Perfect Options strategy for Bulls

The simplest way to explain income strategies is to compare with insurance. Insurance is a form of hedging. To offset any potential losses you may experience on your investment a trader makes another investment as a protection. Two related investments must have a negative correlation, when value of one investment decreases the value of other investment should increase.

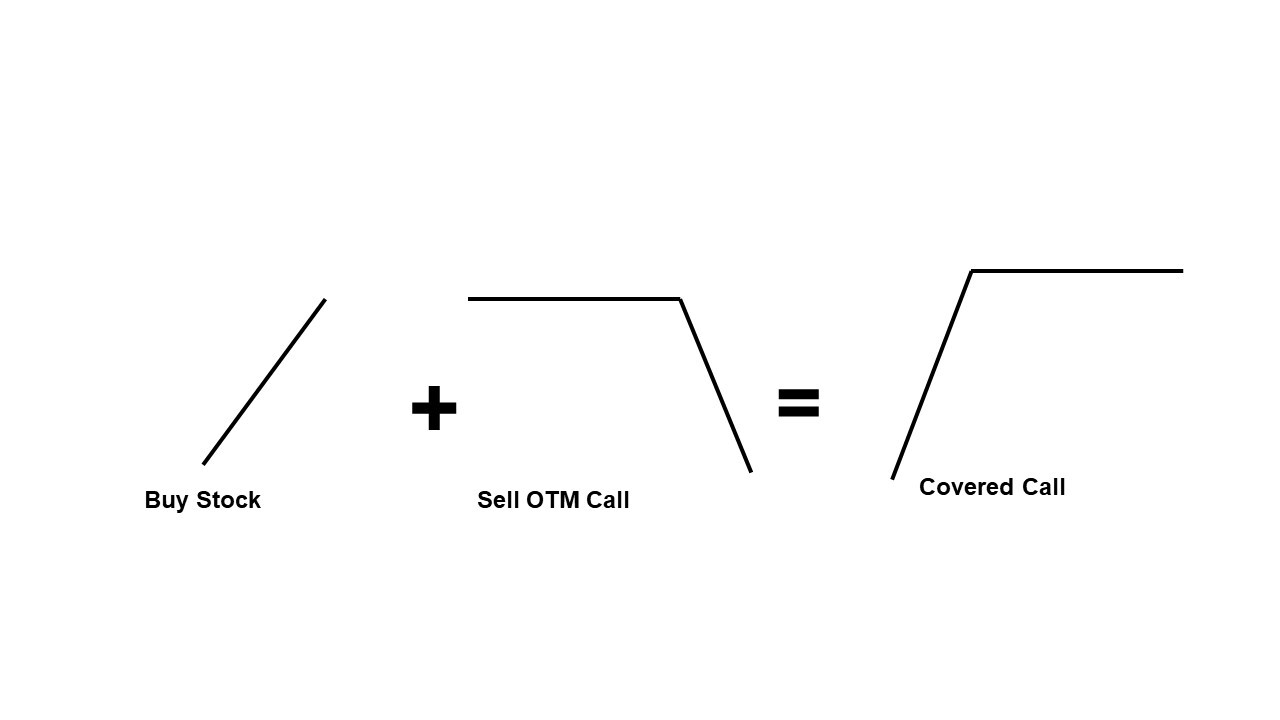

Let’s understand “Covered Call” in detail

A covered call is a simple and yet highly effective strategy which can be used by both new and experienced traders. A covered call is an income strategy where you sell or write call options against the stock you are holding. For example, you have investment in Reliance and you write the call option of Reliance. By writing a call option you collect the option premium, but the premium comes with an obligation. If the call option you sold is exercised by the buyer you are obligated to deliver the security of the underlying (on NSE the transaction is cash settled).You are owning the security so your potential obligation is covered that’s why the strategy is call “covered call”.

As a seller you are now obligated and you will receive the premium and you are covered by the stock. You are profitable as long as the stock declines less than the call option sold. When you sell a covered call, you are expecting to keep the security while generating extra income(call premium).Favourable position is that the stock price remains below your strike price and the option expires worthless. You will keep the entire call option premium at the expiration date and you keep the underlying security. For example, Reliance is trading at 2500 and you sell a 2600 call option and the premium is 62 , on the day of option expiry Reliance closes at 2550 the entire premium of 62 is you income as the call option will expire worthless.

If the stock price is moving sideways or is declining but you want to hold the same for a long term then writing a covered call is a good way to earn extra income on your long term investment holding.

Advantages

- Generate monthly income

- Lower risk than simply owning the stock

- When prices are range bound and in consolidation you can profit from such market conditions.

In the above price chart of Reliance it’s range bound in the range of 2580 -2480,you are holding the stock as a long term investment. You write a 2600 call option. If Reliance closes below 2600 on expiry day the entire premium is your income.

Strategy construction

- A covered call involves selling an Out of the money call option

- The position should be initiated with the same quantity if you are holding 500 shares of Reliance then you write 2 lots of OTM call option.(1 lot of Reliance is 250 qty).

- The writer of the call option earns in the option premium

- A covered call does not protect against the stock losing value in a falling market.