What Is Return On Investment

Introduction: What is the return on investment (ROI)?

The return on investment (ROI) is a mathematical formula that investors may use to assess their investments and determine how well they have fared in comparison to others. When developing a business case for a project, a return on investment (ROI) calculation is frequently combined with other methodologies. The total return on investment (ROI) for a firm is used to assess how well it is handled.

A return on investment (ROI) may be judged in terms of accomplishing one or more of these objectives rather than immediate profit or cost reductions if an organisation has urgent objectives such as gaining market revenue share, creating infrastructure, or positioning itself for sale.

Interpretation of return on investment (ROI) calculations?

Return on investment (ROI) may be used to assess a variety of measures that all contribute to determining a company’s profitability. Entire returns and total expenditures should be measured to compute ROI with the greatest precision.

When a return on investment (ROI) calculation yields a positive return percentage, it indicates that the company — or the ROI metric being examined — is profitable. Meanwhile, a negative return on investment (ROI) % indicates that the firm — or the statistic against which it is being assessed — owes more money than it earns. In other words, if the proportion is positive, the profits outweigh the costs. The investment is losing money if the percentage is negative.

How can we use it?

The return on investment (ROI) may be used to assess various investment decisions by comparing them to their initial cost. Return on investment (ROI) estimates are frequently used by businesses when analysing prospective or previous investments.

Individuals may use the return on investment (ROI) to evaluate their own personal investments and compare one investment to another in their portfolios, whether it’s stockholding or financial interest in a small business.

What are the advantages of a return on investment (ROI)?

The following are some of the advantages of ROI ratios:

- The calculation is often simple. To complete the computation, just a few figures are required, all of which should be available in financial statements or balance sheets

- Capacity for comparative analysis. Because of its broad use and ease of computation, more investment return comparisons may be conducted between firms

- Profitability evaluation. The net income for investments made in a certain business unit is referred to as ROI. This allows for a more accurate assessment of profitability per firm or team

What are the ROI’s limitations?

Return on investment (ROI) is one of the most often utilised investment and profitability measurements today. It does, however, have certain disadvantages. The following are some of them:

- Inability to take time into account in the equation. On the surface, it appears that the bigger return on investment (ROI) is the better investment. However, a Log Term Investment for example 10-year that yields a larger return pales in contrast to a one-year investment that yields a little lesser return

- Inconsistency in the formula: Because numerous algorithms are used to compute ROI, not every organisation utilises the same one, making investment comparisons meaningless

- Managers may only choose investments with higher returns. Even if a return on investment is minimal, it can nevertheless raise the value of a company

- There is no method to account for non-monetary gains. For example, to calculate the ROI for new computers, a company can utilise specified dollar values to determine the net profit and total expenditures. Calculating the value of enhanced worker morale as a result of new computers, on the other hand, is challenging. Businesses can compute ROIs for nontangible advantages by referring to them as soft ROIs, as opposed to hard ROIs, which are calculated using tangible monetary numbers

How to calculate ROI from XIRR and CAGR?

We usually invest money in one of two ways. The first is in a lump-sum payment, similar to a one-time investment. We also invest in little amounts every month in a regular manner. In each situation, how do you calculate the return on investment (ROI)?

The formula is simple. Returns = profit / investment x 100 is a typical formula for calculating returns. This is a straightforward formula that works the majority of the time.

However, there are several instances in which this formula is inapplicable. How do you calculate the return on investment (ROI) for equities that provide both dividend income and capital appreciation, for example?

The acronym CAGR stands for “Compound Annual Growth Rate.” It’s a mathematical method for calculating investment returns on lump-sum investments.

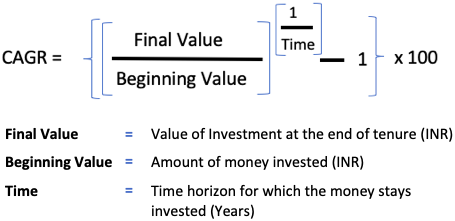

The compound annual growth rate (CAGR) is the yearly pace at which an investment (starting value) must increase to attain its final value. The CAGR formula is as follows:

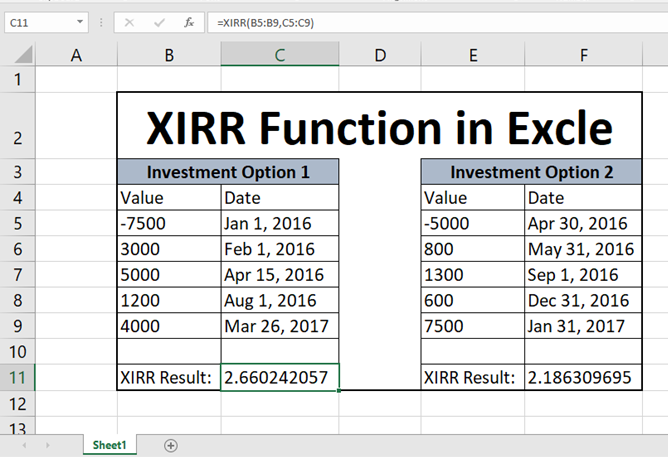

XIRR is essentially an extension of IRR that allows you to attribute precise dates to individual cash flows, making it a considerably more accurate method of calculating returns. All you have to do to calculate the XIRR in Mutual Funds is input the transactions (SIP / SWP instalments, extra purchases, redemptions, and so on) and the associated dates. You may collect these transactions information from the fund house’s statement of account and utilise the XIRR calculation in an excel sheet.

Happy investing!