Options Strategy Part – 1

Introduction to options:

Three reasons to trade options are:

- Leverage: Controlling a larger position or exposure in trade with a small amount of capital. Options trading provides regular leverage and also dynamic leverage while creating a position or a trade.

- Limited risk: When you are bullish you buy a call option and when you are bearish you buy a put option as a directional or a trend trader. The risk in the trade is the premium paid. If the trade goes against you, your loss is limited to the premium paid. Premium for option buyers is like an inbuilt stop loss. It can help a trader in minimising and controlling risk.

- Versatile instrument: Options are versatile instruments for traders as you can create strategies based on various market conditions like bullish, bearish or sideways. Strategies can be with limited risk for unlimited reward.

Call Option and Put Option :

Call Option: Buy a call option when you expect prices to go up.

Put Option: Buy a put option when you expect prices to move downwards.

When prices rally, the premium of the call option appreciates and when the price declines, the premium of the put option appreciates.

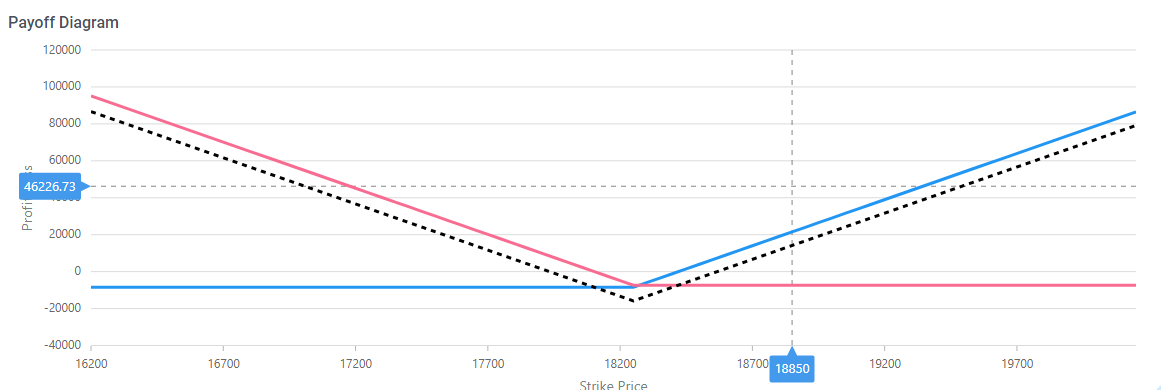

Strategy: Long Straddle:

The long straddle is a simple market-neutral strategy. In a long straddle, you expect a substantial price movement in either direction up or down. Many traders initiate the strategy when there is an event and when prices are consolidating. Prices can move in any direction but have to move either up or down. As long as prices move, irrespective of direction, traders can expect positive P&L.

A long straddle can be implemented by

- Buy a Call option

- Buy a Put option

Both the call and put option should belong to the same underlying and both the call and put option should have the same expiry date and the strike price should also be the same.

Nifty closed at 18200 on 21 December 2022 and the monthly expiry is on 29 December 2022. As a trader you expect the index to move 600 plus points in either direction till the monthly expiry.

Buy a Call option strike price of 18250 premium 170 and buy a put option strike price of 18250 premium 147. Quantity is 1 lot (50).

Net cost of the strategy 15895.Maximum loss at 15850 at 18250.Breakeven 17933 – 18567.

Conclusion:

The strategy is quite straight forwards to understand and implement. The simplicity is you buy the call option and the put option, Each leg has a limited downside to the premium paid. Your loss is limited to the premium of both the call option and put option as stated above The strategy has unlimited profit potential. In the long straddle, you make money if prices go up or go down.