Banking Sector Beats All Odds to Deliver a Strong Quarter

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss

- The Banking Sector beats all odds to come up on top

- Nestle delivers steady, but unexciting numbers

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty: 17,276.30 | -28.20 (-0.16%)

FII Net Sold: INR 2,529.96 crore

Sensex: 57,832.97 | -59.04 (-0.10%)

DII Net Bought: INR 1,929.08 crore

Industry News

The Banking Sector beats all odds to come up on top! What’s up and what do you need to know!

- Most banks have reported earnings higher than investor expectations mainly due to the strong credit growth, better margins and lower loan loss provisions

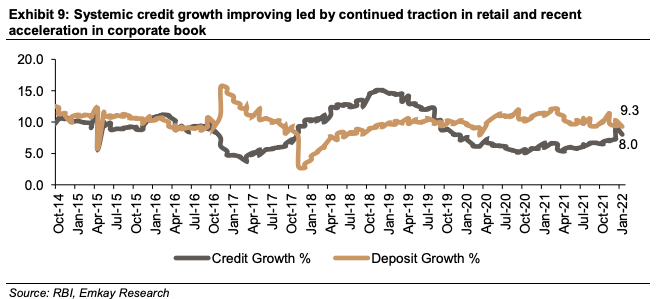

- Overall systemic credit in Q3 stood at 9% led by a surge in both corporate credit and the consumer retail segment

- Q3 also saw a reduction in the GNPA ratio due to moderate slippages, higher recovery and better write-offs

So who did well?

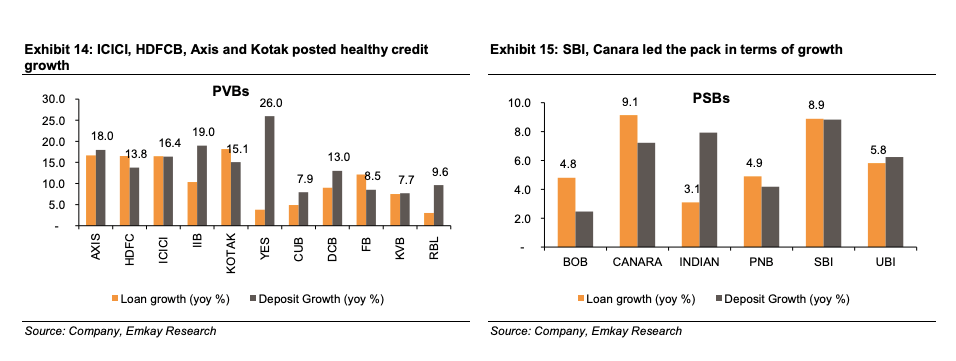

- Among PSBs only SBI, BOB outshone while ICICI and HDFC were also outliers in the private sector

- Axis Bank too showed healthy growth, margins and asset quality with Kotak following close behind; Bandhan Bank too returned to profitability

- Q4 is expected to be stronger for the sector with better growth and NIMs as well as improved asset quality

And sector wise?

- Personal Loans is showing signs of pickup but car finance growth continues to remain sub-par, new Commercial Vehicle Loan too remaining laggard

- Business Banking/SBL segments saw some light with asset quality risks reducing and MFIs too in spite of subpar collection trends showed aggressive growth

And what about the NPAs?

- GNPA ratio has decreased overall but stress remains elevated in certain key retail areas (CV/CE, Two Wheeler, MFI and SBL/SME) with provisions made for Srei, Spice Airways and Future Retail (in the lumpy corporate space)

- The NARCL first phase transfer is likely to provide some relief to reduce corporate NPA size and cash recovery should flow through the P&L

- Overall the recovery trends should work in the favour of the banks with reduced NPAs offsetting a weak treasury performance

In conclusion?

- With the pandemic (almost!) behind us, investors are betting on reacceleration of credit growth rate, strong consistent growth in consumer retail and pick up in commercial retail

- With cleaner balance sheets, valuations should go up and NIMs should be protected by better LDR and lower interest reversals

- Better investment yields, lower retirement liability and disintermediation from the bond market supporting credit growth could largely offset the negative factors like rising bond yields etc

Around the World 🌎

The world seems to be in disorder with some major economies going through some major chaos! What’s happening and what’s next?

