LT Foods Breakout Passes Multiple Tests? 🤑

Yesterday’s Market Performance

Nifty: 17,221.40 | -103.50 (-0.60%)

FII Net Sold: INR 3,407.04 crore

Sensex: 57,788.03 | -329.06 (-0.57%)

DII Net Bought: INR 1,553.01 crore

Howdy Toasters!

In today’s issue of the Morning Toast, we discuss

- LT Foods breakout passes multiple tests?

- ABFRL enters the athleisure segment via Reebok acquisition

- An education concept to keep you chugging along

![]()

LT Foods breakout passes multiple tests? 😳

- Analysing LT Foods on a weekly time-frame, indicates that the stock had been trading in a tight range, forming a consolidation patch. (see image below)

- The stock has been taking support at 63 for the better part of 2021 after breaking the level last year with good volumes (1st Breakout)

- Prices have been trading in a tight range (consolidation) and facing resistance along a falling trendline, thus making a descending triangle pattern

Ok that’s cool! Any confirmations? Any other tools? 🧐

- Looking at the chart on a daily time-frame (see image below), prices have been trading above the 50-day SMA (simple moving average) indicating a trend change (neutral to positive)

- Lately the stock has been trading in a tight range, making 2 swing bottoms at 63 and a swing high at 75, forming a Double bottom pattern, while giving a breakout above (providing us with that much-required confirmation)

That’s Great! How do I enter / exit such a setup? 🙄

- Going long would be the ideal trade in this case. To avoid traps (bull trap) wait for a retest, which is defined as prices taking support at the breakout level (highlighted above – 75)

- Stop-loss should be in place just below the 50-day SMA (trailing stop-loss) and a target as per your RR ratio (2 or more) needs to be set

Interesting! Final thoughts?🤔

- The constant supports taken around 63 and a breakout above the descending triangle pattern suggests the stock is forming a positive chart structure

- On a daily time-frame, prices have been trading in a tight range (accumulation) and making a Double bottom pattern, with continuation above the 50-day SMA showing strength

- We started with overall price action and trend analysis and took second confirmation on moving averages and retests, safeguarding us against possible traps

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

![]()

ABFRL enters the athleisure segment via Reebok acquisition; What’s up and what do you need to know? 🤩

Deal contours

- Aditya Birla Fashion & Retail (ABFRL) has signed a long-term licensing agreement with US-based brand management company Authentic Brands Group (ABG), for the online & offline exclusive distribution rights for Reebok products (in Indian & ASEAN markets)

- ABG had acquired the brand from Adidas last year, for a consideration of USD 2.5 Bn, and is likely to transfer the rights once that transactions is completed (tentatively by Q4FY22)

- The deal also includes the purchase of inventory & net assets amounting to INR 1 Bn

Why? Market Scope & Trend Analysis? 🙄

- Rising income levels, increased health consciousness, and the adoption of active lifestyles by young Indians, has accentuated the need for ‘athleisure’ & sports products segment

- A fast growing category, the total addressable market multiple manifold with an acquisition like this, with industry size estimated at ~USD 10 Bn, and growing at 14% CAGR (touching USD 13 Bn by FY25)

- Globally, since the pandemic athleisure & sportswear has recorded strong growth, and similar trends are highlighted locally

Interesting! Implications for ABFRL (financial / non-financial) 🧐

- Reebok is the 4th largest brand in the Indian sportswear market with Rs. 4.3 bn in revenue last year and a 5% Revenue CAGR over FY15-20 vs -1%/9%/16% for Puma/Adidas/Nike

- From a bottom line perspective, Reebok’s EBITDA margins have been on an upward trajectory, improving from -11% in FY15 to 17% in FY20

