City Union Bank Plans To Re-Accelerate Growth

Good Morning Toasters!

Hii friends!! The hospitality industry is booming again, post a long covid lull. IHCL (Operator for Taj Hotels) reported a return to profit, after recording losses during the same period in the last two years.

In today’s issue, we cover City Union Bank results, a Mid Cap Banking stock that has recorded ~13% YoY growth in advances. The Bank’s management is guiding for mid to high double-digit growth in the future, accelerating SME & Corporate loan books.

Legendary fund Softbank reported its worst ever quarter, recording USD 23 Bn in losses as their investments soured in a market where Tech stocks have found the going tough. The funds have been forced to pare their holding in Alibaba, adding ~USD 34 Bn in pre-tax income as some of their bets get called out.

Market Watch

Nifty 50: 17,534.75 | +9.65 (+0.06%)

Sensex: 58,817.29 | -35.78 (-0.06%)

FII Net Bought: INR 1,061.88 crore

DII Net Sold: INR 768.45 crore

Company News

City Union Bank plans to accelerate growth; what’s up and what do you need to know?

- Recording a beat (higher than estimated across Bloomberg consensus numbers), City Union Bank (Mcap: INR 120 Bn) reported a 28% YoY growth in the bottom line, led by higher recoveries (from earlier write-offs) and lower provisions

- Advances growth was moderate (in comparison with other Mid-Cap Banks), expanding by 13% YoY, as Small & Medium Enterprises (SME) and Corporate Loans slowed down during the quarter (more on this below)

- The Bank recorded higher fresh slippages, in a typically weak quarter for players across the industry, touching INR 2.7 Bn (or ~3% of total loan book), even as the Bank’s exposure to Spice Jet Airlines moved out of SMA (RBI terminology), with expectations of full recovery of dues by this time next year

- Initially growing at a record pace, the Bank’s CASA ratio slipped from its historical high of 32%, with an expectation of deposit growth to return in the ensuing quarters, even as the Cost of Funds for the Bank largely remained the same (high CASA helps in cheaper access to capital)

Interesting! Tell me more? Slippages, future growth outlook?

- The Bank has forecasted for mid-high double-digit growth going forward, primarily led by a return of focus in SME and Corporate Segments, which ideally should positively begin margins in the long run

- While slippages increased for the Bank (mentioned above), Gross Non Performing Assets (GNPA) were flat, coming in at 4.7%, as the management accelerated recoveries; further, the Bank carries 100% provision on its Spice Jet exposure, which it expects to recover in full, most likely leading to a reversion in provisions (and addition to growth pool)

- Likewise, the Bank maintains a high restructuring pool, at ~INR 20 Bn (or 5.1% of its loan book), with ~50% of loans have come out of moratorium (non-repayment), with satisfactory levels of repayment (according to the management)

- The bank’s forecast for an upward trajectory, with respect to RoA, from the current 1.2 / 1.3% to 1.4 / 1.5% is led by higher growth and lower NPA formation, as the majority of book recovers from the restructured pool

Got it! Any colour on valuations? And what about stock price etc.?