- Escalating violence in Ukraine caused the Dow Jones Industrial Average to suffer its steepest one-day loss in 2022 (stock futures have gained since). Adding to the turbulence was an announcement by the Secretary of State of a looming Russian offensive – a war could prolong elevated inflation levels in most countries due to supply disruptions. Bond yields and oil prices were down too, post the news

- Meanwhile in China, a major developer Yango Group failed to make overdue interest payments on two dollar bonds in spite of winning reprieve from debt investors. The company cited reasons of “the macroeconomic environment, the regulations on real estate and financial industry and the Covid-19 pandemic”. The interest due totals $27.3 million

- In better news – Japan posted a healthy recovery in the Oct-Dec quarter thanks to higher consumer spending with a 1.3% growth QoQ. Private spending increased by 2.7% QoQ but a new wave spoiled the party with daily nationwide count exceeding 10000. With increased restrictions leading to suppressed demand and supply-chain constraints, growth in the next quarter looks unimpressive to say the least

Company News

Nestle delivers steady, but unexciting numbers; what’s up and what do you need to know?

Financial Performance

- Sales grew by 9% in Q4 and 10% overall in CY21, with domestic growth at 9.2% and 10.7% respectively, largely driven by volumes & product mix growth; 2 yr CAGR for the company was healthy at 10%

- Gross margins declined by 2.1% YoY but were up 1.3% QoQ; EBITDA grew by 13% to INR 8.1 Bn, on a low base;

- PAT for the company declined by 20% due to an exceptional item of INR 2.4 Bn on account of changes to their pension scheme; adjusted PAT grew by 15% for Maggi’s producer

Business Performance

- Rural growth (for the company & economy in general) has been strong, and was primarily led by expansion, and not increased consumption (which has in-fact slowed down)

- For CY21, pre-prepared dishes recorded 17% growth, led by Maggi noodles; sauces on the other hand saw muted growth, while chocolate items, including Munch, KitKat led the growth in that category

- Beverages grew by 16%, with Nescafe Classic clocking double digit growth, while Milk products saw basic growth, owing to increased competition

- The company highlighted health growth across town classes, with mega citified growing by 14% in Q4 and metro / Town Class (TC) 1 / TC 2-6 / villages all recording growth between 4% to 1%

Okay! Tell me more? (Way too basic bro😒)

