Calls for the day (7th Dec)

07Dec, 2022

FinLearn Academy

Introduction

- The strategy we will be implementing today is wilders moving average (WMA)

- This indicator is also known as Wilder’s Smoothed Moving Average and is similar to the Exponential Moving Average.

- The Wilders Moving Average(WMA) indicator generates buy and sell signals based on trend changes

- A buy or sell signal is triggered when the two averages cross.

Wilders Moving average (WMA) Positive Crossover

- Wilders moving average Positive crossover is a bullish crossover

- ·A Buy call is triggered in such a setup when a shorter time period average cuts the larger time period average from below

- Let’s look at an example in the chart below (Petronet on a daily time frame)

- The short-term average (13-WMA) intersects the long-term average (34-WMA) from below the Bullish crossover

- Now that you know what a wilders moving average positive crossover is, let’s look at a few opportunities in the LIVE market

Wilders Moving average (WMA) Negative Crossover

- Wilders moving average Negative cross is a bearish crossover

- A sell call is triggered in such a setup: When the higher time period average crosses the lower time period average from above

- Let’s look at an example in the chart below (Adani transmission ltd on a daily time frame

- long-term average (34wma) intersects the lower time period average (13wma) from above Bearish crossover

- Now that you know what a wilders moving average Negative crossover is, let’s look at a few opportunities in the LIVE market

Awesome, but what’s my takeaway?

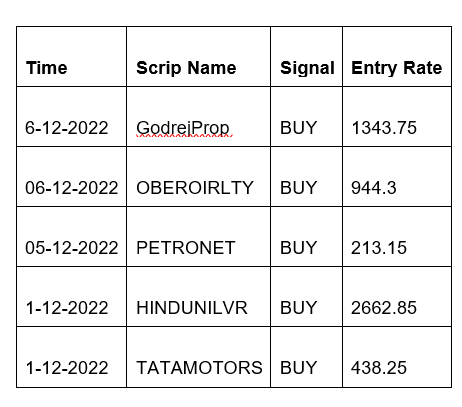

- Godrejprop, Oberoirlty, Ppetronet, Hindustan Unilever & TATA Motors have given a buy call on a daily time frame (implementing wilders moving average Positive cross)

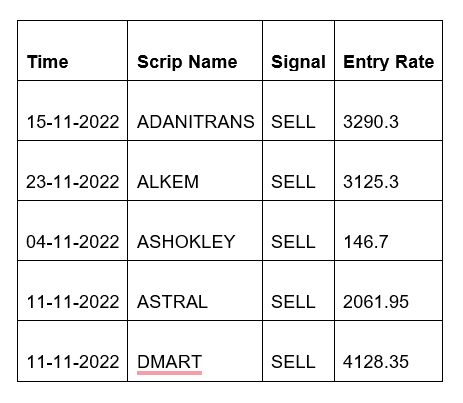

- Adani transmission, alkem, ashokley, astral & D’Mart have given a sell call on a daily time frame (implementing Wilders moving average Negative Cross)