AU Small Finance Bank En-Route to Full-Scale Digital Bank

Good Morning Toasters!

In today’s issue of the Morning Toast, we discuss

- AU Small Finance Bank doubles down on digital adoption to build scale

- Zomato dropped their numbers, with flat Gross Order Values

- News around the world

- An educational concept to keep you learning every day 🙂

Market Watch

Nifty: 17,374.75 | -231.20 (-1.31%)

FII Net Bought: INR 108.53 crore

Sensex: 58,152.92 | -772.11 (-1.31%)

DII Net Sold: INR 696.90 crore

Company News

AU Small Finance Bank doubles down on digital adoption to build scale; what’s up and what do you need to know?

Strategic Update

- AU Small Finance Bank (SFB) hosted an analyst meet to showcase its existing / planned digital capabilities across business verticals (asset/liability), en-route to transforming itself into a full-scale digital universal bank

- The Bank has already done well from a liability standpoint, increasing its CASA (Current Account: Savings Account) ratio from 22% a year ago, to ~39% , which the management largely attributed to its rising digital adoption

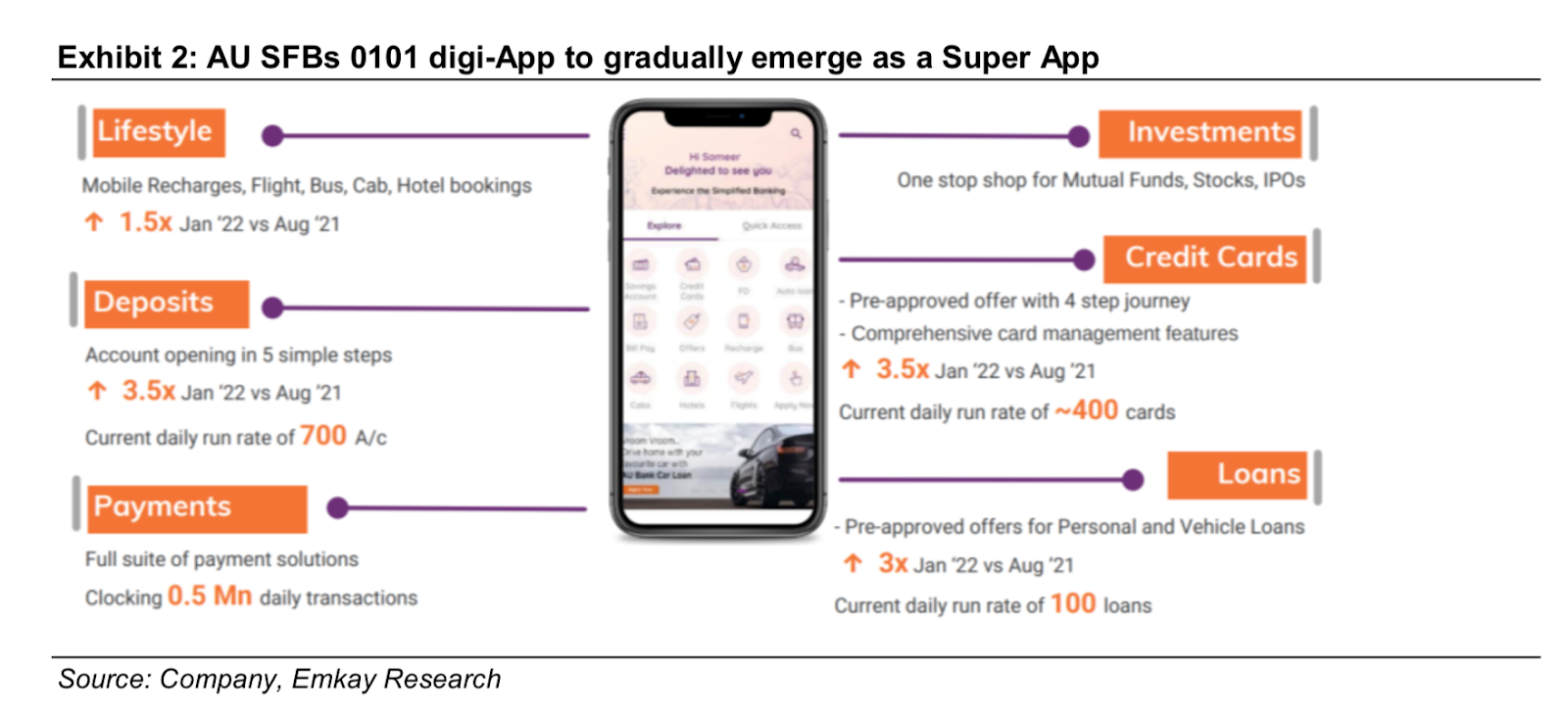

- AU SFB claims that ~38% of Savings Account customers were acquired via video-banking capabilities in Jan’22; at present, the bank has ~250,000 non-AU Bank customers on its AU 0101 digital super-app (more on this below)

- According to the management, the digital adoption has vastly widened target audience, with the bank able to acquire Gen Z / Millennial customers from remote areas, that are beyond the reach of traditional physical branches, at <50% of the physical CAC

Product Update

- AU is the first SFB to launch credit cards, and has already issued >100,000 cards, most of them to captive liability/asset customers, with high activation rates vs industry standards

