Go-Colours IPO: The ‘Go-To-Brand’ In Women’s Bottom-Wear

Yesterday’s Market Performance

Nifty: 17,898.65 I -100.55 (-0.56%)

FII Buy Sold: INR 344.35 Cr

Sensex: 60,008.33 I -314.04 (-0.52%)

DII Buy Sold: INR 61.14 Cr

Howdy Toasters!

In today’s issue of the Morning Toast, we discuss:

- Go-Colours offers a healthy multi-year growth opportunity

- Bharat Forge doubles down on global demand

- An education concept to keep you chugging along

![]()

Go-Colours offers a healthy multi-year growth opportunity 📉🐱🏍

Business overview

- A leader in the Indian women’s bottom wear space (Industry size of INR 135 Bn out of the overall women-wear size of INR 1,633 Bn), Go-Colours offers multiple category led-tailwinds

- The company has delivered a Revenue CAGR of 40%+ over FY18-20, vs a 9.4% growth for the overall women wear industry (over FY15-20) led primarily by network expansion, attractive product positioning & improving brand profile in Tier 2/3/4 cities

- Leveraging a strong supply chain, the company has positioned itself as all things women bottom wear, with an assortment across western + ethnic, through 700+ SKUs across 50 products in 120+ colors, at attractive pricing (ASP ~600)

- The company has an Exclusive Branded Outlet (EBO) presence in ~115 cities, coupled with the LFS model, Go-Colour products reach ~500 cities, with a greater concentration around West & South India

Unit Economics, Business Mix, Product Profile, Financials

-

Go-Colours has an impressive 2x Rev / Sqft in comparison to peers (INR 18k vs INR 8-10k for players like ABFRL/TCNS/V-Mart) led by a stacked SKU display vs hanging for peers, leading to higher sellable inventory

-

The company has consistently recorded a 30% EBITDA margin at a store level, led primarily by a two-pronged approach – a cluster-based expansion model & smaller store sizes that minimize initial outlay

-

The company has outsourced manufacturing functions, with a robust supply chain through an in-house design team and raw material suppliers, enabling a quick 6-month concept to shelf life-cycle

-

The bottom wear category has low obsolescence risk, with high repeat purchase, fast-moving SKUs (set of 3s / 2s), and very low inventory risk, thus making for a sweet scenario

Interesting! Going forward? What are the next steps for the company? 🙄

- Go-Colours has been aggressively adding 100-150 stores on a gross basis, yet the store network (~450 EBOs) is heavily skewed towards South/West India, with the Top 8 cities contribution far higher in comparison to peers (60-70% vs 50-55% for the industry)

-

Similarly, the total number of EBOs, when compared to industry-leading players like Page, ABFRL, TCNS (~450 vs 3000), and total number of cities (115 vs ~300 odd for competition) leaves ample room for the company to expand

-

The company has a high working capital requirement (160-170 odd days) vs industry duration of ~100 days, leaving scope for improvement

-

Go-Colours plans to expand the EBO / Online channels faster over LFS / MBO channels, ensuring higher margin profile and maintenance of ~30% EBITDA margins, with lower overall working capital requirements

IPO Proceeds / Details? Final thoughts? 🧐

- The IPO involves a fresh equity infusion of INR 1.25 Bn (0.4 Bn for 120 EBO Stores, INR 0.6 Bn for working capital funding & remainder for general corporate purposes

-

The company has planned for an OFS of 12.9 Mn shares, leading to total offer size of INR 10 Bn, with a post-money MCAP of INR 37 Bn, with promoter shareholding reducing to ~53% from 57% post the issue

-

Go-Colours has multiple tailwinds, (1) growing preference for separate top & bottom wear, (2) increasing share of organized players, (3) first-mover advantage in terms of the robust supply chain, and priced at 35x Dec 23E EPS, is at a significant discount to industry-leading peers (Page, ABFRL, V-Mart) that trade in 50-60x range

Keep a track?

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

![]()

