HDFCB + Federal Bank Guides For Strong Credit Growth

Good Morning Toasters!

Hii friends!! Hope it was a good start to the week. A key metric turned to green, for the first time in probably forever. FIIs ended the day buying more than selling, albeit with low volumes. Let’s hope this continues, with a DII + FII contribution key to a sustainable rally.

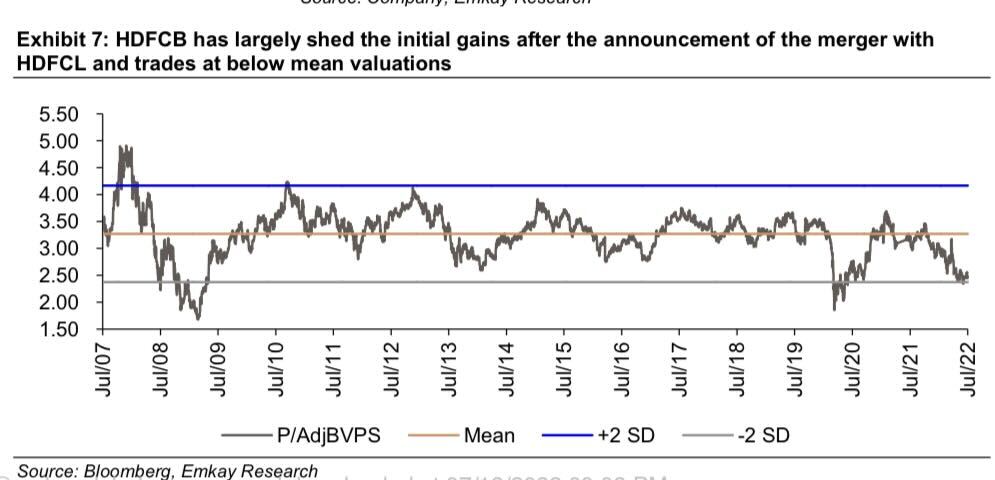

In today’s issue, we cover twin results of HDFCB & Federal Bank, as they record strong credit growth. Both have forecasted for continued strong credit growth, within the Retail segments. HDFC Bank has pretty much given up all the gains made post the merger announcement, and currently trades below its 15 year mean valuation.

The Department of Telecom released details on Earnest Money Deposits (EMDs) submitted by Telcos in preparation for the auction at the end of the month. Airtel had dipped 5% on news of an Adani entry into the space, and yet their EMD deposits tell an entirely different story.

And finally, we’ve started a rollout of our newest product, Trade:able, that aims to democratise trading, via a unique and fun learning experience. There are a bunch of amazing rewards and prizes to win. Click here to know more.

Market Watch

Nifty 50: 16,278.50 | +229.30 (+1.43%)

FII Net Bought: INR 156.08 crore

Sensex: 54,521.15 | +760.37 (+1.41%)

DII Net Bought: INR 844.33 crore

Banking News

HDFCB and Federal Bank record strong credit growth; what’s up and what do you need to know?

HDFC Bank

- India’s OG Bank (sorry RBI) recorded strong credit growth, led by retail (up 22% YoY / 4% QoQ), with the mortgage, personal loans, and payment products all recording >20% growth during the quarter

- In contrast, the corporate segment continued to struggle, with the bank recorded de-growth on a quarter over quarter basis, with the bank indicating a more opportunistic approach towards large, chunky loans, with retail outpacing corporate in the long run and retail as a proportion of total loans veering towards 50-55% range (current at 46%)

- On the asset quality front, the Bank recorded elevated stress in Agri Segment (seasonality playing), and Corporate (more systemic), while the restructuring pool reduced from 1% to 0.8% of total loans as the Bank continued recognising/recovering overdue amounts

- The bank provided clarity on its proposed merger with HDFC Limited, indicating that while in-principle approval from the RBI has been received, granular details pertaining to regulatory reporting, stakes/subsidisation of HDFC Life & NBFCs are still awaited

Federal Bank

- Like HDFCB, Federal reported a strong credit growth, recording 17% YoY / 5% QoQ growth, led by traction in corporate, Agri and business banking segments; within retail, the bank continued its focus on mortgages, growing at a healthy pace, and with scope for further acceleration

- The bank continued its uptick in deposits, albeit at a slower pace (Year on Year comparison), nonetheless touching a lifetime high CASA (Current Account Savings Account) ratio of 37%, helping in the Bank’s margin profile

- In contrast to HDFCB, the restructured pool stood at 2.2% of the total loan book, improving and yet elevated in comparison to Tier 1 Banks, with Federal Management expecting ~INR 11 Bn of loans to exit moratorium in FY23, significantly reducing the overall restructured pool

- The bank recorded higher slippages in Retail due to relapses from the restructured pool, which was partly offset by the lower than expected Agri slippages

Interesting! Any view on valuations/stock performance, and future expectations?

