Options strategy for long traders

Bull Call Spread

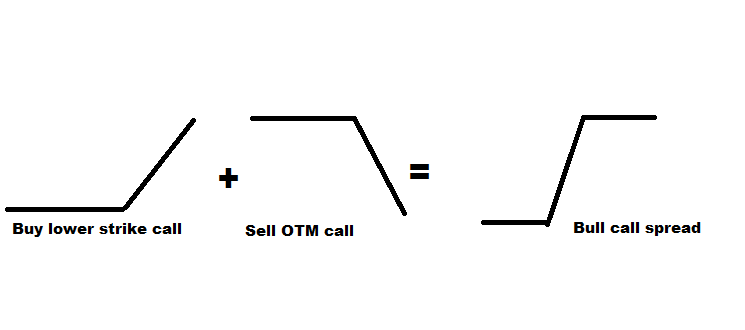

A bull call spread option strategy is a vertical spread strategy that creates a net debit in your account. It consists of one long call with a lower strike price and one short call with a higher strike price. Both calls have the same underlying stock or index and the same expiration date. Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call (lower strike). Traders deploy the bull call strategy when market conditions are moderately bullish. Technical view can be range-bound trading with a positive bias or expecting a pullback in a downtrend.

Technical view: Your outlook is bullish, you expect a rise in stock price or underlying. The stock or indices that you are charting has been in the downswing over a short-term period (corrective decline) or are testing support around a moving average like a 50-day moving average or is at structural support or is oversold. Technical study suggests a high probability that the stock or indices could see a pullback rally. You are not completely bullish but are expecting a pullback.

Strategy Execution: Buy 1 ATM Call option (leg 1); Sell 1 OTM Call option (leg 2). All strikes belong to the same underlying; Belong to the same expiry series; each leg involves the same number of options lots.

Net Position: This is a net debit transaction because the premium of the call you bought will be higher than the premium of the call you sold. Based on moneyness ATM premium is always higher than the OTM premium.

Risk Profile:

Maximum risk: Net debit paid

Maximum Reward: Difference in strikes -Net Debit.

Strike Price Selection :

Lower strike price: At the money call option

Higher strike price selection: Out of the money call option, the strike price should be around resistance.

Note Time value loss in price does not have a significant impact due to the balanced position. The main reason anyone would choose to implement a bull call spread versus buying a plain vanilla call option is the reduced strategy cost.