Own up to own more stocks

Taking responsibility for your trading and knowing the modelling rules for success are closely connected. Knowing yourself, creating a new version of yourself and taking responsibility is the first step towards being a successful trader.

You must create a new version of yourself just as a guitarist creates a likeness for string, a footballer creates a likeness for the ball, and yoga instructors focus on breathing, and have the willingness and desire to learn.

A trader’s ultimate goal is to make money on a consistent basis. If you are a novice trader, you don’t realise the fullest potential of the available opportunities around you. You should cultivate personality traits that learn to think and act like a successful professional trader.

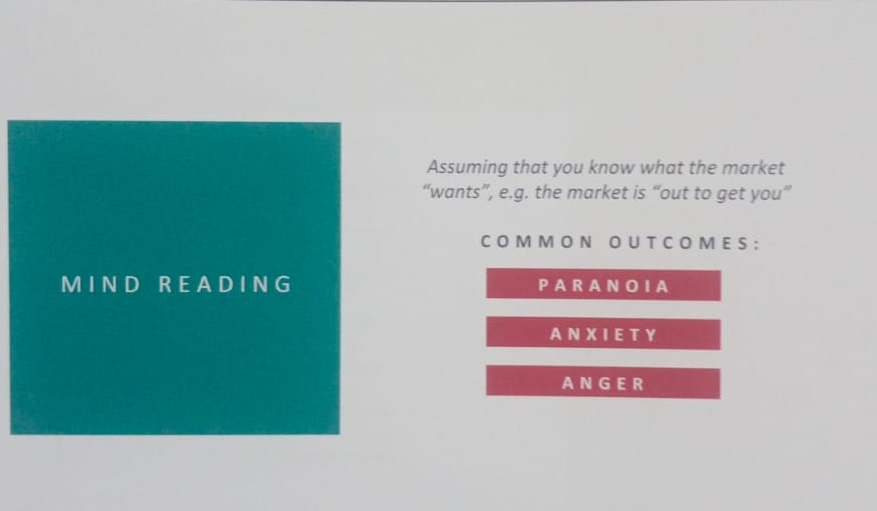

Seasoned traders think in unique ways, they have developed a mental attitude with focus and rational thinking that allows them to trade with fear. They have a rule-based approach and are planned and prepared for the trading business. They are not carried away by the emotion of greed and know how to handle external influence and keep it away from their decision-making process.

Have a positive attitude towards winning. Where most traders fail is a string of winning trades makes them carefree and at times careless in the next trades. Focus on handling success and go back and think what were the factors behind the success. Eg a batsman hit’s a six then the next ball in a good delivery which he should defend, but instead, he again goes to hit a six and get’s out. Knowing when to act and when to stay quiet is also a mental condition a trader needs to develop. In trading carelessness and emotional trading have disastrous financial implications.

Having few winning trades does not mean that you have become a professional trader, but post an initial success you feel that way and go on a mental flight of fancy. It’s dangerous as you become more overconfident. Beginners luck can always be there.

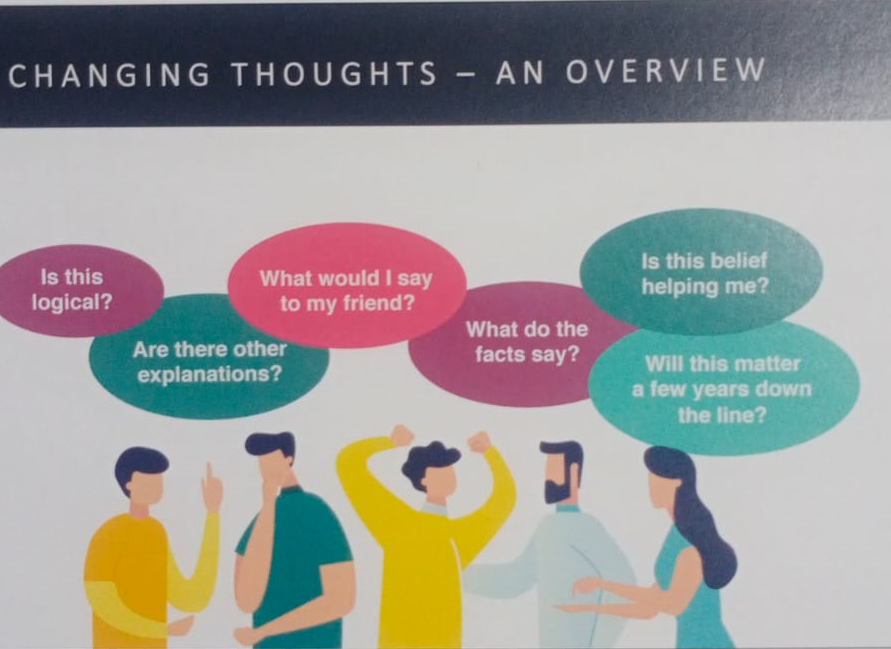

Making a loss on a trade and being wrong are inevitable realities of trading. You cant get every trade right irrespective of your planning and knowledge. Financial markets are erratic and there are too many variables playing out at a given time which can have an impact on short-term price movement. This says that you can’t be right each time. Accept the winning ratio which is having a regular trading income is better than thinking about going right and having a winner in every trade.

The goal of every trader is to trade like a professional and be a consistent winner and have a positive cash flow. Tell yourself that the key to success is in your mind and not in the market or the financial instrument that you are trading.

Accept the risk in trading financial instruments. Accepting the risk means understanding the outcome of your trades without any emotional discomfort or fear. You must condition yourself mentally in such a way that the possibility of going wrong, stopping out trades, and missing out on opportunities have no negative impact emotionally.

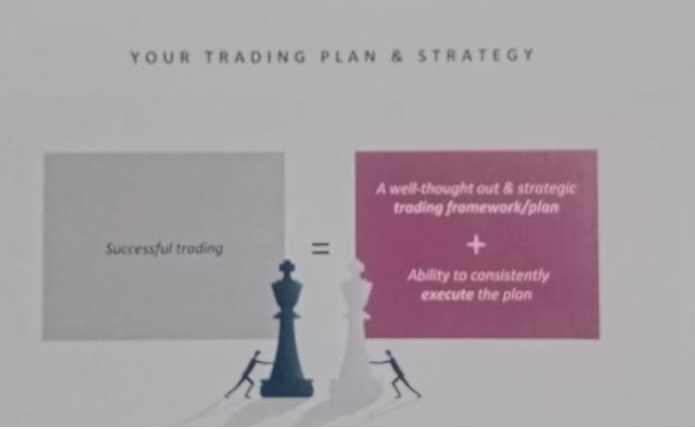

Create a framework defining your approach towards trading, the process and the operating procedure. Create a high-quality preparation. Know what motivates you to trade. have realistic goal setting and work honestly towards achieving the same. Take responsibility for your trading decision and don’t blame bad trades on markets or news info or others like brokers or any analyst.