2021✅/Loading…2022

Yesterday’s Market Performance

Nifty: 17,213.60 | -19.65 (-0.11%)

FII Net Sold: INR 975.23 crore

Sensex: 57,806.49 | -90.99 (-0.16%)

DII Net Bought: INR 1,006.93 crore

Howdy Toasters!

So here we are! The end of another year. We’re 20,000+ members strong, we’ve covered 100+ companies / industries / themes, we’re 150+ issues down, and we’re just getting started (you won’t get rid of us that easily yoo).

This issue’s a little different (high time, right? :P), where we’ll try our best to summarise the most impactful stories of 2021, list down 6 very big numbers of 2021 (and very arbitrary :P), and explore some themes for 2022

Enjoy the holidays, and see you on 4th Jan, ‘22 toasters. It’s been a pleasure :))

2021 In Review :

Stories that caught our eye in 2021

14/7/21

Adani becomes the country’s largest private airport operator, controlling 25% of footfalls and 33% of Air Cargo

- India is poised to become the world’s third largest aviation market by 2024, and with a strong portfolio (now including management control of Mumbai International Airport Limited including the INR 16,000 crore Navi Mumbai Airport Project + 3 other major airports + 3 more in the pipeline) Adani is well placed to ride that wave!

17/7/21

RBI bans Mastercard from issuing fresh cards in India

- The Reserve Bank of India (RBI) imposed restrictions on Mastercard Asia / Pacific Pte Ltd (Mastercard) from onboarding new domestic debit, credit or prepaid customers on its card network for its failure to comply with data storage norms.

17/09/21

Cabinet approves crucial relief package for stressed telecom sector

- In a much-need move, the government announced a relief package for the Telecom Sector by offering a moratorium on Spectrum & AGR Payments up to 4 years, starting October’21 with the aim to prevent it from turning into a duopolistic market. The obvious beneficiaries were not VIL & Bharti but also the banking sector which had huge exposure to the sector.

18/09/21

Government sets up “bad bank” to clear up the NPA mess

- The growing NPA problem plaguing the PSBs forced the government to propose the formation of National Asset Reconstruction Company Ltd. (NARCL) or a ‘bad bank’ to help clean up the mess – it was likely to take over INR 80,000+ crores in the first phase itself. SBI, PNB, BOI, Union Bank of India were a few beneficiaries who would end up with a cleaner balance sheet.

29/09/21

Digital Empowerment Protection Architecture (DEPA), Account Aggregators (AA) & a transformation that began with Aadhar in 2009

- In an attempt to create a data-driven economy the GoI launched the DEPA and coupled AA it aimed to give individuals & small businesses the power to unlock their data lying idle in the walled enclaves of Banks, Telcos, Regulators etc.

14/10/21

India’s Tesla Moment? TATA Motors capital raise to deliver long term value.

- Tata Motors raised $1 billion from investors to build out its passenger electric mobility business including EV manufacturing, charging Infra, drive trains, component localization and platforms. Investments in excess of USD 2 bn are expected by FY26.

Like our news coverages?😍 Become a part of our fam, subscribe to our newsletter. Subscribe here

Loading…. 2022

Some themes to track in 2022

Valuations

-

Nifty’s Earnings Per Share (EPS) CAGR over FY14-20 was a paltry 1.4%, primarily because the government’s back to back domestic reforms, were disruptive (think: GST, Demonetisation etc.) and yet in FY21, we saw a 24% growth in Nifty EPS, on the back of cost savings & business adaptation

-

Taken together, between FY14-21, EPS grew 4.3% vs a Nifty return of ~13.3% during the same period, indicating continuous re-rating of stocks (exit multiples); ~50% of Indian market returns today attributed to multiples expansion, vs 35% for the US and 12% for EU

-

But the markets give high valuations, with the expectation of high growth right? Yes & No. Banking stocks all re-rated after another round of beautiful results in the most recent quarter, and yet pretty much all headline stocks have corrected 10% or more in the ensuing period

-

But then how do you explain heady valuations of new-age tech companies? The so-called disruptors?

- Creating a basket of so-called disruptors (32 stocks), think Zoom, Peloton, Robinhood et al. are now down ~64% from the peak, with individual constituents down between 50% to 90%

-

Amongst the top 500 companies in India, ~180 are now down >20% from their 52 week highs, with >90% of these from the small & midcap space and ~14 from the large cap universe

-

With stretched valuations (in the larger context), simply looking at past returns and expecting the index to continue a one way rally may not work out well; at present, ~73% of Indian Listed stocks are presently trading above their 5-year average price to book valuations

