What Is An ASM And GSM List? Why Impact Does It Have On Investors?

ASM and GSM what impact does it have on investors?

Slide 1-

Additional Surveillance Measure (ASM) and Graded Surveillance Measure (GSM) are measures taken by SEBI through which they impose trading curbs on stocks that are extremely volatile.

Slide 2-

Measures like these in addition to others (like price band, periodic call option etc) help to protect investors by controlling speculative activities.

Slide 3-

ASM: Additional Surveillance Measure

ASM essentially puts restrictions on intraday trading in stocks by disabling margin trading i.e brokers have to collect 100% margin on stocks in ASM.

The objective is to discourage traders to take heavy positions in these stocks and give stability to the prices.

Slide 4-

What does it imply

A stock that enters the list is moved into a 5% price band the next day.

The stock will be halted from trading for the rest of the day if it breaches the 5 per cent limit.

From the fifth trading day, a 100% margin is required.

The Exchanges conduct reviews every two months and stocks can move in and out of the list.

Slide 5-

The SEBI adds a stock to the ASM if it meets ANY of the criteria below:

1) The Spread is > 200% in the last 3 months, and the concentration of top 25 clients is > 20%.

2) The spread is > 200% and the stock has hit the price band > 30% of the time.

3) The stock has a negative PE and has shown a price movement of >100% in the last 30 trading days and the concentration of top 25 clients is >30%.

Slide 6-

4) A stock with a market cap over ₹500 crores whose price has moved >100%, the, spread is > 200% in the last 365 days and >50% in the last 90 trading days

5) A stock with a market cap above ₹500 crore where the concentration of top 25 clients in a quarter is greater than or equal to 50% and five or more of these clients have 50% or more of their trading activity in it.

Slide 7-

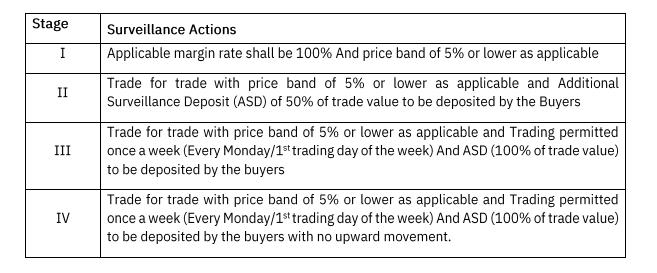

GSM: Graded Surveillance Measures

Through GSM, the SEBI focuses on stocks with abnormal price movements not justified by their fundamentals.

The SEBI wants to identify these stocks with a potential chance for misconduct (due to their illiquid nature and subpar fundamentals) to safeguard investor interests.

This review process is conducted twice in a year (along with quarterly reviews)

Slide 8-

The stock is put into one of the four stages of surveillance.

Tags:Investing