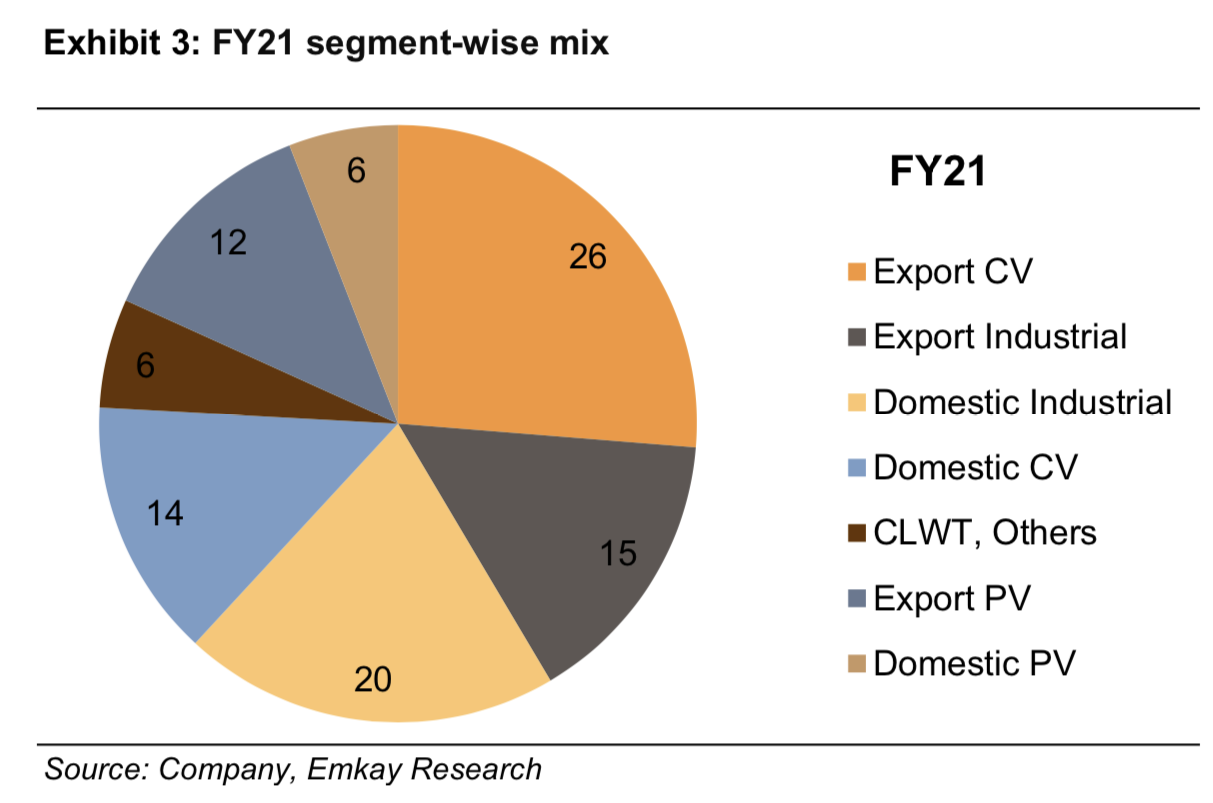

Bharat Forge doubles down on global demand; What’s up and What do you need to know? 🐱🏍

Bharat Forge is a global leader in metal forming, serving several sectors including Auto, Railways, Aerospace, Marine, Oil & Gas, Power, Construction & Mining

- Global demand outlook provided by 21 entities, including CV / PV, OEMs, Non-Auto Companies & Industry Associations indicates a strong positive read-through for forging companies

-

The global Passenger Vehicle (PV) segment is likely to clock double-digit growth in CY22 across regions, owing to a strong pending order book, improving macro scenario and low channel inventory

-

Likewise, industrial segment demand has also considerably improved on strong commodity prices & a pick-up in infrastructure spending (global & local), with the North America Oil & Gas segment likely to grow 20%+ in CY22

-

Bharat Forge is likely to benefit in the near term, with cyclical recovering in underlying Auto & Industrial Segments, in both domestic & overseas markets are expected to positively push Revenue CAGR over FY22-24E

Interesting! Give more details? 🧐

- Global Heavy Commercial Vehicle (HCV) –

-

with an order book of ~1 year, Volvo & Packard expect the HCV segment to grow by ~16% in North America & Europe, aided by better freight and improving transporter availability

-

India growth estimates have been increased by Volvo to ~85% for CY21 and 13% for CY22, driven by better utilisation and pick-up in construction activity

-

-

Passenger Vehicle (PV) – Society of Motor Manufacturers & Traders (Industry body), expects PV demand to touch ~18% in the Europe, North America & India markets led by pending order book, increased economic recovery and low channel inventory

-

Industrials –

-

Volvo & CNH expected the construction equipment & tractors segment to grow by ~15-25% in North America & Europe in CY22, with the recent passage of US Infra Bill likely to elongate the cycle and support volumes through to CY23

-

Locally, ACE & Escorts expect ~15-20% growth for the construction equipment segment in FY22

-

Nice! Final thoughts? Some information on Bharat Forge? 🤔

- BHC is underpinned by its leadership position (largest forging player, across industries in the world), with a multidecadal story likely to assist the company capture demand recovery in the coming years

-

Led by strength in all things auto, the company has smarty diversified to target non-auto related businesses (see image below), which are primed to grow beyond the USD 100 Mn topline mark

-

The stock has performed in the interim, and is +20% in the last 6 months, while currently trading at ~23x FY24E PE, with a likely return profile of >20% in the next 2 years (through significant debt reduction)

-

Demand is expected to return, with supply side bottlenecks slowing easing, Bharat Forge looks best primed to take advantage of a changing scenario

Keep a track?

What else caught our eye? 👀

GDP expectations get a boost

- UBS Securities has revised upwards its growth forecast for the current fiscal to 9.5% t from 8.9% in September.

- Main reasons cited include a good recovery rate, and rising consumer demand.

- RBI forecasts a 9.5% GDP growth rate, while the gov has cited a whooping 10%

IPO Frenzy bringing in new rules?

- SEBI is considering implementing rules around how a company can spend cash raised through an IPO, and how quickly big investors can exit from the same

- It is being proposed that 35% of the IPO issue can be used for inorganic growth initiatives and general corporate purpose

- This move is aimed at protecting small shareholders who have shown very high demand for newly-listed tech stocks

Good news for Indian crypto community

- Indian regulators are looking to ban using crypot for transactions, or make payments but allow them to be held as assets

- Causes of concern include money laundering, and an avenue for funding terrorism

- The RBI has been reluctant citing issues of macroeconomic and financial stability – the SEBI may be appointed as the regulator