Mahindra & Mahindra Showcases Electric Prowess And Plans For Long Haul

Good Morning Toasters!

Sssup friends! Long time no see. The markets reacted well to US CPI Inflation data, which subsequently pushed the Dow lower by 4.6%, inflicting the heaviest day since June 2020. DII buying ensured that the Nifty remained strong, albeit with a weak ending.

In today’s issue, we cover Mahindra & Mahindra’s new EV plans, with the company poised to spend INR 100 Bn over the next 5 years in developing a range of new electric UV vehicles, as it looks to garner a ~30% penetration in the fast growing India EV Market.

In other news, the CPI Inflation print for August came in higher than expected, including an increase for the first time in the last 3 months, much to our surprise. The US Fed is scheduled to meet next week, with high certainty of a 75 bps rate hike, after the high inflation print. Yikes!

Market Watch

Nifty 50: 18,003.75 | −66.30 (0.37%)

FII Net Sold: 1397.51 crore

Sensex: 60,346.97 | −224.11 (0.37%)

DII Net Bought: INR 187.58 crore

Company News

Mahindra & Mahindra showcases electric UV prowess, and plans for long penetration game

- Hosting an analyst day (sell-side finance community), Mahindra & Mahindra showcased its EV capabilities, reiterated its ambition to develop strong EV credentials, and displayed its newest product, the XUV400, which has been developed at a cost of INR 5-6Bn

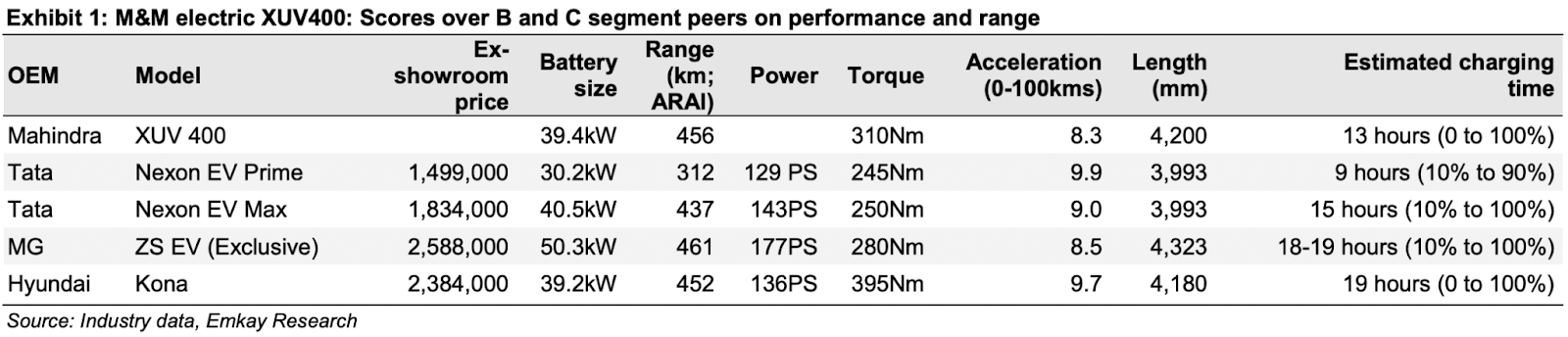

- The model features a superior range and acceleration (in comparison to peers in the non-luxury segment), with bookings & dispatches expected to commence in Q4FY23

- Post the XUV400 launch, Mahindra & Mahindra is expected to launch 4 more electric vehicles under the XUV & BE brands, based on a dedicated platform (INGLO), over December 2024 – October 2026, with investments related to platform and model development expected to touch INR 100 Bn over FY22-27

- Led by multiple products, Mahindra & Mahindra has set an aspirational EV volume target of 200,000 units by FY27, which translates into a cool 30% penetration (steep?), with the company also planning on collaborations with VW on electric drivetrains, battery systems, and battery cells for ~1 Mn+ units (during the lifecycle of partnership)

Interesting! Tell me more? Competitor analysis, details on M&M investment etc?

- The company’s planned for an INR 100 Bn investment spread over FY22-27, with INR 20 Bn in FY 22/23, another INR 20 Bn in FY24, and the remainder INR 60 Bn between FY24-27, with the later stage funded through debt / third-party investors

- The recently announced British International Investment’s INR 19.25 Bn investment will be fully utilised in the first phase of launches, with the overall CAPEX likely to cover the cost of development of the platform and the four models

- From a competitive standpoint (see image below), M&M’s new models are placed at an advantage to competitor’s B & C segment models, providing higher range, better battery power and quicker acceleration (0-100 Km/hr), as the company positions itself in the marketplace

- Likewise, the company has rectified previous errors (of sorts?), increasing the length of the XUV400 to 4.2 mts vs <4 mts for the XUV 300, with manufacturers/consumers alike not receiving any tax benefits for models under 4 mts

Got it! Final thoughts? Stock, valuations etc.

