eClerx Services Records Six Consecutive Quarters Of Growth

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss

- SBI primed to break key resistance?

- Eclerx Services delivers all-round performance

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty: 17,516.20 | -43.90 (-0.25%)

FII Net Sold: INR 2,267.86 crore

Sensex: 58,644.82 | -143.20 (-0.24%)

DII Net Bought: INR 621.98 crore

Technical Setup

SBI primed to break key resistance? 🟢

- Analysing SBI on a weekly time frame, indicates that the stock has been in a steady uptrend making higher highs and higher lows. (View image below)

- Prices have been breaking earlier highs, increasing the chances of a breakout above the current resistance level (544)

Okay great! Tell me more? Any new tools?

- On a daily time frame, prices are currently trading above 10, 20, 50, and 200-day simple moving averages, indicative of strength in the counter

- The 2 crossovers (1st: 10-DMA and 20-DMA positive crossover | 2nd: 20-DMA and 50-DMA positive crossover) show strength in the current uptrend, with legs to sustain a possible rally (?)

That’s Great! How do I enter / exit such a setup?🤩

- A closing above the resistance level will be a good time to enter the uptrend, and going long would make the most sense; stop-loss can be placed just below 540 or the next support level, which will help limit your losses

- India’s OG lender is due to declare results today, with key financial parameters including Loan Growth & Asset Quality likely to impact key next moves in the counter

Interesting! Final thoughts?🧐

- On a weekly time frame, prices taking support at a crucial level and a steady recovery in prices shows positive bias

- On a daily time frame, prices trading above multiple moving averages and making positive crossovers increases chances of the steady uptrend continuing

- Breaking key resistance of 544, either via consistent long build-up or through positive results update will strongly influence next moves in the counter

Keep a track?

Around the World 🌎

Tech stocks making headlines for all the wrong reasons with Meta leading the pack; what happened and what’s next?

- Meta Shares fell over 26% wiping more than $230 billion in market capitalization (greatest one-day loss for a US company) with financial results and forecasts that disappointed even the most pessimistic investors. Revenue growth is expected to slow with expenses increasing by $20 bn owing to their bet on the metaverse

- Another blow to Meta came through Apple’s advertising policy which caused it to lose $10 billion in sales in 2022 (8% of total revenue last year). The alteration in iPhone software which asked users for permission before tracking activity limited Meta’s data collection driving away advertisers – its major revenue stream. It also announced a loss of a million daily users globally

- Paypal Holdings and Spotify also declined 6 and 16% respectively continuing the wrath that tech companies have been facing post the Fed’s decision to raise interest rates. Major corporations are not being able to justify their lofty valuations with robust financial results. But not all hope is lost – Companies like Google and Amazon continue to hold investor interest with healthy sales growth and increase in the bottom line

Company News

Eclerx Services delivers all-round performance; What’s up and What do you need to know?🚀

Financial Performance

- The company recorded revenue growth of 5.8% QoQ and 37.7% YoY to USD 73.4 Mn for the quarter

- EBITDAM for the quarter declined by 0.7% QoQ to 30.8%, due to higher G&A (General & Administrative Expenses) and S&D (Selling & Distribution) costs

- Revenue from emerging clients grew 5.2% / 49.6% QoQ / YoY to USD 29 Mn for the quarter (more on this below)

- This was the sixth quarter of sequential growth for the company, across client buckets, including Top-10 and Emerging

Business Performance

- Revenue growth was led by analytics, managed services, customer engagement, campaign management and digital marketing; Key geographical markets, included North America (6.3% QoQ), Europe (2.5%) and RoW (12%)

- >50% of new sales for the quarter came from focus areas outlined by the company, highlighting + growth trajectory in the coming quarters

- Revenue from Top 10 clients continued to work for the company, growing 5.9% QoQ, with the management indicating sustained revenue flow in the near term

- The company’s most recent acquisition, Personiv (acquired for USD 34 Mn in 2020), which is US based digital marketing & back-office services provider, continues to see healthy growth momentum

- Eclerx had to provide additional earn-out consideration of INR 49.5 Mn in the quarter, owing to the better-than-anticipated financial performance of Personiv; adjusted for this value, the EBITDAM was up 0.2% to 31.7%, closer to the guided range

Interesting! Going forward? More of the same please 😁

- The management (in their earnings call) remains confident of sustaining the revenue growth momentum in the near term, on the back of broad-based demand, anticipated lower churn among clients & healthy deal wins

- Client mining activities have performed positively for the company, adding 5 & 2 clients each in the USD 1mn – 3mn and USD 5mn – 10 Mn client buckets, with more of the same expected (as per management)

- New client traction (via identified focus groups) is likely going to continue, and a widening client portfolio (non-Top 10 bucket) will push the envelope going forward

- Margin guidance (28-32% EBITDAM range) was reiterated by the management in the call, with Q4FY22 margins likely to be closer to the upper end of the guided range

- Headwinds from the higher-than-usual wage hike plan for FY23 and the normalization of travel & other discretionary spends is expected to be partly offset of revenue growth led operating leverage and offshore shift

Nice! Final thoughts? Stock price et al.

