Case Study On Strength Analysis Of PNB Bank

27Nov, 2022

FinLearn Academy

Technical learning points

– Strength Analysis peer comparison

– Price Action

– Top Down Approach

– Multiple time frame analysis

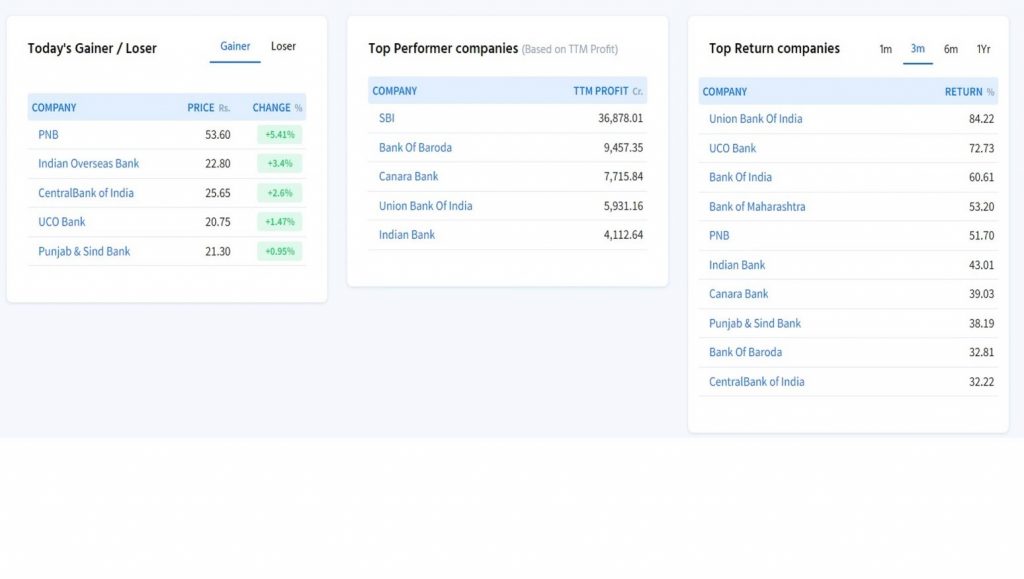

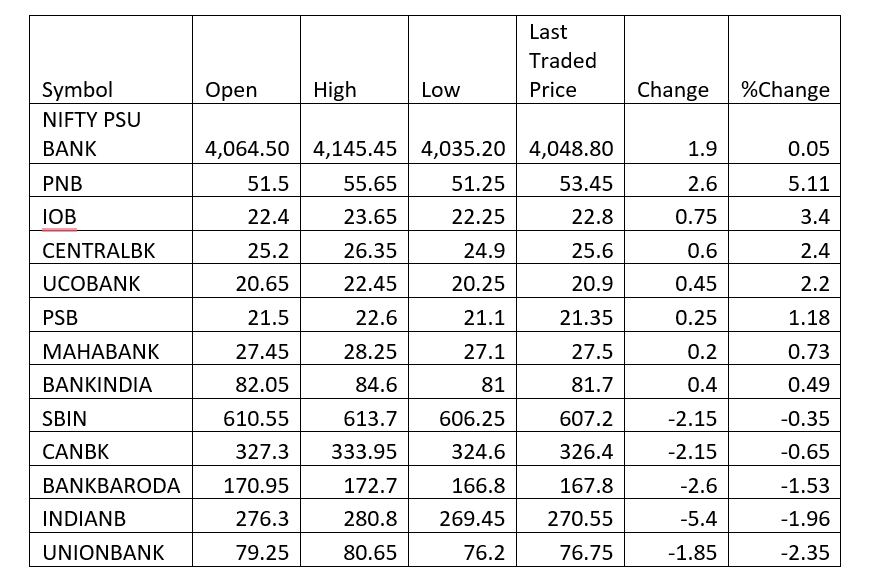

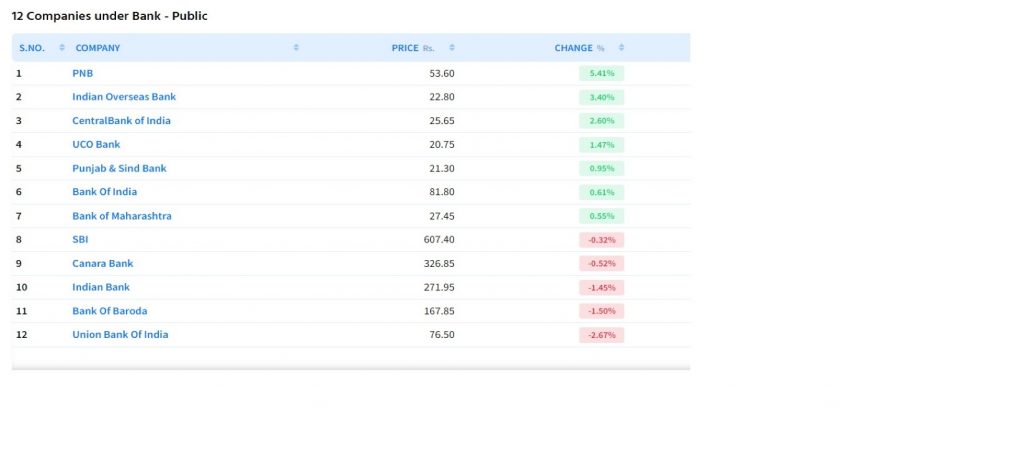

- Looking at the top 5 stocks, PNB is the recent upside swing, overall swing average and previous week. Repetitive occurrence of stocks in various time frames

- PSU Bank sector climbs 25.62% to reach a fresh 52-week high

- The shares of Punjab National Bank (PNB) climbed 9.44% on Friday’s early trades to reach a fresh 52-week high of ₹ 55.65. They took the winning run to the eighth straight session. The stock rose. In the past eight days, it has gained 25.62%

- The bank on Friday received DIPAM’s approval (the government’s divestment arm) to divest its stake in UTI Asset Management Company in single or multiple tranches. PNB owned a 15.22 per cent stake in UTI Asset

- Management Company as of September 30 and it is valued at ~ ₹ 1394 crores. PNB in a BSE filing said that the value of divestment and the price at which the shares will be divested are yet to be decided

- Currently, the State Bank of India, Life Insurance Corporation of India, Bank of Baroda and Punjab National Bank collectively hold 45.16 per cent of the shares of UTI AMC

Daily Chart: – PNB

PNB Daily chart: – Prices have closed above the 10-day moving average at 42 .expect positives towards 60

Weekly chart: – PNB

PNB weekly chart: – Prices are trading in a rising channel. The lower boundary is at 44 and the upper boundary is at 52 expect short-term volatility in the range.

Weekly chart:- PSU bank

- PSU Bank weekly chart:- Prices have closed above the 10 weekly moving average at 3040 .expect positive towards 4100

- PSU Bank weekly chart shows a positive trend

- The government’s efforts to reduce bad loans were yielding results with 12 public sector banks reporting a 50 per cent jump in combined net profit at Rs 25,685 crore in the second quarter that ended September, Finance Minister Nirmala Sitharaman had said earlier this month.

- In the July-September quarter (Q2FY23), the overall banking sector seems to be on a strong footing led by a revival in business growth, improvement in margins and a continued declining trend in the NPA ratio, which has propelled earnings and thereby return ratios

End Note:

- We looked at stocks in comparison with the market and peers.

- We performed price action on a higher time frame chart and sensed a positive structure.

On a daily chart, we identified the positive trend