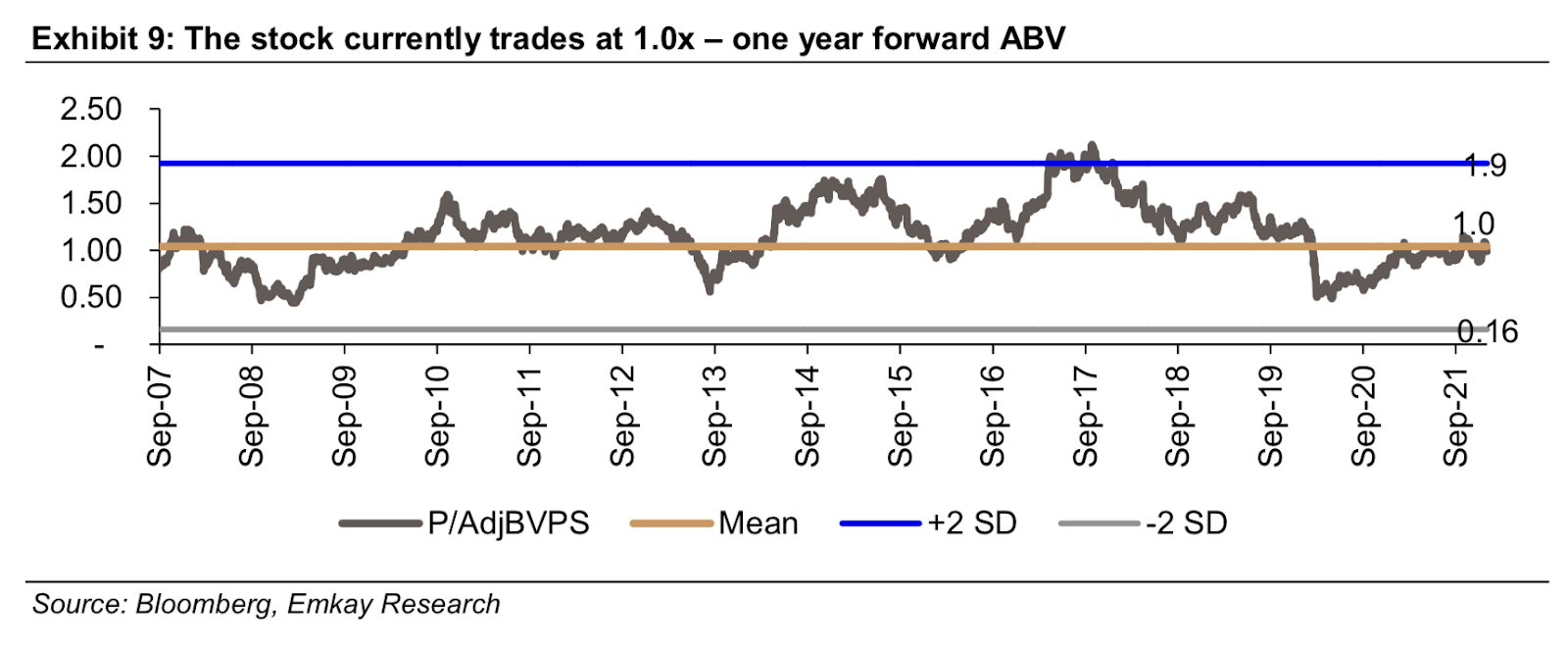

- The bank currently trades at 1.0x 1 Yr FWD Price / Adjusted Book Value, with scope to re-rate towards much larger peers in the long term (we believe)

Keep a track?

What else caught our eye? 👀

India’s favorite Shark is taking his company public

- Boat – one of India’s largest electronics brands – is set to file a DRHP for a Rs 2,000-crore IPO with the SEBI this week

- A valuation of $1.5-2 billion is expected with the largest shareholder PE major Warburg Pincus to offload shares worth INR 700-800 Cr

- Boat said that it is among the Top 2 Players in the sector with a 20% market share and that the market is expected to grow to $2-4 billion by 2025

Future rejects Amazon (again?)

- Future’s independent directors have rejected Amazon’s bailout offer calling the move “plainly an attempt to buy the FRL assets on the cheap”

- Amazon through Samara Capital offered to buy out for a price of Rs. 7000 Cr which was said to be significantly below the amount needed to pay off creditors (~ INR 12000 CR)

- The Board has also refused to assess any further proposals from the giant, and has meanwhile moved the courts to hold off on being declared as a NPA

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Results Preview

Thursday, 27th January: Colgate Palmolive, Indus Towers, KEI Industries, Birlasoft, LIC Housing Finance, Coforge, PNB, Intellect Design Arena, RBL Bank, Laurus Labs, Nippon Life AMC, Dalmia Bharat, Route Mobile

Friday, 28th January: Atul, Britannia Industries, Dr Reddy’s Labs, Kotak Mahindra Bank, L&T, Marico, Infoedge, Oberoi Realty, Vedanta, AU Small Finance Bank, Dixon Technologies, UTI AMC, Happiest Minds Tech

Educational Topic of the day

Amortized Bond

An amortized bond is a bond with the principal amount – otherwise known as face value – regularly paid down over the life of the bond. The bond’s principal is divided up according to the security’s amortization schedule and paid off incrementally (often in one-month increments).