- Likewise, AU has plans to build-out their Personal Loan product line, having already disbursed ~INR 1.75 Bn, with an average ticket size of INR 120,000; the bank also plans to venture into the BNPL category (in fad)

- Unsecured loan category, according to the management is purely a customer subscription strategy, and will be capped at ~2% of the overall loan book

- AU’s strategic vision will entail continued focus on traditional products, including mortgages, vehicle loans and SBL to do major heavy lifting in terms of growth

- The bank remains open to forming tie-ups with fintechs / neo-banks to source business, but remains wary of doubling down on such partnerships, in-which customer ownership & interface are largely with these players, and operational/reputational risk with AU

Nice! Tell me more? What are your views?

- The bank’s built-out a sound digital banking team (across products / verticals), tapping members from large banks / fintechs / consultancies / PEs(think: HDFC, ICICI, KMB, Paypal, BCG, Matrix Capital)

- However, with all the efforts to diversify, en-route to becoming a universal bank, AU runs a high growth risk model, with countercyclical buffers lacking at present (think: change in market prevalent dynamics)

- The Bank is yet to encounter high NPA cycles from the current growth acceleration, with those numbers (in coming quarters) likely to provide judgement on AU’s risk/compliance functions, and should provide comfort in bank’s ability to effectively transition towards a full service universal bank

Interesting! And stock details? Valuations, key risks?

- AU’s buildout a strong CASA profile, which will categorically reduce costs (lower Cost of Funds / higher Net Interest Margins); that being said, moving towards a Phygital model (physical + digital) will keep operational costs elevated in the medium term