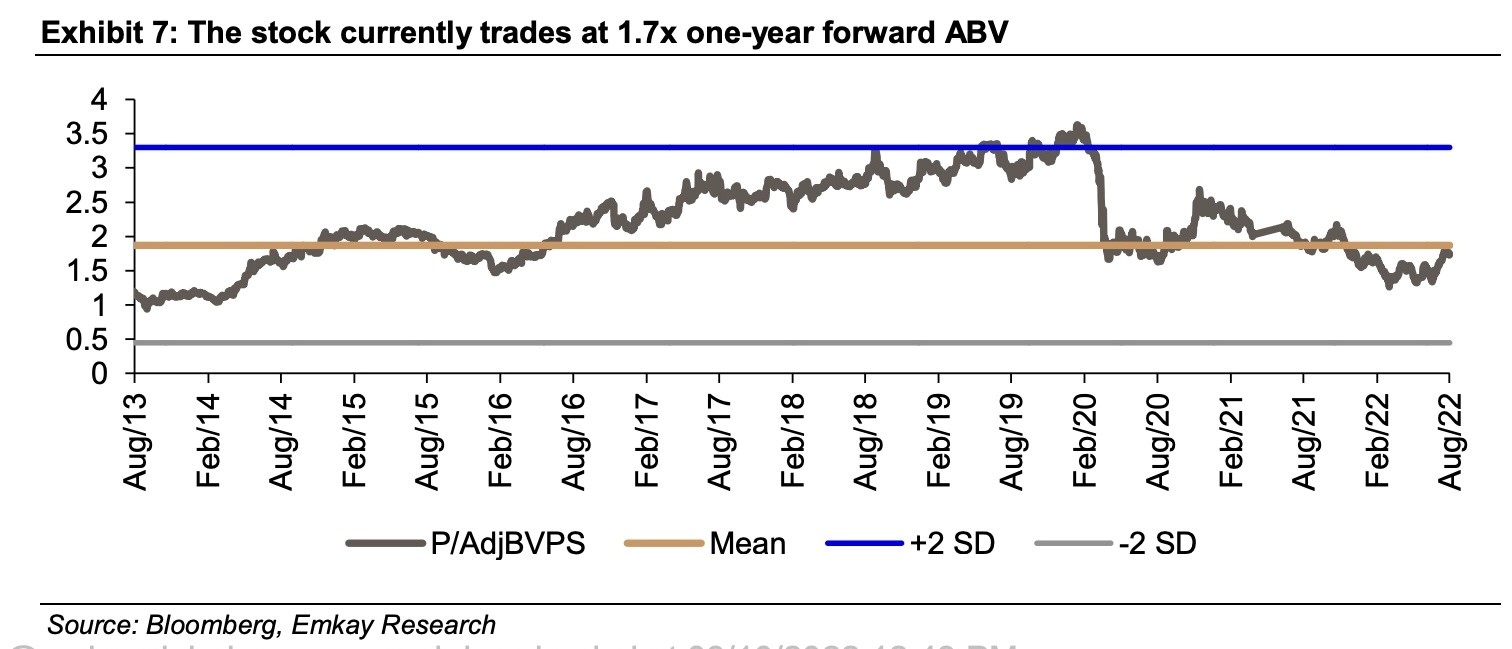

- The stock currently trades at 1.7x P / Adjusted Book Value, on a one-year forward basis, which is closer to its ~10-year mean, but still lower than the highs of ~3x seen during the last cycle (see image below)

- The bank’s management has forecasted for a return to high double-digit growth and coupled with reducing NPAs, RoEs for the bank should improve materially from her, touching ~15% from the current 13.6%

Keep a track?

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- It feels like karma at this point: Coinbase Global, the largest U.S . based crypto exchange, reported a huge loss of $1.1 billion for Q2 adding to the worries of an already distressed cryptocurrency market. In one of the worst phases for the sector, many companies like Celsius Network and Voyager Digital have already filed for bankruptcy while others have incurred huge losses. Coinbase, which mainly depends on trading fees for its revenue, suffered due to a major fall in the number of its active users from 11.2 million to 9 million

- To buy or not to buy?: Our OG Twitterati Musk has sold shares worth $7 billion adding to the $32 billion worth of shares he already sold last year, leaving him with a stake of just 15% in the company. This is in anticipation that the judge might force him to buy Twitter in October for which he’ll have to shell out $33 billion in equity financing. In case the deal does not materialise, he is planning to buy back his Tesla shares and also launch his own social media company X com

- Green will always be the new green: Green Banks, set up by the government and popular in New York, U.K, and Australia for the last few years, are actually public investment funds with the main purpose of financing infrastructure projects to lower carbon emissions. If the Inflation Reduction Act is passed by the U.S House of Representatives and signed by President Biden it would allocate $27 billion to a greenhouse fund to be specifically used for clean energy projects. This would also encourage private sector banks and other asset managers to finance more green projects

