Campus Activewear IPO Bridges Branded Vs Unbranded Gap

Good Morning Toasters!

Hey there! Hope all’s well, and your weeks started brightly. In today’s issue, we cover the Campus Activewear IPO in detail, with the company looking to bridge the branded vs unbranded gap.

Varun Beverages has made a couple of interesting patterns on the chart, starting with a rising channel. Check out the Technical Section below for more details.

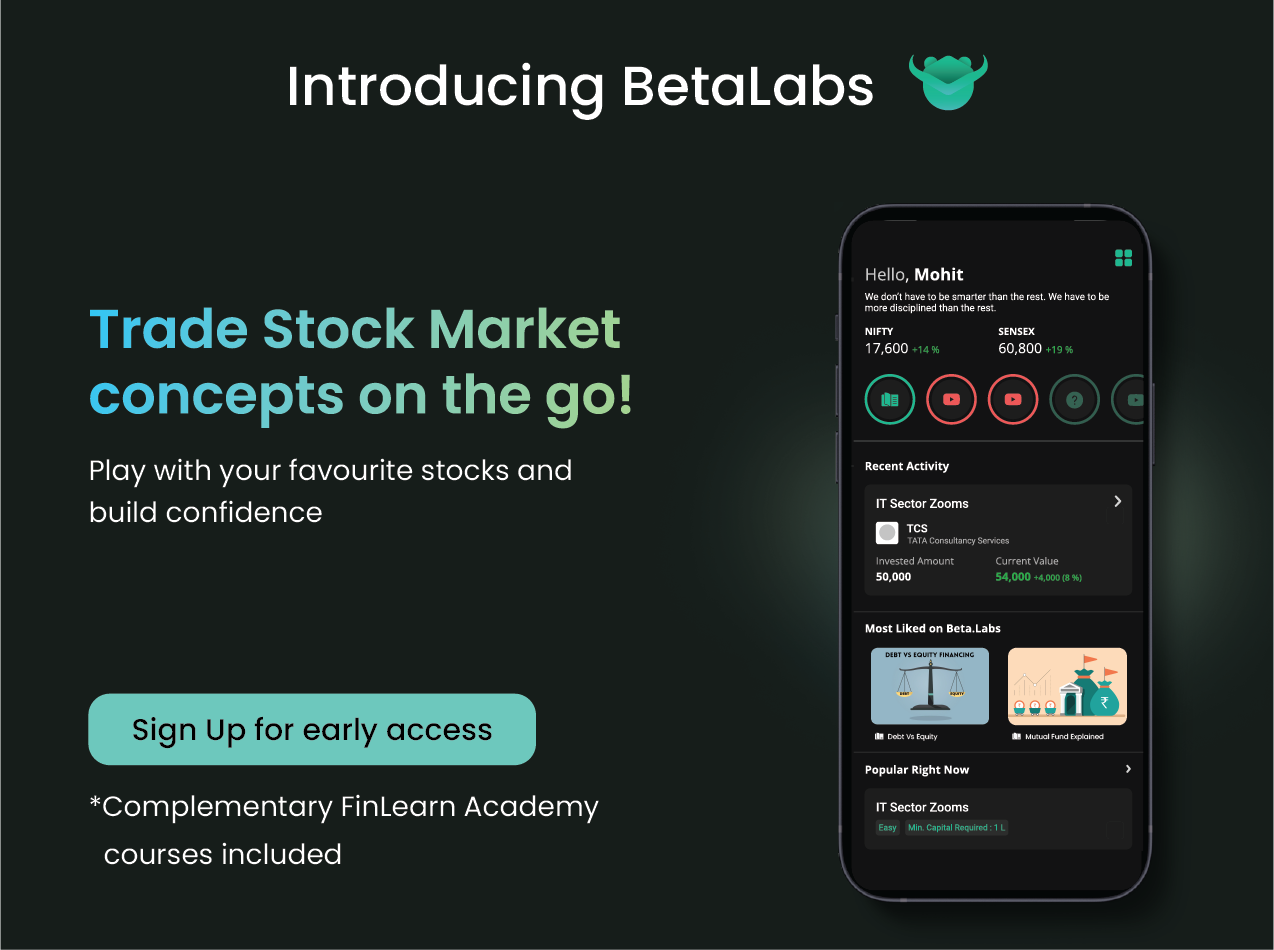

And finally, a big update for you – we’re launching our newest product today, Trade:able, that aims to democratise trading, via a unique and fun learning experience. Click on this link to know more and be a part of the initial rollout.

