Budget Preview: Fiscal Deficit to GDP Ratio to Print at 6.8%

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss

- 2022-2023 Budget Preview

- Route Mobile revenues grow ~30% QoQ / 46% YoY

- News around the world

- And educational concept to keep you learning every day 🙂

Market Watch

Nifty: 17,101.95 | -8.20 (-.0.05%)

FII Net Sold: INR 5,045.34 crore

Sensex: 57,200.23 | -76.71 (-0.13%)

DII Net Bought: INR 3,358.67 crore

Budget Preview 📜

Policy Trade-Off between growth & fiscal consolidation (Numero uno q)

- The upcoming budget faces acute policy trade-offs between nurturing a nascent growth recovery and diminishing fiscal space, coupled with challenging debt dynamics

- Maintaining a delicate balance remains key, especially given the nascent/uneven recovery post the pandemic raises questions around the durability of demand, with key headline questions to ask include –

- The pace of fiscal consolidation

- How the policymakers prioritise the spending ahead

- How do they plan to fund it

- How they aim to increase the growth potential over the years

- And whether they’ll help decrease the hole in our pockets 😉

Slow consolidation ahead: GFD/GDP to print at 6.8% (as forecasted)

- Initial calculations suggest, fiscally trends are in-line with government targets (previous budget), and likely to come in at a 6.8% fiscal deficit / GDP

- Overall positive budget buffers such as robust tax collection, higher nominal GDP and RBI surplus, are likely to be offset by higher doles payouts than budgeted on food, fertiliser subsidy, healthy & NREGA, and possible miss on ambitious divestment targets (accounting for mega LIC IPO)

- The key buffer in the last year has been the robust tax revenue collection, with ~70% of the gross tax collection target already met in the first 8 months – the strongest seen in years and largely attributed to the formal sector that was more or less open during the lockdowns

- Divestment proceeds have been meagre this year, merely 5.3% of the INR 1.75 Tn budget estimate, with the monetisation of non-core PSE assets including pipelines, mobile towers has not seen much traction; likely miss of 0.4% of GDP, even considering mega LIC IPO

Key focus areas to include Rural, MSMEs & Infrastructure

- The rural sectors terms of trade have been unfavourable (with a negative spread between WPI food & rural retail inflation), while rural real wages have been under pressure; the non-Agri rural informal sector has not reaped the benefits of easy financial conditions in the economy

- Revenue expenditure pressure may continue in FY23, with the year also being an election-heavy one, in key states of UP, Punjab & Gujarat, thus making a rural agenda all the more plausible (voter appeasement et al.)

- While the focus will be heavily skewed towards rural & health sectors, also watch out for extensions/seeping of PLIs to exporters promoting Make-in-India and Railway Manufacturers

- Contact sensitive sectors such as Tourism / Travel & Hospitality and MSMEs / Small businesses which have been hit severely by post-Covid are still in nascent recovery mode, and could get higher allocation rebates

Taxation to see limited tinkering (like always)

- While corporate taxes have limited scope for reduction (duh!!), personal income taxes may be tinkered only at the marginal level, given the NDA government has only ever fiddled with this category without giving any meaningful direct tax relieve

- Watch-out for commentary on GST related discussions, with likely points around GST Tax rate revisions and possible slab-reductions impact on revenues

Targets for the year? (We believe)

- FY23E GFD / GDP can be pegged at 6.2% (INR 16.2 Tn), with gross tax revenue growth assumed at 12%, after a robust 24% growth in FY22E, non-tax revenues at INR 2.7 Tn and divestment proceeds at INR 800 Bn

- Overall expenditure growth at 5.5%, with a mild increase in the proportion of revenue expenditure vs capital expenditure

- Nominal GDP growth rate of 13.0%

Interesting! Final thoughts? 🧐

- Policymakers aka Ms. Sitharaman, in the upcoming budget will need to improve growth, while maintaining an eye on medium term fiscal sustainability (i.e. can’t spend beyond their means yoo)

- Some key areas to target include continued financial sector reforms, funding aggressive asset sales via functional infrastructure monetisation, divestment / strategic sales (something the government promised, but failed to deliver beyond the headline grabbing LIC IPO)

- Key sectors to watch out for include Infrastructure, Auto & Ancillaries, Residential Real Estate and Financials (like always)

Around the World 🌍

Big day for the world with some highly anticipated results out! What happened and what’s next?

