Indian Bank Benefits From Merger With Allahabad Bank

Yesterday’s Market Performance

Nifty: 16,955.45 | +184.60 (+1.10%)

FII Net Sold: INR 827.26 crore

Sensex: 56,930.56 | +611.55 (+1.09%)

DII Net Bought: INR 1,593.41 crore

In today’s issue of the Morning Toast, we discuss:

- Indian bank benefits most from merger with Allahabad Bank

- Real Estate launch tracker

- An education concept to keep you chugging along

Indian bank benefits most from merger with Allahabad Bank; What’s up and What do you need to know? 🤑

The Finance Minister, in August 2019 announced the merger/amalgamation of 10 PSU (Banks) into 4 mega-state owned ones-

-

United Bank of India & Oriental Bank of Commerce will merge with Punjab National Bank (brand to continue)

-

Syndicate Bank will be merged with Canara Bank & Allahabad Bank with Indian Bank

- Andhra Bank & Corporation Bank will be merged with Union Bank of India

Indian Bank + Allahabad Bank

-

The key rationale for this exercise was to ensure better use of capital, and amongst all the mergers listed above, Indian bank benefitted the most (we believe) from its merger with Allahabad Bank, primarily due to the strong liability franchise it inherited (Current Account Savings Account Ratio >40%)

- Additionally, given Indian Bank’s strong technology capabilities, integration with Allahabad Bank was more seamless, when compared to other mergers (think: BoB)

Tell me more? Growth, Cost of Deposits, Margins? 🤩

-

Overall loan growth for the Bank has been subdued at 6% YoY, mainly due to a corporate drag stemming from underutilisation of capacities & deleveraging (heavy skewness towards corporate side)

-

That being said, RAM (Retail, Agri & MSME) segment growth was reasonable at 13% YoY, primarily driven by retail (14%) and Agri (16%), with the company indicating a dependence on RAM in the short-term

-

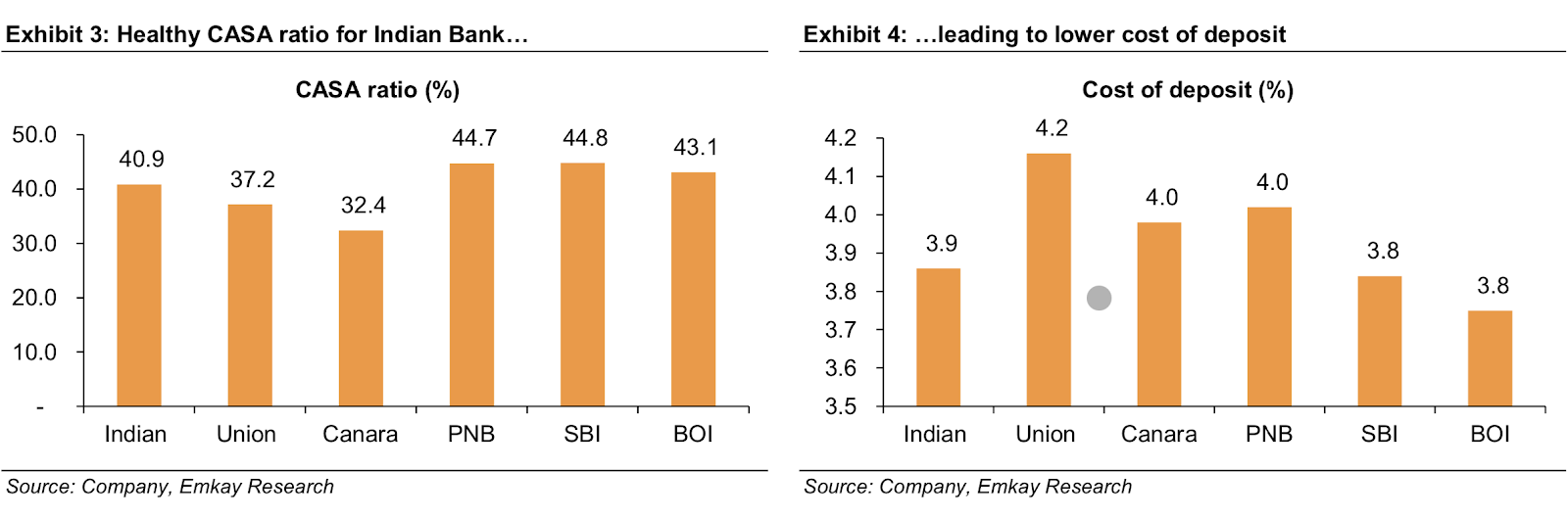

With a CASA ratio >40%, the Bank is best-in-class, when compared to Non SBI peers, significantly assisting in reducing cost of deposits (see image below)

-

Likewise, the bank maintains strong capital buffers (CET1@11.7%), and with overall NPA trends down trending (more on this below), the bank is well-placed to take advantage of an economic revival and kick-on with growth across RAM & Mid-Corporate segments

