Hindalco Primed For Breakout? 🚀

Yesterday’s Market Performance

Nifty: 17,625.70 | +271.65 (+1.57%)

FII Net Sold: INR 902.64 crore

Sensex: 59,183.22 | +929.40 (+1.60%)

DII Net Bought: INR 803.11 crore

In today’s issue of the Morning Toast, we discuss:

- Hindalco primed for breakout?

- India’s Current Account needs some aid;

- An education concept to keep you chugging along

![]()

Hindalco primed for breakout?

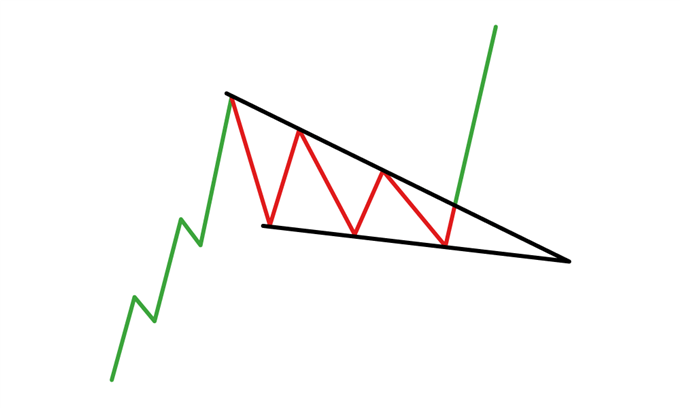

- Analysing Hindalco on a weekly time-frame, indicates that the stock had been in a good upward momentum in the last 5-6 weeks (see image below)

-

This up move in prices took place due to the breakout above the falling wedge, which is a positive sign

-

The overall structure of the chart is bullish as prices have been making continuous higher highs and higher lows as shown in the image

Awesome! Tell me more? Any other tools? 🙄

- Looking at the chart on a daily time frame, prices have been facing stiff resistance around 464 – 473, ending up being pushed down (see image below)

-

Prices have been taking support along a rising trendline making an ascending triangle pattern; and giving a closing above the resistance level (which can be termed as a breakout)

-

The breakout above the ascending triangle pattern might lead to prices breaking upcoming resistance levels (though retesting that level is key to avoid traps)

That’s Great! How do I enter / exit such a setup? 🤩

- You should wait for prices to retest the resistance band (464-473), and going long post-breakout would make the most sense; stop-loss can be placed just below the lower end of the resistance band, which will help limit your losses.

Interesting! Final thoughts? ☺

- On a weekly time-frame, a breakout above the falling wedge shows a positive bias

- On a daily time frame, a breakout above the ascending triangle pattern adds strength

Keep a track?

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

- The current account reverted to a deficit of USD 9.6bn (1.3% of GDP) in Q2FY22 as against a surplus of USD6.5bn (0.9% of GDP) in Q1FY22

-

Main reasons include widening of merchandise trade deficit (i.e import > export of goods) due to demand normalization

-

Imports rose 16.5% QoQ to USD149.3bn, with exports rising a mere 7.6% QoQ to USD105bn in Q2FY22

Jargon alert! Make things simple, please! 🙄

- The Current Account is the sum of 3 major components: net exports (also called the trade balance for goods and services) + net income (mostly from foreign countries) + net transfers (mostly government transfers)

-

For the last quarter, net export of services remained healthy due to computer & business services sector

-

Both net transfers (at USD 18.9bn) and net income (at USD 10.4 bn) remained steady

Okay, tell us more! 🧐

- The Balance of Payments (BoP) consists of the Current Account (above) and Capital Account which includes foreign investments (FDI, FPI etc), borrowings and other financial flows

-

The capital account also saw a significant gain in Q2FY22 (USD40bn) from Q1FY22 (USD25.8bn) due to USD17.9bn of SDR allocation from IMF (to provide liquidity and supplement our foreign reserves)

-

Overall, the BoP surplus was steady at USD 31.2 bn (USD31.9bn prior) with both FDI (at USD 9.5 billion) and FPI flows (at USD 3.9 billion) at a moderate level albeit much lower than last year

- Omicron and supply chain constraints could slow the global recovery on the back of a steady vaccination progress

-

The FPIs may also demand a higher return from Emerging Markets (like ours) owing to these factors and the Fed tightening financial conditions, which could directly impact flows into the markets (remember that thing called liquidity rally :P)

-

Current Account Deficit is expected to be around 1.7% of GDP in FY22 compared to 0.9% in FY21 due to the increasing rate of imports

-

Capital flows may provide relief to the BoP led by the LIC IPO, bond-index inclusion-related flows, and a healthy FDI pipeline (all news to be watched out for!)

What else caught our eye? 👀

Future wants to get the HC on its side

- The infamous dispute between Amazon and Future Retail over a 2019 deal is being heard by a Singapore arbitration panel

- Future has now filed at the Delhi HC that the arbitration process is a ‘perpetuation of illegality’ since the CCI has stated that the deal has ‘no legal existence’ in India

- The Singapore Panel did not agree to terminate the proceedings and hence the move by Future (Both sides have been enforcing Indian laws to overrule decisions taken by the said arbitrator)

GST revenues bring in some good news

- GST collection stood at ₹1,29,780 crore (12.7% higher Y-o-Y) and slightly less than the preceeding two months at Rs. 1.3 lakh crore

- It is also 25.8% higher than December 2019 (a pre-Covid period) and indicates not only recovery but also robust growth of business activities

- Services had an increased contribution last month, and unless the new variant plays spoilsport, and upward trend is expected (acc to the Fin Min)

NTPC planning some moves

- NTPC Ltd. is planning to acquire a 5% stake in Power Exchange of India Ltd (PXIL) – India’s first institutionally promoted power exchange

- As a part of the National Electricity Policy (NEP) the GoI might expand the share of the spot power market in total electricity supply to 25% by 2023-24.

- A >5% stake would not be possible as the NTPC could also be a buyer/seller on the platform

![]()

Falling Wedge

The Falling Wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. This price action forms a cone that slopes down as the reaction highs and reaction lows converge.