ICICI Bank Doubles Down On Tech, Spends 8.4% in 9MFY22

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss:

- ICICI Bank once again reports healthy core profitability

- Indian Cinemas finally get happy ending

- News around the World

- And educational concept to keep you learning everyday 🙂

Market Watch

Nifty: 17,149.10 | -468.05 (-2.66%)

FII Net Sold: INR 3,751.58 crore

Sensex: 57,491.51 | -1,545.67 (-2.62%)

DII Net Bought: INR 74.88 crore

Company News

ICICI Bank once again reports healthy core profitability; What’s up and What do you need to know? 💪

Credit Highlights

- The bank reported strong overall credit growth for the quarter, up 16% YoY / 6% QoQ mainly led by

- Healthy retail growth during the festive season (up 19% YoY / 5% QoQ)

- Small & Medium Enterprises / Business Banking and a

- Sharp uptick in the domestic corporate book (12.5% YoY / 11% QoQ) toward better rated corporates

- Retail growth for the bank was led by mortgages, cards / Personal Loans, and pick-up in Vehicle Financing (ex-commercial vehicles); market share for the bank has continuously improved, over the last couple of quarters, and now stands at 18% in CIF / 21% in spends, leading to strong fees in Q3

- Healthy credit growth, along with higher retail / SME / BB growth and re-pricing of mortgage portfolios when the interest rate cycle reverses, should hold the book in good stead and help sustain margins

Asset Quality Highlights

- Gross slippages were down QoQ to INR 40 Bn, while recovering were equally strong at INR 42 Bn, leading to net negative slippages (think about that); higher write-offs led to a 69bps QoQ reduction in the GNPA ratio

- The restructuring pool remained largely flat at 1.2% of loans, of which 95% of the secured and well-provided for, thus offering strong comfort to the bank in case of surprises

- The COVID led buffer for the bank stands at 0.8% of the overall loans, which is also an industry best

Interesting! Tell me more? 🤔

- The Bank once again reported healthy core profitability (up 25% YoY) on the back of strong credit growth (+16% YoY), robust margins (~4%) and higher fees collection (up 19% YoY), and coupled with lower provisions led a strong PAT of > INR 59 Bn

- The bank for the first time disclosed tech spending, which stood at ~8.4% of operating expenses vs 4-7% for industry peers, given the groups aim to transform the Bank into a ‘Super BankTech’

- In terms of competition, ICICI Bank’s PCR (Provision Coverage Ratio) is amongst best in class at ~80% of NPAs, while their restructure pool (~1.2% of loans) is lower than HDFC Banks (1.4% of loans), having stood the test of multiple quarters

Nice! Final thoughts? Stock performance, valuations et al.? 🤓

- ICICI Bank has outperformed its peers in terms of credit growth, mainly led by SME / BB, with an added pinch like once corporate credit accelerates; this coupled with strong traction in fees and increasing digitisation of services will likely lead to improved operational efficiencies, driving up core profitabilities

- Asset quality continues to improve at a fast pace, while the reversal of COVID provision buffer will likely lead to strong RoEs in the future (we believe)