We’re super stoked for you to try it out.

Market Watch

Nifty 50: 16,953.95 | -218.00 (-1.27%)

FII Net Sold: INR 3,302.85 crore

Sensex: 56,579.89 | -617.26 (-1.08%)

DII Net Bought: INR 1,870.45 crore

IPO News

Campus Activewear launches INR 14 Bn IPO; What’s up and What do you need to know?

Company Profile & Industry Overview

- Campus footwear is a leader in India’s sports and athleisure (S&A) segment, which accounts for ~15% of INR 720 Bn Indian footwear industry

- S&A segment has witnessed industry-beating growth of 14% CAGR b/w FY15-20 vs footwear industry growth of 9% during the same period

- Indian footwear currently lags global consumption trends, 1.9 pairs per person vs the global average of 3.2, which coupled with sport & athleisure growth during the pandemic (Technopak expects ~21% CAGR b/w FY22-25E) creates an interesting market dynamic

Tell me more? MOATs, Distribution Capabilities, Supply Chain, Competition et al.

- Brand Campus largely caters to the INR 500-3000 price band, which acts as a bridge for customer transition from unbranded to branded; this segment forms ~87% of the overall S&A footwear in India

- In comparison to its peers (Relaxo, Bata, Liberty), Campus is a leader in terms of size (2x / 3x in comparison) and # of active designs/options (2,100+), led by an agile supply chain

- Among sales channels, online has lead growth in the recent past, growing strongly from a pre-Covid run-rate of INR 0.3 Bn in FY20 to INR 3 Bn in 9MFY22, with equal traction in B2B outright sales to online partners (Myntra / Flipkart / Amazon) and market-place model (PPMP)

- Strong design offerings have enabled the company to command higher pricing power (4-5% CAGR), achieved via incorporating feedback from sales/consumers/channel partners, test-launching new SKUs, and quickly replenishing fast-selling SKUs (implementing an automated system)

- ~65% of revenue is achieved via B2B distribution, with Campus liaising with a large network of ~19,000 footwear retailers in 664 cities via 425+ distributors; Campus Exclusive Branded Outlets (EBOs) have a lower revenue contribution (~5%) at present (more on this below)

Interesting! And financial profile?

- The campus has grown at a sales CAGR of 27% during FY15-20, led by attractive pricing, brand positioning and industry led tailwinds

- EBITDA % has improved by ~2.6% to 19.5% over FY19 – 9MFY22, helped by an increase in the online mix (unlike peers), premiumization (average price hike of 7%) and vertical integration of the supply chain

- Working Capital (key in the retail/apparel industry) has fallen from 166 days pre-covid to ~120 days in FY21 / 9MFY22, led by channel financing of ~20% distributor-led sales

- In comparison to peers, Campus WC is higher by ~60-70 days, resulting in slightly lower Return on Investment Capital at ~30% vs 40-45% for peers

Okay! Valuation and IPO Details? Final thoughts? Going forward?

- The INR 14 Bn IPO is entirely an Offer for Sale (no primary issuance of shares), with the company valued at ~25x FY24E EV / EBITDA at the higher end of the IPO price band of INR 278-292

- The company plans to ramp up its women’s / kids offerings, with the portfolio currently men’s heavy with respect to styles/revenues (85% / 65%)

- From a distribution perspective, the management has indicated a continued need to expand touch physically, targeting ~60,000 retailers in India via premiumization and expansion of its women’s / kids portfolios

- Likewise, given strong margin returns from the online business, and with the initial success achieved post the pandemic, Campus expects to continue to grow its online profile, increasing the revenue contribution beyond the 30% at present

Final thoughts?