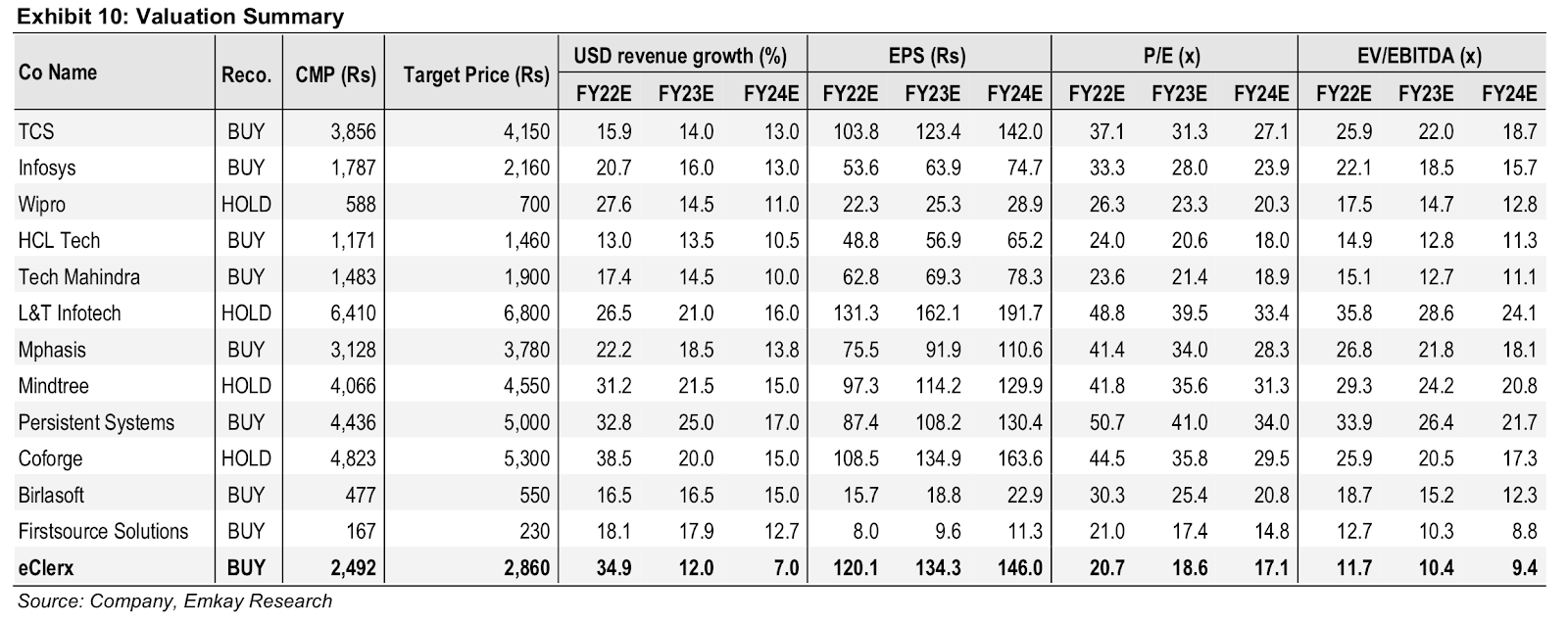

- YTD the stock’s down ~12% and trades at ~17x FY24E P/E (x), which is at a stark discount to comparable (size & return profile) peers in the space (see image below)

- The stocks had a stellar run in the last 1 year (much like all listed IT players), and is up ~145%; is there more to come?

Keep a track?

What else caught our eye?👀

LIC IPO making headway

- LIC’s embedded value has been finalized at more than Rs. 5 trillion ($66.82 bn) – it measures future cash flows in life insurance companies and is the key financial gauge for insurers

- The embedded value will not help to determine its market cap and amount raised – with a projection of enterprise value to be 4x embedded value

- It has also been reported that LIC is likely to sell its entire stake to IDBI Bank in 2022/23

Yes Bank to get a saving grace?

- Advent International (PE Group) is considering an investment of Rs. 7500 Cr ($1 bn) into Yes Bank to help stabilize operations

- PE Firms are allowed to purchase up to 9.9% in banks – the deal is in due diligence but Advent wants to rope in another co-investor to mitigate the risk

- With a current market cap of ~ Rs. 33k Crore, 10% of the shares would be valued at Rs. 3364 Cr

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Results Preview

Saturday, 5th February: Aarti Industries, Bank of Baroda, SBI

Monday, 7th February: Exide Industries, Coforge, Castrol, Indian Bank, National Aluminium, TVS Motor, Union Bank of India

Educational Topic of the day

Option Greeks: Delta

The delta of an option is the rate of change of the price with respect to changes in the price of the underlying.

It tells us how much the price of an option would increase when the underlying increases by $1. It allows us to make predictions about how much the option value would change as the underlying changes.