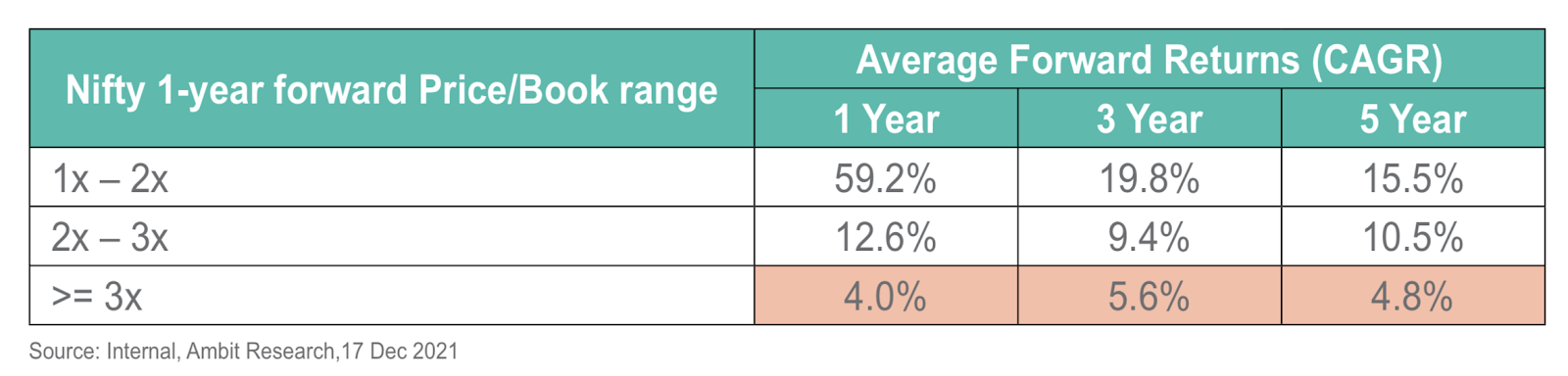

- We’re presently at ~3.1x 1 Yr FWD P / Book today, and history suggests that within that valuation range, returns (when compared) reduce drastically (see image below)

So is there a bubble? And final thoughts on the India growth story?

-

A lot also comes down to investor psychology & mindset, with multiple cycles indicating an increasing / decrease investor risk-averseness driving activity within the markets (think: early / late 2018 and early-2020 when activity dipped drastically)

-

35 companies are holding SEBI approval to raise ~INR 50,000 crores, with another 33 companies awaiting regulator go-ahead to raise ~INR 60,000 crores, excluding the mega LIC IPO planned the coming year

-

There are so many case-studies of countries where a per capita income of USD 2000 led to a non-linear jump in discretionary spending, and we’re at this particular inflexion point

-

In-fact, we’re already past this mark in the top 11 states (~1/3rd of populations & 56% of GDP) , which now have an average of USD 3,730, and 8 other states (~28% of GDP) have touched the USD 2,000 mark

-

In a nutshell, exciting times albeit with some periods of underperformance / risk (but then again, as one famous investor eulogised, risk hai toh ishq hai)

Source: DSP Mutual Fund, Ambit Capital Research, Emkay Global Research

Tech Disruptions – Web3, Metaverse et al.

Web3

-

Silicon Valley buzzword refers to a conceptual internet of the future that runs on public blockchains, and can be loosely defined as –

-

Decentralised – instead of accessing the web through services controlled by titans like Google & Facebook, Web3 would include features owned by their users

-

Unified – by recording your activity in a crypto sharpie, Web3 would let you carry your data around and bounce between sites with one account

-

Direct – remove the middleman, with blockchain allowing for more direct online interactions & transactions

-

-

Emergence of concepts listed below are likely current envisaged applications of Web3 –

-

DeFI – create decentralised finance apps to replace financial mediators like Banks

-

NFTs – purchase / sale of digital art via non-fungible tokens

-

Voting – empower communal platform decisions

-

-

Web3 is likely going to be a threat for big tech, however the current blockchains are too small to handle all transactions that happen on Web2, with the likelihood of Big Tech participating in building out & scaling the infrastructure required for Web3 in the near term, pretty high

Metaverse

-

In October 2021, Facebook changed their name to Meta, to double down on its vision for an internet you can literally be inside of —- from VR gaming worlds, to virtual offices and meta-malls

-

Likes of Microsoft, Roblox and more are also racing to claim their stake in what is pegged to be the future of work, entertainment, & commerce

-

OG Social Media guy Mark hopes to on-board upwards of, wait for it, 1 Billion users on his Metaverse by 2030 (dayummm), with ‘Horizon Worlds’ (his verse) presently accessible for Oculus users in USA & Canada

Transformation to a Phygital World

-

In the last 6 months, India has seen 3 major listings – Zomato, Nykaa & Paytm, with Mcaps > INR 1 Trillion; in contrast, there are 44 listed companies with >100 years of heritage, of which only two, ITC & Tata Steel that enjoy a MCap > 1 Trillion

-

A value migration is underway, from the physical to the digital, via a Phygital model, which is loosely defined as using technology to bridge the digital & physical world

-

As an investor into these businesses, look for hyper growth, large TAMs, product-market fit, wide distribution, network effects & favourable unit economies

Six big numbers of 2021 👀

- 150 = ~ number of SPACs (Special Purpose Acquisition Vehicles), which are down anywhere between 50% to 90% from their 52 week highs

- 313M+ = total number of Squid Game views, including 142M+ views of the actual Netflix series

- 51 = number of space launches in 2021, including Virgin Galactic, SpaceX and Blue Origin, well & truly indicating the beginning of space-tourism

- INR 1,18,704 Crores = the amount mobilised by Indian companies via IPOs during the calendar year, with 63 corporates accessing the markets

- 15,500+ = total number of cryptos at the time of writing this, with 447 coin exchanges and a total market cap of USD 2.1 Trillion (insane!!)

- 6,04,44,000 = # of biryanis ordered via a popular food delivery chain, which translates to a cool 115 biryanis per minute or 2 biryanis per second & before you wonder, yes these were Chicken