- Apple Inc posted its quarterly results and surpassed investor expectations on both revenue ($123.9bn) and profit ($34.6bn) fronts showing that it has managed to overcome the supply chain constraints and microprocessor shortage even though it had lost $6 bn in sales last quarter. YoY growth is expected in the next quarter too

- The world has been waiting for the Fed to make its moves who are likely looking at March to raise the Fed funds rate due to inflation being well above its target of 2% (at ~7%) and a strong job market. It has also planned to end its bond purchases in the same month before launching a significant reduction in asset holdings

- Impact of the news was seen across asset classes – Asian shares fell to their lowest in more than 14 months, while short-term U.S. yields rose to 23-month highs

Company News

Route Mobile revenues grow ~30% QoQ / 46% YoY; What’s up and What do you need to know? 📳

Founded in 2004, the company is a full-stack Cloud Communications Platform Service provider, offering Communication Platform as a Service (CPaaS); catering to enterprises, OTT players, and Mobile Network Operators, with a product portfolio including messaging, voice, email, SMS filtering, analytics and monetisation

Financial Highlights

- The company recorded strong revenue Bloomberg Consensus estimates beat, growing ~30% QoQ / 46% YoY to INR 5.6 Bn; Q3 revenue included an inorganic contribution from Masivian & Interteleco (recent acquisitions, more below)

- Organic revenue growth for the quarter stood at ~38% YoY / 22% QoQ; billable transactions stood at INR 16.3 Bn (highest ever in a quarter)

- Gross margins were flat, while EBITAM declined 1.6% to 10.8% on account of ESOP costs, increase in Sales & Marketing Expenditures and hiring developers

Business Highlights

- Q3 is typically the best quarter for the company (seasonality et al.), however, the management indicated they expect the current run-rate & momentum to sustain in the coming quarters

- The company continues to see strong momentum in the Non-SMS business (up 156% YoY to INR 277 Mn) as next generation messaging channels (IP-based messaging, email, enterprise voice solutions, and unified communication solutions) continue to witness increasing adoption by enterprises

- The route has developed deep customer engagement, which continues to drive high recurring revenues (90% on LTM basis)

- Revenue from new products rose 156% YoY (mentioned above), and now constitute ~5% of the total revenue; email business contributed ~INR 52 Mn for 9MFY22

Interesting! Tell me more? Acquisitions, Targets, Fund-Raise et al. 🤩

- The company has closed two acquisitions, which offer synergistic value and have been value accretive from the get-go –

- Masivian SAS for USD 50 Mn to expand into new markets – particularly Colombia, Peru and further expand across LATAM

- 49% stake in Interteleco, along with an additional 41% of economic & beneficial interest (including profits, dividends, voting & distribution) for USD 2.2 Mn to establish a direct presence in Kuwait

- The two acquisitions contributed 3.31 bn billable transactions in Q3 (total for the company stood at 16.3 Bn, sizeable contribution)

- The route has recently raised INR 8.7 Bn via QIP, to invest in organic or inorganic growth opportunities to further accelerate growth, with M&A likely to augment current capabilities, while remaining a key part of the company’s overall strategy

Nice! Final thoughts? Stock price, Valuations? 😃

- The stocks down, to varying degrees over the last 6 months, overall several possible reasons, primarily surrounding gross margin stagnation/pressure

