Learn From Our Grads

Our Programs

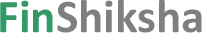

Smart Trader Intraday Programme

A comprehensive course on Intraday trading covering various charting tools, strategies, and profitable hacks.

Swing Trading with Price Action & Harmonic Trading Principles

A comprehensive programme covering the details of swing trading and its key strategies.

Index Trading Programme: Beginner to Advanced

A comprehensive course on trading in NIfty50 & Bank Nifty taking directional and non-directional trades.

Smart Trader Commodity & Currency Programme

Gain an in-depth understanding of the commodity and currency markets in India.

The Art of Stock Picking and Long Term Investing

A Comprehensive Course on Fundamental Investing

Index Trading Programme: Beginner to Advanced

A comprehensive course on trading in NIfty50 & Bank Nifty taking directional and non-directional trades.

Smart Trader Commodity & Currency Programme

Gain an in-depth understanding of the commodity and currency markets in India.

Stock Markets 101

Introduction to the World of Stock Market I Thorough Study of the Concepts

Weekly Pass

Confused what course / style is best suited to you? Unsure whether the course is worth your time?

Try a Toast

Sample our NewsletterA Responsible Community of Traders and Investors

Constructive Discussions

- Trade Support

- Learning Support

- Psychological Support

Quizzes

- Assesments to Build Confidence

- Practice Variety of Market Conditions to Build

your Strength

Join us. Become a part of the smartest trading & investing community

Instructors

What our grads have to say about us!

Narender Mulani -12/7/20

In today’s session, I’ve learned how to trade band Bollinger squeeze break out and I captured almost 70 points in Mindtree. thank to Prateek sir & the FinLearn team

Sanket Vaidya -7/4/20

The most important approach we’ve learned at FinLearn Academy: Top down approach

1. Watch Global markets

2. Watch SGX nifty

3. Watch sector index and study those chart

Osunam Ngukir -8/4/20

Jab Nifty isse upar trade Kar ratha to maine ye point se market ka fall calculation kiya tha. Aur fir Nifty 15828.5 se 15721.5 per close hua. Means 107 points points ki fall. Maine iss formula ko FinLearn se sikha hai or fir khud ki ek formula build kiya hai. Accha profit book hua mujhe. Thanks to FinLearn Academy.

Bhavesh -10/6/20

Thanks to FinLearn Academy as well as all the mentors for the assessment. It is helping to boost my confidence.

Shripad Bapat -9/8/21

Earned 1% in ICICI Bank on the reversal from 15min Bollinger Band. Thanks to all our mentors of FinLearn Academy.

Rajesh Thakur -9/9/21

It was really a nice journey with FinLearn Academy. Before joining this course, I was afraid but mentors and other members of FinLearn Academy are really very supportive, helpful, and knowledgeable. Prabhu Sir’s teaching methodology is very simple and specific, I learned a lot from him. Once again thanks to Prabhu sir, Hitesh sir, Prateek sir, Virag sir, and all my colleagues for this wonderful journey.

Tejpal Singh Narula -11/8/21

Galtiyon se he sikhte hain. Abhi tak seekh hi rahe hain. Thank you so much to FinLearn Academy ki aaj kaffi decision sahi hote hai trade ke. Warna I used to do trading on a somebody’s call basis.

One time I lost almost 10L. On commodity as well as equity. Now I make my own decisions.

Sachin -9/8/21

Today I attended the webinar conducted by Pratik sir. I really appreciate FinLearn Academy’s approach and dedication towards students who want to learn the market, and the handholding is really very impressive. Thank you.

Jyoti Dutta -9/8/21

A very good initiative to bring all the students together. This will help everyone to learn from each other. Thank you FinLearn Academy and all their staff, who are working very hard during this pandemic for making sure that our learning is happening.

Nahida Mahadik -9/8/20

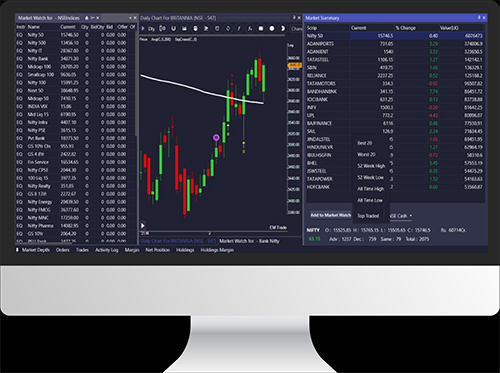

Hello.. Good Morning sir… he trades mi Kal complete zhala..EmTrade Pro moderate chyaIndicatorene.. trail la ekuch lot ghetlahota. Ha profit zhala. Thanks to FinLearn Academy.

Madhur Shroff -10/8/21

Along with Trendlines & resistance, support zones, please observe MMA as well. (Multiple timeframes MMA 9 in the trending market) can give you an idea of resistance and support that can hold or be broken. Thanks! Thanks o Hitesh Sir & FinLearn for teaching this.

Abhishek -16/5/21

This quiz to practice the trading concepts really blew my mind…..Thanks to all the mentors and FinLearn Academy.

Rajan Ram Sippy -6/4/20

FinLearn – this highly acclaimed Academy teaches not just equity/derivatives trading for short-term, positional, or intraday, but goes all out to mold/sharpen one’s trading skills/style. From the very friendly/patient/accessible faculty to smart technical tools/analysis, this is an ever-evolving workshop. We are blessed to be part of this enterprising universe. this one is really good

Sonia Patel -11/8/21

FinLearn Academy, with excellent faculty, has helped me to get a good grasp on the technical part of stock entry & exit. The best part of the academy is the continuous, constant support & encouragement to become good at trading. Live hours Hand holding trade is a great way to induce confidence among the budding traders, I wish, I had this opportunity long back or at least pre covid phase.

Our Partners (Broking And Education)