EV/EBITDA- A Beginners Guide To Value Investing

The EV/EBITDA ratio (a type of Enterprise multiple) is used to determine the value of a company.

Formula:

EV/EBITDA = (Market Capitalisation + Debt – Cash )/(Net Income + Interest + Taxes + Dep & Amortisation

EV calculates a company’s assessed worth while EBITDA measures overall financial performance and profitability.

What is Enterprise Value?

The EV is often thought of as a theoretical takeover price that one would pay to buy the entire company. It is a better measure than market capitalization since it also factors in debt.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Tax, Depreciation and Amortisation. It is used to evaluate a company’s operating performance and is considered to be a proxy for cash flow from operations.

How to interpret it?

One way people interpret the ratio is in terms of payback period. For example, if the multiple is 5 it means that it will take 5 years to recover the cost of acquiring the company using the EBITDA.

A lower multiple (compared to industry standards or historical averages) signifies undervaluation, and vice-versa.

What is a good multiple?

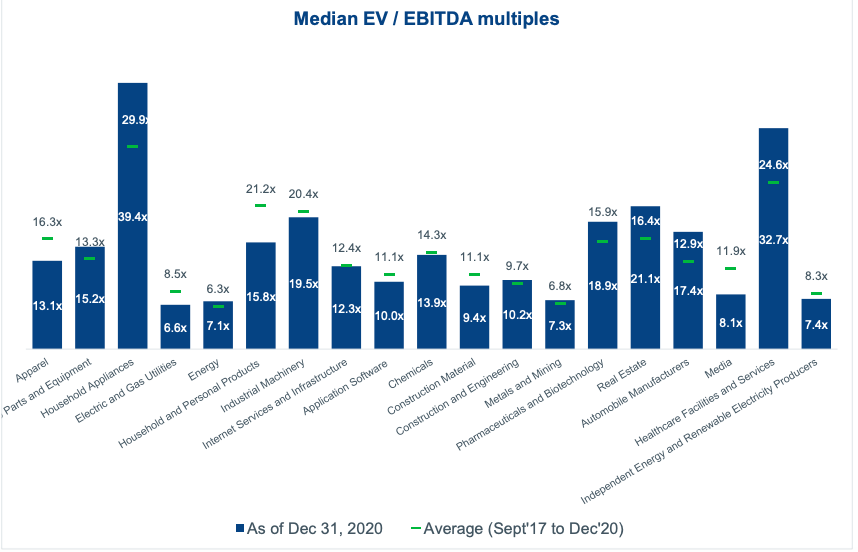

It varies greatly from industry to industry. A high-growth industry usually commands a higher multiple.

For example:

Energy: 7.1x

Pharma: 18.9x

Media: 8.1x

A Duff and Phelps report calculated the median EV/EBITDA across various industries:

(Source: https://www.duffandphelps.com/-/media/assets/pdfs/publications/valuation/industry-multiples-india-quarterly-report-13th-edition.pdf – December 2020)

It can be used to:

- Compare companies within the same industry.

- Compare companies with different degrees of financial leverage.

- For Valuation in M&A (since it considers debt unlike P/E etc)

- For Valuation of capital-intensive businesses with high levels of depreciation and amortization.

- For Valuation of service companies and where the gestation period is too long.

- Useful for transnational companies as it ignores the effect of different taxation policies.

What are some limitations?

Investors often fall into the ‘value trap’. Some stocks have a low multiple not because they are undervalued but because they are struggling and won’t recover. Thus, it can create an illusion of value that is not supposed by fundamentals.

Sometimes the EV can be negative (in case of businesses that hold a high level of cash and equivalents) and thus the multiple does not stand.

Multiples for some famous Indian companies:

(As of March’21)

Reliance Industries: 30.61x

Tata Consultancy Services: 25.65x

Asian Paints: 50.05x

ITC: 14.11x

(Source: moneycontrol)