- Both banks have via their commentary (during earnings calls) guided for strong credit growth to continue going forward, with retail a key area of focus for HDFC (explained above) as well as Federal, who will look to accelerate their mortgage portfolio, while also buildout other retail products including MFI, CV / CE and Cards (unsecured)

- HDFC Bank has largely shed all the gains made post its merger announcement, and now trades at below mean valuations (see image below), while Federal currently trades at 1.1x one year forward P / Adjusted Book value OR mean valuation (last 14 years)

- Both banks (albeit at different levels) are expected to deliver rising exit RoA (Return on Assets) in the near term, via an improved product mix, increasing CASA % and reduced slippages (we believe)

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- GSK takes a new path – The greater focus will be given to innovative drugs and vaccines in the spinoff of the consumer-healthcare business of GSK PLC. With a market value of $36.4 billion, the new stand-alone company Haleon PLC will give it more financial firepower for deal-making

- Everyone wants the dough – PE firms are going through an intense battle to raise money with a collective target of $1 trillion in the capital, a 60% increase over the beginning of 2021. Many clients have opted to invest part of their 2023 budget this year to secure a place in the more coveted funds

- Stellantis gives up on China – In a strategic reversal, Stellantis NV is ending the JV that makes and distributes its Jeep brand in China with an alternative plan on selling imported Jeep vehicles into the world’s biggest auto market. Its presence in China was also being opposed by Germany’s influential metal worker trade union

Industry News

Jio goes all out in preparing for the 5G bid, with Adani just about participating; what’s up and what do you need to know?

- Background I: department of telecom invited tenders/expressions of interest from Telco majors to participate in the 5G+ more auction planned for the end of the month, with companies required to submit Earnest Money Deposits to indicate their level of interest

- Background II: Adani caused a bit of a stir, as the conglomerate submitted its interest, which lead to market participants bracing themselves for another round of capital destruction, as Airtel dipped by 5%

- Cut to this week, the Department of Telecom released details pertaining to the Earnest Money Deposits (EMDs) submitted by Telco majors, with business as usual resuming, as Jio for the 5th auction in a row submitted the highest EMD amongst all the operators, earmarking INR 140 Bn for the auction

- In contrast, Bharti was a distant second, submitting EMD worth INR 55 Bn, followed by Vi, who deposited only INR 22 Bn, given their precarious financial condition, while the much talked about Adani Networks deposited only INR 1 Bn, indicative of their plans to be a very marginal buyer of spectrum

Interesting! Share more details?

- Historical precedence suggests that telcos end up bidding ~5-8x the amount deposited as EMD, with the highest multiplier in 2010, when operators had bid ~11-15x the EMD amount in acquiring spectrum space, pointing towards gains of ~INR 1,090 – 1,744 Bn for the government from the planned auction

- From a stock perspective, given the high amount deposited by Jio, and assuming a ~5-8x bid, Jio will likely spend INR 850 – 1000 Bn in acquisition spectrum across 100, 800, and 10 Mhz at a pan-India level

- In contrast, and given the much smaller EMD submission, Airtel will likely bid for 800 and 80 Mhz, with an outlay of INR 310 Bn on new frequencies, far lesser when compared to Jio

- On the face of it, and given a very low EMD submission, Adani seems likely to only bid for spectrum in its geographical circles, while the super high # deposited by Jio should result in aggressive bidding and acquisition of majority spectrum put for sale (would you have it any other way?)

- This should put to rest any ensuing rumours of entry of another behemoth into the telco space, with Airtel continuing as a price maker, as Jio rekindles its aggressive spirit

What else caught our eye? 👀

Tata Steel bullish on itself

- CapEx worth ₹12,000 crores (₹8,500 crores in India and ₹3,500 crores in Europe) has been planned for the current financial year

- Europe will be focused on sustenance, product mix enrichment and environment-related Capex, while the focus will be on the Kalinganagar project expansion and mining activity in India

- Additionally, it will be spending about ₹12,000 crores on inorganic growth in India in the NINL acquisition

Ola in it for the long haul

- OG Aggarwal has announced an investment of $500 million for setting up one of the world’s largest Battery Innovation Center (BIC) in Bengaluru

- With a talent pool of 500 engineers and PhDs and 165 ‘unique and cutting-edge’ lab equipment, the project is expected to be running by the next month

- The aim is to scale and innovate faster to build advanced and affordable EV products in record time

Results Preview:

Tuesday, 19th July: Ambuja Cements, HUL, L&T Finance Holdings, AU Small Finance Bank, ICICI Lombard, HDFC Life, Polycab

Wednesday, 20th July: Havells, IndusInd Bank, OFSS, Tata Communications, Wipro, Syngene International, Gland Pharma

Bold are from Nifty200 Universe

Educational Topic of the day

Bottom Fishing

Bottom fishing is a short-term price action strategy where the investor buys securities that have observed a sudden fall in their prices over a very short period with or without any big fundamental change in the prospects of the company.

Bottom fishing can be an attractive investment strategy. However, it can be a risky approach even for seasoned investors.

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com