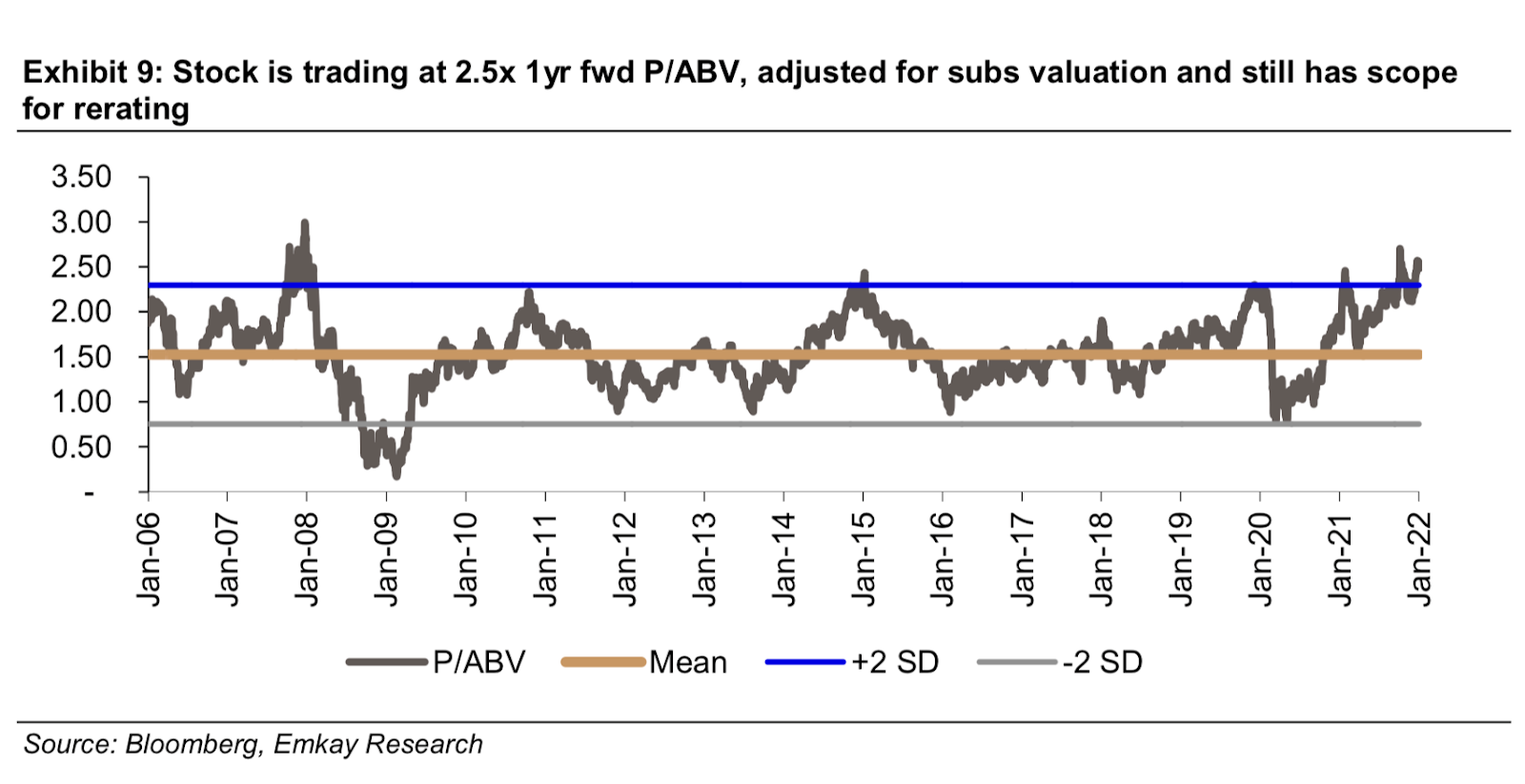

- The stock currently trades at 2.5x 1 Yr FWD P / ABV (see image below), which leaves plenty of scope for expansion, taking into consideration consistent asset quality improvement and strong credit growth

- Investors though didn’t appreciate the numbers, with the stock down ~2% during trading, but we wouldn’t read too much into that, with headline indices down >2% in major sell-offs

Keep a track?

Around the World 🌍

The NASDAQ is down almost 12% so far this year with most indices wrapping up their worst week since March 2020; what happens next?

- Amid speculations of a tightening of the monetary policy, investors are counting on the stalwarts to be the knight in shining armor! Apple is expected to post its highest-ever quarterly sales of $118.74 bn with Microsoft following close behind at a record-breaking $50 bn in quarterly sales. Tesla too is expected to set records with a quarterly profit of $2.33 billion on revenue of $16.99 billion. This week marks the start of the results calendar for Big Tech, with the likes of Apple, Tesla, Microsoft and others all expected to drop numbers

- $BTC seems to be shadowing the stock market with a fall to below $35000 on Saturday (albeit it did recover slightly on Sunday). Investors can see a clear correlation with the stock market and the once ‘isolated risk’ asset now responding to global policy changes – what remains to be seen is how a series of expected Federal Reserve interest-rate increases will ripple through markets