- The campus is a market leader, driving the transition and reducing the gap from unbranded to branded wear via aesthetically designed, consciously priced footwear products that are strategically positioned in the marketplace (~80% contribution from non-metro cities)

- The company is valued at a discount to listed comparable peers, with the likes of Metro / Relaxo / Bata all trading at 35-40x FY24E EV / EBITDA

- Key to highlight and which can be a drag is the purpose of the issue, with a sole Offer for Sale, designed to provide current management / PE exits likely to have a negative bearing (from a retail investors perspective)

If you’re interested in financial news & analysis, and wish to receive this email in your mailbox consistently, click here to Subscribe Now

Around the World 🌎

- Twitter-Musk saga reaching its climax – Twitter is close to accepting Musk’s proposal of acquiring the company for $43 billion (at $54.20 per share) after it just recently put in a ‘poison pill’ that prevented Musk from raising his stake by >15%. Musk has been actively pitching investors, especially actively managed funds, and has promised to solve issues of free-speech, and high dependence on advertising. Shares opened ~ $50 on Monday, up 4%, considerably closer to the below the offer price showing investor acceptance of the deal going through

- Apple workers follow suit – Employees at companies like Starbucks, and Amazon unionised in the recent months leading to employees at Apple also mobilizing in hopes of their organizing success. Major demands, though they vary from region to region, include higher pay, increased tuition reimbursement and larger 401(k) matches as well as cost-of-living adjustments are given soaring inflation. Apple has a headcount of 65,000 retail workers in more than 500 stores but only 6% of its sales happen in person

- Yen fighting the dollar – The Japanese yen, long seen by traders to gauge how investors are feeling globally, has dropped to a 20-year low against the U.S. dollar. It has however reversed a trend this spring by falling 12% against the $ in spite of global stocks sliding (when markets get volatile, the yen usually gains ground). The Fed was relying on major Japanese institutions to absorb the excess liquidity as it winds down its bond-buying program. Most investors are waiting on the sidelines, then trying to bet on the movements of the Yen

Technical Setup

VBL on the move? 👇

- Analyzing Varun Beverages on a weekly time frame indicates that the stock has been in a strong uptrend, trading between 2 rising trendlines. (see image below)

- The stock has been breaking interim resistance levels making higher highs (impulse moves) and higher lows (corrective declines)

Nice! Tell me more? Anything on a lower time frame?

- Looking at the daily chart, we can depict that the stock has already given a breakout above its stiff resistance (1015) and is currently retesting breakout levels

- Prices are currently trading above all 4 important moving averages (10 SMA, 20 SMA, 50 SMA and 200 SMA) which shows that buyers are in control

That’s Great! How do I enter / exit such a setup?

- As prices are currently trading close to breakout levels, it is a good time to create a long position

- A stop-loss can be placed just below the 20-SMA (swing trade) or 50-SMA (positional trade) depending on your holding period

- RR ratio can be set as per your risk appetite, hence your target can be calculated accordingly

Interesting! Final thoughts?

- On a weekly time frame, prices are trading along 2 rising trend lines making higher highs and higher lows show positivity

- On a daily time frame, prices giving a breakout above key resistance and trading above all moving averages add strength

Keep a track?

What else caught our eye? 👀

LIC IPO not looking so good now

- LIC will be selling a 3,5% stake for Rs. 210 billion ($2.8 billion) as opposed to the earlier planned target of Rs. 500 billion mainly because of a lack of commitment from anchor investors post the outbreak of war

- With crude prices being at all time highs, the GoI needs to step in to find new ways to bridge the deficit as taxation no longer is sustainable

- The goal for the year is 650 billion rupees which will help offset the deficit set at 6.4% of the GDP

UK-India love story begins

- The third round of India-UK free trade agreement talks starts Monday and is expected to bring in some major changes when they close in October

- Major demands from the UK include reduced tariffs on alcoholic beverages and processed food and in turn, Indian professionals will be given more opportunities to live and work in their country

- The deal is expected to double India-UK bilateral trade to about $100 billion by 2030 with aims to cover 65% of goods and 40% of services

Results Preview (Nifty 200)

Tuesday, 26th April: Bajaj Finance, AU Small Finance Bank, Nippon Life India AMC, HDFC Life

Wednesday, 27th April: Bajaj Auto, HUL, IHCL, Persistent Systems, Trent, Syngene International, IEX, HDFC AMC

Educational Topic of the day

HODL

“HODL” is a term that is often used in the Bitcoin investment community. It is a misspelling of “hold,” with an interesting story behind it. The term also spread to the communities of other cryptocurrencies. It is not only a popular term but is also considered an investment strategy.

Edited by Raunak Karwa

Let’s connect, I always love hearing from you. Hit me up at Raunak_Karwa on Twitter or Raunak.karwa@finlearnacademy.com