AGS IPO Offers Cash-X-Digital Opportunity

Yesterday’s Market Performance

Nifty: 18,308.10 | +52.35 (+0.29%)

FII net sold: INR 855.47 crore

Sensex: 61,308.91 | +85.88 (+0.14%)

DII net sold: INR 115.31 crore

Howdy Toasters!

In today’s issue of the Morning Toast, we discuss:

- AGS Transact Technologies Ltd to IPO this week

- Inflation woes not going away soon

- And educational concept to keep you learning everyday 🙂

![]()

AGS Transact Technologies Ltd to IPO this week; What’s up and what do you need to know?📳

Industry Overview

- Cash in circulation still remains high and growing at 14.5% of GDP in 2021 (10.7% in 2018) in spite of digital payments gaining traction due to their convenience at low transaction values, anonymity etc

- Though at a slower pace, demand for ATMs is likely to continue to grow in the medium term esp given outsourcing by banks, replacement/upgradation of existing ATMs and the CMS business

- When compared globally, ATM penetration in India remains low, with 15 ATMs per 1 lac people vs 70 ATMs per 1 lac people in China, leaving the massive scope of growth (albeit amid a changing landscape)

Company Details

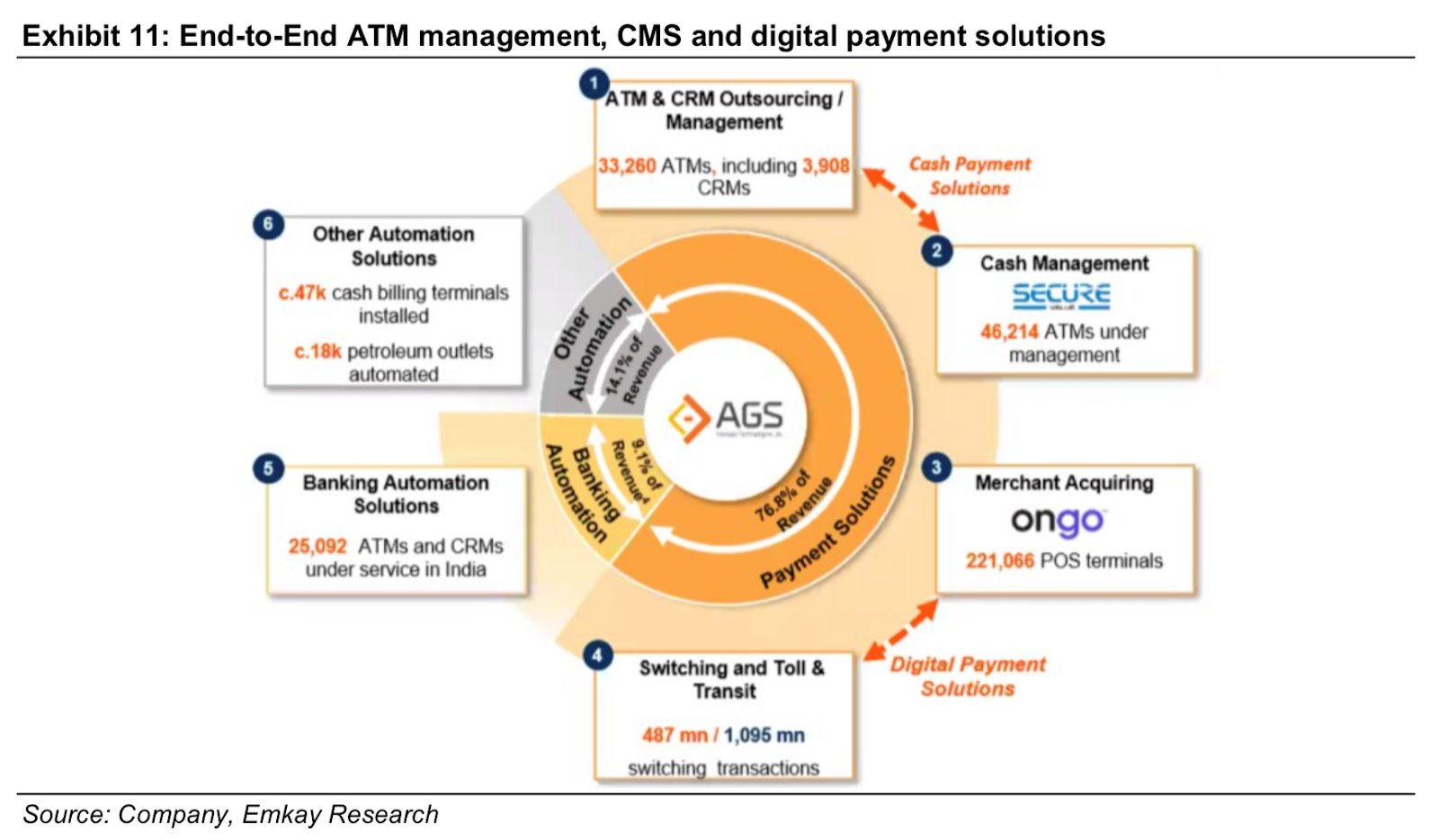

- AGS Transact is the most integrated player in the ATM business, providing end-to-end ATM services, including supplying machines, maintenance/management, CMS and Retail Cash Pick Up / Delivery

- The company has a proven track record in winning long-term mandates from banks, given it is the largest and most integrated player in the ATM/CMS business (with banks looking to outsource all activities to one player, rather than dealing with independent vendors)

