Lithium & Cobalt Are The New Silver & Gold?

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss:

- HDFC Bank leads the way in terms of credit growth

- Lithium & Cobalt are the new Silver & Gold

- Results Preview

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty: 17,173.65 | -302.00 (-1.73%)

FII Net Sold: INR 6,387.45 crore

Sensex: 57,166.74 | -1,172.19 (-2.01%)

DII Net Bought: INR 3,341.96 crore

Company News

HDFC Bank leads the way in terms of credit growth; what’s up and what do you need to know?

- India’s gold standard amongst private lenders, HDFCB has reported sector-leading credit growth of 21% YoY / 9% QoQ, primarily driven by corporate/commercial banking

- Retail credit growth on the other hand was reasonable at 15% YoY / 4% QoQ (vs peers); however, the sub-par growth (in comparison to previous years) lead to a decline in the overall book share of retail loans to 45% from 50-55%

- The Bank (via the analyst call) expects the share of retail loans to inch back up, initially led by unsecured loans as restrictions on the issuance of new Credit Cards are lifted, and subsequently through Personal Loans picking up as the covid-induced disruptions are done & dusted (🤞)

- Despite the sector-leading growth, the Bank reported a miss (vs Bloomberg consensus estimates) on PAT, which came in at INR 100 Bn, down 3% quarter on quarter (primarily due to a miss on weak margins/fees and additional provisions of INR 10 Bn)

- Asset quality trended well for the bank, with the Gross Non Performing Asset Ratio (GNPA) down 0.9% QoQ; the restructuring pool (assets that are likely to move into NPAs) was also down QoQ by INR 41 Bn (1% of loans from 1.4% of loans in Q3)

Okay! Going forward?

- The bank was able to (finally) comply with RBI directives on all things digital, now allowing HDFCB to re-accelerate retail credit growth (fresh issuance of credit cards, new digital initiatives), which coupled with strong commercial / corporate growth augurs well from a longer term perspective

- The merger with HDFC Limited creates a behemoth, with multiple key synergistic values, allowing for size/scale, and efficient balance sheet utilisation, albeit with margin dilution until the merger is completed (2-3 year timeline)

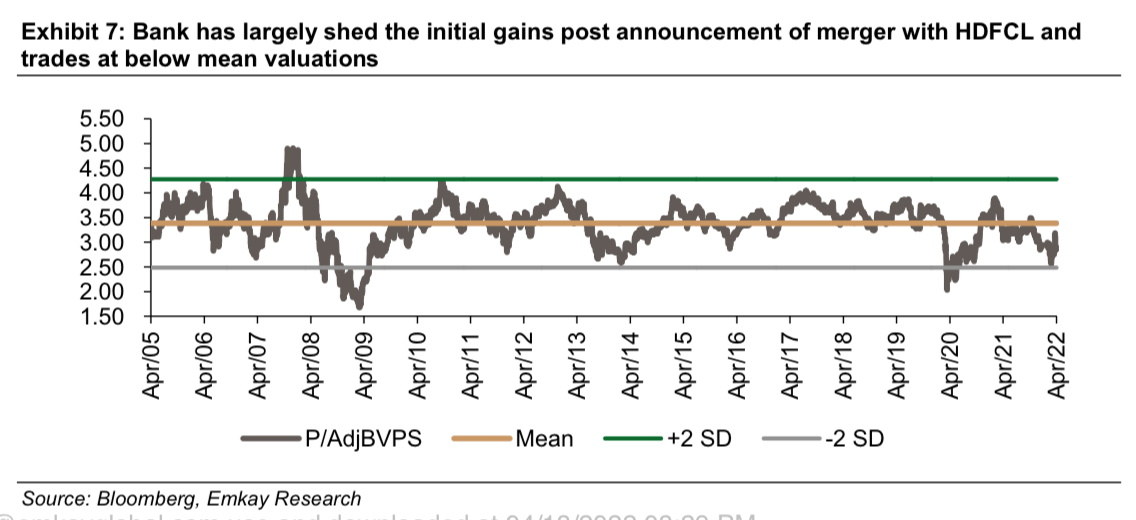

- HDFCB’s mean P / Adj Book Value (BV) valuation over the last decade + more, is ~3.5x (see image below); the stock had shed almost all the gains made post the merger, currently trades below the mean valuation

- With margins likely to be under pressure in the near term (until merger period), and a decreasing share of retail loans, the Bank’s RoAs / RoEs are expected to come under pressure for the future (which is likely impacting the stock at the moment, we believe)

- An uptick/change in stock direction will likely depend on changing retail loan growth, consistent delivery of technology upgradation, limited regulatory challenges in a merger, and delivery of core profitability