Global Company News

Softbank posts record loss and reduce exposure to Alibaba

- The OG Investment Giant also known for their poetic earnings deck (think: unicorns falling off a covid cliff), Softbank reported their worst ever quarter, recording USD 23.4 Bn in losses, as the much famed Softbank Vision Fund 1 lost USD 22 Bn

- The fund recorded losses across its 300+ company portfolio, including in companies like Klarna, DiDi (Uber of China), and Singapore’s superapp, Grab; tech stock bloodbath had its own impact, with stocks like DoorDash, Uber and WeWork all performing poorly in the aftermath of Quantitative Tightening (QT)

- In an effort to stem the tide and prepare for the future (to remain solvent), the funds sold its entire stake in performing (just about) portfolio companies like Uber (made a USD 1.5 Bn profit), Slack, Nvidia and OpenDoor

- To make matters worse (right?), the funds only approved USD 600 Mn in new investments between April to June, down from a whopping USD 20.6 Bn (whatt) during the same period last year, as conservations are the name of the game

Interesting! Tell me more? How were things at their peak? And what’s the Alibaba story?

- The Masayoshi Son led fund reported USD 46 Bn in profits in 2020, which believe it or not was USD 5 Bn more than Alphabet’s bottomline, with soaring prices making the legendary investor ‘delirious’, as he now regrets all the $$ he ‘drained’ into failed investments

- In related news, and as a consequence of soaring losses, Softbank announced plans to pare its stake in the OG Chinese e-commerce player, Alibaba, bringing it down from ~23.6% to ~14.6%, a move that should provide the fund with USD 34 Bn in pre-tax income

- The move relates to a pre-determined contract the company’s made with financial institutions, one in which the fund pares its stake in Alibaba, and raises capital in the face of losses in other portfolio companies

- Throwback: at its peak, Alibaba accounted for ~half of Softbank’s total assets, which eventually decreased as a consequence of Alibaba shares falling, once Chinese tech stocks began their freefall, and coupled further as Jack Ma disappeared & re-surfaced (jk jk)

What else caught our eye? 👀

Hotels are gaining heights

- The near-term picture for the hospitality industry looks bright as hotels and eateries post delicious quarterly results even amidst the global geopolitical tensions, inflation and pandemic

- Tata’s IHCL has reported a profit of ₹181 crores compared to last year’s loss of ₹302 crores along with a three and a half-fold increase in its revenue which touched ₹1,266 crores

- Oberoi Group’s EIH, Lemon Tree Hotels, Speciality Restaurants, Barbeque Nation and Westlife Development have all tasted welcoming growth in their profits after last year’s losses due to the second wave of covid 19

Passenger vehicle sales ready to race

- 2020’s pandemic and 2021’s semiconductor shortage had downshifted the gears of India’s automobile industry but now the coin seems to have flipped. In the calendar year 2022, sales of cars, utility vehicles and vans are set out to reach 3.6 to 3.7 million units

- Enhanced component supplies, consistent bookings and new models are steering the industry by stepping up production and clearing the backlog. The industry is on an accelerated trajectory despite the roadblocks of increased interest rates and inflation

- Vinkesh Gulati, president of FADA, believes that this will be the best ever year for car sales after 2018 when the sales had touched 3.3 million units

Results Preview:

Thursday, 11th August: Apollo Hospitals, Trent, Aurobindo Pharma, Bata India, Bharat Forge, Page Industries

Friday, 12th August: Astral, PFC, HAL, Grasim Industries, Zee Entertainment, Sun TV Network., ONGC, Info Edge, Hero Motocorp, Divi’s Laboratories, Apollo Tyres

Educational Topic of the day

What is CASA Ratio?

- CASA stands for Current Account Savings Account Ratio. It’s the ratio of deposits in current and saving accounts to total deposits

- A higher CASA ratio indicates a lower cost of funds because banks do not usually give any interest on current account deposits

- In simple words, a CASA is a flexible Savings Account with little to no interest rates which in turn helps the bank increase its total deposits

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com