10 stocks to track during results season

18Jan, 2023

FinLearn Academy

Introduction

- The strategy we will be implementing today is VIDYA also known as the Variable Moving Average (VMA)

- VIDYA was developed by Tushar S. Chande and was first introduced in the March 1992 Technical Analysis of Stocks and Commodities article. In this article, we used standard deviation as the volatility index

- The Vidya Moving Average(VMA) indicator generates buy and sells signals based on trend changes

- A buy or sell signal is triggered when the two averages cross

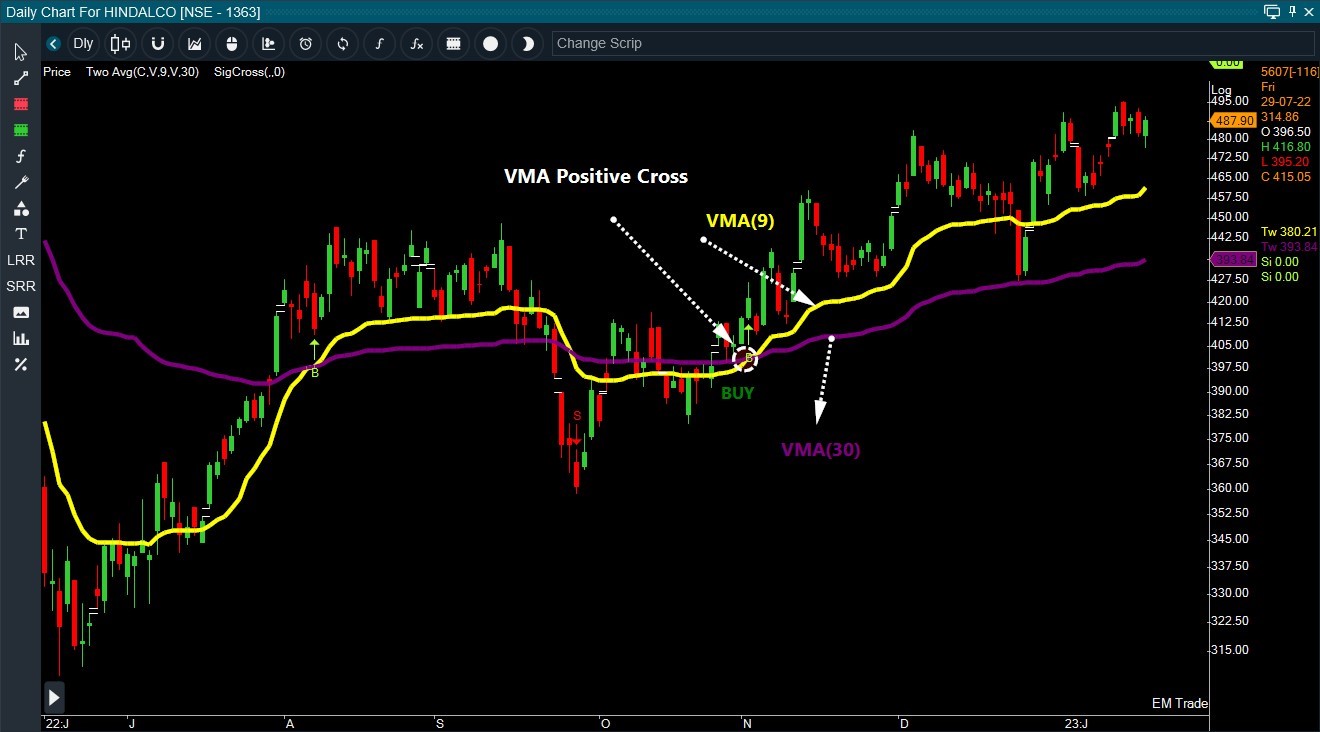

Vidya Moving average (VMA) Positive Crossover

- Vidya moving average Positive crossover is a bullish crossover

- A Buy call is triggered in such a setup when a shorter time period average cuts the larger time period average from below

- Let’s look at an example in the chart below ( on a Hindalco daily time frame)

- Short-term average (9-vma) intersects the long-term average (30-vma) from below Bullish crossover Now that you know what a Vidya moving average positive crossover is, let’s look at a few opportunities in the LIVE market

| Time | Scrip Name | Signal | Entry Rate |

| 29-11-22 | GODREJCP | BUY | 865 |

| 28-11-22 | HDFCLIFE | BUY | 586 |

| 2-11-22 | HINDALCO | BUY | 421 |

| 6-12-22 | ICICIGI | BUY | 1220 |

| 28-11-22 | IOC | BUY | 76.20 |

Wilders Moving average (WMA) Negative Crossover

- Vidya moving average Negative cross is a bearish crossover

- A sell call is triggered in such a setup: When the higher time period average crosses the lower time period average from above

- Let’s look at an example in the chart below ( on a Colpal daily time frame)

- long-term average (30vma) intersects the lower time period average (9wma) from above Bearish crossover

- Now that you know what a Vidya moving average Negative crossover is, let’s look at a few opportunities in the LIVE market

| Time | Scrip Name | Signal | Entry Rate |

| 30-12-22 | COLPAL | SELL | 1536.30 |

| 27-12-22 | BAJAJFINSV | SELL | 1537.70 |

| 13-01-23 | DABUR | SELL | 543 |

| 13-12-22 | MARUTI | SELL | 8620.70 |

| 2-01-23 | TATACONSUM | SELL | 762.30 |

Awesome, but what’s my takeaway?

- GODREJCP, HDFCLIFE, HINDALCO, ICICIGI & IOC have given a buy call on a daily time frame (implementing Vidya moving average Positive cross)

- COLPAL, BAJAJFINSV, DABUR, MARUTI & TATACONSUM have given a sell call on a daily time frame (implementing Vidya moving average Negative Cross)