- Mahindra & Mahindra has developed a strong sales upcycle (across its products), including a larger Passenger Vehicle Order Book (270,000+ units), which augurs well for the company going forward

- The stock’s (& the auto sector as a whole) has been in a strong cycle in the recent past, with M&M up 25% in the last 3M, and 77% in the last 6M, indicative of the general buoyancy in the company and the space overall

Keep a track?

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- The US is not the class topper anymore: In one of the worst one-day % drops after June’20, the Dow Jones tumbled 3.94%, the S&P500 plunged 4.32% and the Nasdaq dropped 5.16% on Tuesday. This was in response to the CPI reading at higher than expected levels of 8.3% as investors feared the prospect of another aggressive rate hike by the Federal Reserve. All of the eleven major sectors recorded a decline with consumer discretionary, communications and technology being the worst hit

- No more gold for their men (ok cringe we accept): In some horrible news for Wall Street OG Goldman Sachs employees, the firm has plans to start laying off hundreds from next week.The step became necessary after the company reported a huge decline of 48% in its last quarterly profits.The company used to follow the practice of laying off 1-5% of its workforce every year but had not implemented it for last 2 years due to the pandemic

- Elon gets a taste of his own medicine: Twitter’s shareholders have approved the $44 billion takeover bid of Tesla CEO Elon Musk with a whopping 98.6% votes cast in its favour, even though he is trying to break the contract. On the same day, former Twitter security executive Peiter Zatko testified in a Senate hearing that the company failed to protect users’ data and gave priority to profits over security adding to the serious concerns being raised over security breaches by social media giants

Economy News

August CPI Inflation rises after 3 straight months of decline; what’s up and what do you need to know?

- In not so good news (& definitely not according to plan), August CPI inflation came in at 7%, as higher food inflation was one the biggest drivers, with the current print not only the 8th straight month above the RBI’s upper tolerance limit of 6.0%, but also the first time in 3 months an uptick was recorded (yikes)

- Food inflation surged in August, with the impact of a lower sown area and irregular monsoons being felt dearly, as cereals & pulses prices rose >1.5% each, while vegetable prices also increased >2.5%

- Energy inflation, while high eased sequentially as weakness in precious and base metals, and select energy prices should help in moderating headline inflation; core inflation (excluding food, fuel & intoxicants) was unchanged, reflecting lower transport costs

- Worryingly, mandi prices (markets where farmers sell their produce) are already tracking higher for next month, with the inflation print for September now tracking at 7.14%

Damn! What about US Inflation, rate expectations, and market mood going forward? (phew a fair few questions there!)

- US inflation remained elevated in August, despite a ~10.6% drop in gasoline prices (largest in >2 years), defying estimates of a drop in momentum, as the Fed Chairman made his intentions clear at Jackson Hole Symposium

- Inflations clearly not transitory (hehe) and worse is likely non-linear vs market expectations, as the US Fed’s trajectory is still entirely based on how quickly and how effectively inflation drops

- The US Fed meets on 21st September, and is according to consensus expected to raise interest rates by 75 bps again, with the prospects of higher hikes in the coming meets also a possibility (we believe)

- Global macro scenarios and the Fed’s actions will likely have an impact on Indian markets and the RBI’s actions, even as CPI Inflation locally is under control, albeit higher than the RBI’s tolerance threshold, as the next hike (?) becomes tough to call

What else caught our eye? 👀

The extrication of oil firms

- Companies like Bharat Petroleum and Hindustan Petroleum have been holding down pump prices of gasoline and diesel since early April in order to curb the rising inflation

- But recently, Bharat Petroleum’s chairman, Arun Kumar Singh said that the oil companies will require some intervention either through price increases or government compensation to cover sustained losses

- And now, India plans to pay about ₹20,000 crores or $2.5 billion to the state-run fuel retailers, such as Indian Oil to partly compensate them for losses and keep a check on cooking gas prices

Indian dairy market on the rise

- The size of the Indian dairy market is forecasted to grow over two-fold and reach ₹30 lakh crore by 2027. Such growth can be attributed to the increase in the production of milk and other dairy products along with its value appreciation

- The chairman of the National Dairy Development Board, Meenesh Shah said that the government is not “insensitive” and it will protect the interest of 8 crore dairy farmers while signing free trade agreements (FTAs) with other countries

- India’s milk production is expected to grow at a CAGR of 4.5% in the next 25 years and will reach 628 million tonnes. Its share in the global milk production is also expected to double to 45% in the same time

Educational Topic of the day

EBITDA

- An acronym for ‘Earnings before interest, taxes, depreciation and amortisation’, is a business analysis metric used to analyse a company’s financial health and operating performance

- When calculating EBITDA, one measures the company’s income with costs associated with interest expenses, taxes, depreciation and amortisation added back in

Utilising EBITDA

- Compare value for companies: The formula can be used to standardise the business performances of a company against an industry-wide set average

- Can be used as a proxy for cash flow from a company’s operation

- Can be used by early-stage companies that have an initial volatility in their earnings

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com