- An expectation of a faster-rate increase has also driven up inflation-linked bond yields with the benchmark 10-year Treasury note falling to 1.747% Friday. The overall verdict is that the risk premium for equities needs to go up – what seems to be working is only the quality stocks

Industry News

Indian Cinemas finally get happy ending?; What’s up and What do you need to know? 🎞

Industry Overview

- The relatively mild Covid19 third wave coupled with a healthy vaccination pace provided much-needed respite to theatres who saw fewer and not as severe lockdowns

- Things look good with theatres having a strong content line up across languages, and the industry seeing a waning of the OTT addiction

- That being said, the pandemic is not behind us yet; Add to that rent inflation and lack of quality content and the top cinema houses could find themselves in a soup

So how did the big players do? 🤔

- PVR in Q3 reported better than expected revenues of Rs. 6.1bn leading to a recovery rate of 99-112% during Dec’21(headcount less by 28% than the pre covid era)

- A strong ATP (Average Ticket Price) and SPH (Spending Per Head on F&B) of Rs. 239 and Rs. 129 (up by 14%, 28% YoY) proved the robust growth

- The recovery also put an end to the cash burn after six successive quarters with a reduction in debt to Rs. 8.6bn (vs Rs.9.1 bn in Q2)

Tell us more! 🤨

- These numbers only show the strength of quality content given that most states had a 50% occupancy caveat on theatres

- The average rental discount stood at 21% in Q3, and 5% when fully operational; total available liquidity also increased to Rs. 7.4bn (Rs. 7.1bn in Q2)

- The stocks (current trades at 2YR FWD 8x EV / EBITDA) recorded an absolute return of 21% in the last month, with industry tailwinds, strong content line-up and limited genuine out of home entertainment options likely to positively push the stock further (we believe)

Okay! And Inox? 😏

- Inox meanwhile reported a revenue of Rs. 3bn in Q3 (higher than expected) but fell short in translating that into EBITDA due to high operational costs

- ATP was up by 11% (to Rs. 226) while SPH followed close behind with a 20% increase (to Rs.97) compared to Q3FY20 with footfalls at 56% of the same time

- Inox has YTD opened 24 new screens with a plan of adding 17 more by the end of the year incurring a Capex of Rs.100mn

Anything else? 🧐

- All things positive as Ad revenue for Inox also recovered and stood at Rs. 200mn, F&B margins were also strong at 78.2%

- It has a strong war chest of Rs. 1.8bn which would help it battle any further virus disruptions

- The stock, in comparison to PVR, is up ~6% in the last one month, and trades along similar valuations (albeit on a smaller scale)

Keep a track?

What else caught our eye?

AMZN to the rescue but who asked for help?

- Amazon has offered to bail out the debt-ridden Future Group by responding to a plea by Future Retail Ltd management for emergency funding of ₹3,500 crore by Monday

- But there are no free lunches in the world as it has asked that its Rs. 24713 Crore deal with Reliance be called off in return

- Future Group owes about Rs. 2.5bn to a pool of ~20 creditors and can face bankruptcy if it does not service its debts by the end of the month

Zomato, Paytm riding the wrong wave

- New age stocks like Zomato and Paytm have hit their lowest since listing as they slipped 18% and 4% respectively early on Monday

- Zomato may be up more than 30% from its IPO issue price of ₹76 but Paytm is far behind down over 57% from its issue price of ₹2,150

- The sell-off in tech stocks around the world has been brutal with non-profitable stocks taking a massive hit – effect percolating to the Indian markets too

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Results Preview

Tuesday, 25th January: APL Apollo Tubes, Can Fin Homes, Cipla, Finolex Industries, Indiabulls Real Estate, Maruti Suzuki, United Spirits, Pidilite Industries, SRF, Symphony Torrent Pharma, Teamlease Services, Star Cement, Macrotech Developer

Educational Topic of the day

Gap and Go Trading Strategy

If the gap opens higher than the previous day, then it is called the gap up, and if it opens lower than the previous day, then it is called gap down. Such situations occur when news acts as a catalyst.

Intraday traders look for such stocks and bet on them, believing the gaps will close by the end of the day. This strategy is great for one who wants short and quick profits but not much risk.