History Repeating Itself in Nifty50?!

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss:

- JK Cement forays into paint business

- PVR in talks to acquire Cinepolis

- History repeating itself in Nifty 50?!

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty: 15,863.15 | -382.20 (-2.35%)

FII Net Sold: INR 7,482.08 crore

Sensex: 52,842.75 | -1,491.06 (-2.74%)

DII Net Bought: INR 5,331.03 crore

Development👨💻

JK Cement forays into paint business

What’s up?

- JK Cement’s (Ticker: JKCE) board has approved the company’s entry into the paints business through a wholly-owned subsidiary (WOS), which is expected to undertake manufacturing, selling, trading, importing & exporting and other dealing in all types of paints & allied products and services

- The board has approved an investment of ~INR 6 Bn over a period of 5 years, with primary capital expenditure expected around setting-up manufacturing & distribution, targeting revenues of INR 8.5 Bn during that period

- JK Cement is likely expected to leverage its wall putty business distribution network, which is 67,000+ dealers and retailers strong (for marketing white cement & value-added products)

Tell me more?

- Indian Paint Industry is pegged at INR 600 Bn in size, and has recorded low double-digit growth in the recent past; the top 3 players control ~70% of revenues, while recording ~15-20% EBITDA % and a pre-tax RoCE of 30% (on average)

- It is estimated, for listed paint companies, every 1% revenue market share, amounts to an equity valuation of INR 40-50 Bn

- That being said JKCE targets (INR 8.5 Bn in 5 years) are optimistic, which includes land acquisition, setting up manufacturing facilities, the establishment of a management team, creation of strong brand equity and investment in tinting machines

- Taking above calculations into perspective, and assuming perfect execution scenario, JKCE has potential to add ~5% to its MCAP at the end of this period)

And core business? What’s happening there?

- JKCE’s strengths lie in the North & Central regions (will likely be their focus for the paints business as well); the company commissioned a 4MT grey cement Panna project (greenfield) in MP, which is expected to be completed by March’23

- Likewise, the company’s grinding unit at Hamirpur is progressing, with foundation work completed, and silo construction ongoing

PVR in talks to acquire Cinepolis

What’s up?

- India’s largest multiplex chain, PVR and the local unit of the Mexican Company Cinepolis are in advanced merger talks, potentially reshaping the country’s film exhibition industry

- The first phase of consolidation in India’s film exhibition industry began in the new millennium, when a large number of single screen facilities failed to match up to the well-capitalised multiplex screens, resulting in either closure or acquisition

- Assuming this merger goes through, India’s landscape will be dominated by one large player (PVR + Cinepolis) and INOX Cinemas (which will have half the number of screens in comparison)

Deets 🕵️

- PVR current operates ~846 screens in 176 cinemas across 71 cities in India & Sri Lanka, with an aggregate seating capacity of ~182,000; in comparison Cinepolis operates 417 screens in 93 properties, across 22 states

- The merger entity will operate 1,263 screens, across 269 locations (rough estimates, with some likely to close due to close anti-competitive nature); in comparison, INOX Leisure operates 160 multiplexes, and 675 screens across 72 cities

- With finer details still to become public, according to public chatter, Cinepolis is expected to become the largest shareholder (~20%) in the merger entity, while PVR promoters are expected to own b/w 10-14%, while maintaining complete management control for a short-term period (~3 years)

- The merger is expected to go through, without the scrutiny of the OG watchdog, Competition Commission of India (CCI), as combined revenues as pegged to be <INR 1000 crore, on account of pandemic de-growth (silver lining 😝)

And?

- The industry has a history of inorganic growth examples –

- PVR has in the past acquired Cinemax (138 screens) in 2012, DT Cinemas (32 screens) in 2016, and SPI Cinemas (76 screens) in 2018

- Cinepolis acquired Fun Cinemas (83 screens) from Essel Group in 2015

- INOX Leisure acquired CCPL (89 cinemas) in 2007, Fame Cinemas (94 screens) in 2010 and Satyam Cinemas in 2014

- The entertainment industry has suffered the most during the pandemic years, yet with limited genuine out-of-home recreation options, longer-term view for the industry is still intact

- With this consolidation, and subsequent scale, PVR will become the undisputed leader in the space, resulting in increased power across the spectrum (distributors, producers, consumers)

Around the World 🌎

Collateral damage from the conflict continues! What happened and what’s next!

- Oil prices soared after the threat of a potential ban on Russian oil hit the news causing US stock futures and global indices to take a major tumble. Japan’s Nikkei 225 shed > 3% and Hong Kong’s Hang Seng Index fell 3.4%. Prices meanwhile in the US topped $110 a barrel for the first time in a decade, even reaching $130 in off-hours trading following fresh attacks, and mounting civilian casualties

- Post being cut off from the global financial system (Visa and Mastercard have suspended operations in the country and account for 74% of transactions), Russian banks are looking to China’s state-owned UnionPay system which is accepted in 180-200 countries worldwide. This also has some political implications as Beijing officials have previously opposed the sanctions by the West and may signal increased cooperation between the two nations

- Investors meanwhile are also betting on the war coming to an end soon by buying Russia and Ukraine bonds which have plummeted to heavy discount prices. It is undeniable that the trade is highly risky due to the uncertainty about the condition of Ukraine post the war as well as the reputational dangers of being associated with Russia in any way

Technical Set-Up Deep Dive🤿

History repeating itself in Nifty 50?!