- AGS is also focusing on cash recycling machines (CRM, relatively more profitable), providing value-added services (VAS) across financial/non-financial clientele and building a strong digital payment business (see image below)

- As a part of its geographic diversification strategy, AGS has also ventured into countries including Sri Lanka, Singapore, Cambodia, the Philippines and Indonesia to offer automation and payment solutions

Some numbers please? 🤨

- Key revenue contributors are the cash and digital payment businesses with a 65%/60% and 12%/15% share in FY21/5m FY22, respectively

- The company’s RoE was low at 10% in FY21, while it slipped into a loss during 5MFY22, mainly due to higher opex/finance costs

Interesting! Tell me more? 🤩

- The RBI has revised the interchange fee structure for financial transactions on ATM, increasing to INR 17 from INR 15, while non-financial transactions have increased to INR 6 from INR 5, which should provide a boost to the company’s revenues

- Similarly, as per the management, increased focused on Cash Recycling Machines (CRM), which is more margin accretive could be a key value driver for the ATM business

- In the Digi-Payment business, the company’s focus until now has been on entering select customer segments (petroleum, retail, paints) and expanding product offerings; going forward, the company plans to further penetrate existing customers, while expanding into different segments

- Financially, the company aims to reduce costs via –

- Increasing the share of high-revenue segments (CRM / Digi-Payments)

- Improving Cost Efficiency, by leveraging their central information management, tracking & cash forecasting system

- Retiring debt (NCD @12%) as the promoter infuses OFS proceeds

Financials? And IPO details? 😎

- The IPO size has been toned down to Rs6.8bn, with the majority of the issue earmarked for OFS segment; the promoter is raising capital to retire debt (high cost NCDs @ 12%) with the money deployed in escrow to be used to repay NCD holders INR 5500 Million + interest

- At the higher price band of Rs175, the stock is valued at 3.7x FY21/3.8x annualized FY22E BV, similar to its peers like CMS Info Systems (recently listed with decent upmove) trading at 4.4x FY21/3.7x annualized FY22E BV and SIS with multiple business lines trading at 3.7x FY21 BV

- Longer term, with a high concentration of revenue from traditional Cash / CMS business, the company is on the path to buildout Digi-Payment business (growing from 9% to 15% in 5MFY22), with width of offerings & customers likely to decide course (initial signs are promising)

Opens on 19th Jan – 21st Jan; Keep a track?

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Inflation woes not going away soon; what’s up and what do you need to know? 😓

- Profitability is taking a hit across sectors as firms are unable to raise prices to fully offset increased input costs, especially the sharp increases in metal and energy prices

- Consumer durables, packaged goods etc. companies are increasing prices between 5 to 10% in the next few months – a pricing power luxury many can’t afford

How bad is the situation? 🤔

- Global commodity prices rose sharply as the strong post-covid recovery in China stimulated demand for metals and fuels

- Indian hot-rolled coils, steel and aluminium prices (48% and 41% higher) all doubled in this period from June’20 to Oct’21 due to this rally which now seems to have softened

Numbers please! 😏

- The EBITDA margin likely narrowed 100-120 basis points from a year earlier, and 70-100 bps sequentially in the quarter ended December (Source: Crisil)

- Corporate revenue is estimated to rise 16-17% to Rs. 9.1 trillion in the first nine months while EBITDA profit should moderate to 10-12% against 47% clocked in the first half

Impact? 🤨

- An inflationary environment of this kind puts pressure on consumer wallets leading to low volume growth across staple industries esp in rural areas

- HUL for example has undertaken grammage cuts to indirectly absorb price hikes leading to optically low volume growth despite the same number of packs being sold

What else caught our eye? 👀

PV exports see a huge jump

- Passenger vehicle exports from India saw a huge jump and increased 46% in the first nine months standing at 4,24,037 units (2,91,170 a year ago)

- Passenger car shipments grew 45%, utility vehicles at 47% and even the export of vans nearly doubled

- Maruti Suzuki led the segment (with 0.16 million units) followed by Hyundai Motor and Kia India close behind

PMC Bank Merger still on yellow light

- The proposed merger of Punjab and Maharashtra Cooperative Bank with Unity Small Finance Bank due to huge debts of the former is still awaiting GoI approval

- Various aspects of the scheme of amalgamation are being examined and the GoI is expected to send in its suggestions soon

- The RBI had last month extended the restrictions on PMC till March’22 as the process on the takeover was not complete

Jet Airways needs to pull up its socks

- The airline’s air operator’s permit (AOP) is yet to be revalidated under its new promoters of UAE based Murari Lal Jalan and UK’s Kalrock Capital

- The exit of key employees seems to have aggravated the problem – with the entry of Akasa Air (backed by OG Jhunjhunwala) likely to take place before Jet

- The new promoters are paying Rs. 1183 crore over five years to creditors

Tuesday, 18th January: Bajaj Finance, DCM Shriram, Just Dial, Network 18, Tata Elxsi, Trident, TV18 Broadcast, L&T Technology Services, ICICI Prudential Life Insurance, ICICI Securities

Wednesday, 19th January: Bajaj Auto, CCL Products, Ceat, JSW Steel, Mastek, Oracle Financial Services, Rallis, Tata Communications, Syngene International, L&T Infotech, ICICI Lombard General Insurance

What is share buyback?

Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future.