Keep a track for ICICI Bank results later this week

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- Covid got nothing on China – In spite of a raging pandemic that kept factories shut China managed to expand its gross GDP by 4.8% in the first quarter (vs expected 4.6%). The gov has a slightly ambitious target of a growth rate of 5.5% in 2022 especially since the economy is grappling with a pandemic, a war, inflation and unstable monetary policies. GDP expanded 1.3% so far this year (when compared with the Q4FY22), slowing from the 1.6% QoQ increase in the previous quarter

- NFTs are not as good as they look – Twitter founder had the honour of having his tweet-converted-to-NFT (which reads “just setting up my twttr.”) sold for a whopping $2.9 million. But the same asset now will likely be resold for $14000 – the previous owner, Sina Estavi had expected a price of $50 million and is now reconsidering the sale. The NFT market has been slowing in the recent months with global sales in March at $2.4 billion (vs $5 billion in August last year)

- Put your automobile dreams on hold – The ongoing car shortage is likely to extend into the next year as well with car prices remaining higher than normal – though they seem to easing off their record levels. The average transaction price depleted slightly in March to $43,700 but is still 26% higher than pre-pandemic levels. Depleted car lots, strong consumer demand (despite rising interest rates and strong gasoline prices) and lower factory output are not helping the situation

Global Industry News

Lithium & Cobalt are the new Silver & Gold 🤑

- Crown Jewels of the electric-vehicle business, Lithium & Cobalt are in high demand, with prices having soared >18x and >3x in the last decade itself, as the EV boom gets going

- Cobalt has roughly tripled from end 2019 to March 2022

- Nickel Sulfate is up 85% during the same period

- Lithium Carbonate is up 670% during the same period

- Car companies are trying to lock up limited supplies of raw materials like cobalt, lithium and nickel that are key to battery making, with many entering the mining business to fulfil the demand

- Rivian, a US based startup, that had a blockbuster IPO last year raising USD 12 Bn in proceeds, pushing its MCAPs higher than Ford Motor and General Motors has cut its production targets for the year in half, citing the unavailability of key raw materials

- According to the CEO, while the present semiconductor shortage has more to do with a mis-judgement of demand vs supply, the EV shortage is likely to be 10x more challenging in comparison, with the current cell production capacity representing under 10% of the world’s needs in 10 years (Woah!!)

Damn! Tell me more?

- In 2020, Tesla secured its own rights to mine Lithium in Nevada, US after a deal to buy a Lithium Mining company fell through; as recently as last week, the Tesla CEO tweeted about the sky high prices of Lithium, hinting at entering the mining & refining business at scale to maintain margins

- General Motors Co. has struck a multiyear agreement to source cobalt from commodities firm Glencore, with the automaker amongst the most aggressive in shifting its lineup to EVs, with plans to debut 30 new models by 2025 and build 1 Million EVs in North America

- The auto industry has been racing to get prices down, with recognition of high cost of ownership a key issue amongst buyers to make the switch; efforts have had varying degrees of success in the past decade (Lithium prices were down 90% at the start of the pandemic)

- The Russia – Ukraine conflict is playing its part, as Russia accounts for 5-6% of the world’s Nickel supply, and 17% of the high-purity nickel production; EV manufacturers globally have had to increase/pass on cost pressures to customers (Tesla’s Model Y is up 30%, Rivian increased prices)

- Key to a large-scale switch to EV will be a low cost option, which is directly linked to availability of battery components at reasonable prices; with 90-95% of the world’s supply chain still not created, there’s a long way to go before we see mass adoption?

What else caught our eye? 👀

Indian real estate is back on the block

- PE investment inflows into the real estate sector stood at USD 1 billion in the first three months of the year – 5x that of the previous quarter but saw a 47% dip YoY

- Most interest is in Commercial office assets that have a share of more than two-thirds with most investments being concentrated in Bengaluru

- The third wave too didn’t seem to hamper prospects, and retail consumption is on the path to rebound once the pandemic is over – increasing interest from investors globally

Zomato and Swiggy on the same team?

- UrbanPiper – a restaurant management platform – raised $24 million in a new funding round led by investors like Sequoia Capital India, Tiger Global, Swiggy and Zomato (yes, both!!)

- The main use of capital will be to scale its product and engineering teams, strengthen its platform capabilities, as well as increase services to restaurants

- The platform is live in 27000+ restaurants and processes 14 million orders monthly with the aim of onboarding 200,000 restaurant locations on the platform in the next two years

Results Preview (Nifty 200)

Tuesday, 19th April: ACC, L&T

Wednesday, 20th April: Tata Elxsi, ICICI Securities

Educational Topic of the day

Shooting Star

A Shooting Star is a single candlestick pattern that is found in an uptrend.

The candlestick can mark a top (but is often retested).

A Shooting Star is formed when the price opens higher, trades much higher, and then closes near its opening.

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com