Agenda:

- In technical analysis, it’s believed that history tends to repeat itself; this repetitive nature of price movements is often attributed to market psychology, which tends to be very predictable based on emotions

- Nifty50 is the same, moving in similar patterns

Observation 1:

- The fourth quarter (Jan-Mar) is a period during which the index usually tops out

- This pattern has formed 6 times since 2007 – once every 2-3 years (see image below)

Observation 2:

- Looking at the chart closely, you’ll understand that a breakdown of the previous low followed by the 4th quarter (Jan-Mar) has resulted in a decent correction (see image below)

- 4 out of the 5 times, the headline index has shown weakness once it’s given a breakdown below the previous swing low (on a monthly chart)

- Recently, the Index has breached the last swing low

Observation 3:

- Index has been moving in a cyclical trend; Prices consolidate, leading to a rise, peppered with (timely) healthy corrections once in while (fall)

- This has been typical of Nifty50 in the recent past (sadly 🤦🏼♂️)

Observation 4:

- Post the huge correction during the 2008 crash, Nifty experienced a strong rally for 2 years (24 months) post

- A similar scenario is unfolding this year; post covid, markets have rallied for 2 years and have now started showing weakness (as discussed earlier)

Observation 5:

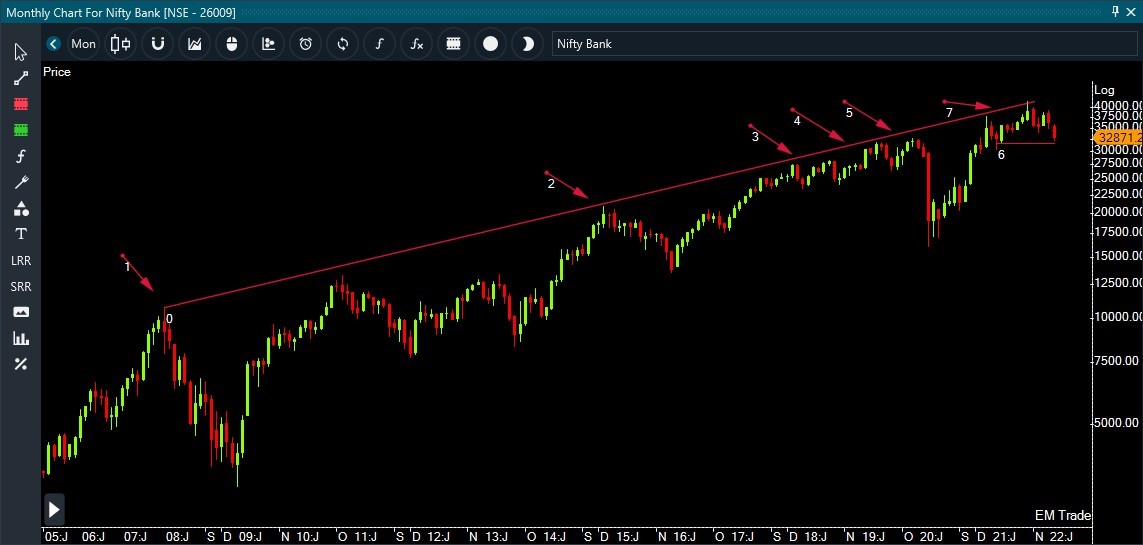

- Nifty Bank and Nifty50 are closely intertwined, with one affecting the other

- Analysis Nifty Bank (monthly time-frame) prices face a resistance along a rising trendline (7-8 times)

- Correction might become steeper if prices break below 34,500 on closing basis (weekly)

Observation 6:

- Historical data shows that ~8 out of 10 times, the markets see a rise in prices in the month of December

- Likewise, 6 out of 10 times, March is the month where prices cor

Conclusion:

- Breakdown of the earlier swing low, correction in the 4th quarter, preceded by a 2-year bull run, history suggests that Nifty50 undergoes a correction for a few months (86% probability)

- Nifty 50 trading in cyclic trends increases the chances of steady correction in the near term and Bank Nifty’s 34,500 level (closing on weekly basis) can be the make or break level for both the indices

What else caught our eye?👀

Cred surpassing all expectations

- CRED has projected an operating revenue of Rs. 108 Cr in FY21 (from Rs. 52 lakhs in FY20) i.e 170X increase in a single year

- This comes after it introduced many new revenue verticals like its e-commerce platform, P2P lending, and house rental payments.

- CRED’s annual losses are not behind and have grown by 45.1% to Rs 523.85 crore during FY21 (Rs 361.1 crore in FY20)

Indian markets not sheltered from war

- FII participation in India’s largest IPO could be dampened after strict sanctions on Russia have been imposed including its exclusion from the SWIFT platform

- Investors across the globe are not being able to liquidate their Russian assets and invest them in securities like LIC

- The GoI is analyzing the effect of increasing oil prices and overall inflation as well as the pitfalls of delay and losing momentum with investors and is yet to make a final call on the timing

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Educational Topic of the day

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a popular momentum indicator. Also an oscillator, the RSI acts as a metric for price changes and the speed at which they change. The indicator fluctuates back and forth between zero and 100. Signals can be spotted by traders and analysts if they look for divergences, failed swings of the oscillator, and when the indicator crosses over the centerline.