-

Asset quality is a bit of hit & miss (like all PSUs), with the bank taking on-board legacy NPAs like SREI Group (50% provision cover), while providing for incumbent loans turned sour, like Future Retail (INR 11 Bn)

-

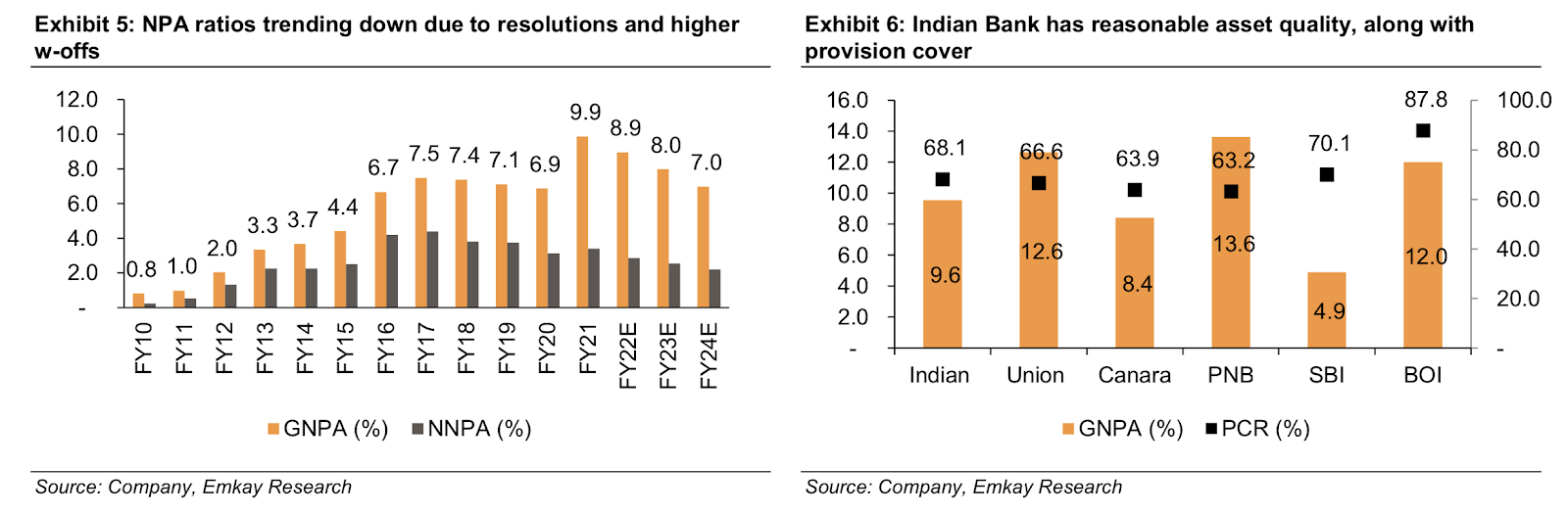

The bank expects certain lumpy resolution (including IL&FS) transfers of NPAs to NARCL (re-construction) and higher write-offs given healthy provisioning cover to keep NPAs in check (see image below)

-

~5% of the total loan book (INR 192 Bn) is in the restructured book, which is extremely high, and mostly centred around Retail & MSME, yet the management indicated they expect limited slippages, based on repayment trends and product portfolio (more geared towards mortgages)

-

Irrespective, asset quality has consistently improved, with NPAs declining to 9.6% from a peak of 12.7% (at the time of the merger)

- Amongst its peers, and especially within the Mid-Cap PSB pack, Indian bank has a strong liability franchise, seamless technology capabilities and a downward moving NPA profile

-

Additionally, given an expected uptick in Corporate Loan Book, with supply side challenges eventually abating, growth via a combination of RAM & Mid Level Corporates should hold the bank in good stead

- Absolute stock performance has suffered across all banking peers, which has affected valuations in the interim, with no meaningful change in business dynamics, the bank is poised to build on its return profile in the short-term

Keep a track?

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Real Estate launch tracker: Pune most diversified market, and larger units in greater demand; What’s up and What do you need to know? 😧

We analysed launch data across Tier 1 cities in the last 2 years, and have attempted to extrapolate findings applicable across listed players; Source: Emkay Global