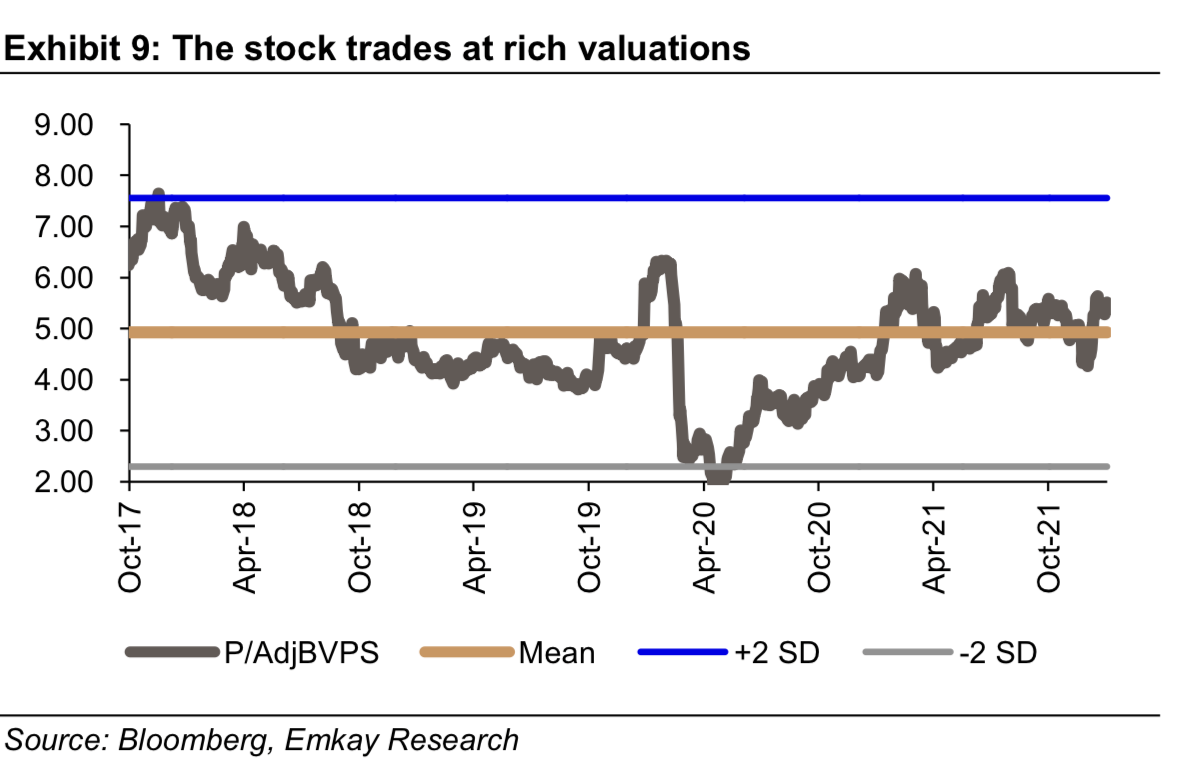

- The stocks expensive (see image below), but is on a path to becoming a universal bank, with a strong digital franchise (think: ICICI Bank), and growth across key products

- Next few cycles, when unwinding of current growth will take place should adequately guide on future fate of the bank

Keep a track?

Around the World 🌎

Inflation making headlines again for all the wrong reasons; what happened and what’s next?

- US inflation reached its four-decade high last month, accelerating to a 7.5% annual rate due to a heavy demand pull coupled with supply disruptions like shipping bottlenecks and intermediate goods shortage post the pandemic. CPI in Jan’22 reached its highest since Feb’82 adding almost $250 a month to living expenses. (Food up 7%, Energy up 27%) The fatal consequence of stimulated growth can no longer be ignored by the Fed

- Potentially disastrous inflation levels may force the Fed to raise interest rates with a larger half-percentage-point increase rather than the standard quarter-percentage-point – a move not done since 2000. Bond investors have factored in an aggressive hike with yields reflecting the same. (The two-year Treasury note settled at 1.56% on Thurs). The Fed also has the task of shrinking its $9 tn portfolio with a last round of purchases of $30 bn before ending the expansion

- Stocks haven’t been reacting positively to the news either with The S&P 500, Dow Jones Industrial Average and Nasdaq Composite all falling > 1.4%. The market had just begun to stabilise but now investors are bracing for more volatility and choppy markets ahead. All 11 sectors of the S&P 500 closed in the red with shares of fast-growing companies being hit hardest. Many are of the opinion that the market will not settle in the second half of the year

Food Tech News

Zomato dropped their numbers, with flat Gross Order Values; What’s up and What do you need to know?