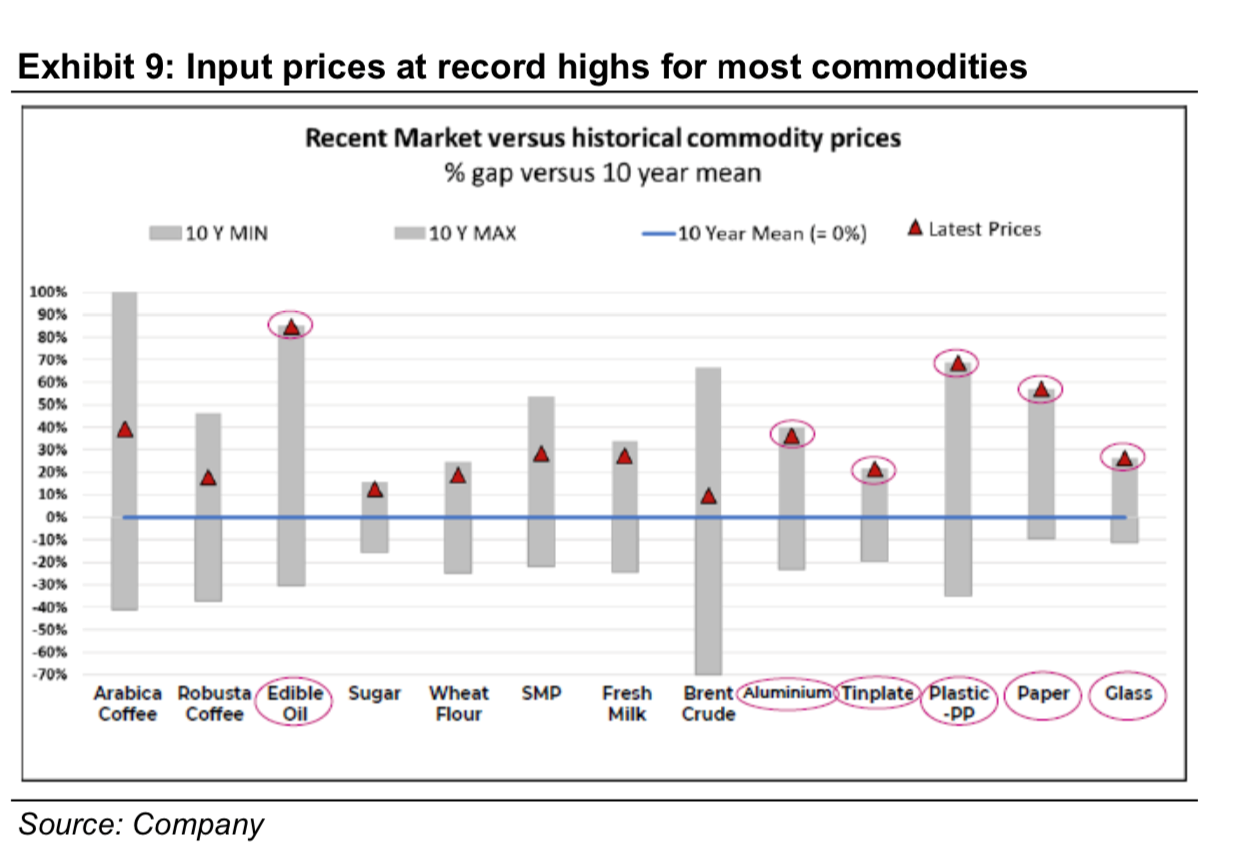

- The management highlighted rising inflation post Dec-21 (cue Mr. Das), with the commodity cost index up in the high single digits; Nestle instituted a price hike of 100-200 bps, and expects to continue doing so in the coming quarters

- The company expects rural initiatives to continue, and targets a wider penetration via multiple new product launches, across ticket sizes

- The company highlighted a sequential deceleration seen across town classes, and raised concerns over rising input cost pressures going forward (see image below)

And? Final thoughts?

- Nestle results were basic, with limited to excite, both from a top and bottom line perspective; product growth is taking place in incumbent portfolio, with limited new information on fresh product launches / scale-up

- At 56.6x FY24E P / E (x), the stock is probably one of the most expensive on the street (across sectors); does the growth justify the valuations? (We’ll let you answer that :P)

What else caught our eye?👀

LIC sets a date

- LIC’s IPO will most likely open for anchor investors on March 11 with the book opening for bidding by other investors a couple of days later

- Regulatory approval are expected by the first week of March after which an indicative marketing price band will be set

- The GoI is looking to sell a 5% stake in LIC to raise upwards of $8 billion tentatively

30% Tax is now a cause for celebration for crypto exchanges

- Most Crypto Exchange Houses are reporting increased daily sign-ups on its platforms with CoinSwitch and WazirX leading the pack at 35% and 30% since Feb1

- The step is being seen as legitimizing the industry in spite of the RBI’s strong stance against the same with a lot of clarity and visibility given post taxation

- Most crypto bulls are expecting upwards of 100 million people in the country to invest in crypto in the next 2-3 years

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Educational Topic of the day

Scalping

Scalping is a trading style with the shortest trading cycle—even shorter than other forms of day trading.

It got its name because traders who adopt the style—known as “scalpers”—quickly enter and exit the market to skim small profits off a large number of trades throughout a trading day.

Scalping requires discipline—once a set profit or loss has been reached, the scalper needs to exit the trade.