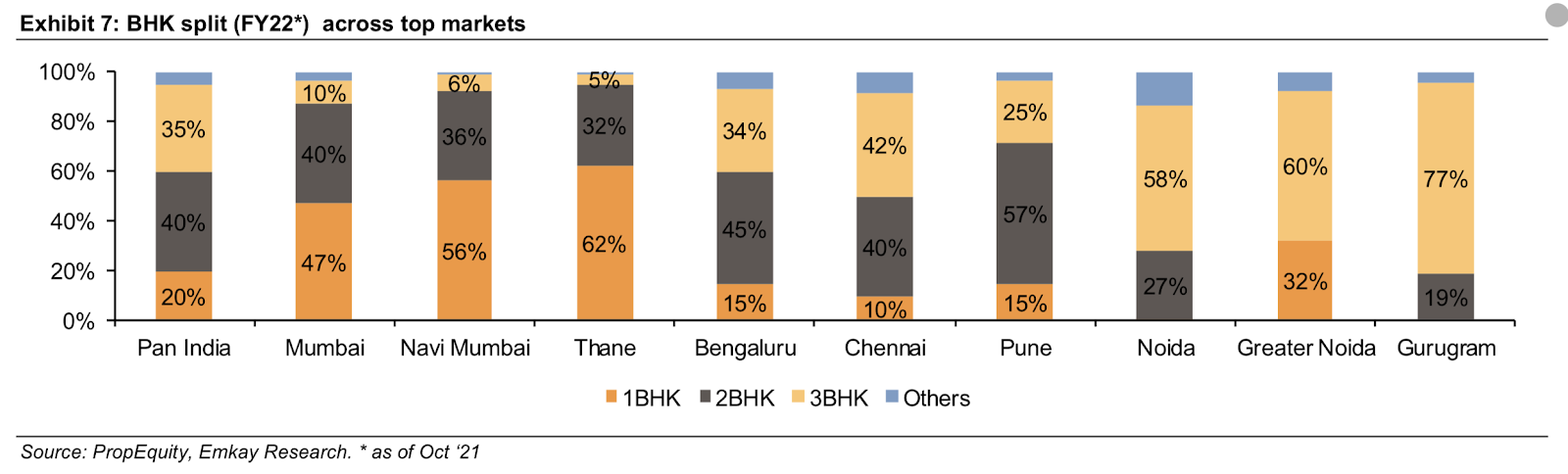

- On a Pan-India basis, share of 3BHK configuration increased to 35% vs 31% / 27% in FY21 / FY19, with Tier 1 cities recording a share of ~31%; 2BHK commands a lion’s share of 40%+ followed by 1BHK at 20% / 25% for Pan India / Tier 1 cities (see image below)

-

Key factors driving this change include increased instances of WFH / hybrid office culture, and high affordability measured in terms of EMI / household income (see image below)

-

Overall launch numbers indicate new units (annualised) are running flat YoY and down 22% when compared to FY19 numbers – NCR, Mumbai & Hyderabad have all added units, while Kolkata, Bangalore, Chennai, Thane & Navi Mumbai have registered de-growth

-

Share of listed developers is inching higher to 10% on a pan-India basis, with key markets of Bangalore, Noida & Mumbai witnessing notable increase in share of listed developers rising to 34%, 34% and 9%

Nice! Tell me more? And any stock specific information? 🙄

- Amongst tier 1 cities, Pune remains the most diversified with share of launches in Top 5 micro markets accounting for ~23% between April’21 and Oct’21; likewise, NCR continues as the market with the most concentration, with Top 5 micro markets accounting for 62% of supply

-

Notable launches during CY21 include –

-

DLF independent floor products clocking cumulative sales to launch ratio of ~90% (NCR region)

-

Godrej selling out ~85% of the launched inventory in Noida Godrej Woods

-

Macrotech clocked ~60% sales to launch in Lodha Woods (Kandivali, Mumbai)

-

Oberoi’s Elyssan is running ~45% sales to launch ratio (MMR)

-

-

Launches to track going forward, would include Prestige Estate Mulund (unlisted), which will likely set the tone for longer term acceptance in that micro market, Oberoi Thane and DLF’s central Delhi

What else caught our eye? 👀

Telecoms compensating for past behaviour

-

Airtel, Jio and Vodafone Idea all recently increased prices of prepaid plans by up to 20-25%

-

Vodafone has introduced four new prepaid plans (for Rs 155, Rs 239, Rs 666 and Rs 699) while Airtel has come up with one (Rs. 666)

-

Market Leader Jio gained 17.6 lakh, new subscribers, in October while its two rivals lost a cumulative 14.5 lakhs

New king in the Indian Entertainment space

-

Sony Pictures Networks India (SPNI) will own 51% of one of the most awaited mergers of the year between Sony and Zee

-

The new entity will consist of 75 television channels, numerous film assets and two streaming platforms

-

Zee’s regional reach coupled with Sony’s global presence is said to increase the competition in this space manifold and form the country’s second largest entertainment network

Adani and his new airports

-

Adani might raise ~ $1 billion through a bond sale in January to refinance debt of Mumbai’s international airport

-

Control of the same was given in July after buying out 50.5% from GVK Airport Developers Ltd. and 23.5% from two South African companies.

-

Adani Airports will currently operate, manage and develop eight airports in India

Coffe can investing

Coffee Can Investing approach refers to “buy and forget” to investing in shares of companies which have performed well consistently.

Such investment in shares creates a “Coffee Can Portfolio.” Those who invest in such shares build a diverse portfolio of consistently performing companies, buy their stocks, and hold them for at least 10 years.