Financial Performance

- Reported revenue for the quarter grew 8.6% / 82.5% QoQ / YoY to INR 11.1 Bn; adjusted revenue (includes customer delivery charges) for India food delivery was flat sequentially and grew 78% YoY to INR 14.2 Bn

- EBITDA loss shrinked to INR 4.9 Bn vs INR 5.4 Bn QoQ driven by rationalisation of spends across various businesses & functions;

- Reported net loss for the company dipped to INR 632 bn, boosted by exceptional gain of INR 3.2 Bn; adjusted loss was INR 3.8 Bn

- Contribution profit as a % of Gross Order Value declined to 1.1% in Q3 vs 1.2% in Q2; Zomato has ~USD 1.7 Bn cash on balance sheet at the end of Q3

Business Performance

- Average monthly transacting users (MTU) were 15.3 Mn in Q3FY22 vs 15.5 Mn in Q2FY22 and 8.4 Mn Q3FY21

- Number of orders grew 93% YoY and 5% QoQ; average order value shrunk by 3% QoQ, mostly on account of reduction in customer delivery charges, with the brand entering ~180 new cities, where it introduced temporary free delivery to cultivate a culture of ordering food from restaurants

- The company is in the process of setting up its NBFC, which will allow it to extend short term credit to its ecosystem – delivery, customers and restaurant partners

- Zomato has made two additional minority equity investments in UrbanPiper (USD 5 Mn) and Afonso (USD 15 Mn) in Q3

- UrbanPiper is a neutral tech infrastructure layer helping restaurants become ‘food delivery ready’

- AdonMo is building a unique tech-enabled hyper local ad-network, which can serve targeted and contextual ads to hyper local audiences

And Swiggy?

- Consolidated revenue for Swiggy has dropped 26.6% YoY to Rs. 2547 Cr for FY21 with net losses shrinking by 59% YoY to Rs. 1616 Cr

- The pandemic is alleged to be the main culprit with numerous lockdowns, restrictions and emergencies coupled with a fear of contracting the virus from outside food

- Top management has assured of a strong recovery however with its contribution margin per order improved by 150% YoY

- The company has reversed its customer acquisition strategies, reducing heavy discounting, increasing delivery charges, which has led to an overall uptick in Average Order Value

- Swiggy InstaMart has a USD 700 Mn war chest, with the hyper local delivery space a prime area of focus for the brand; the company last raised a new round in Jan’22 at USD 10.8 Bn valuation

What else caught our eye?👀

MPC not one to give in to peer pressure

- In spite of no potential disruptions, the MPC has decided to not hike the Reverse Repo Rate (RRR) and has reiterated its accommodative stance

- FY23 inflation estimates were announced at 4.5% complimented by a GDP growth rate of 7.8% while also acknowledge the loss in momentum in economic activity

- This gradualist approach is likely to be challenged by various factors including market volatility, supply-side disruptions, and a huge bond market supply etc

GoI does not want to commit to crypto

- Sitharaman during the ongoing Budget session of Parliament expressed the GoI’s ‘sovereign right to tax profit made from cryptocurrency transactions’

- She also clarified that taxation does not imply legalization of the same – and the status of a ban on crypto is still under consultation

- It has already been made clear that the RBI issued ‘Digital Rupee’ will only be considered currency, while other crypto will be taxed as assets at 30%

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Results Preview

Saturday, 12th February: Hindustan Copper, Muthoot Finance

Monday, 14th February: Adani Enterprise, Balkrishna Industries, Coal India, Grasim Industries, Dhani Services, IPCA Labs, Manappuram Finance, Natco Pharma

Educational Topic of the day

Hedge Fund

A hedge fund is a form of alternative investment that pools capital from individual or institutional investors to invest in varied assets, often relying on complex techniques to build its portfolio and manage risk.

Hedge funds can invest in anything from real estate to currencies and other alternative assets; this is one of many ways in which hedge funds differ from mutual funds, which normally only invest in stocks or bonds.