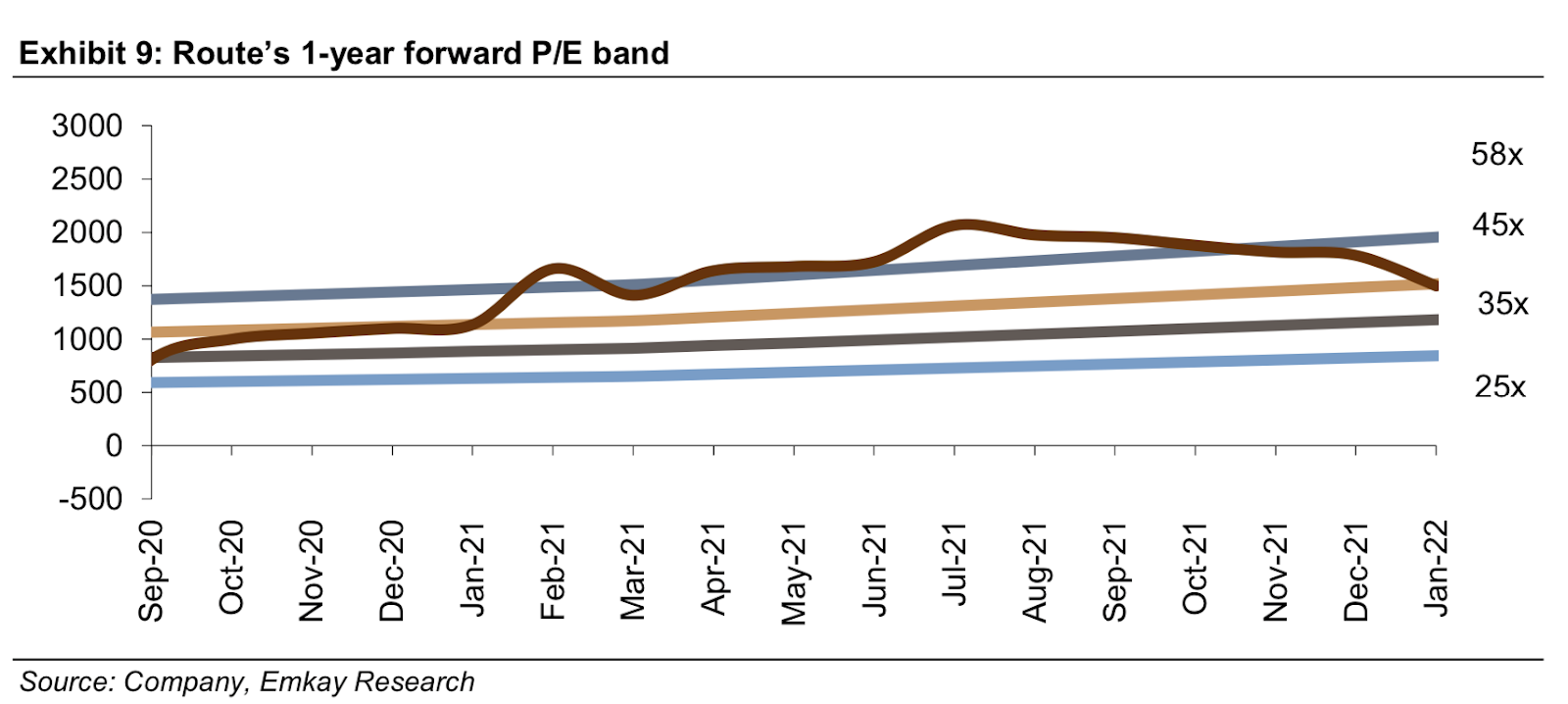

- However, the markets were enthused with the results, with the stock up ~8% post the results; the stocks 1 Yr PE FWD looks to have taken a beating in the recent months (see image below)

- Yet with solid growth potential, in a highly specialised category, coupled with strong management commentary, there lies the scope for achieving past multiples?

Keep a track?

What else caught our eye? 👀

Google to enter India’s telecom space

- Bharti Airtel has approved the issuance of 7.1 crore equity shares to Google International LLC with a face value of Rs. 5 on a preferential basis

- Google has promised to invest upto $1bn under its Google for India Digitization Fund over the next five years

- The shares have been bought at Rs. 734 apiece; stocks surged 2% to Rs. 725 post the news indicating a positive feedback from the market

FRL to be bankrupt or not to be bankrupt?

- The Supreme Court will hear a petition on Monday by Future Retail Limited seeking a deadline extension for the Rs. 3500 Cr installment it owes to lenders

- Lenders include SBI, Bank of India, Bank of Baroda etc. who had earlier already agreed to a one-time restructuring (OTR) that included selling its small network of 800 stores

- The injunction from the Singapore Arbitration Centre’s Emergency Order however does not allow them to sell these assets

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Results Preview

Saturday, 29th January: Indusind Bank, MCX India, NTPC, Relaxo Footwear, Amber Enterprises, Easy Trip Planners, Rossari Biotech, JSW Holdings, Olectra Greentech

Monday, 31st January: Aarti Drugs, BPCL, DLF, Exide Industries, HPCL, IOC, Navin Fluorine, Sun Pharma, Tata Motors, KPIT Tech

Educational Topic of the day

What is Loss Aversion?

Loss aversion is a tendency in behavioral finance where investors are so fearful of losses that they focus on trying to avoid a loss more so than on making gains. The more one experiences losses, the more likely they are to become prone to loss aversion.

Research on loss aversion shows that investors feel the pain of a loss more than twice as strongly as they feel the enjoyment of making a profit.