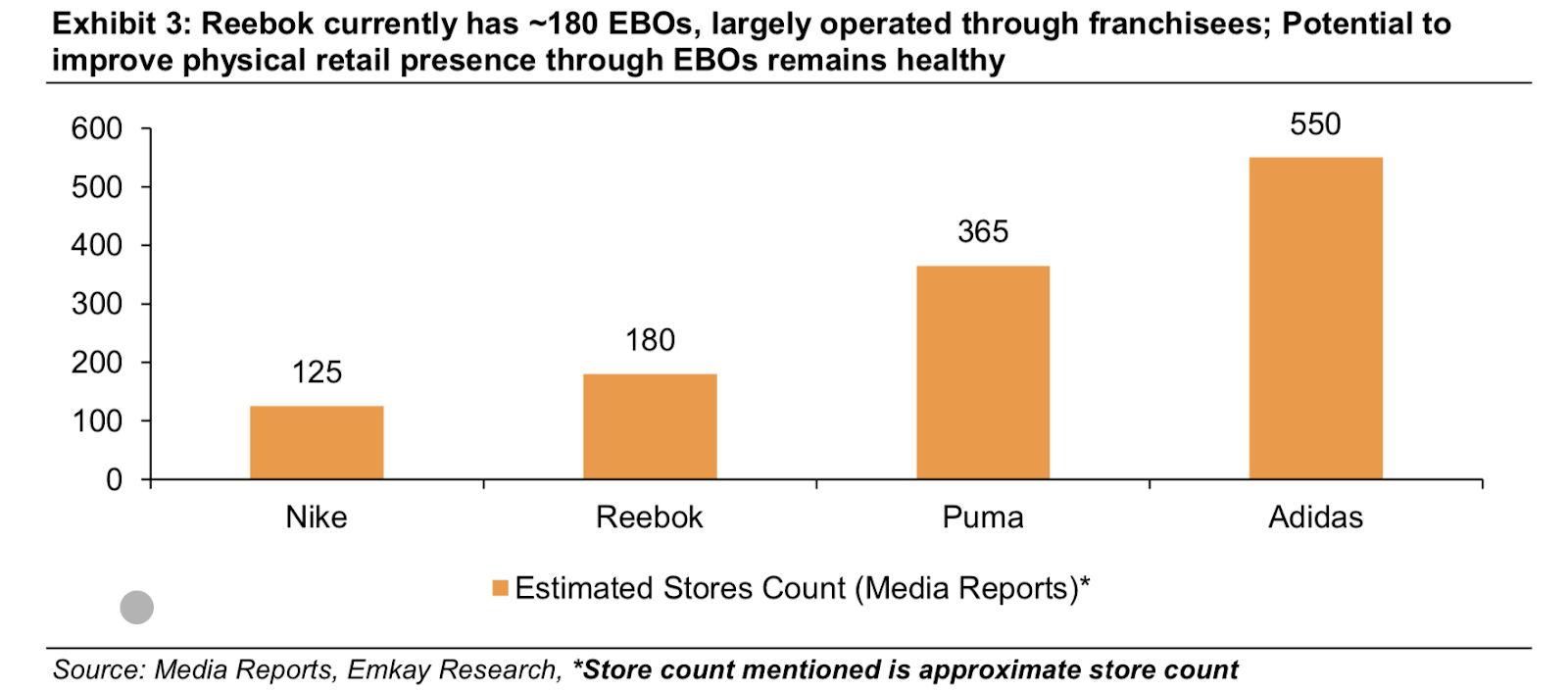

- Reebok has ~180 exclusive branded outlets (EBOs) in the country, that are majorly operated through the franchise route, leaving massive scope for expansion, with integration through Pantaloons stores

- Likewise, ABFRL will likely leverage their growing online channel to funnel through sales, opening up multiple new segments in the process

Nice! Final thoughts? 🤑

- The market was enthused with the acquisition, with the stock up 3% in early trade after this news broke out; ABFRL in general has been on an buying spree – with brands like Sabyasachi, Shantanu & Nikhil & Tarun Tahiliani recently acquired

- Overall strong demand trends, aggressive store expansion and improving efficiencies have positively impacted the company, with the stock trading at ~25x 2yr EV / EBITDA, which is at a discount to peers

What else caught our eye? 👀

SBI to use IPO to offload

- State Bank of India might offload 6% of its shares in its Mutual Fund arm through its IPO

- It is looking to raise $1 billion through this IPO, and the mutual fund arm is valued at $7 billion

- SBI Mutual Fund is the largest in the country with Rs. 5 lakh crore in assets under management

TVS Motors looking to enter the EV space

- TVS Motors will develop electric vehicles with BMW’s motorcycle brand in India

- This comes against the backdrop of ICRA downgrading the growth forecast for the passenger vehicles industry to 8-11% (from 14-17%)

- Reduced discretionary income, increase in two-wheeler and petrol prices and moderation in financial availability are some major reasons

Centre looking to aid the semiconductor industry

- The Cabinet has cleared a Rs. 76000 crore incentive scheme to push the manufacturing of semiconductors

- India will set up more than 20 semiconductor design, components manufacturing and display fabrication (fab) units over the next six years

- The government will also incentivise startups – with investments worth Rs. 1.7 lakh crore expected

![]()

New Fund Offer : NFO of Mutual Funds

A New Fund Offer (NFO) is how an asset management company launches a new fund on a first-subscription basis for financing its purchase of securities.

The investors may purchase units of the mutual fund scheme during the pre-defined period and subscribe to the NFO at an offer price.